The prospect of a full-fledged war between India and Pakistan, two nuclear-armed neighbors with a history of conflict, is a scenario that carries profound economic and financial implications.

While historical data and recent tensions, such as the Pahalgam terror attack in April 2025, provide insights into market reactions to geopolitical escalations, a prolonged war would introduce unprecedented challenges.

The India Pakistan war news has been shaking tables lately; and everyone’s glued to their screens for updates.

This blog explores the potential economic impacts and effects on the Indian stock market in such a scenario, drawing on historical trends, expert analyses, and economic fundamentals.

Understanding the Context

India and Pakistan have fought four wars (1947, 1965, 1971, and 1999) and numerous skirmishes, primarily over Kashmir. Recent escalations, including India’s suspension of the Indus Waters Treaty and Operation Sindoor in May 2025, have heightened tensions.

A full-fledged war, unlike limited strikes or border clashes, would involve sustained military engagement, potentially disrupting trade, investment, and economic stability.

Given India’s status as the world’s fifth-largest economy and Pakistan’s fragile economic state, the impacts would be disproportionate but significant for both.

Suggested Read: Geopolitical Events: The Profound Shockwaves Shaping Financial Markets in 2025

Economic Impacts of a Full-Fledged War

1. Fiscal Strain and Increased Defense Spending

A prolonged war would demand substantial financial resources. The Kargil War (1999) cost India approximately $1 billion per week in today’s terms, and a modern war could cost $1 billion per day. This would exacerbate India’s fiscal deficit, currently around 5% of GDP, potentially increasing it by 50% over a few weeks. To finance this, the government might:

- Raise Taxes: Higher taxes could reduce disposable income, dampening consumer spending and affecting sectors like retail and automobiles.

- Increase Borrowing: Higher borrowing could elevate bond yields, crowding out private investment and raising interest rates.

- Divert Resources: Budget reallocations from infrastructure, health, or education to defense could slow long-term growth.

2. Disruption of Trade and Supply Chains

India’s economy relies on global trade, with exports accounting for 20% of GDP. A war would disrupt regional trade and supply chains:

- Suspension of Trade with Pakistan: Though formal trade is minimal ($2.4 billion), informal trade worth $10 billion, including pharmaceuticals and textiles, would collapse.

- Regional Instability: Neighboring countries like Bangladesh and Sri Lanka could face spillover effects, impacting India’s trade within South Asia.

- Global Supply Chains: India’s role in pharmaceuticals (supplying 20% of global generic drugs) and technology could face disruptions if ports in Gujarat, near Pakistan, are affected. However, experts suggest only a “massively destructive” war would significantly impact pharma exports, given the U.S. market’s dominance.

3. Inflation and Currency Volatility

War would drive inflation and weaken the Indian rupee (INR):

- Energy Prices: Escalating tensions could spike oil prices, as India imports 80% of its crude oil. A $10 per barrel increase could raise India’s import bill by $12 billion annually, fueling inflation.

- Food Inflation: Suspension of the Indus Waters Treaty could disrupt agriculture in Pakistan, indirectly affecting regional food prices.

- Rupee Depreciation: The INR fell 31 paise to 84.66 against the USD during Operation Sindoor, and a war could push it lower, increasing import costs. Currency volatility hit a two-year high in May 2025.

4. Foreign Investment Outflows

India attracts significant foreign direct investment (FDI) and foreign portfolio investment (FPI), with $43,940 crore in FII inflows in the fortnight before May 7, 2025. A war would:

- Reduce Investor Confidence: Investors avoid war zones due to risks of asset damage and higher taxes. FPI outflows of ₹3,000 crore followed the Pulwama attack in 2019.

- Increase Risk Premiums: Bond markets are already pricing in geopolitical risks, and equity markets could see higher volatility.

- Shift to Safe-Haven Assets: Global investors may move to gold, the Japanese yen, or U.S. treasuries, reducing capital flows to India.

5. Sector-Specific Impacts

Certain sectors would face significant challenges:

- Aviation and Tourism: Hotel and aviation stocks fell after the Pahalgam attack due to expected declines in tourism.

- Banking and Finance: PSU bank stocks, like Bank of Baroda, dropped 5-10% during recent tensions, reflecting investor caution.

- Manufacturing and Technology: Disruptions in Gujarat ports or security concerns could delay tech investments, impacting India’s $250 billion IT sector.

Effects on the Indian Stock Market

Historical Context

Historical data suggests Indian markets are resilient to India-Pakistan conflicts:

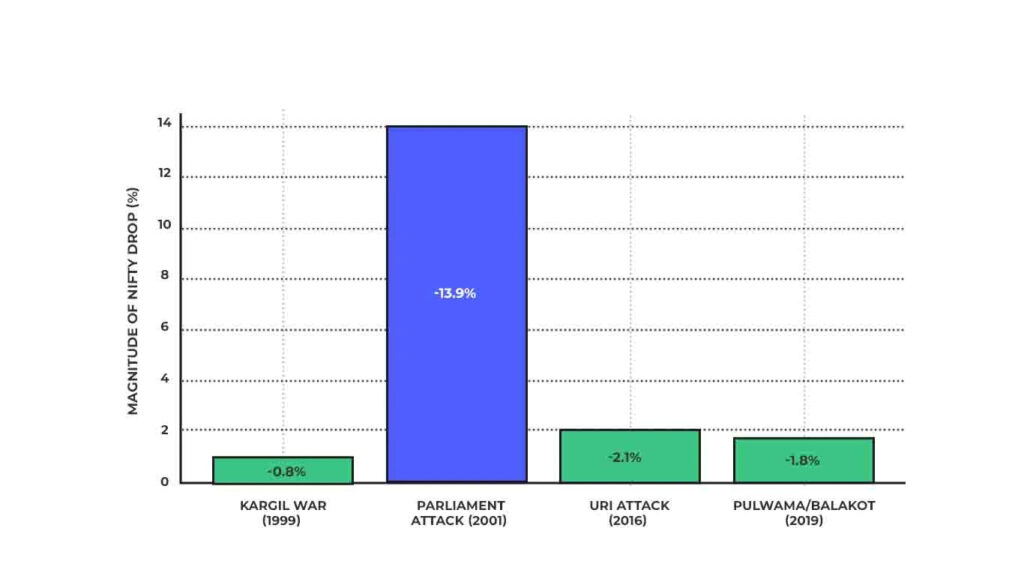

- Kargil War (1999): The Nifty fell 0.8% from May to July but rallied 41% during the conflict, closing the year higher.

- Uri Attack (2016): The Nifty dropped 2.1% over 10 days but recovered quickly.

- Pulwama Attack and Balakot Airstrike (2019): The Nifty fell 1.8% from February 14 to March 1 but resumed its uptrend.

- Parliament Attack (2001): A 13.9% correction occurred, but global factors, including a 30% S&P 500 drop, were primary drivers. Anand Rathi’s analysis of four major conflicts since 1999 indicates an average correction of 7%, with a median of 3%, and no correction exceeding 5-10% unless global factors dominate.

Check this graph to better understand how the Nifty reacted to the mentioned situations:

Short-Term Market Reactions

A full-fledged war would likely cause immediate volatility:

- Initial Sell-Off: The Nifty 50 and BSE Sensex dropped 1.5% and 800 points, respectively, after the Pahalgam attack, with small- and mid-cap indices falling over 3%. A war could trigger a 5-10% correction, as predicted by Anand Rathi.

- Sectoral Declines: Aviation, tourism, banking, and finance would face sharp sell-offs, as seen in recent tensions.

- India VIX Surge: The volatility index rose 11% in the week of April 25, 2025, and could spike further, reflecting investor fear.

Long-Term Market Outlook

Despite short-term turbulence, India’s markets have historically recovered swiftly due to:

- Economic Resilience: India’s $3.5 trillion economy, the fastest-growing major economy, underpins market stability.

- Domestic Investment: Strong domestic institutional investor (DII) participation offsets FPI outflows.

- **Cls: Expert analyses, like those from Geojit Investments and Motilal Oswal, suggest markets rebound if tensions do not escalate into prolonged war.

- Historical Precedents: Post-conflict rallies, like the 37% Sensex surge during the Kargil War, indicate long-term optimism. However, a sustained war could delay recovery, especially if global factors (e.g., U.S. tariffs or oil price spikes) compound domestic challenges.

Defensive Sectors and Opportunities

During war, investors shift to defensive sectors:

- Defense Stocks: Companies like Hindustan Aeronautics and Bharat Dynamics could benefit from increased orders.

- Gold and FMCG: Safe-haven assets and consumer staples tend to perform well.

- IT Sector: Less affected due to global demand, as seen with Nifty IT gains during recent tensions. Experts recommend accumulating quality stocks during dips, focusing on banking and defensive sectors for long-term gains.

Pakistan’s Economic Context

Pakistan’s economy, with a GDP of $305 billion and $130 billion in external debt, is far more vulnerable. The KSE-100 index crashed 6% during Operation Sindoor, reflecting investor panic. A war could bankrupt Pakistan, as it lacks the financial capacity for sustained conflict, further stabilizing Indian markets by reducing escalation risks.

Investor Strategies

- Avoid Panic Selling: Historical data shows quick recoveries, so long-term investors should hold quality stocks.

- Diversify Portfolios: Spread investments across defensive sectors and geographies to mitigate risks.

- Monitor Developments: Markets react to military updates, so stay informed via reliable sources.

- Buy the Dip: Use corrections to invest in fundamentally strong companies, as suggested by Anand Rathi’s 65:35:20 strategy.

- Hedge Currency Risks: With INR volatility rising, consider USD or gold exposure.

Conclusion

A full-fledged India-Pakistan war would disrupt India’s economy through fiscal strain, trade disruptions, inflation, and FPI outflows, leading to a 5-10% stock market correction in the short term. However, India’s robust economic fundamentals, historical resilience, and strong domestic investment base suggest a swift recovery unless global factors intervene.

Pakistan’s economic fragility reduces the likelihood of prolonged conflict, further supporting India’s market stability.

Investors should remain cautious, diversify, and seize opportunities in defensive sectors to navigate this high-stakes scenario.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.