ICICI Prudential has introduced two new investment choices to monitor the Nifty 200 Value 30 Index: the ICICI Prudential Nifty200 Value 30 ETF and the ICICI Prudential Nifty200 Value 30 Index Fund NFO. Both strategies seek to give returns that roughly mirror the total return of the underlying index, with a small margin for error (tracking error). These are open-ended schemes classified as “Other ETFs” and “Index Funds” respectively.

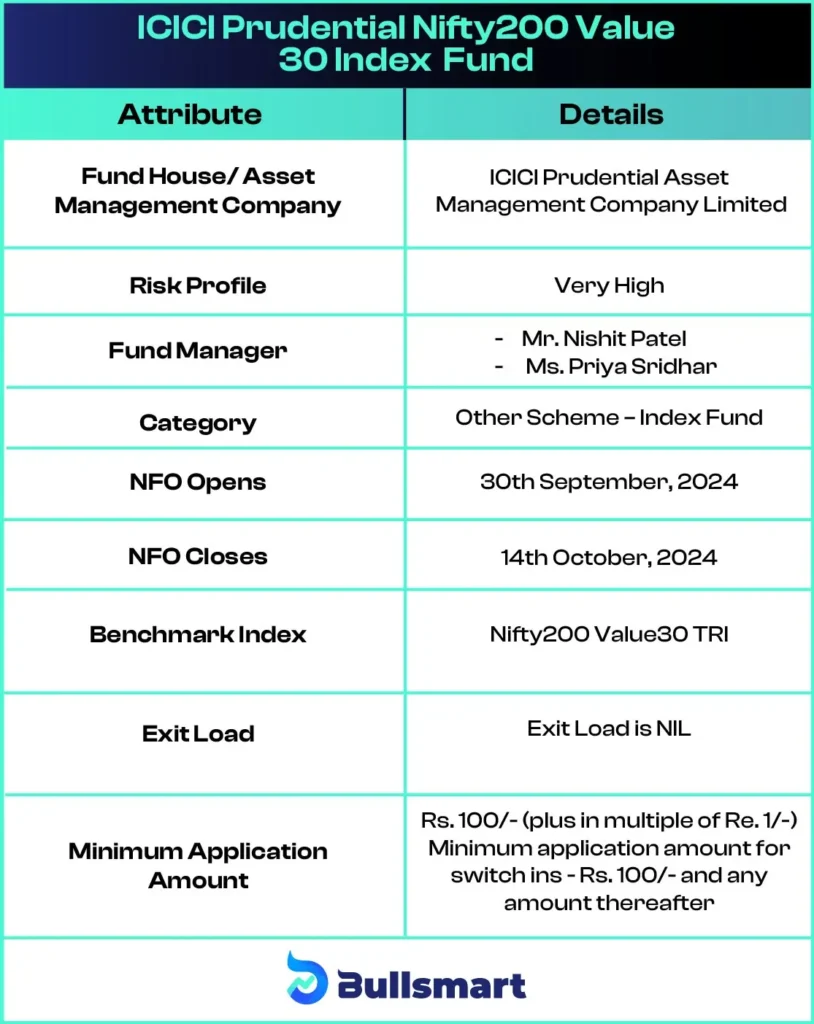

Key Facts about ICICI Prudential Nifty200 Value 30 Index Fund

The ICICI Prudential Nifty200 Value 30 Index Fund NFO is an open-ended index fund that aims to monitor and replicate the Nifty200 Value 30 Index. This index is carefully curated to contain 30 stocks from the Nifty 200 universe that have excellent value characteristics, such as low price-to-earnings ratios and book-to-market values. Investing in this index fund provides you with exposure to a diverse portfolio of value-oriented firms without the need for intensive research or stock choice. The product seeks returns that are closely related to the performance of the Nifty200 Value 30 Index.

One of the primary benefits of investing in index funds is the opportunity to do so without a Demat account. Unlike typical equity investments, which require a Demat account to hold shares, index funds can frequently be purchased directly from fund houses or via intermediaries such as banks or financial consultants. Units in the ICICI Prudential Nifty200 Value 30 Index Fund are valued at the Net Asset Value (NAV), which is determined daily. The NAV represents the value of each unit in the fund and is calculated by dividing the total fund assets by the number of outstanding units. By purchasing units at the NAV, you are effectively owning a share of the fund’s underlying investments.

Investment Objectives

ICICI Prudential Nifty200 Value 30 Index Fund aims to invest in firms that are part of the Nifty200 Value 30 Index, with the goal of achieving the same returns as the index, subject to tracking mistakes. This would be accomplished by investing in all of the stocks that make up the Nifty200 Value 30 Index at the same weightage.

However, there is no assurance or guarantee that the scheme’s investing objective will be attained.

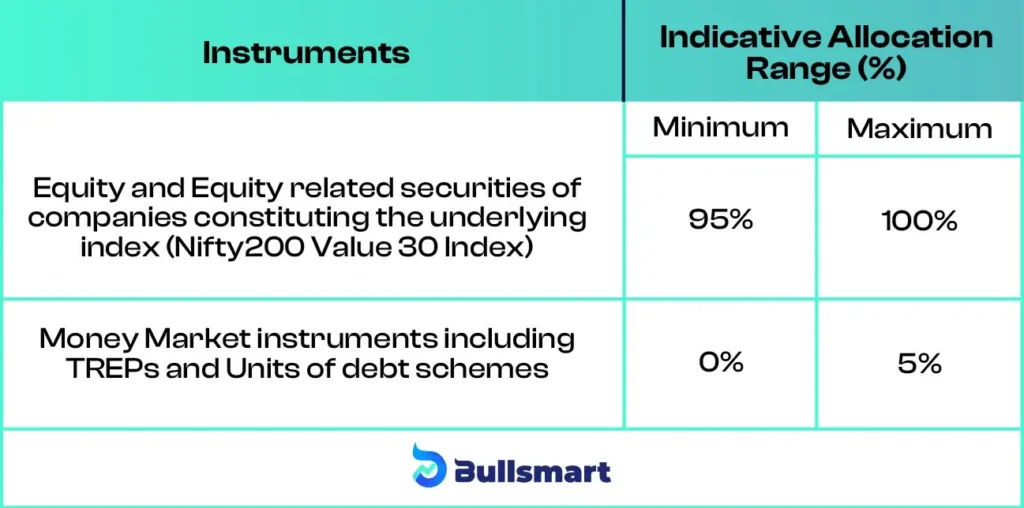

Portfolio Allocation

Under normal circumstances, the anticipated asset allocation of ICICI Prudential Nifty200 Value 30 Index Fund NFO would be:

Risks and Returns Explained

ICICI Prudential Nifty200 Value 30 Index Fund’s benchmark riskometer indicates a very high risk level. While the fund aspires to produce similar results to the Nifty200 Value 30 TRI, there are no guarantees, and actual returns may differ owing to tracking errors. The fund invests in shares listed in the Nifty200 Value 30 Index, regardless of their individual investing quality. During a market downturn, the fund managers will not try to pick particular equities or use defensive techniques.

Meet the Fund Managers

Mr Nishit Patel

Mr. Nishit Patel brings his experience as a CFA (Level 1) Charterholder, Chartered Accountant, and B.Com graduate to the table. Mr. Patel joined ICICI Prudential Asset Management Company Limited in November 2018. He has managed a variety of Exchange Traded Funds (ETFs) and Index Funds ICICI Prudential Nifty Next 50 Index Fund, including those focusing on the Nifty 50, Nifty Next 50, and BSE Sensex.

Ms. Priya Sridhar

Ms. Priya Sridhar, a B.Com graduate from Mumbai University and a Master of Financial Management from Somaiya College of Management Studies, joined ICICI Prudential Asset Management Company Limited’s Investments Department in January 2022. She has experience managing a variety of ETFs & ICICI Prudential BHARAT 22 FOF.

About the Asset Management Company

ICICI Prudential Asset Management Company Limited manages 762 schemes worth ₹8,86,339.36 crores. ICICI Prudential Mutual Fund Asset Management Company Limited, excluding variants, manages 48 equity plans, 20 debt schemes, 21 hybrid schemes, and two money market schemes. ICICI Prudential Asset Management Company Limited’s custodian is the Stock Holding Corporation of India. Its registration and transfer agency is Computer Age Management Services Ltd. S. R. BATLIBOI & Co. is the auditor for ICICI Prudential Asset Management Company Limited.

Who should invest in this NFO?

ICICI Prudential Nifty200 Value 30 Index Fund NFO might be suitable for investors:

Seeking long-term wealth creation: Ifyou have a long investing horizon and are comfortable with equity market volatility, this fund, which focuses on value firms in the Nifty200, may be a good fit for you.

Preferring a passive investment approach: If you believe in market efficiency and prefer a hands-off approach to investing, this passively managed fund may be a good choice.

Suggested Read – ICICI Energy Opportunities Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.