India’s equity market offers a variety of investment schemes catering to different market capitalisations. One such category is large-cap funds, which focus on investing in companies with substantial market value and stable growth prospects.

Large-cap equity funds are known for providing a more stable investment option, thanks to their focus on well-established companies. These funds are suitable for investors seeking long-term wealth creation with a lower risk compared to mid-cap or small-cap funds.

The ICICI Prudential Bluechip Fund, managed by ICICI Prudential Mutual Fund, focuses on large-cap stocks and aims to provide capital appreciation and income distribution over the long term.

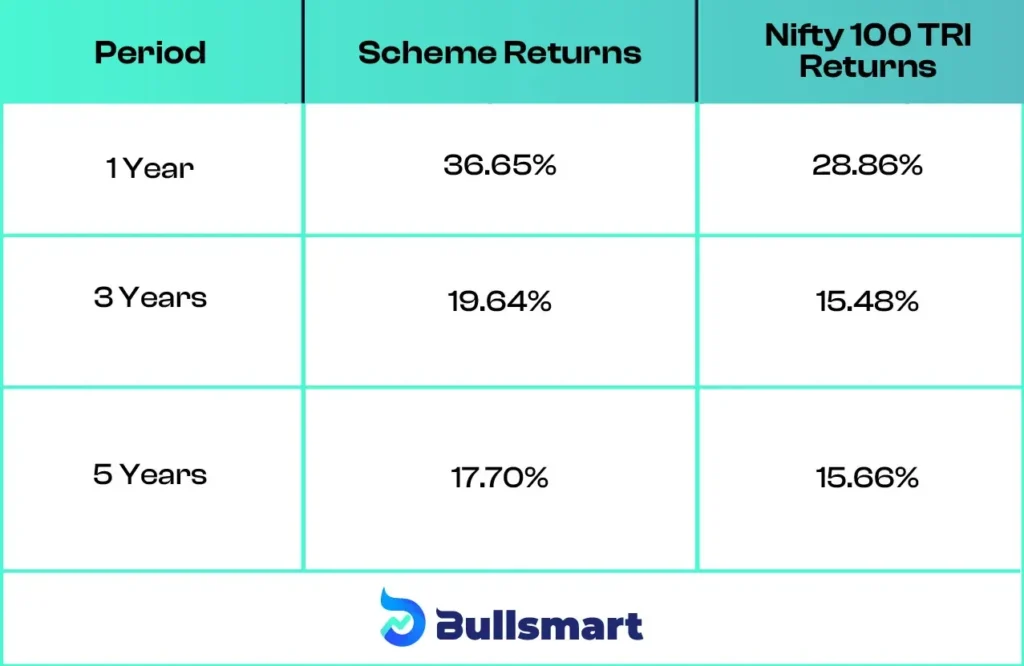

Over the past decade, the fund has delivered an XIRR of 18.8%, outperforming its benchmark, Nifty 100 TRI, which grew to 16.7% during the same period.

Let’s explore this fund to help you decide if it aligns with your investment goals.

Details of ICICI Prudential Bluechip Fund

The ICICI Prudential Bluechip Fund is an open-ended equity scheme primarily investing in large-cap companies. It aims to generate long-term capital appreciation and income for investors by focusing on a portfolio of large-cap companies with strong fundamentals.

The fund considers the Nifty 100 TRI as its benchmark.

Investment Objective and Strategy

The Scheme aims to generate long-term capital appreciation and income by investing primarily in large-cap stocks.

Let’s take a quick look at the key basic details of the fund:

Portfolio Construction

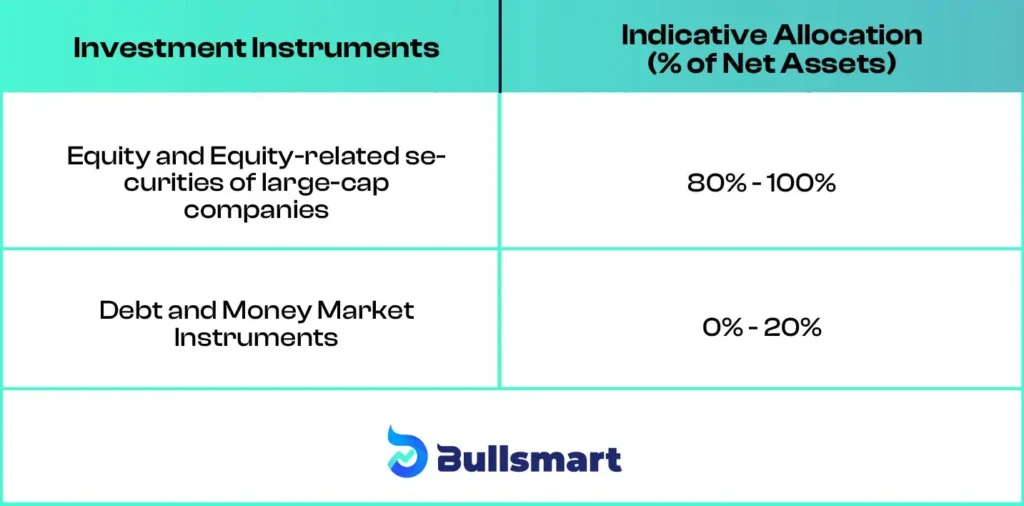

The asset allocation of the ICICI Prudential Bluechip Fund is as follows:

Understanding Risks and Returns

The ICICI Prudential Bluechip Fund carries a very high-risk profile due to its equity-focused nature. However, large-cap companies typically offer more stability, which can help balance risk.

The scheme has consistently given better returns as compared to the benchmark.

ICICI Prudential Mutual Fund AMC

Founded in 1993 through a collaboration between ICICI Bank and Prudential Corporation Holdings Ltd (a subsidiary of Prudential PLC), ICICI Prudential Asset Management Company (AMC) has emerged as a key and highly profitable player in India’s mutual fund industry.

The AMC has contributed significantly to the creation of the CRISIL rating system for Asset Management Companies.

As of June 30, 2024, ICICI Prudential AMC manages assets worth ₹ 811,057.38 crore, making it one of the top two asset management companies in the country. Most of its offerings are rated ‘AAAmfs,’ reflecting strong financial health.

Suggested read: icici energy opportunities fund nfo

Meet the Fund Managers

The fund is managed by a team of experienced professionals:

Anish Tawakley: With 28 years of experience, Anish Tawakley has been managing the fund since September 2018, bringing extensive expertise to his role. He also oversees other significant funds such as ICICI Prudential Manufacturing Fund and ICICI Prudential Smallcap Fund.

Mr. Vaibhav Dusad: Managing the fund since January 2021, Vaibhav Dusad has 12 years of industry experience. His responsibilities include overseeing key schemes like the ICICI Prudential Innovation Fund and ICICI Prudential Focused Equity Fund.

Who Should Invest in ICICI Prudential Bluechip Fund?

The ICICI Prudential Bluechip Fund is ideal for investors who are:

- Seeking long-term wealth creation

- Comfortable with high-risk investments in large-cap companies

- Looking to invest for at least 5 years or more

- Planning for retirement or wealth creation over the long term

This fund is designed for those who want to benefit from the stability of large-cap companies while aiming for capital appreciation.

However, as with all investments, it is essential to consult a financial advisor to ensure this fund fits well within your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.