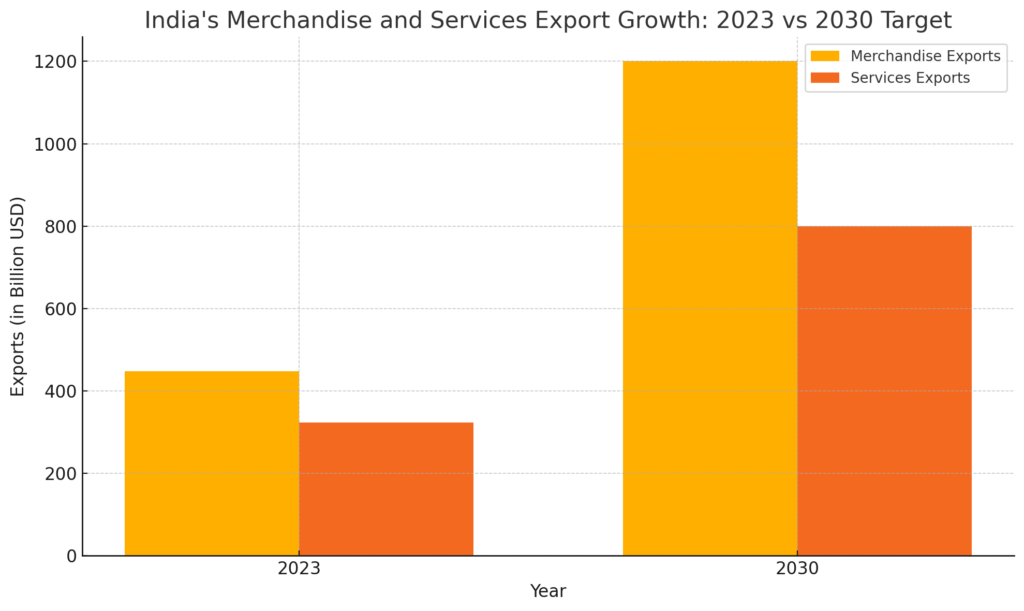

Imagine a nation where progress is taking place at an electrifying pace with exports causing waves in the international arena, and that is India! In 2023, India’s exports had an astonishing figure of $447.46 billion worth of merchandise exports and $322.72 billion worth of services. From petroleum and pharmaceuticals to IT services as well as eco-friendly textiles, Indian companies are going globally fueled by apt policies such as PLI Scheme or Foreign Trade Policy 2023-28. Plus, with an audacious forecast for $2 trillion worth of exports by 2030, there are no brakes on this train!

Now picture yourself being part of all this action. You can invest in various export driven sectors in India through HSBC India Export Opportunities Fund NFO which gives you access to booming areas. If you want your money to experience excitement while sending shockwaves through the international market, take advantage of this opportunity. Let us dive into more specifics!

Understanding HSBC India Export Opportunities Fund NFO

HSBC India Export Opportunities Fund NFO is an actively managed equity scheme that primarily invests in companies whose revenues come from exports of goods and services with the objective of long-term capital appreciation. It shall place particular focus on growth opportunities for businesses expected to benefit from demand being transmitted out of the transforming global economy, IT, pharmaceuticals, textiles, etc. HSBC India Export Opportunities Fund dynamically trades into one of the several techniques: derivatives, short selling, securities lending, and investments in REITS and InvITs as well as allocations to overseas businesses.

HSBC India Export Opportunities Fund has been designed to help an individual investor invest in the growing export potential of India within the dynamic world with changing boundaries as implied by SEBI and RBI. Though it may create significant growth potential, HSBC India Export Opportunities Fund does not guarantee or assure a certain level of capital growth, and the value of the investments can be subjected to heightened volatility based on the fact that the fund invests in the equity market and adopts various investment strategies.

Take a peek at the deets :

Note: KIM updated as of August 12, 2024.

About the HSBC Mutual Fund

In 2002, HSBC Asset Management (India) Pvt Ltd commenced its operations in India and made an impressive entry into the mutual fund industry by taking advantage of economic liberalization. Being part of the global family of HSBC Holdings plc, it became an instant favorite, not only for retail investors but also for large institutions and high-net-worth individuals.

Now, with assets under management of Rs. 1.16 lakh crores, it has a prominent and widespread presence in the asset management industry in India as of early 2024. However, it is not the size that defines this asset management company, but rather their approach and evidence-based active-investment strategies. The HSBC fund range includes the HSBC Large Cap Fund for growth and consistency, the HSBC Small Cap Fund for those smaller high-return/multi-bagger stocks, and the unique HSBC Global Equity Climate Change Fund of Fund focused on climate issues. HSBC Mutual Fund is committed to providing different investment strategies that mimic or follow client’s changing needs.

About the Benchmark

The performance of the top 500 companies listed on the National Stock Exchange (NSE), representing 95% of the total market capitalization, is measured by the Nifty 500 Total Return Index (TRI). The Index provides representation across large-cap, mid-cap, and small-cap equities, serving as a broad representation of India’s equity market.

The TRI measures total returns, which includes the impact of dividends, instead of just stock price appreciation. The Index is widely used by Mutual Funds and Portfolio Managers as a benchmark to judge the performance of diversified equity investments. The Index is updated twice-a-year to incorporate new listings and performance of the companies relative to one another, assuring that it remains relevant and the data is dependable.

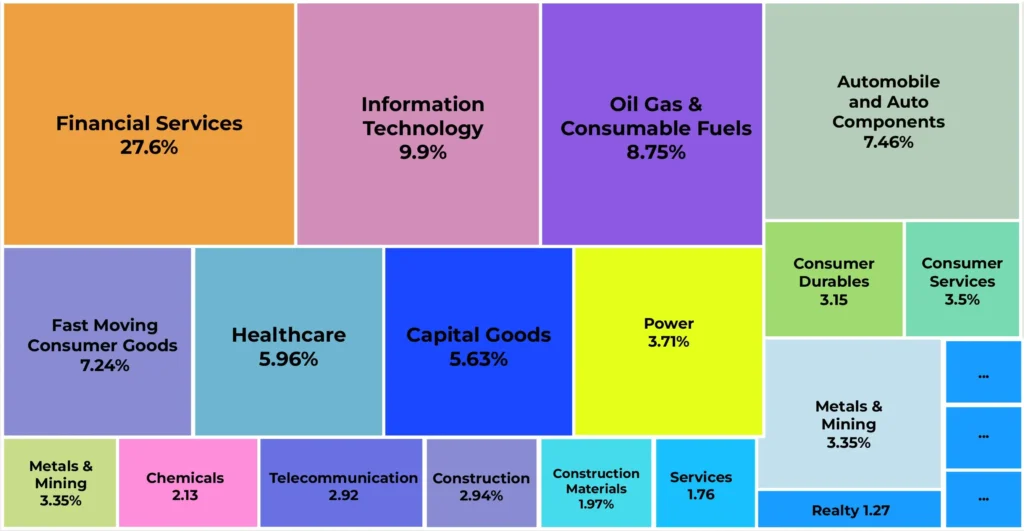

Caption: This image represents how the index maps investments in a varied range of sectors.

Financial Services represent the largest sector representation in benchmark, which is 27.76%, which illustrates importance of this widespread stance in terms of investments, among others within the economic densities. The second highest representation is in Information Technology at 9.75%, reflecting the influence of technology on modern commerce, productivity and transformation. Oil, Gas & Consumable Fuels at 8.57%, remains a steadfast representation, indicating the need for oil and energy continues, and remains a reflection of modern society.

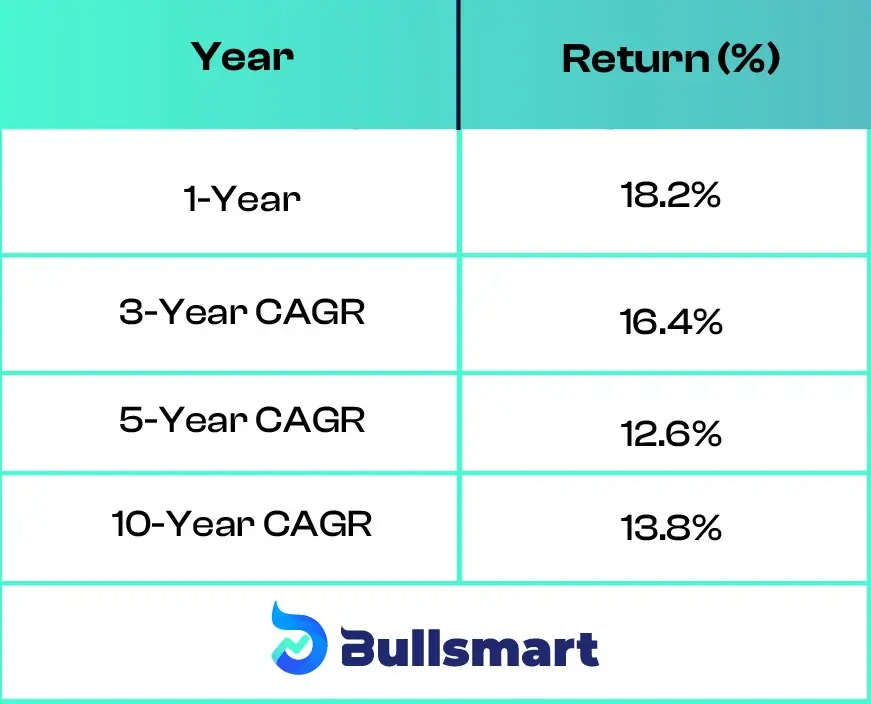

As of September, 2024, the Nifty 500 TRI has had an attractive return, which is noted in the table shown below:

Asset Allocation

The fund mainly focuses on companies that will benefit from increased Indian export growth. It generally invests 80% to 100% of the fund’s assets in equities of export-oriented businesses. Additionally, the fund can invest up to 20% of the fund’s assets in equities of other types and up to 20% of the fund’s assets in debt and money market instruments, including cash and equivalents.

HSBC India Export Opportunities Fund NFO can also invest up to 10% in REITs and InvITs. It includes an opportunity to invest in foreign securities, but only up to 20%. The fund may also engage in securities lending, but not in securities of foreign entities, and has limited capability to engage in derivatives and repo transactions. While the fund will avoid structured debt, credit default swaps, and commodity derivatives, it has the capacity to modify the investments from time to time depending on market and external regulatory changes.

Assessing Potential Risks and Returns

The HSBC India Export Opportunities Fund focuses on investments in sectors that stand to benefit from India’s export growth, including IT, pharmaceuticals, and textiles. Thus, this fund may encounter sector-specific risks, currency fluctuations, and global trade conditions influenced by economic developments. For example, a stronger Indian Rupee would largely impact fund’s performance, any decline in exports or the global demand for these goods would have a serious impact on its performance.

Investors should expect volatility since the fund has concentrated holdings. Interest rate changes may affect returns if the fund is invested in debt. Overall, the fund is likely to have more volatility and is best suited for investors with a higher risk tolerance looking for longer-term gains related to growth in India’s exports.

Meet the Expert Behind the Fund

Abhishek Gupta, who currently serves as the Fund Manager for HSBC India Export Opportunities Fund, has substantial experience and expertise in the asset management industry. Abhishek Gupta holds a Bachelor of Commerce (B.Com), Post Graduate Diploma in Management (PGDM) with a Finance Specialization, and is a Chartered Financial Analyst (CFA), demonstrating depth of understanding of investments and the functioning of the financial markets.

Prior to joining HSBC Mutual Fund, Mr. Gupta was engaged with several globally reputed financial institutions, most notably:

- Edelweiss Asset Management Limited

- Goldman Sachs

- Baer Capital

- Deutsche Asset Management

In his previous roles, Mr. Gupta has also had considerable exposure to managing portfolios of equities, analyzing stocks, and managing actively-managed funds while running multi-asset strategies across diverse asset classes. Through this varied experience, he has developed a unique knowledge and lens to manage thematic mutual funds like the HSBC India Export Opportunities Fund, which have consideration to global markets, sectoral themes, and macro variables.

Who should invest in this NFO?

Designed for investors who wish to take advantage of the rising export sector in India comprising industries such as IT, pharmaceutical, and textile industry, the HSBC India Export Opportunities Fund mainly concentrates on equity investments in the export-driven sectors to be able to derive returns from the ever-increasing global demand for Indian goods and services.

This fund could be best recommended or chosen by someone whose investment horizon is long-term with a high-risk appetite because, after all, it captures all kinds of businesses that are exporting, but basically focuses on low-premium stocks including those that are floating shares because they follow these firms’ performance policies like any other stocks listed on stock exchanges.

This fund is ideal if you are confident about India’s increasing global trade role and want to invest in companies that benefit from this change. So it targets investors who tolerate greater price fluctuation within the currency exchange framework together with other unfriendly risk-taking behaviors induced by international markets.

Another interesting thing is that it invests internationally improving exposure by offering diverse choices i.e. derivatives’ options as well as Real Estate Investment Trust (REIT) products which result into hence enabling one to achieve progressive capital gains rather than waiting for sudden upswings expected during bearish market periods only.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.