India’s equity market has been a major destination for both domestic and international investors, and the large and mid-cap segments continue to offer substantial growth opportunities. To tap into this potential, Helios Mutual Fund has introduced the Helios Large & Mid Cap Fund NFO, an open-ended equity scheme investing in both large-cap and mid-cap stocks.

This new fund offer aims to provide investors with long-term capital appreciation by investing in a diversified portfolio of large-cap and mid-cap companies.

Let’s explore the details of Helios Large & Mid Cap Fund offering and see how it fits into an investor’s portfolio.

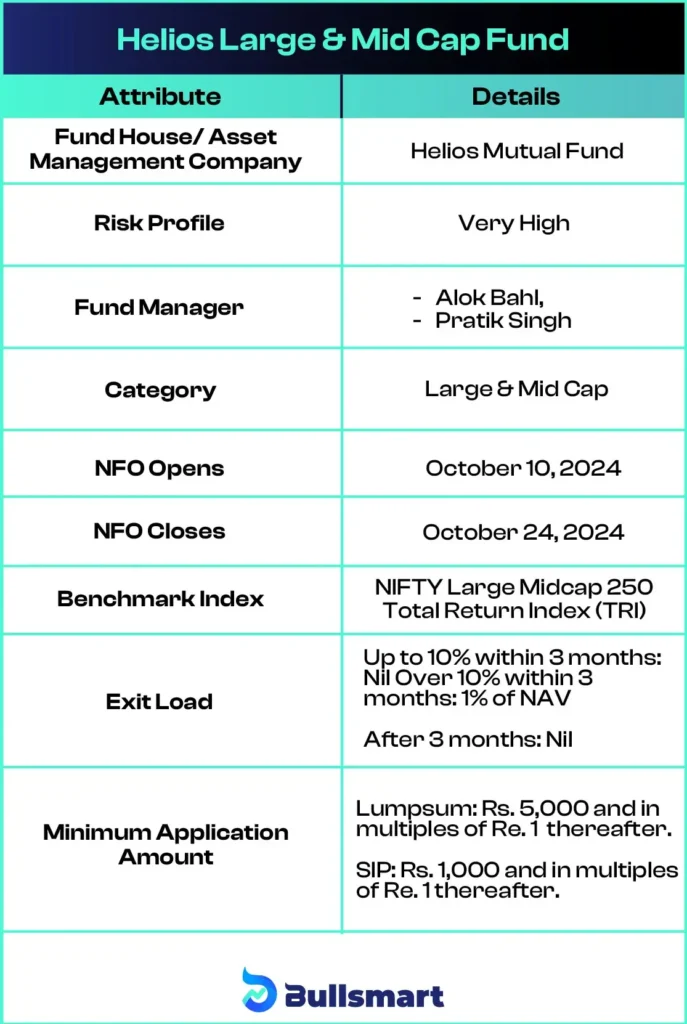

Details of Helios Large & Mid Cap Fund

The Helios Large & Mid Cap Fund NFO is an open-ended equity scheme that focuses on investing in a mix of large and mid-cap companies. It will benchmark against the NIFTY Large Midcap 250 Total Return Index (TRI), which covers a blend of large and mid-cap stocks.

Investment Objective of the fund

Helios Large & Mid Cap Fund objective is to provide long-term wealth creation opportunities by investing in a diversified portfolio, making it suitable for investors who have a high-risk tolerance and are looking for exposure to both large and mid-sized companies in India.

Here are the key details of the fund:

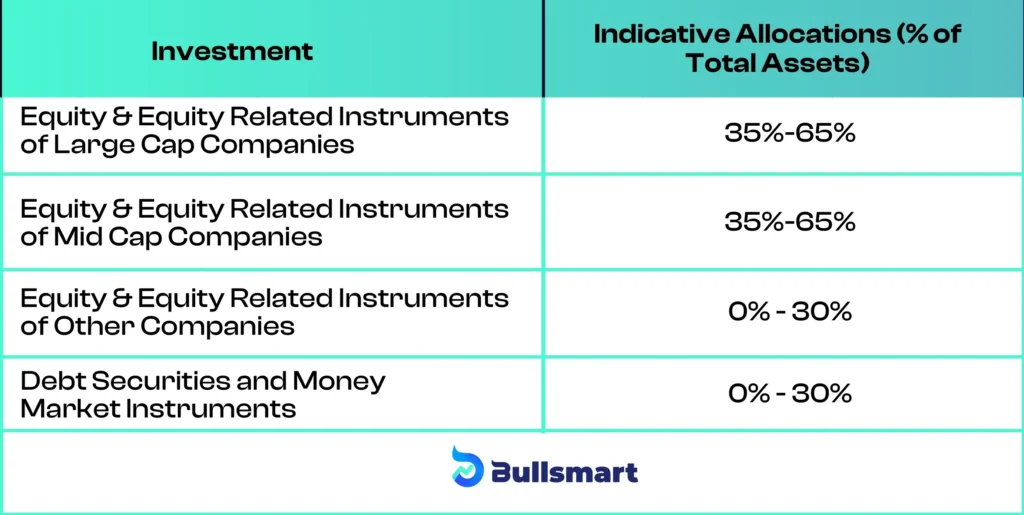

Portfolio Allocation

The asset allocation of the Helios Large & Mid Cap Fund is as follows:

Understanding Risks and Returns

As a large and mid-cap fund, the Helios Large & Mid Cap Fund NFO is suitable for investors looking for long-term capital growth but with a high-risk appetite.

The fund will primarily focus on large-cap stocks, which tend to be more stable, alongside mid-cap stocks that offer higher growth potential but with greater volatility.

The fund’s benchmark, the NIFTY Large Midcap 250 TRI, has historically delivered significant returns of 44.18% and 25.96% in the last 1 year, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Helios Mutual Fund

Helios Capital Asset Management (India) Pvt. Ltd., or Helios India, is a Mumbai-based firm authorized by SEBI to manage Portfolio Management Services (PMS) and Alternative Investment Funds (AIF).

It oversees investment strategies for Helios Mutual Fund’s schemes and is backed by its parent company, Helios Capital Management Pte. Ltd. in Singapore, which is also recognized as a Foreign Portfolio Investor.

Founded in 2005 by Samir Arora, Helios Mutual Fund began managing funds in India under PMS/AIF regulations in 2020 and received SEBI approval to launch a mutual fund in August 2023. This move aims to expand its reach to more investors.

As of June 30, 2024, Helios Mutual Fund manages assets worth ₹ 2,056.26 crores, offering three fund schemes: a flexicap fund, a balanced advantage fund, and an overnight fund. The company employs over 50 people across its main offices in Singapore and Mumbai.

Meet the Fund Managers

The fund is managed by experienced fund managers:

Mr Alok Bahl is the Chief Investment Officer at Helios Capital Asset Management (India) Private Limited, bringing over 33 years of experience in the financial sector. He manages several funds, including the Helios Flexi Cap Fund, Helios Overnight Fund, and Helios Balanced Advantage Fund.

Mr Pratik Singh, with over 10 years of experience, is a Fund Manager for Equities at Helios Capital. He also oversees the Helios Balanced Advantage Fund, Helios Flexi Cap Fund, and Helios Financial Services Fund.

Who should invest in this fund?

The Helios Large & Mid Cap Fund could be a good choice for:

- Investors seeking long-term wealth creation through exposure to large and mid-cap companies.

- Those who want a diversified portfolio that can benefit from the stability of large-cap stocks and the growth potential of mid-cap stocks.

- Investors with a very high-risk tolerance, as the fund is subject to market fluctuations and equity-related risks.

This fund is ideal for those looking to diversify their equity investments and are comfortable with the volatility that comes with investing in large and mid-cap stocks.

Suggested Read – ITI Large and Mid cap Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.