Navigating the investment landscape can feel a bit like choosing a dish from an extensive menu at your favorite restaurant. With so many options available, how do you decide what’s right for you?

On one hand, you have the allure of equity funds, known for their potential high returns and the thrill of the stock market rollercoaster. On the other hand, hybrid funds blend the best of both worlds, offering a balanced mix of equity and debt for those seeking stability with a sprinkle of growth.

In the realm of Indian mutual funds, two popular contenders have been catching investor’s eyes: HDFC Top 100 Fund and HDFC Hybrid Equity Fund. Both these funds follow different strategies and offer diverse aspects to look upon.

But which fund is the right pick for your financial palate? Let’s dive deeper into the contrasting flavors of these two funds, exploring their unique characteristics and what makes each one a worthy contender on your investment menu.

We’ll start-off by understanding basic details of both the funds!

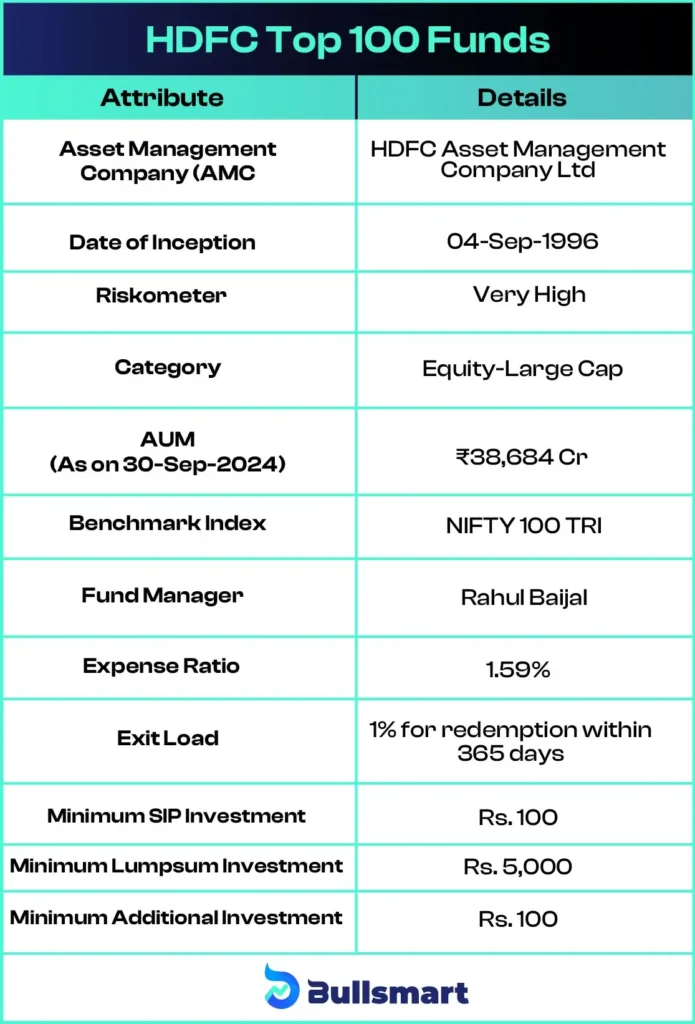

Overview of HDFC Top 100 Funds

The HDFC Top 100 Fund is a well-regarded large-cap equity Mutual Fund that focuses on long-term growth by investing in the biggest and most stable companies in the market. Its strategy involves putting corpus into large cap stocks, which tend to be less volatile and safer than smaller stocks.

What sets this fund apart is its smart way of spreading investment across various sectors that drive the economy like finance, technology, and consumer goods. This diversification helps reduce risk, meaning if one sector isn’t doing well, others can balance it out. The fund also follows a bottom-up approach when choosing stocks, meaning it spectates closely at individual companies to spot those with strong fundamentals and growth potential.

Peek at the fund’s details:

Data updated as of 15.10.24

Overview of HDFC Hybrid Equity Fund

The HDFC Hybrid Equity Fund is an aggressive hybrid mutual fund that aims to strike a balance between capital appreciation with income generation. Basically, it invests in a mix of stocks and debt instruments, as this fund seeks to deliver higher returns than traditional fixed-income options while remaining less volatile than pure Equity Mutual Funds. The goal is to provide long-term growth by leveraging the potential of equity markets, all while offering some stability through debt investments.

This fund is particularly well-suited for conservative investors or those new to the equity market. It offers exposure to stocks but with a lower risk compared to a fully equity-focused portfolio.

Peek at the fund’s details:

Data updated as of 15.10.24

Portfolio Allocation of Funds

The HDFC Top 100 Fund invests a whopping 96.32% of its corpus in stocks and 3% in cash equivalents. The fund focuses mainly on the financial sector, with major investments in top players like ICICI Bank (9.89%), HDFC Bank (9.01%), NTPC (6.27%), Larsen & Turbo (5.53%), and Bharti Airtel (5.27%).

The HDFC Hybrid Equity Fund allocates 69.4% of its corpus to equities and 28.47% to debt securities, with a smaller portion of 1.03% in cash equivalents and 0.96% in real estate assets. The fund primarily invests in large-cap companies, focusing on major players like ICICI Bank(7.5%), HDFC Bank(6.59%), Larsen & Turbo (4.65%), Reliance Industries (4.38%), and Bharti Airtel (4.14%).

The equity allocation breakdown is as follows:

- Large-cap: 76.1%

- Mid-cap: 15.59%

- Small-cap: 8.21%

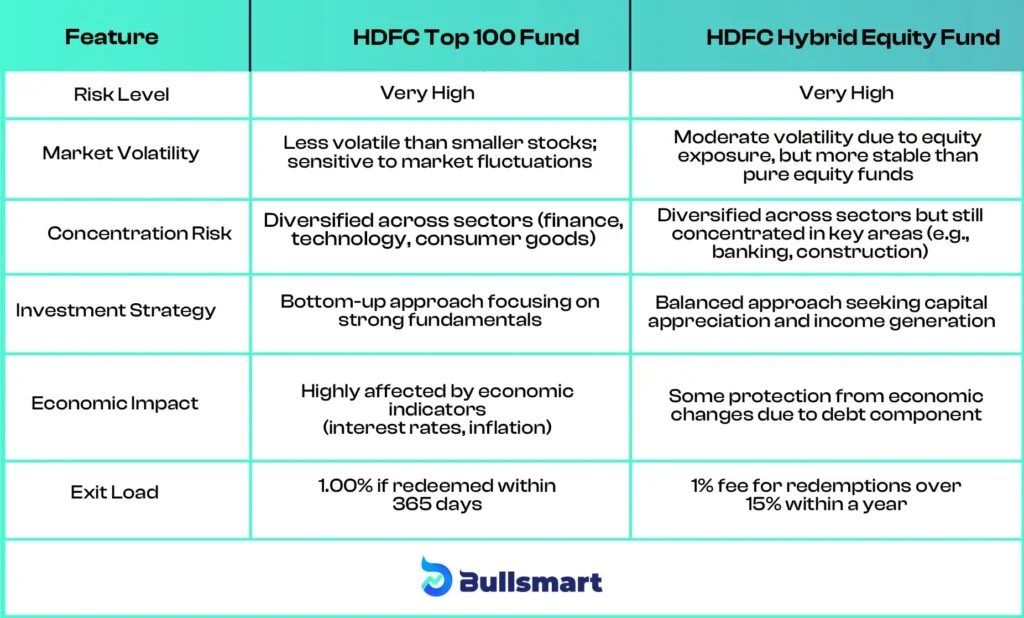

Risk Profile

While we compare two funds to find the right choice of investment, it becomes imperative to look over risk profiles too. We’ve fed some details in the table for your better understanding.

Take a look:

What can be derived from the table?

From the table, we can see that both the HDFC Top 100 Fund and the HDFC Hybrid Equity Fund have a very high risk. The Top 100 fund focuses on big, established companies which are usually less bumpy than smaller stocks, but you’ve still got to expect some wild price swings. It’s well-diversified across major sectors like finance and tech, helping spread out the risk.

On the other hand, the Hybrid Mutual Fund mixes stocks with some safer debt instruments, making it less volatile overall. It’s still a bit risky but offers a smoother ride. Both funds have similar exit loads, but the Hybrid Fund has a twist with a fee if you pull out too much soon.

Returns and Performance

Both the funds have showcased admirable performance over the years. Here’s a sneak-peak for you:

Taxation and Time Horizon

Both the HDFC Top 100 Fund and the HDFC Hybrid Equity Fund are taxed similarly as equity-oriented funds, with short-term capital gains taxed at 15% and long-term capital gains taxed at 10% (above Rs. 1 lakh) The key difference is in the asset allocation and risk exposure, not the tax treatment.

However, as the HDFC Hybrid Equity Fund holds a portion in debt, its overall risk is lower than the HDFC Top 100 Fund.

Which Fund is Suitable for Whom?

HDFC TOP 100 Fund

- For Aggressive Investors: Ideal for those looking for long-term capital growth and comfortable with high risk and market volatility.

- Equity Enthusiasts: Best suited for investors who want exposure to large-cap stocks and believe in the stability and growth potential of established companies.

- Experienced Investors: Suitable for investors who have a higher risk tolerance and a longer investment horizon (5+ years) to ride out market fluctuations.

- Sector Diversification Seekers: Investors looking to spread out risk across key sectors like finance, technology and goods.

HDFC Hybrid Equity Fund

- For Conservative Investors: Great for those seeking a balanced approach, blending growth potential with the safety of debt instruments.

- First-Time Equity Investors: Ideal for those new to equities but want some exposure to stocks with lower risk due to debt allocation.

- Moderate Risk Takers: Perfect for investors seeking capital appreciation but with a preference for some stability, making it less volatile than pure equity funds.

- Shorter Time Horizon: Suitable for investors with a 3-5 year investment horizon, offering a smoother ride with lower volatility.

Conclusion

Choosing the right fund can feel like picking a dish from an endless menu, each option offering its unique flavor!

The HDFC Top 100 Fund tempts you with the excitement of mammoth growth, while the HDFC Hybrid Equity Fund invites you to enjoy a blend of stocks and stability with Best SIP Platform.

With both funds showcasing impressive attributes, your decision hinges on your appetite for risk and investment goals.

So, which investment flavor are you craving to explore?

Suggested Read – Nippon India Small Cap Fund vs Quant Small Cap Fund Comparison

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.