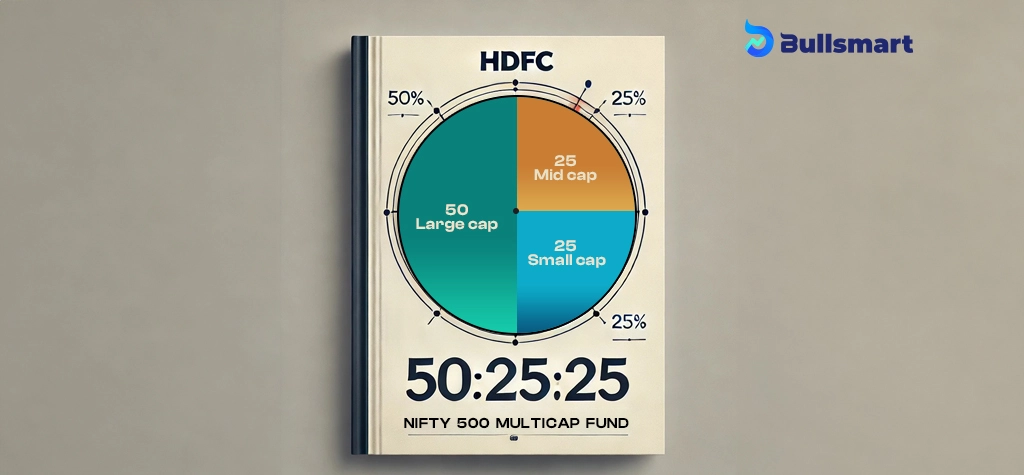

In the ever-evolving investment landscape, the HDFC Nifty500 Multicap 50:25:25 Index Fund stands out with a unique twist due to its allocation strategy. The fundal locates its corpus across various categories within a fund, offering a balanced blend of growth and stability.

It aims to capture the reliability of established industry giants while embracing the dynamic opportunities presented by emerging players. Let’s delve into the blog to explore this exceptional fund by HDFC and determine whether it aligns with your financial goals.

Details of HDFC Nifty500 Index Multicap Fund

The HDFC Nifty500 Multicap 50:25:25 Index Fund is a New Fund Offering(NFO) by HDFC fund house. It is an Open-ended fund (investors can enter & exit at any time they want) and it provides a smart and efficient way to invest in India’s top 500 companies.

The fund will be managed passively and seeks to replicate or track its benchmark index, the “Nifty 500 Multicap 50:25:25 Index”, which offers diversified exposure across various market segments to investors. The fund seeks to maintain a well-balanced allocation and delivers a broad market reach in a single investment that ensures a tax-efficient approach for long-term wealth creation.

It is Ideal for both seasoned investors and newcomers as it offers a robust strategy to enhance the investment portfolio.

Risks and returns of fund

Historically, the benchmark of the fund “Nifty500 Multicap 50:25:25 TRI” has out performed the NIFTY 500 TRI over 1, 3, 5, and 10-year periods, that demonstrates its potential for long-term wealth creation.

As of 31 July 2024, the benchmark of this fund has generated 45.31% returns over1 year and 25.94% over 5 years. The fund is also expected to generate returns like its benchmark, though they may vary according to market conditions.

The HDFC Nifty 500 Multicap 50:25:25 Index Fund provides investors with exposure to India’s top 500 companies, allowing them to benefit from the country’s economic growth. However, the fund’s exclusive investment in equities makes it a high-risk option.

HDFC Asset Management Company

HDFC Asset Management Company is India’s one of the largest AMC currently holds an AUM (Asset Under Management) of Rs. 7,15,750.38 crore. Over the past two decades, HDFC Mutual Funds have been delivering simple and accessible investment products to Indian households.

Most HDFC Mutual Fund schemes have weathered multiple market cycles, many of them going back over two decades. HDFC has a wide network of 228 Investor Service Centers (ISCs) across more than 200 cities. The goal of this AMC is to understand investors’ unique financial needs and provide them with tailored solutions to meet their needs.

They offer Portfolio Management Services and Separately Managed Account(SMA) Services to meet the unique investment needs of their investors, including High Net Worth Individuals (HNIs), family offices, domestic corporates, trusts, provident funds, and domestic and global institutions.

Meet the Fund Management team

The fund managers assigned to this fund are Mr. Nirman S. Morakhia and Mr. Arun Agarwal, both the managers have significant experience in managing various funds.

Mr. Nirman S. Morakhia, the Fund Manager and Dealer of Equities, is an MBA graduate with an impressive track record. Managing nearly 25 schemes, he has honed his skills through years of experience at Mirae Asset Global Investment Management India Pvt. Ltd. before joining HDFC Mutual Fund.

Mr. Arun Agarwal, with over 23 years of experience, is a powerhouse in equity, debt, derivative dealing, fund management, internal audit, and treasury operations. His extensive background and deep understanding of the financial landscape make him an asset to the fund’s management team.

Who should invest in HDFC Nifty500 Multicap 50:25:25 Index Fund NFO?

This fund is ideal for those seeking a diversified portfolio within a single investment. Despite the high risk associated with its equity investments, the fund offers significant growth potential. It aims to create wealth over the long term, making it best suited for investors willing to invest for more than three years. It’s always advisable to consult a financial advisor to get personalized mutual fund recommendations based on your risk appetite.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.