Index funds have gained immense popularity among investors due to their low-cost structure and ability to deliver returns that mirror a specific market index. Globally, index funds have seen significant growth, and in India, their AUM (Assets Under Management) has grown at a CAGR of over 50% in the past five years.

One such option in the index fund category is the HDFC Nifty LargeMidcap 250 Index Fund NFO, which replicates the Nifty LargeMidcap 250 Index (TRI).

These funds aim to provide returns in line with the performance of an underlying index, without the higher fees associated with actively managed funds.

This index captures the performance of 250 stocks, offering a balance between the stability of large-cap stocks and the growth potential of mid-cap stocks.

With large-cap companies known for their stability and mid-cap companies for their growth prospects, this fund creates an attractive opportunity for long-term wealth creation.

The ongoing NFO (New Fund Offer) for HDFC Nifty LargeMidcap 250 Index Fund is open from September 20, 2024, and closes on October 4, 2024.

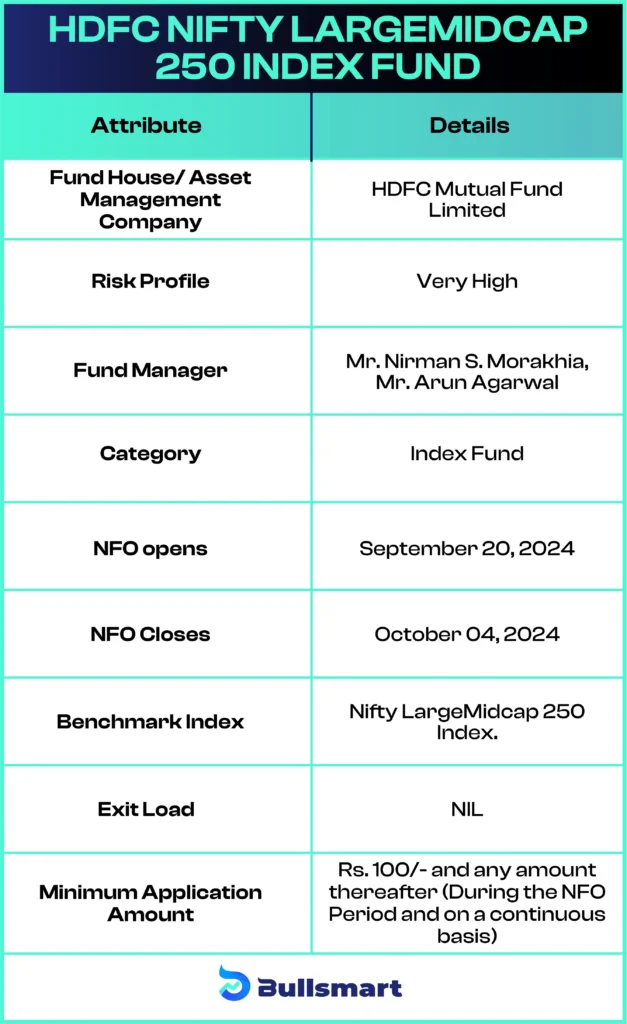

Details of HDFC Nifty LargeMidcap 250 Index Fund

HDFC Nifty LargeMidcap 250 Index Fund NFO is an open-ended equity scheme that replicates or tracks the Nifty LargeMidcap 250 Index (Total Returns Index).

Launching on September 20, 2024, HDFC Nifty LargeMidcap 250 Index Fund will provide an opportunity for investors to achieve returns that closely match the performance of the Nifty LargeMidcap 250 Index, over the long term.

Investing Strategy of the Fund

The primary objective of the HDFC Nifty LargeMidcap 250 Index Fund is to provide returns that correspond, before expenses, to the total returns of the securities represented by the Nifty LargeMidcap 250 Index.

Let’s look at the basic fund details:

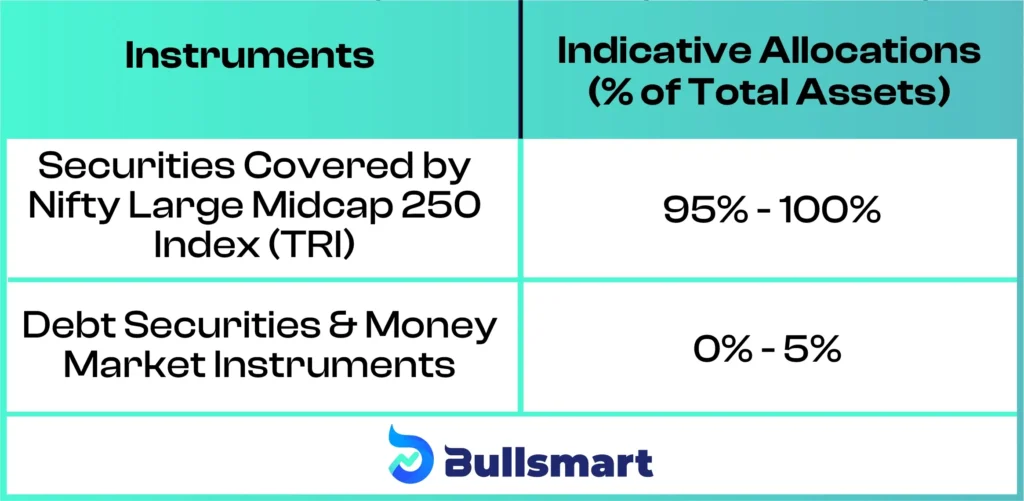

Portfolio Allocation

The fund will allocate its assets as follows:

Understanding Risks and Returns

HDFC Nifty LargeMidcap 250 Index Fund comes with a Very High-Risk rating. Since it primarily invests in equity securities, market volatility could impact returns.

The scheme follows the Nifty LargeMidcap 250 Index as its benchmark, which has delivered returns of 40.89%, 21.34%, and 25.89% in the last 1 year, 3 years, and 5 years.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Suggested Read – HDFC Manufacturing Fund

HDFC AMC Overview

HDFC Mutual Fund, supported by India’s largest private bank, is a leading asset management company in the country, managing assets totalling ₹ 715,750.38 crores as of June 30, 2024.

Founded in 1999 through a collaboration between HDFC and ABRDN Investment Management Limited, the company went public in 2018.

With a strong 28-year history and a reputation for profitability, HDFC Mutual Fund offers a diverse range of investment products across various asset classes, aimed at generating income and building wealth for its investors.

The fund is known for its robust performance and has a vast network of millions of active investors and thousands of distribution partners, including mutual fund distributors and banks.

Fund Manager Profiles

The fund is managed by experienced fund managers:

Nirman Morakhia

Nirman Morakhia, with 16 years of experience in equity dealing, holds an MBA in Financial Markets and a BMS from Mumbai University. At HDFC Asset Management Company since March 15, 2018, he has co-managed several schemes including the HDFC Arbitrage Fund and HDFC Balanced Advantage Fund. Previously, he served as an Equity Dealer at Mirae Asset Global Investment Management India Pvt. Ltd.

Arun Agarwal

Arun Agarwal, a Chartered Accountant with over 25 years of experience in equity, debt, and derivative dealing, has been with HDFC Asset Management Company since September 16, 2010. He co-manages the HDFC Arbitrage Fund and HDFC Balanced Advantage Fund, among others. His extensive background includes roles in fund management, internal audit, and treasury operations.

Is HDFC Nifty LargeMidcap 250 Index Fund NFO a Good Fit for You?

- Those with an investment horizon of more than 3 years, looking for capital appreciation from a diversified equity portfolio that spans both large-cap and mid-cap stocks.

- Investors who prefer a low-cost, passive investment strategy that aims to track an index, rather than relying on active management.

- The fund is categorized as Very High Risk. It is suitable for those who are comfortable with the market’s ups and downs and are willing to endure short-term volatility for potential long-term gains.

- Ideal for individuals focused on building wealth over time by investing in a broad-based portfolio that offers stability from large-cap companies and growth potential from mid-cap companies.

- This fund is a good fit for those seeking a diversified investment across multiple sectors and company sizes, which can help mitigate risks and provide balanced growth.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.