Driving India’s development through a focus on the Manufacturing sector is one of the major emphasis of Union Budget 2024. This sector attracts substantial government investments and boosts economic growth.

Key factors for this growth include availability of skilled labor, and initiatives by government such as Make in India, Atma Nirbhar Bharat, adjustments in custom duty, sector specific initiatives and MSME support is driving India towards a 10 trillion-dollar economy.

Imagine a landscape where infrastructure and logistics have evolved to make Indian businesses globally competitive. Yes, resurgence in the manufacturing sector could be a golden ticket for investors to gain potential returns.

Ready to bet on the future? Then check out the manufacturing fund launched by HDFC Mutual Fund, designed to capture the growth momentum of this sector. Dive into the blog to know more about this manufacturing fund and see how this could be your opportunity.

Details of HDFC Manufacturing Fund

HDFC Manufacturing Fund is an open ended Sectoral or Thematic Equity Mutual Fund launched by one of the India’s largest AMC, HDFC Mutual Fund house that manages an AUM (Asset Under Management) of Rs. 7,15,750.38 crore.

As on July,2024 HDFC Manufacturing Fund manages an AUM of Rs.11882.92 crores.

Currently, the fund holds 78 stocks in its portfolio representing diverse sectors in manufacturing that predominately includes capital goods, automobiles, healthcare, FMCG, oil & gas, chemicals etc.

Investment Objective of fund

HDFC Manufacturing Fund follows bottom-up style to pick stocks and add to its portfolio. This means the fund focuses on analyzing and selecting individual companies and stocks that may benefit from government initiatives, and schemes, as well as the companies positioned to substitute India’s imports or boost exports.

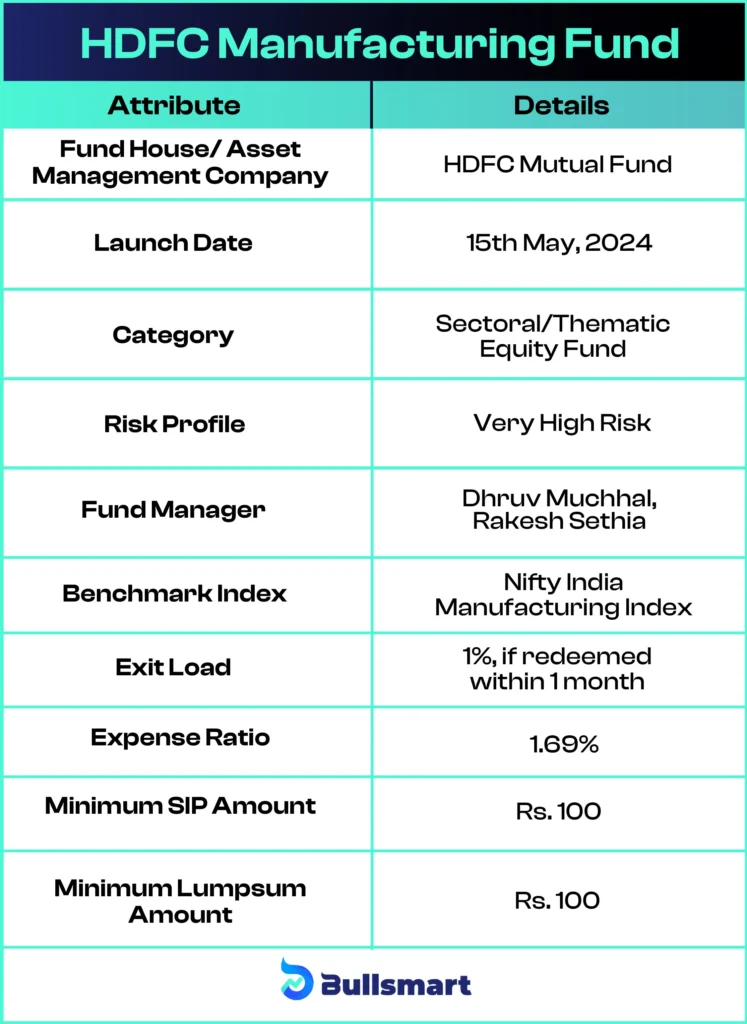

Let’s have a quick glance at the details of the Fund:

The minimum lumpsum & SIP amount is Rs.100 which makes the fund more accessible and affordable to its investors.

How is the Fund’s Portfolio Constructed?

The fund primarily invests in equities of manufacturing companies, allocating 86.57% of its assets to this sector. Out of which its main emphasis is on large-cap stocks, with 50.82% of the investments in this category, while also maintaining a balanced mix of large, mid, and small-cap companies.

This diversified approach aims to capture the growth potential across different market segments.

Navigating the risks and returns of fund

HDFC Manufacturing fund exhibits significant growth potential due to increased allocation of funds to the manufacturing sector by the government.

However, it comes with a catch of higher risk due to its concentrated portfolio where it allocates the major portion of its funds into equities. Hence, it is a highly risky fund with high growth potential due to industries remarkable growth

Suggested read : Motilal Oswal Manufacturing Fund

Meet the Fund Management Team

The fund is managed by a team of seasoned professionals, including Dhruv and Rakesh Setia, who bring exceptional expertise to the table. Mr. Rakesh Setia, a senior Equity Analyst at HDFC Asset Management Company Ltd, and Dhruv, a skilled investment manager, leverage their extensive experience to navigate and capitalize on market opportunities effectively.

Their combined knowledge and strategic approach contribute significantly to the fund’s success.

Who should invest in HDFC Manufacturing fund?

Investors with advanced knowledge of macro trends and a willingness to take higher risks may consider this fund. As the fund aims to provide long-term capital appreciation, it is best suited for investors who are optimistic about the growth of the manufacturing sector.

As always, investors should conduct thorough analysis before investing or seek professional advice if needed.