One HDFC Flexi Cap Fund standout in this category, which holds the second largest AUM among Flexi Cap funds, could be just what you’re looking for. Let’s explore further to see if it fits your investment needs.

Flexi Cap Funds offer the flexibility to invest in companies of all sizes – large, mid, and small caps, providing investors with a well-rounded approach to the stock market. This means you get the stability of large companies, the growth potential of mid-sized firms, and the high-reward opportunities of smaller companies, all within one fund.

Understanding HDFC Flexi Cap Fund

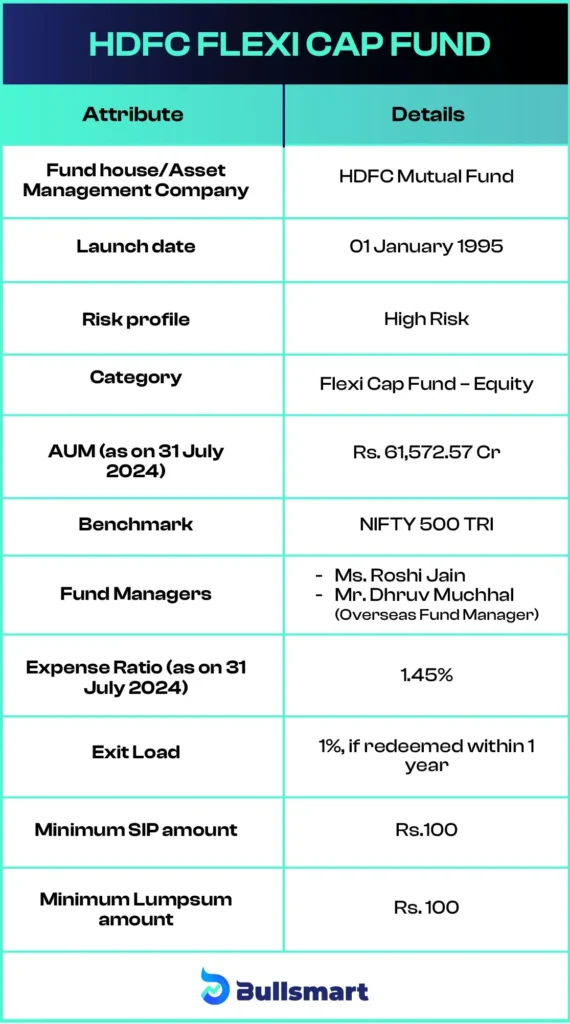

HDFC Flexi Cap Fund is an open-ended equity scheme that currently has an AUM of Rs. 61,572.57 crore, making it the second largest in the Flexi Cap category as of August 27, 2024. The fund uses the NIFTY 500 TRI as its benchmark index.

It is launched by HDFC Asset Management Company, one of the largest AMCs in India, the fund benefits from the company’s extensive experience. As of July 31, 2024, HDFC Asset Management Company holds an AUM of Rs. 7,15,750.38 crore. Over the past two decades, HDFC Mutual Fund have been known for delivering simple and accessible investment products to Indian households.

Let’s have a look at the basic details of the fund:

The expense ratio of the fund is 1.45%, which is lower than the category average of 1.90%, indicating that the fund is more affordable.

Portfolio Construction

HDFC Flexi Cap Fund allocates 87.81% of its investments to equities and 8.28% to cash and cash equivalents. Of the equity investments, 60.68% is in large-cap stocks, 5.77% in mid-cap stocks, and 4.19% in small-cap stocks. Its top holdings include ICICI Bank, HDFC Bank, Axis Bank, Cipla Ltd, and HCL Technologies.

Meet the Fund Managers

The fund is managed by Ms. Roshi Jain, who holds a CFA, ACA, and PGDM. She has been associated with the fund since July 29, 2022. Prior to joining HDFC Asset Management Company Limited, she has worked with Franklin Templeton Investments, Goldman Sachs, London, Goldman Sachs, Singapore, Wipro Ltd. And S. R. Batliboi & Co.

Mr. Dhruv Muchhal is an Equity Analyst, serves as the dedicated Overseas Fund Manager, adding global expertise to the team’s investment approach.

Suggested read – Is HDFC Balanced Advantage Fund Safe

Risks and Returns in the Fund

As a Flexi Cap Fund, it invests in equities of companies across various sizes, adapting to changing market conditions. Although it is a high-risk fund, it also has the potential to generate high returns.

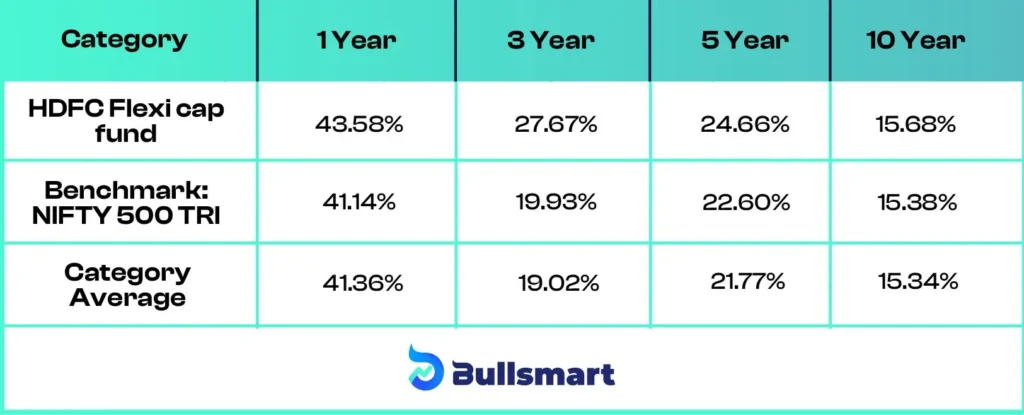

Let’s take a closer look at the returns generated by the fund compared to its benchmark over the years.

Note: The returns mentioned above are as of August 27, 2024. However, past performance is not an indicator of future returns.

HDFC Flexi Cap Fund has consistently outperformed its benchmark index and the category average, demonstrating its exceptional performance in the market.

Who should invest in this HDFC Flexi cap fund?

The HDFC Flexi cap Fund is ideal for long-term investors, particularly those with financial goals such as retirement, a child’s education, or wealth creation. It’s suited for risk-tolerant individuals who are comfortable with market volatility in pursuit of long-term gains.

This fund is also a good option for those seeking diversification across market capitalizations and with a high-risk appetite. Additionally, it’s best for investors who have financial flexibility and do not need immediate access to their invested funds.

It’s best to consider with a financial advisor to determine if this fund fits well within your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.