Introduction

The rise of geopolitical wars in many countries has led governments, including Indian government to focus on increasing their investment in the defense sector, thereby driving its growth. To grab this momentum HDFC fund house released India’s first defense fund which is “HDFC defence fund” on June 2nd,2023.

HDFC Defence Fund is a sectoral or thematic fund launched by HDFC Mutual Fund, one of the India’s largest Asset Management Companies. HDFC mutual Fund house is the most profitable AMC in the country with an impressive AUM of Rs. 715,750.38 crores as on 30 June 2024.

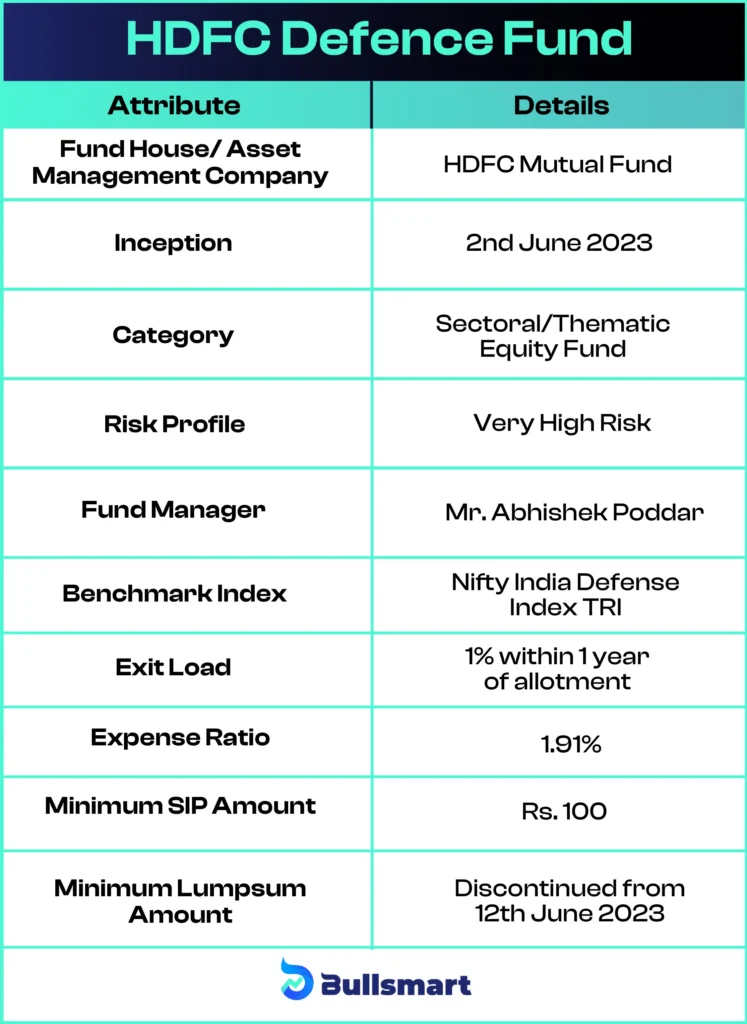

Details of HDFC Defence Fund

The HDFC defence fund is “India’s first defense themed fund” and it is an open-ended sectoral/thematic equity scheme that holds an AUM of Rs.3665.95 crore as on 30 June 2024. The fund considers “Nifty India Defense Index TRI” as its benchmark index.

The fund has an expense ratio of 1.91% which is slightly higher than the category average of 1.52%, which indicates that the fund is bit more expensive than other funds in the category.

It carries an exit load of 1% if funds are redeemed within 1 year of investment.

Alright! Let’s have a quick glance at the details of the HDFC Defence fund:

Portfolio construction

The HDFC defence fund aims to invest a minimum of 80% of its assets in defense related stocks. It strategically invests in equity & equity related instruments within the defense, and its allied sectors. 95.09% of its corpus is allocated to equities across Large cap, mid cap, small cap and other categories. Currently, the fund holds 20 top performing defense stocks, establishing itself as the premium choice for investors.

Meet the Fund manager: Mr. Abhishek Poddar

The HDFC defence fund is strategically managed by Mr. Abhishek Poddar, a seasoned professional with an overall experience of 17 years in equity research, investment banking, corporate finance and risk audit.

The minimum SIP investment is Rs. 100, and the maximum SIP limit is Rs.10,000 imposed by the AMC.

HDFC fund house announced that it has discontinued accepting lumpsum investments from June 12, 2023, for its defense fund due to limited availability of defense sector stocks.

Risk and returns

HDFC defence fund exhibits significant growth potential due to increased allocation of funds to the defense sector by the government.

However, it comes with a catch of higher risk due to its concentrated portfolio. This is a highly risky fund with the potential of long-term capital appreciation.

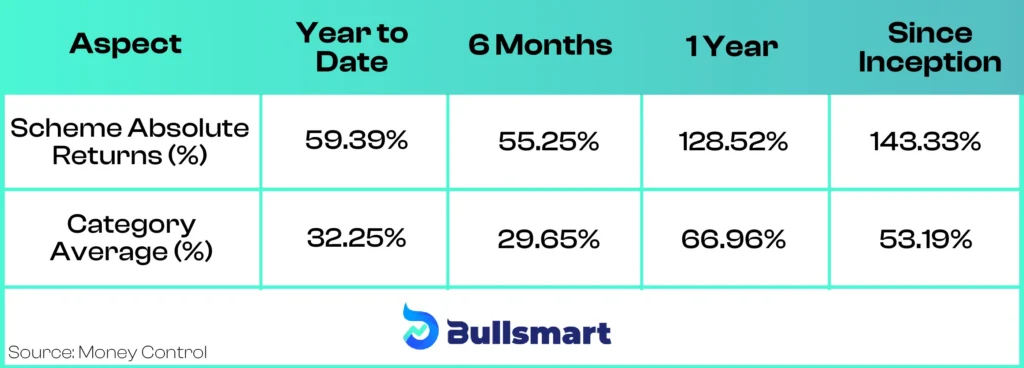

The returns generated by the HDFC defence fund compared to its benchmark is as follows:

Note: Past performance is not an indicator of future returns.

The fund has generated positive returns since its inception and is higher than the category average. Investors are advised to evaluate the figures against their peers before investing.

Who should invest in this HDFC Defence fund?

As HDFC defence fund is a sector specific fund, it is most suitable for investors with a keen interest in the defense sector and believe in its growth. Investors seeking sector specific exposure to diversify their portfolio and with higher risk tolerance. Hence, Investors must analyze their risk appetite before investing.