India’s defence sector is growing fast, and investors are taking notice. The government is spending more on defence each year and wants to boost defence manufacturing. This has led to increased interest in defense-related investments.

Now, Groww, a popular investment platform, just launched Groww Nifty India Defence ETF.

Several mutual fund companies have launched defence-focused funds recently. HDFC and Motilal Oswal have already introduced their defence funds, which have been well-received by investors.

This new fund aims to invest in defence-related companies listed on the stock market. It will track an index called the Nifty India Defence Index, which includes 15 stocks of companies involved in defence manufacturing and services.

Let’s take a closer look at what Groww is offering with this new defence ETF and how it might fit into an investor’s portfolio.

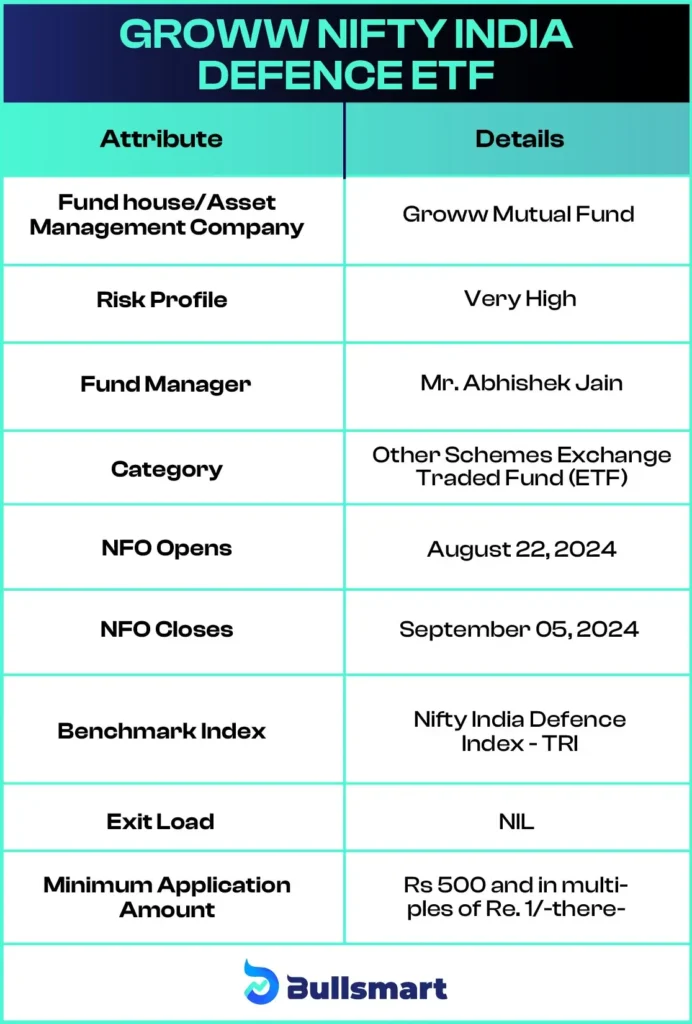

Details of Groww Nifty India Defence ETF NFO

The Groww Nifty India Defence ETF is proposed to be an open-ended exchange-traded fund (ETF) that will replicate the Nifty India Defence Index – Total Return Index (TRI). This fund aims to provide investors with exposure to companies benefiting from India’s growing defence sector.

The fund will consider the Nifty India Defence Index – TRI as its benchmark.

Investing Strategy of the NFO

The Scheme aims to provide returns that, before expenses, closely correspond to the total returns of the Nifty India Defence Index, subject to tracking errors.

Let’s have a quick look at the key basic details of the proposed fund:

Portfolio Construction

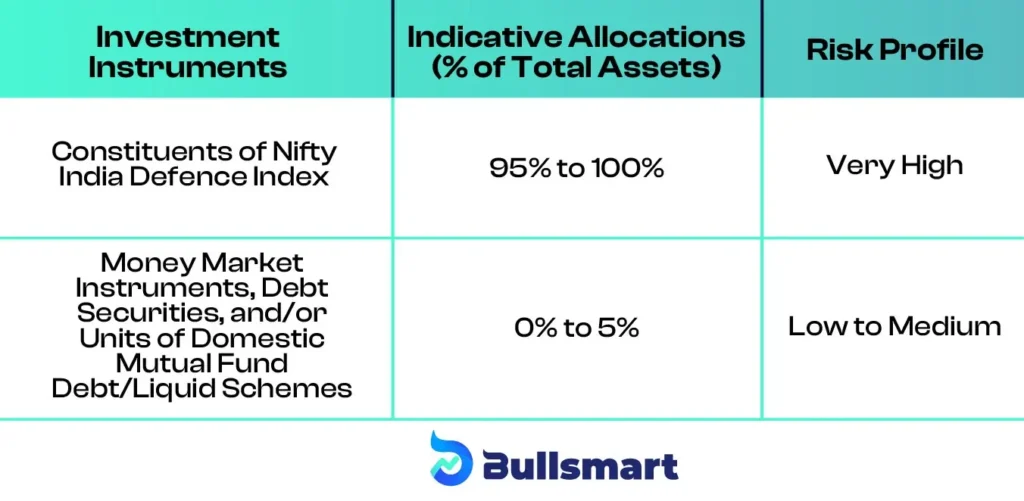

The asset allocation of the Groww Nifty India Defence ETF is as follows:

Understanding Risks and Returns

As a sector-specific ETF, the Groww Nifty India Defence ETF is likely to carry a high-risk profile. The defense sector can be influenced by government policies, geopolitical events, and technological advancements, which can lead to potential volatility.

However, with India’s push for self-reliance in defence and increasing budget allocations, this sector also presents growth opportunities.

Nifty India Defence Index – TRI has delivered returns of 159.32% and 62.65% over the past 1 and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Groww Asset Management

Groww Mutual Fund, part of the Groww financial platform, expanded its portfolio in March 2023 by acquiring Indiabulls Housing Finance. Dedicated to meeting diverse investor goals, Groww Mutual Fund provides a variety of products, including debt, hybrid, equity funds, and ETFs.

As of June 30, 2024, the company’s assets under management (AUM) stood at ₹ 857.24 crore.

Who should consider this ETF?

The Groww Nifty India Defence ETF may be a good choice for investors who are keen on gaining exposure to India’s defense sector and prefer the low-cost, transparent nature of ETFs. It is suitable for those with a high-risk tolerance who seek long-term capital appreciation. Additionally, this ETF is ideal for investors looking to diversify their portfolio with a sector-specific investment.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.