India’s defence sector is rapidly growing, driven by the government’s focus on indigenisation and boosting exports under the ‘Make in India’ initiative.

Small businesses and startups are also playing a key role, with over 430 involved in defence production as of December 2023. For investors wanting to benefit from this growth, the Groww Nifty India Defence ETF Fund of Fund offers a simple and diversified way to invest in India’s defence sector.

Over 2,900 defence items have already been produced domestically, with a goal to triple annual defence production to ₹3 lakh crore by 2028-29 and increase defence exports to ₹50,000 crore.

The stock market has responded positively to these initiatives, with defence stocks hitting new highs.

With the industry expected to grow at a 13% annual rate through FY23-30, this fund provides exposure to companies driving India’s defence transformation.

Let’s see if this NFO aligns with your financial objective.

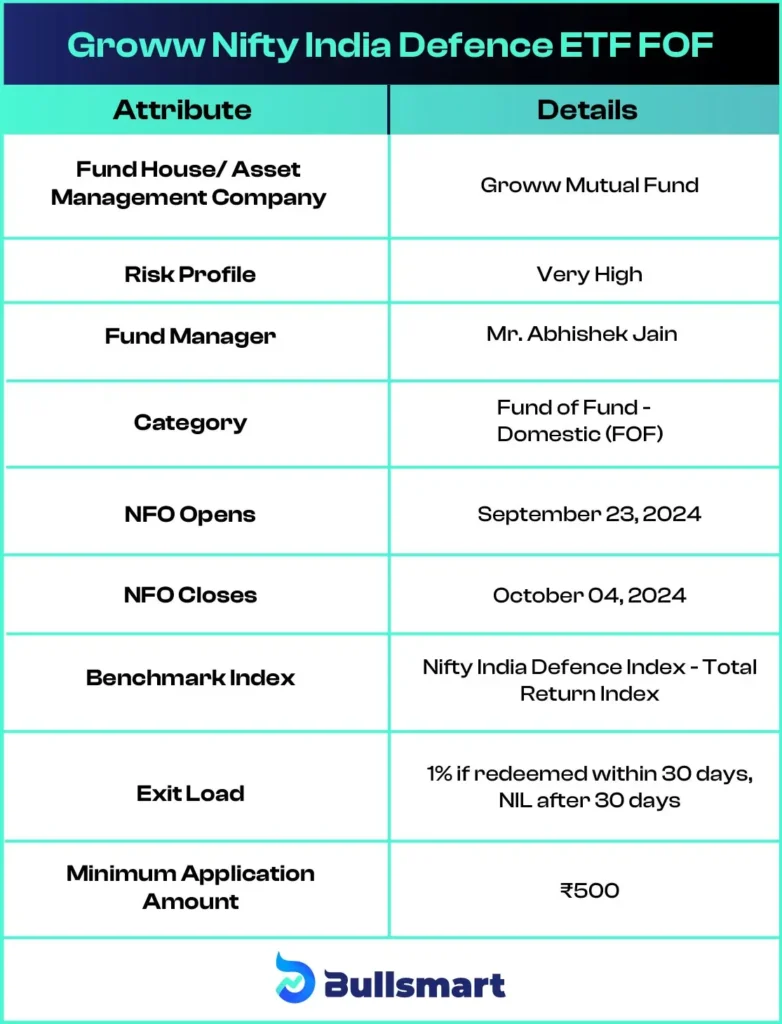

Details of Groww Nifty India Defence ETF Fund Of Fund

The Groww Nifty India Defence ETF Fund Of Fund is an open-ended fund of fund scheme that primarily invests in units of the Groww Nifty India Defence ETF. The ETF itself aims to replicate the performance of the Nifty India Defence Index, which comprises companies in the defence sector. With rising defence expenditure and a focus on self-reliance (Atmanirbhar Bharat), this fund offers exposure to the growing defence industry in India.

Investment Objective of the Fund

The fund’s investment objective is to generate long-term capital gains by investing in units of the Groww Nifty India Defence ETF. While the fund does not guarantee returns, it aims to benefit from the growth potential of companies in the Indian defence sector.

Here are the key details of the fund:

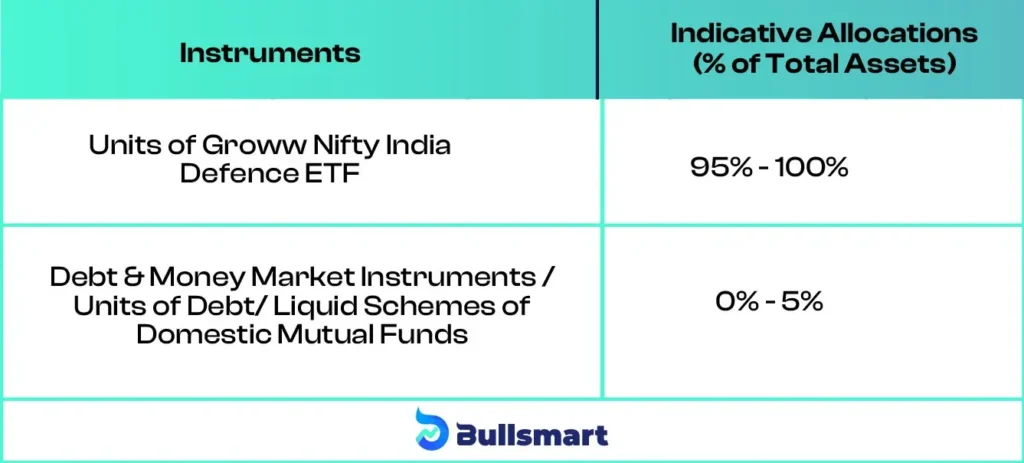

Portfolio Analysis

The scheme allocates its assets as follows:

Understanding Risks and Returns

The Groww Nifty India Defence ETF Fund of Fund carries a very high-risk profile due to its concentrated investment in the defence sector. This means that investors should be prepared for market volatility and sector-specific risks.

However, the defence sector in India is growing, with increased government spending, export opportunities, and the push for indigenous production.

The fund follows the Nifty India Defence Index – Total Return Index which has delivered returns of 159.32% and 62.65% over the past 1 and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Asset Management Company

In March 2023, Groww Mutual Fund, part of the Groww financial platform, broadened its offerings by acquiring India bulls Housing Finance. Committed to addressing various investor needs, Groww Mutual Fund offers a range of products, including debt, hybrid, equity funds, and ETFs.

As of June 30, 2024, the company’s assets under management (AUM) reached ₹ 857.24 crore.

Meet the Fund Managers

The scheme is managed by Mr. Abhishek Jain.

He is a seasoned Equity Dealer and Fund Manager with 12 years of experience in the equity market. He currently manages several schemes, including the Groww Nifty Total Market Index Fund and the Groww Nifty Smallcap Index 250 Index Fund.

Who should invest in this fund?

The Groww Nifty India Defence ETF FOF is suitable for investors who:

- Are seeking long-term capital appreciation.

- Want to gain exposure to the Indian defence sector.

- Have a high-risk tolerance and are willing to face market volatility for the potential of high returns.

- Want to diversify their portfolio by including a sector-focused thematic fund.

This fund is ideal for those who believe in the long-term potential of the defence sector in India, driven by government initiatives and growing global demand for defence products.

However, it is advisable to consult with a financial advisor to ensure that this fund fits your financial objectives and risk tolerance.

Suggested Read – Groww Nifty India Defence ETF NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.