Gold price levels in India have hit a point that few imagined so soon. In 2026, gold has surged all the way to around ₹1.36 lakh per 10 grams, turning what was once a distant milestone into today’s reality. For a country where gold is central to weddings, festivals, and long-term savings, this sharp rise has naturally put the spotlight back on gold investments.

What makes this rally stand out is not just the number, but the speed. After crossing the much-discussed ₹1 lakh mark earlier this year, gold prices didn’t pause, they accelerated. In a matter of months, the gold price climbed to new record highs, surprising investors, jewellers, and households alike. A level that was earlier discussed as a long-term target has arrived far quicker than most forecasts anticipated.

So, what exactly is driving gold prices higher in India right now? Is it global economic uncertainty, heavy buying by central banks, inflation concerns, or the impact of a weakening rupee? And with gold trading at such elevated levels, is this still the right time to consider gold investments, or should investors be cautious?

In this blog, we break down why gold prices are rising, look at the key trends shaping the market, and explore what the road ahead could look like for gold in 2026 and beyond, in simple, practical terms.

What’s Driving Gold Prices Up in India?

Gold prices are influenced by global and local factors, from economic uncertainty to festive demand. Here are the key reasons behind the surge:

1. Safe Haven Demand: Why Gold Continued Rising After ₹1 Lakh

Gold has always attracted investors during uncertain times, and that pattern has only strengthened in 2026. Early in the year, geopolitical tensions, supply chain concerns, and ongoing global conflicts pushed investors toward safe-haven assets, helping gold cross the psychological ₹1 lakh per 10 grams level.

What stood out, however, was that gold prices did not pause after hitting this milestone. Instead, the gold price continued to rise and eventually touched around ₹1.36 lakh per 10 grams. This happened because the risks supporting gold demand remained firmly in place.

Key factors that kept gold prices elevated include:

- Persistent global uncertainty: Trade tensions between major economies and unresolved geopolitical risks continued to unsettle financial markets.

- Equity market volatility: Periodic corrections in stock markets encouraged investors to increase exposure to gold as a defensive asset.

- Sticky inflation concerns: Inflation pressures did not ease as quickly as expected, reinforcing gold’s role as a hedge against loss of purchasing power.

- Currency impact in India: Episodes of rupee weakness pushed domestic gold prices higher, adding to investor interest in gold investments.

Together, these factors explain why gold moved well beyond ₹1 lakh instead of consolidating. As long as uncertainty and volatility remain part of the global economic landscape, gold’s safe-haven appeal is likely to continue supporting prices at elevated levels.

2. Central Banks Are Still Buying, and the RBI Is No Exception

One of the strongest forces behind the ongoing gold rally is sustained buying by central banks. This support has remained intact even after gold crossed ₹1 lakh and moved toward ₹1.36 lakh per 10 grams, helping prices stay elevated instead of correcting sharply.

Over the past few years, central banks globally have purchased more than 1,000 tonnes of gold annually, marking one of the longest accumulation phases in recent history. This trend reflects a clear shift in how countries manage their foreign exchange reserves.

Key reasons behind continued central bank buying include:

- Diversification away from the US dollar: Many countries are reducing their dependence on dollar-heavy reserves and increasing allocation to gold as a neutral reserve asset.

- Geopolitical and financial risk management: Events such as asset freezes and sanctions have reinforced gold’s role as a safe and sovereign store of value.

- Long-term reserve stability: Gold is being accumulated as a strategic asset, not for short-term price movements.

In India’s case, the Reserve Bank of India has continued adding gold to its reserves beyond 2024. RBI gold holdings are now estimated to be around or above 900 tonnes, signalling confidence in gold as a long-term component of India’s reserves.

When central banks continue buying gold even at record prices, it sends a strong signal to the market. This steady institutional demand creates a solid base for prices and helps explain why gold has been able to sustain levels close to ₹1.36 lakh per 10 grams.

3. Inflation and Rupee Weakness

Inflation and interest rate expectations have always played a major role in shaping gold prices, and this cycle is no different. However, what stands out in 2026 is that gold prices surged sharply even before actual interest rate cuts were announced, pushing prices toward ₹1.36 lakh per 10 grams.

Here is how these factors came together:

- Sticky inflation concerns: While headline inflation showed signs of easing in some economies, underlying cost pressures remained persistent. This kept real returns on savings low and strengthened gold’s appeal as a store of value.

- Rupee impact on domestic gold prices: The Indian rupee traded under pressure for much of the year due to global capital flows and trade imbalances. Even small bouts of rupee weakness amplified domestic gold prices, making gold costlier in India compared to global levels.

- Interest rate expectations versus reality: Markets widely expected rate cuts from major central banks, especially the US Federal Reserve. Despite delays in actual cuts, gold prices moved up in anticipation, as investors positioned themselves ahead of policy shifts rather than waiting for confirmation.

- Lower real yields: Even without formal rate cuts, real yields remained unattractive after adjusting for inflation. This reduced the opportunity cost of holding gold, which does not offer interest income.

Together, these factors explain why gold prices continued rising despite the absence of immediate rate cuts. For investors, this signals that gold is being driven not just by policy actions, but by expectations, currency dynamics, and persistent inflation risks.

4. Falling Interest Rates

Gold doesn’t earn interest, so it shines when interest rates drop. In 2026, expected rate cuts by the US Federal Reserve have made gold more attractive than fixed deposits or bonds.

In India, lower returns on savings accounts (3-6% annually) make gold a better option for preserving wealth. Global gold ETFs saw ₹783 billion (approx. $9.4 billion) in inflows in February 2026, reflecting this trend.

5. Festive and Cultural Demand

India is the world’s second-largest gold consumer, and gold is more than an investment it’s a cultural essential for weddings, Diwali, and Akshaya Tritiya. The 2024 festive season saw massive demand, with jewelers reporting a 20% sales spike.

This seasonal rush, combined with global trends, keeps prices high. For instance, demand surged during Dhanteras 2024, pushing local prices to ₹80,000 per 10 grams.

6. Limited Gold Supply

Gold supply isn’t keeping pace with demand. New gold from mines adds just 2-3% to global stocks yearly, and mining faces challenges like high costs (₹1,08,000 per ounce, or $1,300) and environmental rules.

Recycling is up 9% but not enough. With India importing 700-800 tonnes annually, this tight supply drives prices higher.

7. Investor Rush and ETF Inflows

Gold’s move beyond ₹1 lakh was not driven only by global factors. Investor behaviour changed sharply once this psychological level was crossed. Instead of triggering profit booking, the breakout actually strengthened participation, especially through financial gold products.

After gold crossed ₹1 lakh per 10 grams, gold ETFs saw renewed interest from both retail and institutional investors. Many investors who had been waiting on the sidelines treated the breakout as confirmation of a strong trend rather than a peak.

Key trends seen after the ₹1 lakh breakout include:

- Higher gold ETF inflows: Gold ETFs witnessed increased inflows as investors preferred paper gold over physical buying at elevated prices.

- Rising retail participation: First-time investors entered gold ETFs and gold mutual funds to hedge against equity volatility and economic uncertainty.

- Shift from equity risk to portfolio balance: While equity markets remained volatile, investors increasingly used gold to stabilise portfolios rather than chase returns.

This steady flow of investment money helped gold sustain momentum and move toward ₹1.36 lakh instead of correcting after the initial rally.

Recent Trends in the Gold Market

- Gold prices moved steadily higher from around ₹63,700 per 10 grams in mid-2023 to nearly ₹78,800 by October 2024, reflecting normal inflation hedging and seasonal demand.

- The pace of the rally changed in early 2026 as global economic risks increased and central bank gold buying remained strong.

- Gold crossed the ₹1 lakh per 10 grams mark in 2026, which was earlier seen as a long-term target.

- Instead of stabilising, prices accelerated further and touched around ₹1.36 lakh per 10 grams within months, much faster than most forecasts expected.

- This rapid rise signals a shift from gradual appreciation to fast price discovery, driven by global and institutional factors rather than only domestic demand.

What this trend indicates:

- Gold prices are no longer moving only due to festivals, weddings, or routine inflation protection.

- The metal is increasingly being treated as a strategic asset amid persistent global uncertainty and currency pressures.

- Institutional participation and long-term capital flows are playing a bigger role than before.

These trends explain why the current gold rally feels structurally different and why record price levels are being reached much sooner than earlier cycles.

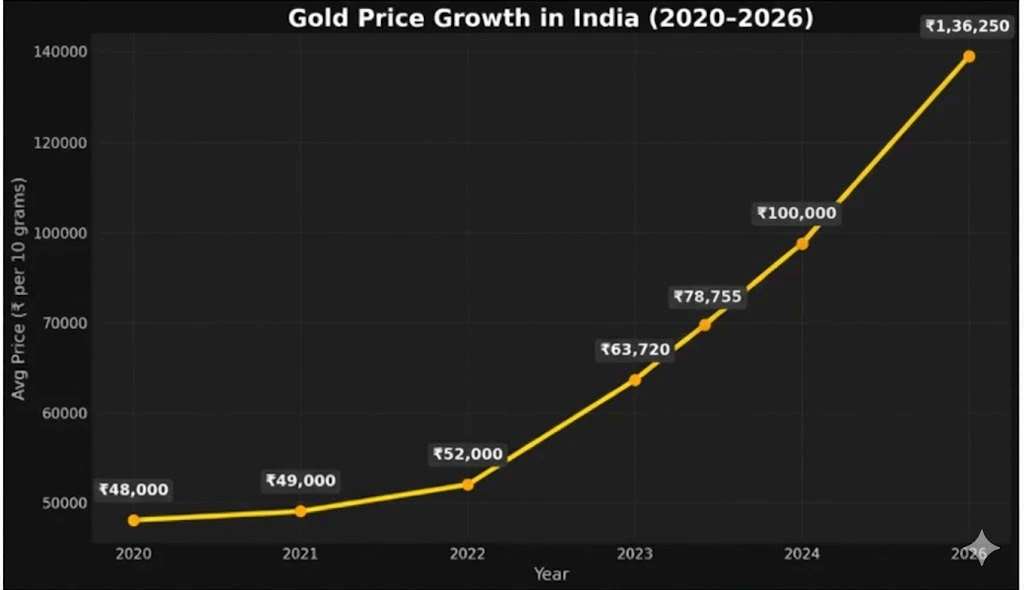

Gold Price Growth Chart (2020-2025)

Here’s a look at the average annual gold prices in India (per 10 grams) to show the upward trend:

| Year | Average Price (₹/10 grams) |

| 2020 | 48,651 |

| 2021 | 47,910 |

| 2022 | 50,926 |

| 2023 | 60,456 |

| 2024 | 73,250 (Q4) |

| 2025 (Apr) | 1,00,000 |

| 2025 (Dec) | 1,36,250 |

Source: World Gold Council, MCX, and market data (converted at average annual USD/INR rates)

This chart highlights gold’s steady rise, with a sharp spike in 2024-2025 due to global and local factors.

Glance at this chart for a visual showcase of the price uptrend:

Will Gold Prices Go Down?

- After reaching around ₹1.36 lakh per 10 grams, the conversation around gold has shifted.

- The key question is no longer about a sharp fall, but about how deep and how frequent corrections could be.

What a downside may look like now:

- Any decline is more likely to be a short-term correction from elevated levels, not a return to old price zones.

- Profit booking after a sharp rally can cause temporary pullbacks, especially if global risk sentiment improves.

- Higher interest rates or stronger equity markets could reduce incremental demand for gold in the short run.

What is less likely at this stage:

- A collapse back to levels like ₹85,000 or ₹90,000 per 10 grams, unless there is a major shift in global conditions.

- A sustained fall without a meaningful change in central bank buying, inflation trends, or currency dynamics.

After ₹1.36 lakh, market psychology has changed. Gold is now viewed as a structurally strong asset, making corrections more about consolidation than reversal.

Suggested Read: Silver vs. Gold: Reasons Why Silver Could Outshine Gold for Explosive Returns in 2026!

Expert Forecasts: How Expectations Have Changed After ₹1.36 Lakh

- Earlier forecasts had projected gold prices reaching ₹1.30 to ₹1.36 lakh by 2026 or 2027.

- Those targets have already been met far sooner than expected, forcing analysts to reassess their assumptions.

How forecasts are being revised now:

- Analysts are shifting from single-number targets to price ranges.

- The focus has moved to sustainability, volatility, and long-term allocation rather than exact peak levels.

Updated outlook trends include:

- Medium-term range-based views, instead of point forecasts.

- Expectations of consolidation phases interspersed with gradual upside rather than a straight-line rise.

- Long-term projections continue to factor in inflation, currency depreciation, and central bank demand rather than speculative momentum.

In short, forecasts today are less about predicting the next exact number and more about understanding gold’s role in a high-price environment. This change in approach reflects how significantly gold has outperformed earlier expectations.

The Verdict

Gold prices might dip short-term if supply rises or global tensions ease, but the long-term outlook is strong due to central bank buying, festive demand, and inflation fears.

Indian investors should monitor RBI policies, global events, and the rupee’s value closely.

Listen to what the expert says:

Are Gold Prices and Silver Prices Correlated?

Gold and silver prices often move in the same direction, but they are not perfectly correlated. Historically, silver has tended to follow gold during major uptrends and downturns, especially in times of economic uncertainty. When investors rush toward safe-haven assets, gold usually leads the move, and silver reacts soon after.

However, the relationship is not one-to-one. Gold is primarily driven by investment demand, central bank buying, interest rates, and currency movements. Silver, on the other hand, has a dual personality. It acts as both a precious metal and an industrial metal. Nearly half of global silver demand comes from industries like electronics, solar panels, electric vehicles, and medical equipment. Because of this, silver prices are also influenced by economic growth and industrial activity.

So, will silver go up if gold rises? Often, yes, but not always immediately. In many past cycles, silver has lagged gold initially and then caught up later, sometimes rising faster once momentum builds. This is why silver is often more volatile than gold.

Similarly, if gold prices fall, silver can decline too, but industrial demand can sometimes cushion the fall. In short, gold sets the direction, while silver adds volatility. Investors should view them as related but distinct assets rather than perfect substitutes.

Wrapping Up

Gold’s journey in 2026 has clearly gone far beyond expectations. What started as a steady rise has turned into a powerful rally, with the gold price climbing all the way to around ₹1.36 lakh per 10 grams. This move is not being driven by a single factor. Global uncertainty, aggressive central bank buying, inflation concerns, currency pressure, and strong cultural demand in India have all come together to push gold to record highs.

At the same time, the rally has changed how investors should look at gold. It is no longer about whether gold can cross ₹1 lakh. That question has already been answered. The real focus now is on sustainability, volatility, and the role gold should play in a portfolio at elevated levels. Short-term corrections are always possible, especially after such a sharp run-up, but the long-term case for gold remains intact.

For Indian investors, gold still works best as a stabiliser rather than a return-chasing asset. Whether through jewellery, sovereign gold bonds, gold ETFs, or mutual funds, gold investments can help balance risk when equity markets turn volatile or economic conditions remain uncertain. Most experts continue to suggest keeping gold exposure in the range of 5 to 10 percent of the overall portfolio.

Gold may not move in a straight line from here, but its role as a trusted store of value in India looks firmly intact.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

FAQs

Can gold prices reach 1 lakh?

Yes, gold prices in India have already moved well beyond this level. The ₹1 lakh mark, which was once seen as a major psychological barrier, was crossed earlier in 2025. Since then, gold prices have continued to rise and are now trading around ₹1.36 lakh per 10 grams.

This shows that the rally was not a one-time spike. It was supported by sustained global uncertainty, strong central bank buying, inflation concerns, and currency pressures. The discussion around gold has now shifted from whether it can reach ₹1 lakh to how stable prices can remain above this level.

How much is 1 kg of gold today?

At current levels, with gold priced at around ₹1.36 lakh per 10 grams, the cost of 1 kilogram of 24 karat gold works out to approximately ₹1.36 crore.

Actual prices may vary slightly depending on location, jeweller premiums, taxes, and making charges in the case of physical gold. Financial gold products like gold ETFs or sovereign gold bonds typically track market prices more closely.

Did gold cross 1 lakh?

Yes, gold prices in India crossed the ₹1 lakh per 10 grams mark in 2025 and have since moved significantly higher. The rally did not stop at that level. Instead, gold continued to gain momentum and reached around ₹1.36 lakh per 10 grams, reflecting strong demand and changing global risk dynamics.

How much is 1 gram of gold today?

At current market levels, 24 karat gold is priced at approximately ₹13,600 per gram, while 22 karat gold is available at a slightly lower rate depending on jeweller margins, local taxes, and making charges. Gold prices can vary across cities and sellers, especially in the case of jewellery purchases. Investors and buyers are advised to check live gold rates before making a purchase, as prices fluctuate daily based on market conditions.