ESOPs, aka Employee Stock Ownership Plans, are a big deal in employee perks. They let you own a piece of the place you work at. It’s like saying, “I own a part of this ship!” These plans make everyone feel like they’re in it together, aiming for the same goal. Plus, they’re like a treasure map for your finances, showing you the way to growth and security.

This guide will break down how ESOPs work, why they’re awesome, and what they mean, especially in India.

ESOPs in India: An Old Fable

In ancient times, the wise sage Chanakya devised a fair compensation system for cowherds. He divided them into groups based on the quality of the cows they tended. This was one of the many techniques derived from the ancient Sanatan text called “Artha Shastra.”

For high-end cows, a fixed salary was recommended to prevent overwork. For mid-range cows a fixed return for the owner, with the surplus going to the cowherd. For low-grade cows, there is shared compensation between the owner and cowherd.

This ties earnings to assets and employees. Today, we see this in tech companies where individual effort is linked to ownership and accountability.

Want some tips from Chanakya himself? Well then, check out this short video for some crisp tips:

Introduction of ESOPs in the Modern World (Globally)

In September 1957, 5 scientists and 3 engineers had a bold idea for transistors: they wanted to make them out of silicon. So, they quit their jobs at Shockley Transistor Laboratories and started their own company called Fairchild Semiconductor Corporation. Sherman Fairchild, a big-time inventor and the largest shareholder of IBM at the time, decided to back their idea with $1.38 million.

These 8 people became the “founders” of the company, each getting 100 shares. They also had 2 smart money guys who helped organize things and got 225 shares each. 300 shares were set aside for future big shots they planned to hire.

The money to fund all this came from Fairchild Camera and Instruments, an already successful company. They had the option to buy shares from the founders and other shareholders for $3 million, but only if Fairchild Semiconductor made a $300,000 profit for 3 years. If they waited until the company made a $5 million profit, they could buy the shares, but for a bit more money.

Within 2 years, the new company made $6.5 million. So Fairchild Camera and Instruments exercised their option to buy the shares. Each of the 8 founders got around $250,000 for their work. Back then, that was a lot of money–imagine that, before people talked about billionaires like they do now! This sets a new standard for how people in the tech world get paid.

Birth and Growth of ESOPs in India

- Infosys, in the 1990s, popularized ESOPs by creating numerous rupee millionaires and billionaires through its ESOP programs.

- During the 1990s, ESOPs became highly attractive due to tax benefits. They were exempt from tax at the time of option exercise and sale, doubling their value compared to alternative salaries.

- Despite the loophole being closed in the early 2000s, ESOPs remained appealing as they offered employees stock ownership without requiring upfront investments.

- Following the telecom and dot-com double burst in the early 2000s, ESOPs faced scrutiny, leading to a requirement for companies to account for ESOP costs in their financial statements.

- Previously considered free, companies issuing ESOPs were now mandated to book the cost of options if the exercise price matched the market value.

- Established and profitable companies saw less benefit in issuing ESOPs due to these accounting changes. However, ESOPs continued to thrive in the startup ecosystem and are poised for continued success in the future.

Benefits of ESOPs

Talent Attraction and Retention

ESOP helps companies attract and retain top talent by offering them a stake in the company’s growth and success.

Alignment of Interests

ESOP aligns the interests of employees with those of the company and its shareholders, incentivizing employees to work towards the company’s long-term success.

Wealth Creation

ESOP allows employees to participate in the company’s equity upside, providing them with an opportunity to create wealth over the long term.

Tax Benefits

ESOP schemes in India offer certain tax benefits to both the company and the employees, making them an attractive compensation tool.

Procedure for Issuing an ESOP

- Board Approval: The company’s board of directors must approve the ESOP scheme, outlining key details such as the total number of shares to be granted, eligibility criteria, vesting period, and exercise price.

- Shareholder Approval: Following board approval, the scheme must be ratified by the shareholders through a special resolution,

- ESOP Scheme Drafting: The company drafts the ESOP scheme document, detailing its governance, administration, and operational guidelines. This document ensures compliance with legal requirements under the Companies Act, 2013, and Companies (Share Capital and Debentures) Rules, 2014.

- Grant of Options: Once the scheme is approved, eligible employees are granted options. A grant letter is issued specifying the terms of the grant, including the number of shares, vesting schedule, and exercise price.

- Vesting and Exercise: When you earn stock options through your job, they become fully yours, or “vested,” when you meet certain conditions or wait a certain amount of time. At that point, you can choose to buy the company stock at a special price, usually lower than the current market value. You don’t have to buy the stock at the special price if you don’t want to, and if you don’t, you won’t owe any taxes on the options.

- Taxation: Taxation of ESOPs occurs in two stages: at exercise and at sale. The tax treatment depends on various factors, including the type of options, holding period, and applicable tax laws.

How Can an Individual Avail ESOP?

- Snagging a Job: Get hired at a company rolling out an ESOP.

- Eligibility Check: Tick off the requirements outlined by the ESOP, like how long you’ve been there and what you do.

- Option Handout: Score some stock options, giving you the green light to buy company shares at a set price.

- Vested Timeline: Stick to the schedule where options become available for exercise over time, usually if you stick with the job.

- Option Execution: Cash in those options by buying shares at the set price once they’re up for grabs.

- Tax Tracking: Wrap your head around the tax stuff that comes with exercising options and selling shares down the line.

- Share Showdown: Figure out whether to keep or sell your newfound shares, based on what’s happening in the market and what you want to achieve.

- Pro Talk: Chat with financial whizzes and tax pros to navigate the nitty-gritty of ESOPs and make smart moves for your money.

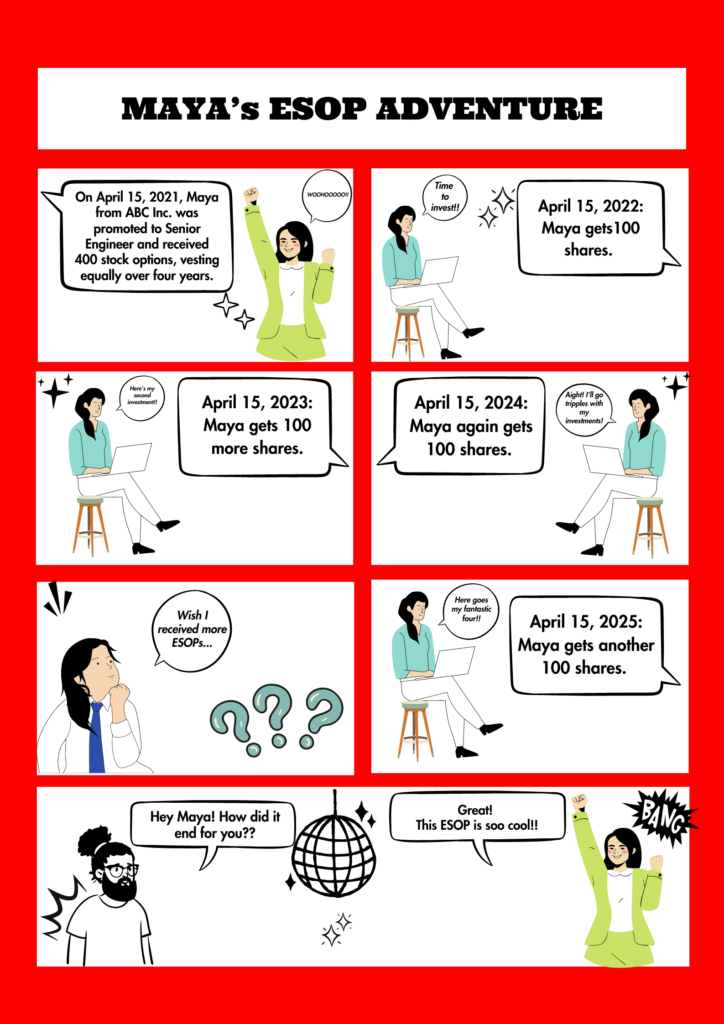

Comic Time!!

The date was April 15, 2022, and Maya was at the receiving end of a bonus, i.e., shares of her company ABC Inc. priced at Rs. 100. Here’s a tabular presentation of how her bank sum increased manifold:

| Year of ESOPs | Price of Single Share | Number of Shares Allotted | Total Value of ESOPs (INR) |

| 2022 | 100 | 100 | 10,000 |

| 2023 | 150 | 100 | 30,000 |

| 2024 | 400 | 100 | 1,20,000 |

| 2025 | 1000 | 100 | 4,00,000 |

Four years down the lane, Maya finds herself owning a hefty sum of Rs. 4,00,000 (4 lakhs). This showcases how her perseverance and the time she spent maintaining a persistent stance contributed to her bank’s sum.

All this fancy shuffle and ruffle raised her hopes to work more diligently for her company.

Both shareholders, i.e., ABC Inc. and Maya, savored a win-win situation.

What a day! Look at all the money she made!

Bottom Line

In a nutshell, ESOPs are the ultimate power-up for workplace vibes. They’ve come a long way from their ancient roots to becoming the cool new thing in modern companies.

Think of them as your ticket to being more than just an employee—you’re part owner now. They’re not just about making bank; they’re about teaming up for success.

Just look at companies like Wipro and Infosys in India; they’ve shown how ESOPs can attract and keep top talent while making everyone feel like they’re in it together.

And for you, diving into ESOPs means diving into a journey of growth, ownership, and teamwork. So, buckle up and get ready to level up in your career game with ESOPs by your side.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

FAQs

What is ESOP terms in India?

So, this is basically how long it takes for the stocks to become fully available. Let’s say a company gives out 100 shares to an employee with a 4-year vesting period. That means the employee gets 25 shares each year for 4 years. Once those 4 years are up, the employee can turn those options into actual shares.

Is ESOP calculated in CTC?

ESOPs are usually part of what an employee gets in their total compensation, called the Cost-to-Company (CTC). This CTC covers more than just the basic salary—it also includes bonuses, allowances, and perks like ESOPs. The worth of ESOPs depends on how many options are given, the exercise price, and the market value of the shares when they’re granted.

What is the ESOP 25% rule?

It says that the ESOPs shouldn’t own more than 25% of the whole value of the company’s stocks. It’s for keeping things fair, so that employees have a piece of the pie, but investors and managers, have a dominant say. This rule ensures that employees have a say in the company, but also that everything stays balanced and the company stays financially healthy.

Is ESOP better than salary?

It depends on your financial goals, risk tolerance, and career aspirations. A higher salary provides immediate cash flow and stability, while ESOPs offer long-term wealth accumulation and potentially higher returns. ESOPs align employees with the company’s success but come with market risks. A balanced approach may be ideal, combining salary and ESOPs.