“El Niño”….You may have heard this word in news or on TV, but what does it really mean for India? In simple words, El Niño happens when the water in the Pacific Ocean becomes hotter than usual. This change in temperature may look far away, but it affects weather all over the world.

For India, El-Niño often means weaker or delayed monsoons. When rains are not normal, farmers face big problems. Crops like rice, sugar, and pulses may not grow well, which can lead to less supply and higher food prices. This does not just hurt farmers – it affects everyone, because food becomes costlier and rural incomes fall.

When agriculture slows down, it impacts other industries too. Companies that sell everyday items in villages, businesses that depend on crops, and even electricity providers may all feel the pressure. Past records show that El Niño years often bring challenges for India’s economy and sometimes cause ups and downs in the stock market.

In this blog, we will look at how El-Niño has affected India in the past, which sectors are sensitive to it, and why it matters for the economy. This is for education, not advice.

What is El Nino?

El Niño is when the Pacific Ocean gets hotter than usual near the equator. This change in ocean temperature messes up normal weather, causing droughts in some places and floods in others.

Imagine the Earth’s oceans as a giant bathtub, and El-Niño is like a burner turning up the heat under that bathtub. It’s a natural climate pattern characterized by warmer-than-average sea surface temperatures in the central and eastern Pacific Ocean. This warming of the ocean can cause a ripple effect across the globe, messing with the usual weather patterns.

For example, it can lead to heavy rainfall in some areas and droughts in others. In places like the western coast of South America, where normally cold water upwells from the deep ocean, El Niño can disrupt this, affecting marine life and fishing industries.

In more distant places, like Asia and Africa, it can influence rainfall patterns, potentially causing flooding or drought conditions, which can impact agriculture and food production. And yes, it can even mess with the stock market because disruptions in agriculture and other primary industries can affect economic stability.

So, in a nutshell, El-Niño is like nature hitting the climate control switch, stirring up a whole lot of unpredictable weather chaos around the world.

Historical Evidence of El Nino Affecting the Industries

El-Niño, that funky weather vibe when the Pacific Ocean gets too hot, can really shake things up for industries in India, especially messing with the monsoon and farming. Here’s a breakdown of how it all goes down:

Farming

When El-Niño hits, it’s like the rain takes a vacation. Less rain means trouble for crops, leading to failed harvests, water shortages, and food prices shooting through the roof. In 2015, all-India seasonal rainfall was 86% of the long-period average (≈14% below normal).

Consumer World

When farming struggles, it’s not just the farmers feeling it. Sales of everyday stuff like FMCG (Fast Moving Consumer Goods) slow down too, especially in rural areas. During the 2105 El-Niño, FMCG sales growth slashed to just 9%, down from 14% the year before.

Infrastructure

El Niño often reduces overall Indian monsoon rainfall, but the spatial impact varies by year and depends on other climate drivers such as the Indian Ocean Dipole.

That messes with projects like irrigation and hydroelectric power, causing a headache for builders and planners.

Electricity

Hotter summers plus less hydroelectric power? That’s a recipe for power shortages and higher prices. In 2015, electricity prices shot up by 2.5% because of extra strain on the system.

Economy

Less cash for farmers means less spending overall, hitting industries like textiles and leather that rely on agricultural materials. In India, the El Niño events of 1982-83 and 1997-98 resulted in economic losses amounting to approximately 3% and 1.5% of the country’s GDP per capita, respectively.

So yeah, El Niño might sound chill, but when it comes to on-ground reality in terms of India’s industries and economic development, it’s not. It can send shivers to farmers, economists, and environmentalists.

Analyzing Some Empirical Evidence & Case Studies

- Several studies have examined the relationship between El Niño events and the Indian Stock market. A study conducted by Khatua, P., and Pattanaik, A. (2016) found that El Niño events have a significant impact on Indian stock returns, particularly in sectors such as agriculture, consumer goods, and infrastructure. The study observed that negative returns were more pronounced during El Niño events, reflecting the market’s sensitivity to weather-related disruptions.

- Another study by Mukherjee, J. (2018) analyzed the impact of El Niño on Indian agricultural stocks specifically. The findings suggested that agricultural stocks exhibit higher volatility during El Niño years, as investors react to uncertainties surrounding crop yields and commodity prices.

India’s Past with El Niño

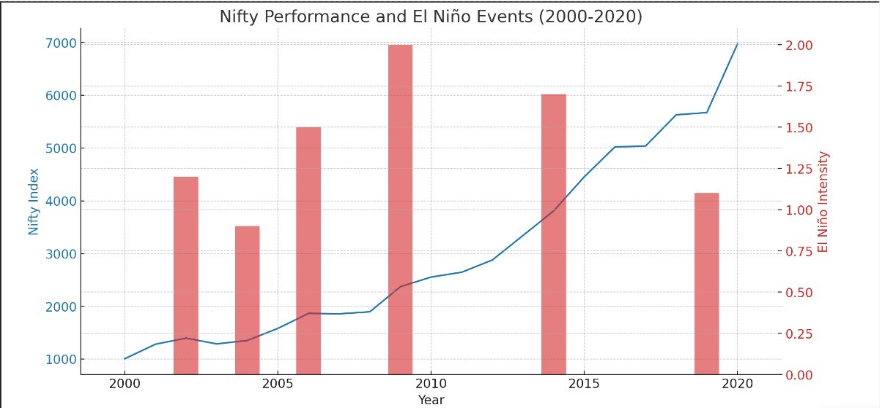

- India experienced the El Niño effect in 2002, 2004, 2006, 2009, 2014, and 2015.

- El Niño can impact the Indian stock market through various channels.

- Stock-market movements during El Niño years have been mixed; some studies note sector-specific volatility (e.g., agriculture, energy), but outcomes depend on rainfall severity and government responses.

- The severity of the drought and the government’s response were significant factors influencing the impact of El Niño on the Indian stock market.

- El Niño’s implications for the Indian economy and stock market varied depending on factors such as drought severity and government action.

Note: The 2023-24 El Niño peaked in late 2023 and weakened by mid-2024. As of August 2025, conditions are ENSO-neutral, with a La Niña watch for late-2025.

How does El Nino Affect the Investors?

El Niño years often bring weaker monsoons, which can mean lower farm output and higher food prices. For investors, that translates into inflationary pressure. When inflation rises, the Reserve Bank is less likely to cut interest rates and may even raise them, which usually affects bond values and makes borrowing costlier across the market.

Higher food inflation also reduces disposable income. Households spend more on essentials, leaving less for discretionary goods and services. As an investor, this is a sign to be cautious with sectors that depend on consumer demand.

On the positive side, hotter weather often boosts electricity demand and sales of cooling products. That means opportunities may emerge in areas linked to energy consumption or defensive sectors that are less sensitive to inflation.

Global commodity prices, such as oil, metals, and agricultural products, also tend to spike during El Niño, which can ripple into your portfolio through higher input costs or market volatility.

For individual investors, the lesson is simple: expect more inflation risk, keep some allocation in defensive assets, and avoid overexposure to areas that depend heavily on stable monsoons.

Market Volatility and Economic Implications

El Niño’s influence extends beyond the stock market to broader economic implications. Market volatility tends to increase during El Niño years, with sectors like agriculture and energy experiencing heightened volatility due to weather patterns affecting crop production.

The 2015 El Niño event, one of the strongest on record, led to significant weather disruptions and subsequent slumps in global stock markets, particularly in the material and energy sectors.

Bottom Line

So there you have it, folks! El Niño isn’t just some fancy weather term; it’s a mischievous player in the grand scheme of things, especially when it comes to the stock market. From messing with rainfall patterns to stirring up chaos in various sectors like agriculture, consumer goods, and infrastructure, this whimsical weather phenomenon doesn’t play nice.

Looking back at past occurrences, we see a pattern emerge: when El Niño strikes, it’s not just about the weather; it’s about how it ripples through economics and markets worldwide.

So, as we gear up to face the heat of both El Niño and the stock market, here’s a suggestion to help us keep our cool: Invest in ice cream! Yep, while El Niño might be turning up the heat outside, you can turn up the flavor inside with a scoop or two of your favorite frosty treats.

After all, what better way to weather the stormy market waters than with a refreshing cone in hand?

So, grab your spoons and your stock portfolios, everyone, and let’s vibe our way through whatever El Niño throws at us!

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities mentioned, if any, are quoted as examples and not as recommendations. This article is for educational purposes only and does not constitute investment advice.

FAQs

Is El Nino good for India?

El Nino isn’t exactly what we’d call good news for India. It messes with the usual rain patterns, bringing droughts or floods to different spots. And guess what? That wreaks havoc on farming and hikes up food prices. It’s like a domino effect, hitting the economy and stock market hard, especially sectors linked to farming like agribusiness, fertilizers, and food processing.

Which stocks to buy in El Nino?

El Nino ain’t just about the weather; it’s got its hands in the stock market cookie jar too. It messes with the weather patterns, stirring up droughts and floods, which, in turn, messes with agriculture. And you know what’s linked to agriculture? Yup, stocks in businesses like agribusiness, fertilizers, and food processors.

What are the positive economic effects of El Nino?

Can’t really say there are any high-fives for the economy when El Nino rolls in. It’s more about what it messes up: rains, droughts, and floods, all playing havoc with farming and food prices. That, in turn, throws the agricultural sector and its stocks into a rollercoaster ride, no positives there, unfortunately.

What is El Nino in the stock market?

El Nino ain’t just about the weather; it’s got its hands in the stock market cookie jar too. It messes with the weather patterns, stirring up droughts and floods, which, in turn, messes with agriculture. And you know what’s linked to agriculture? Yup, stocks in businesses like agribusiness, fertilizers, and food processors.