What if you could invest in the top 10 leading companies and get the best of their growth without relying too much on any single stock? Sounds interesting right! Sounds interesting, right? Well, now you can! DSP Mutual Fund has introduced the “DSP Nifty Top 10 Equal Weight Index Fund” to make this possible.

With this fund, you get to invest in India’s biggest companies, each given equal weight in your portfolio. This approach not only lets you tap into the financial strength and stability of these large firms but also helps balance the risks.

“DSP Nifty Top 10 Equal Weight Index Fund” is launched as a New Fund Offer (NFO) on 16 August 2024 and is open for subscription until 30 August 2024.

Details of the DSP Nifty Top 10 Equal Weight Index Fund

It is India’s first index fund based on the Nifty Top 10 Equal Weight Index. The fund is launched by DSP Mutual Fund, which manages an AUM of Rs. 1,67,071.26 crore as of June 30, 2024.

This is an open-ended index fund that aims to replicate its benchmark index. The DSP Nifty Top 10 Equal Weight Index Fund provides investors with a concentrated portfolio of large-cap companies, which are known for their durability, strong financial health, and high liquidity.

Investment Objective

The investment objective of the Scheme is to generate returns that are commensurate with the performance of the Nifty Top 10 Equal Weight Index, subject to tracking error.

Let’s have a quick look at the key basic details of the fund:

About NIFTY Top 10 Equal Weight Index TRI

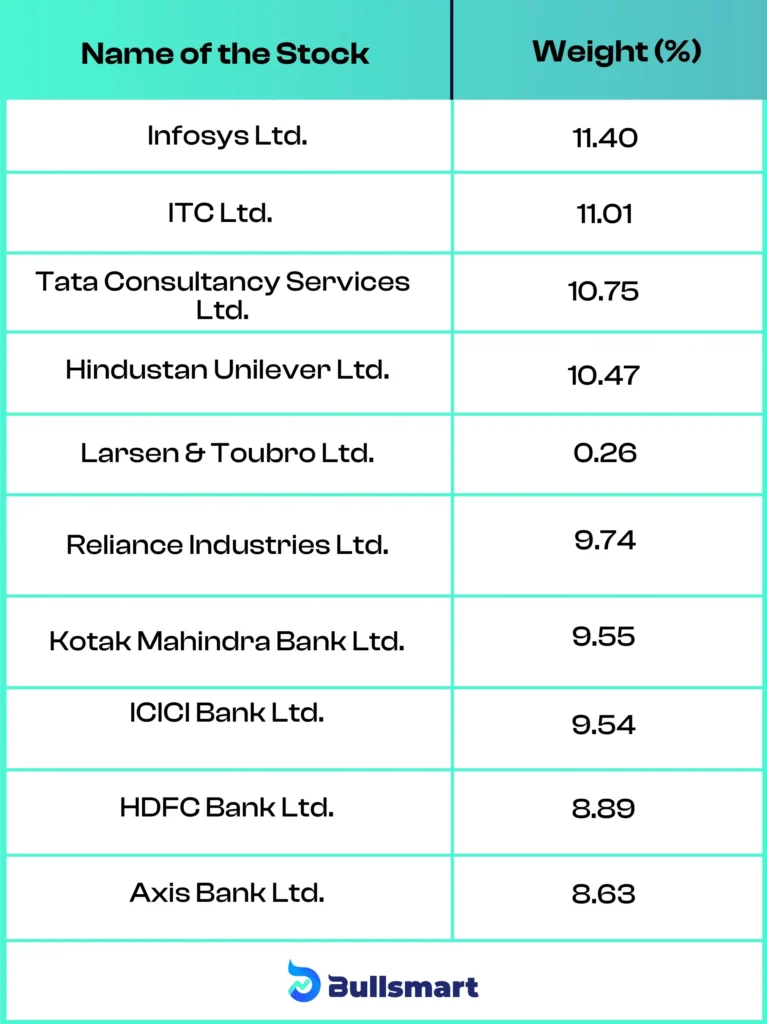

This index comprises the top 10 stocks from the Nifty 50, which contribute to nearly 49% of the profits of the Nifty 50. This index uses an equal-weight strategy, where it allocates equal weightage to all the top stocks.

This approach aims to reduce concentration risk by ensuring that each stock has an equal impact on the index’s performance. Given the current undervaluation and positive historical trends, there is potential for strong future returns.

Let’s have a look at the holdings of the Benchmark index:

Note: The holdings mentioned above as of 31 July 2024.

As of July 31, 2024, the index has generated returns of 20.32% over 1 year and 16.61% over 5 years. The DSP Nifty Top 10 Equal Weight Index Fund aims to mimic its benchmark, so it is expected to provide similar returns. However, actual returns may vary based on market conditions.

Meet the Fund Management Team

The fund is managed by two expert professionals, Anil Ghelani and Diipesh Shah, each bringing significant experience to the table.

Anil Ghelani has over 26 years of work experience. He has been associated with the DSP Group since 2003 and is currently the Head of Passive Investments & Products. Prior to joining DSP Mutual Funds, he worked with IL&FS Asset Management Company and S.R. Batliboi, a member firm of EY.

Diipesh Shah has over 20 years of work experience. He joined DSP Fund House in September 2019 as a Dealer for ETF and Passive Investments. He is now also a Fund Manager for various schemes at DSP Mutual Fund. Before joining DSP, he worked with JM Financial Institutional Broking Limited, Centrum Broking Limited, IDFC Securities Limited, and Kotak Securities Limited as an Institutional Equity Sales Trader.

Who should invest in DSP Nifty Top 10 Equal Weight Index Fund?

This NFO is ideal for investors with a high-risk appetite aiming for long-term wealth creation. It suits those seeking exposure to stable, durable businesses and who plan to stay invested through market cycles.

This fund is also a great choice for cost-conscious investors as it offers a low-cost option due to its passive investment approach and a lower expense ratio compared to actively managed large-cap funds.

It is always advisable to conduct thorough research on the fund or consult a financial advisor before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.