Looking to invest in stable, relatively safer mutual fund schemes to meet your medium or long-term financial goals. If so, parking your money in more reliable options like “Corporate Bond Mutual Funds” could be the best option for you.

The blend of safety and steady returns makes them a go to choice for conservative investors seeking peace of mind with their investments.

Buckle up, as we delve into the world of Corporate Bond Mutual Funds and let’s see if they align with your investment goals and suit your preferences.

What are Corporate Bond Mutual Funds?

It invest in high-quality corporate bond securities issued by private and public corporations to finance their operations, expansions, or projects.

The focus of these funds is generally on bonds with high credit ratings, typically AA and above, and they allocate around 80% of corpus to these bonds, which indicates a low risk of default and aims to provide stable interest income.

Why Corporate Bond Funds Shines?

Two key factors that make these mutual funds shine are its Safety and Interest rate.

Safety

It is considered safe because they invest in high rated corporates which ensure safety due to their strong track record of minimal to no credit defaults. Companies with an “AAA” credit rating is considered highly secure, as this is the highest level of creditworthiness.

Interest Rate

Interest rate changes are crucial as central banks, facing persistent inflation, warn that rate cuts may be delayed. In India, the RBI is also holding interest rates steady and remains undecided on future rate cuts. This cautious approach impacts investment strategies in corporate bond mutual funds.

It deliver better returns compared to fixed bank deposits of similar duration.

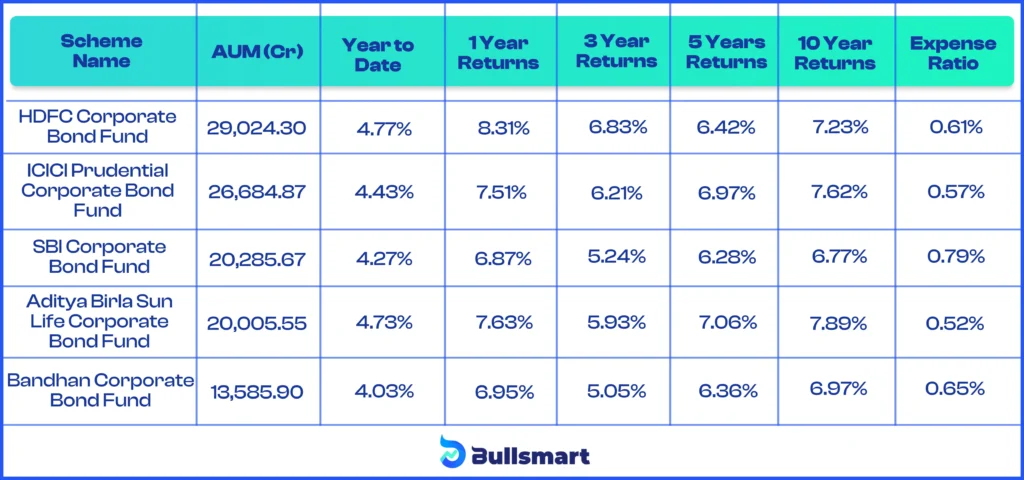

Top 5 Corporate Bond funds based on AUM

Let’s take a look at the top five Corporate Bond Funds based on their Assets Under Management and the returns they have generated over the years:

All the top funds have been delivering consistent returns over the years and generally Debt Mutual Funds contain less expense ratio than many equity funds which makes them an affordable option for conservative investors.

Risks and Return metrics

Returns from Corporate Bond Mutual Funds are generally low when compared to the funds that invest in equities, as they do not come up with the roller coaster ride like equities. However Corporate Bond Funds are a bit riskier than government securities.

They strive to maintain a balance between high risk of equity funds and low risk of government security funds. Overall, Corporate bond funds offer low to moderate risk with the potential to give stable and reliable returns.

Who should invest in Corporate Bond Funds

Corporate Bond Funds are a great option for investors who are willing to take a bit more risk than government securities with potential for higher returns. It can be a suitable option for investors aiming for a steady source of income and predictable returns.

Investors seeking to spice up their portfolio beyond equities and government bonds can consider adding Corporate Bond Mutual Funds to their portfolio.

As always, it’s important to align investments with your overall financial plan and investment objectives.