Just like in life, flexibility goes a long way in investing too. It’s no surprise that flexi-cap mutual funds have become the second-most popular category among equity funds. According to data from AMFI, these schemes saw an inflow of ₹3,513 crore in August 2024, second only to sectoral funds, which witnessed an inflow of ₹18,117 crore.

Flexi-cap schemes have gained significant traction among retail investors. With a total of 39 schemes in this category, they collectively manage an AUM (Assets Under Management) of ₹4,29,311.51 crore, making them the second-largest in terms of asset size after sectoral funds.

In this blog, we will compare Parag Parikh Flexi Cap & HDFC Flexi Cap Fund, two popular flexi cap schemes in the market. Both funds aim to generate long-term capital appreciation but have different strategies and performance records.

What Are Flexi-Cap Funds?

Flexi-cap mutual funds are schemes that invest a minimum of 65% of their assets in equity and equity-related instruments. Introduced in November 2020 via a SEBI circular, these funds can invest across large-cap, mid-cap, and small-cap stocks without any restrictions on how much to allocate in each category.

Parag Parikh Flexi Cap & HDFC Flexi Cap Fund gives fund managers greater flexibility compared to multi-cap funds, which are required to allocate at least 25% to each category.

Investment Objective of Schemes

Parag Parikh Flexi Cap & HDFC Flexi Cap Fund are open-ended dynamic equity schemes that invest across large-cap, mid-cap, and small-cap stocks.

Investment Objective of Parag Parikh Flexi Cap Fund: The scheme aims to achieve long-term capital growth through an actively managed portfolio of equity and equity-related securities.

Investment Objective of HDFC Flexi Cap Fund: The scheme aims to generate capital appreciation and income from a portfolio primarily focused on equity and equity-related instruments.

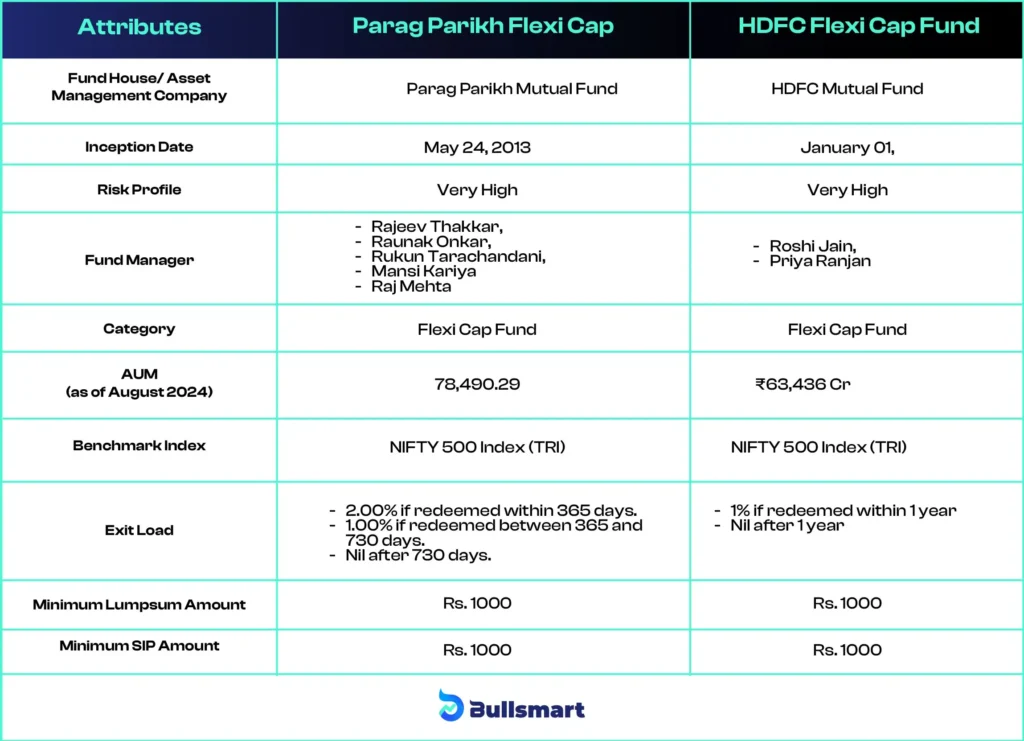

Comparison of Key Fund Details

Here is a comparison of the basic details of the Parag Parikh Flexi Cap & HDFC Flexi Cap Fund:

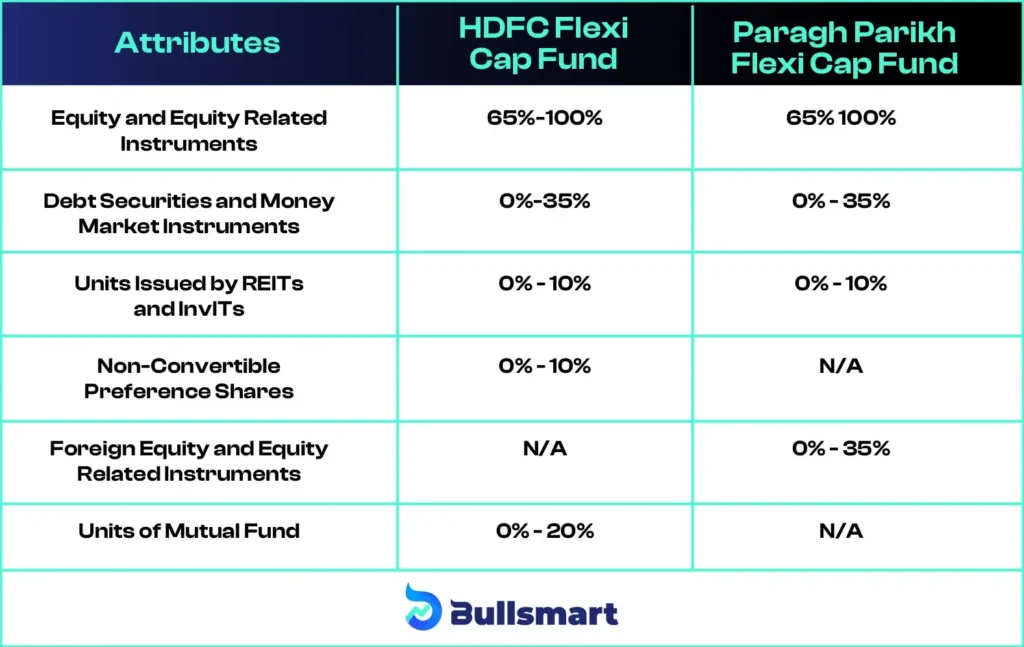

Portfolio Allocation of Schemes

Here’s a comparison of how these funds allocate their assets.

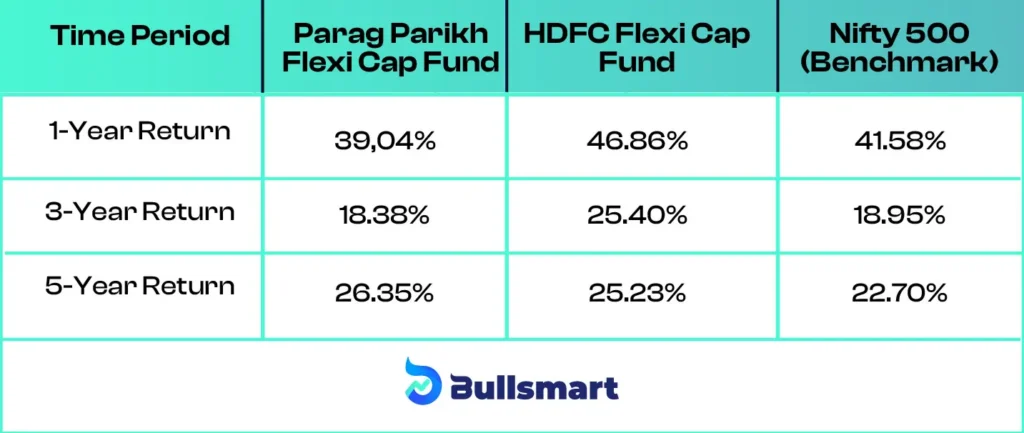

Comparison of Risk and Returns

Parag Parikh Flexi Cap & HDFC Flexi Cap Fund offer a balance between growth and diversification. Both funds follow the NIFTY 500 Index (TRI) as the benchmark scheme.

Here’s a comparison of the performance of these funds against each other and their benchmark.

Asset Management Company

PPFAS Mutual Fund

PPFAS Asset Management Private Ltd, registered with SEBI, acts as the asset manager for PPFAS Mutual Fund. Parag Parikh Financial Advisory Services Limited (PPFAS Ltd) distinguishes itself from other asset management companies by implementing time-tested principles of value investing in its fund management approach. As of 30th June 2024, the asset management company has an AUM of ₹ 81,162.76 crore.

HDFC Mutual Fund

HDFC Mutual Fund, supported by India’s largest private bank, is the top Asset Management Company in the country, managing assets totalling INR 6,14,665.43 crore as of June 30, 2024.

Founded in 1999 through a collaboration between HDFC and ABRDN Investment Management Limited, it was listed on the stock exchange in 2018. With a strong profitability record and 28 years of experience, HDFC Mutual Fund offers a wide range of savings and investment products across various asset classes, prioritizing income generation and wealth growth for investors.

With millions of active investors and a vast network of distribution partners, including mutual fund distributors and banks, HDFC Mutual Fund consistently demonstrates strong performance metrics.

Which Scheme is Right For You?

Parag Parikh Flexi Cap Fund could be an excellent choice for:

- Investors with a long-term investment horizon.

- Those looking for global diversification.

- Value investors who are willing to weather market fluctuations.

HDFC Flexi Cap Fund is ideal for:

- Investors seeking steady growth from Indian equities across different market caps.

- Those with a moderate risk appetite and looking for high AUM management.

Flexi-cap funds like Parag Parikh Flexi Cap & HDFC Flexi Cap Fund offer flexibility across sectors and market capitalization. However, they cater to slightly different investor needs. Parag Parikh stands out for its unique foreign equity exposure, while HDFC focuses more on domestic equities. Before investing, consider your risk appetite, investment horizon, and long-term financial goals.

Suggested Read – HDFC Flexi Cap Fund

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.