When it comes to investing in small-cap mutual funds, two popular choices are Kotak Small Cap Fund and Motilal Oswal Small Cap Fund. Both funds are designed to tap into the high-growth potential of smaller companies, but they differ in their strategies, performance, and investment approaches.

Small-cap funds have historically delivered impressive returns, often outpacing larger-cap funds. For example, the Nifty Smallcap 250 TRI index has delivered a 23.65% return over the past three years.

In this comparison, we will dive into the key features of Kotak Small Cap Fund vs Motilal Oswal Small Cap Fund, helping you understand their past performance, risk profile, fund management, and much more.

Whether you’re an aggressive investor seeking high returns or looking for a fund with a strong historical track record, this guide will help you choose the best fit for your portfolio.

Kotak Small Cap Fund: Overview

The Kotak Small Cap Fund focuses on investing in small-cap companies, which are typically more volatile than large and mid-cap stocks but offer higher growth potential over the long term. The fund seeks to identify companies that are under-researched or undervalued and have the potential to deliver significant returns as they grow.

Motilal Oswal Small Cap Fund: Overview

The Motilal Oswal Small Cap Fund has a similar investment strategy but focuses on small-cap companies with strong competitive advantages and sustainable business models. The fund aims for long-term wealth creation by investing in a portfolio of small-cap companies with significant growth potential.

Investment Objectives of the Scheme

Both funds share a common goal of long-term capital appreciation by investing in small-cap companies, but they differ slightly in their investment approach. While Kotak Small Cap Fund focuses more on undervalued companies that have potential for growth, Motilal Oswal Small Cap Fund emphasises strong fundamentals and competitive advantages.

Comparison of Key Fund Details

Here are the key details of both the schemes:

| Attributes | Kotak Small Cap Fund | Motilal Oswal Small Cap Fund |

| Fund House | Kotak Mutual Fund | Motilal Oswal Mutual Fund |

| Inception Date | Feburary 24, 2005 | December 26, 2023 |

| Risk Profile | Very High | Very High |

| Fund Manager | Harish Bihani | Santosh Singh, Ajay Khandelwal,Niket Shah, Sunil Sawant,and Rakesh Shetty |

| AUM (as of September 30, 2024) | ₹18,286 crore | ₹ 2,579.08 crore |

| Benchmark Index | Nifty Smallcap 250 TRI | Nifty Smallcap 250 TRI |

| Exit Load | 1% if redeemed within 1 year | 1% Exit Load within 1 year1% if redeemed within 1 year |

| Minimum Lumpsum Amount | Rs 100 | Rs 500 |

| Minimum SIP Amount | Rs 100 | Rs 500 |

Portfolio Construction of the Scheme

Asset Allocation

The asset allocation of both the funds are as follows:

| Asset Class | Kotak Small Cap Allocation (% of Total Assets) | Motilal Oswal Small Cap Allocation (% of Total Assets) |

| Equity and Equity-related Instruments | 65 – 100 | 65 – 100 |

| Investments in Small Cap Companies | 65 – 100 | 65 – 100 |

| Investments in Companies Other than Small Cap | 0 – 35 | 0 – 35 |

| Debt and Money Market Securities | 0 – 35 | 0 – 35 |

| Units issued by REITs and InvITs | 0 – 10 | 0 – 10 |

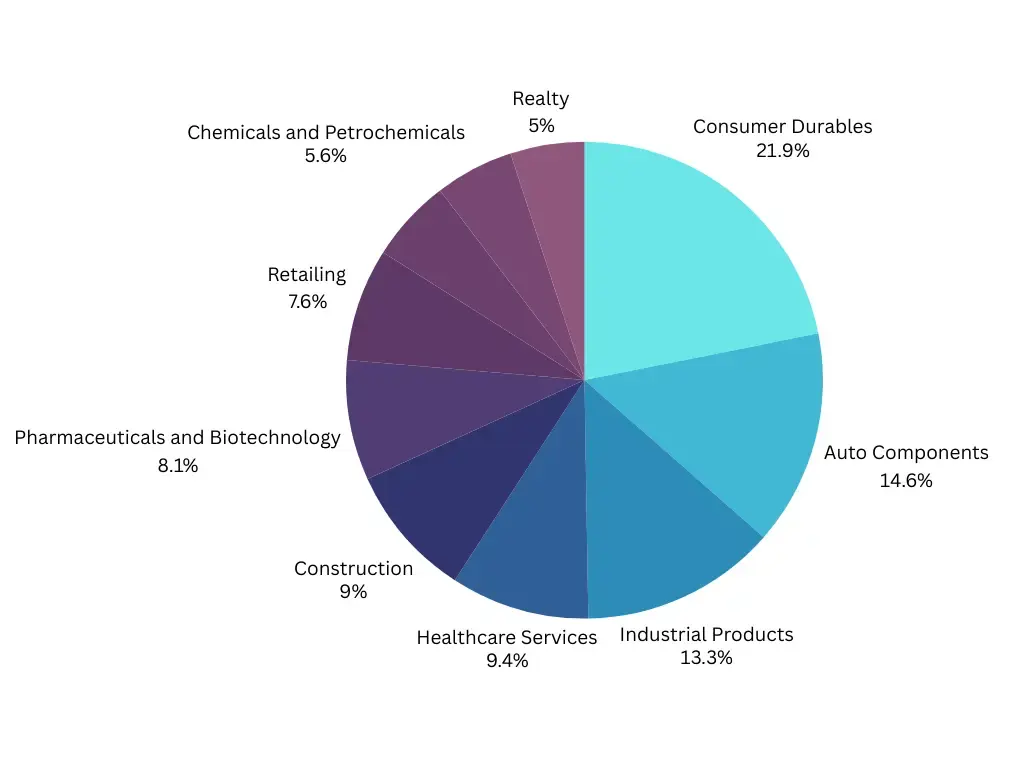

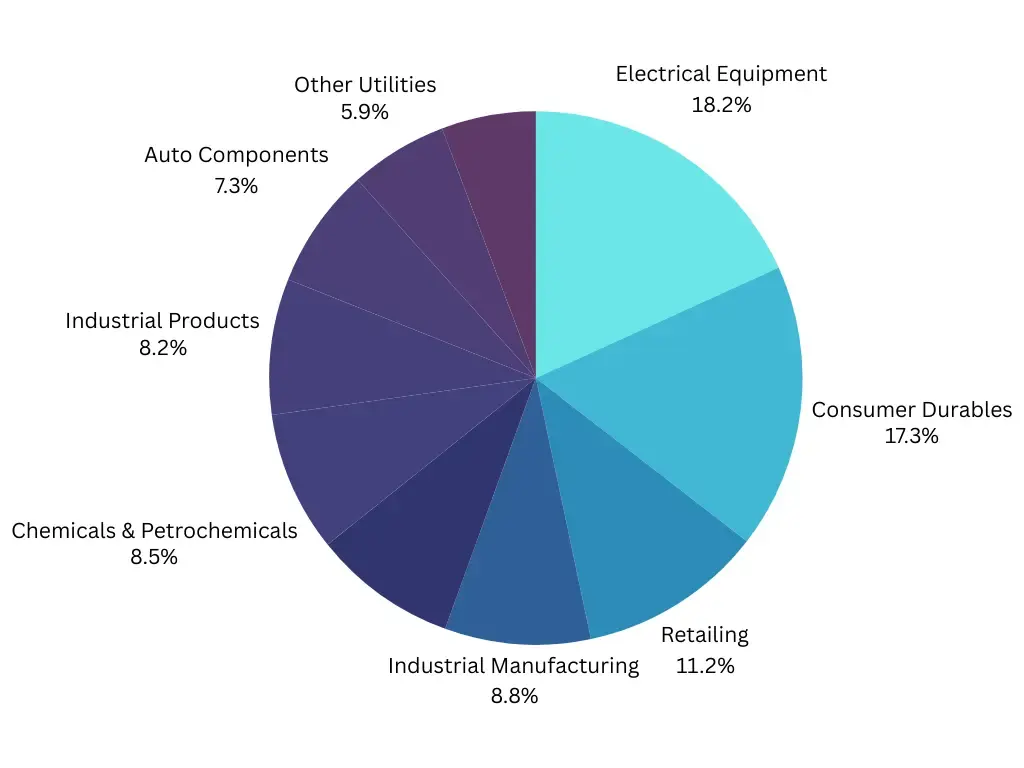

Sector Allocation

The sector wise allocation of Kotak Small Cap Fund is as follows:

The sector wise allocation of Motilal Oswal Small Cap Fund is as follows:

Understanding Risks and Returns

Both Kotak Small Cap Fund and Motilal Oswal Small Cap Fund belong to the high-risk category due to the nature of small-cap investing. Historically, small-cap funds have delivered higher returns than large- and mid-cap funds, but they are also more vulnerable to maket volatility.

Here’s a comparison of their performance over different time frames:

| Performance (CAGR) | Kotak Small Cap Fund | Motilal Oswal Small Cap Fund | Benchmark Return |

| 6 Months | 18.75% | 22.18% | 11.63% |

| 1 Year | 41.22% | – | 46.37% |

| 3 Year | 19.14% | – | 23.40% |

| 5 Year | 31.21% | – | 31.18% |

Note: 1 year, 3 years, and 5 years returns of Motilal Oswal Small Cap Fund are not available as the schemes haven’t completed a year yet.

About the AMCs

Here’s a brief information about the AMCs:

Motilal Oswal Asset Management Company

Motilal Oswal Asset Management Company (MOAMC) is a SEBI-registered portfolio manager that runs the Motilal Oswal Mutual Fund (MOMF). It is backed by Motilal Oswal Financial Services Limited (MOFSL), which is publicly listed on major Indian stock exchanges, BSE and NSE. MOAMC received its SEBI registration in 2009.

As of June 30, 2024, Motilal Oswal Mutual Fund manages assets exceeding ₹66,452.27 crore and offers over 40 mutual fund schemes. Some of its popular schemes include the Motilal Oswal Flexi Cap Fund, Motilal Oswal Nifty India Defence Index Fund, and Motilal Oswal NASDAQ 100 ETF, based on their assets under management (AUM).

Kotak Mahindra Asset Management Company Limited

Kotak Mahindra Asset Management Company Limited (KMAMC) was established on August 2, 1994, under the Companies Act of 1956 to oversee Kotak Mahindra Mutual Fund (KMMF). As a prominent player in the asset management industry, Kotak has made a notable impact on a range of innovative investment schemes.

It was the first to launch a gilt fund, which exclusively invests in government securities. As of June 30, 2024, Kotak Mutual Fund manages assets totaling ₹444,792.28 crore, positioning it among the leading mutual fund companies in India.

Who Should Invest?

Investors with a high-risk tolerance and a long-term investment horizon (at least 5-7 years) are best suited for these Mutual Funds. Small-cap companies can go through periods of underperformance, especially during market downturns, but they have the potential to deliver superior returns over the long run.

- Kotak Small Cap Fund is ideal for those looking for a more diversified portfolio with a focus on undervalued companies.

- Motilal Oswal Small Cap Fund is better suited for those who prefer a more concentrated portfolio with a focus on strong fundamentals and competitive advantages.

Conclusion

Both Kotak Small Cap Fund and Motilal Oswal Small Cap Fund offer excellent opportunities for long-term investors looking to tap into the growth potential of India’s small-cap companies. While Kotak offers a lower expense ratio and a more diversified portfolio, Motilal Oswal provides a focused approach on businesses with strong fundamentals.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.