Large and mid-cap funds create a winning combination by harnessing the stability of top industry giants and the explosive growth potential of emerging players. This blend offers investors a dynamic approach, balancing steady returns with exciting opportunities.

Perfect for those with a long-term vision, these funds navigate diverse market segments to deliver a robust performance that thrives on both stability and innovation.

One of the leading funds in its category, recognized for delivering impressive returns over the past 10 years, is the Canara Robeco Emerging Equities Fund.

Curious to know how this fund could benefit your investment strategy? Let’s dive in!

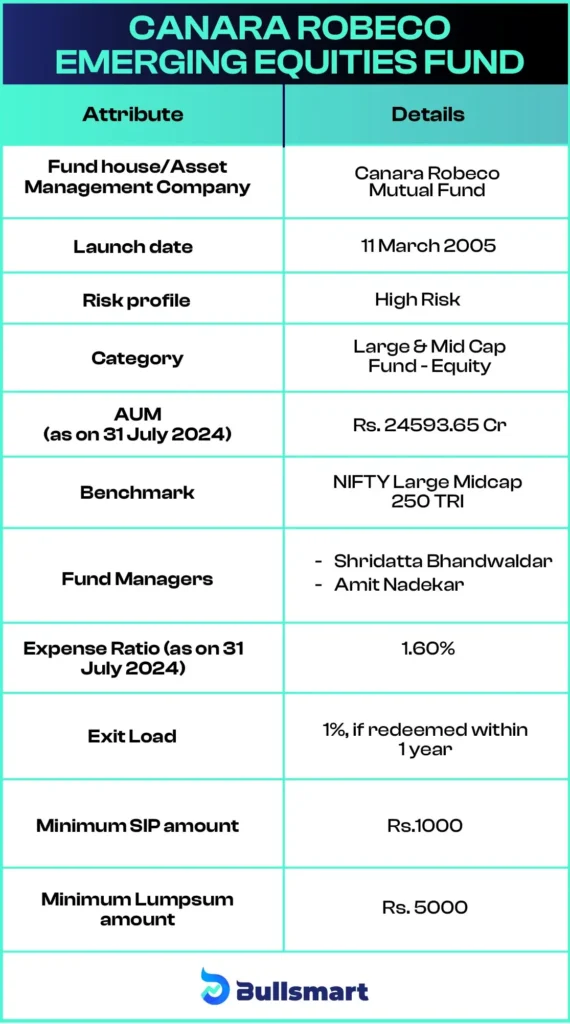

Details of Canara Robeco Emerging Equities Fund

Canara Robeco Emerging Equities Fund is an open-ended equity scheme launched by Canara Robeco Mutual Fund. It is a large and mid-cap equity fund, which means it invests in both large-cap companies (the top 100 companies by market capitalization) and mid-cap companies (those ranked 101 to 250).

This fund currently holds an AUM of Rs. 24593.65 Cr and considers NIFTY Large Midcap 250 TRI as its benchmark index.

Investment Objective of fund

The fund aims to generate capital appreciation by investing in a diversified portfolio of large and mid-cap stocks.

Let’s have a look at the basic details of the fund:

The expense ratio of the fund is 1.60%, which is lower than the category average of 1.89%, indicating that the fund is more affordable.

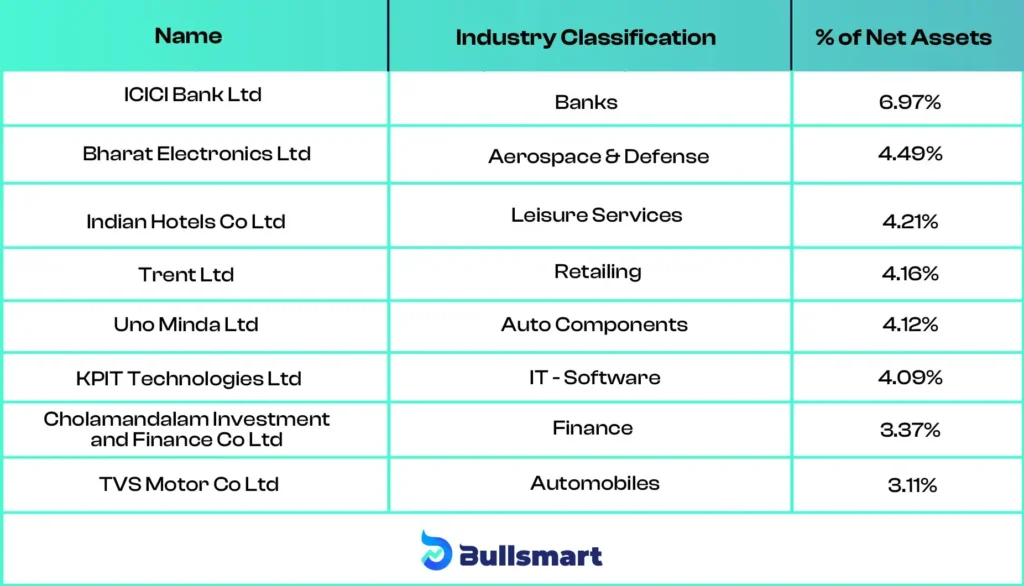

Strategic Portfolio Construction of Canara Robeco Emerging Equities Fund

The Canara Robeco Emerging Equities Fund strategically invests 96.91% of its portfolio in domestic equities. 48.34% is allocated to Large Cap stocks and 37.44% to promising Mid Cap stocks, where it expertly balances stability and growth.

Let’s take a quick sneak peek at the top holdings of the fund:

Note: The holdings mentioned above are as of July 31, 2024.

Introducing the Fund Management Team

The fund is managed by two expert professionals, Shridatta Bhandwaldar and Amit Nadekar, each bringing significant experience to the table.

Mr. Shridatta Bhandwaldar, with a BE in Mechanical Engineering and an MMS in Finance, brings extensive experience to Canara Robeco Mutual Fund. Before joining, he served as Head of Research at SBI Pension Funds Pvt. Ltd. and held key roles at Heritage India Advisory Pvt. Ltd. as a Senior Equity Analyst, Motilal Oswal Securities, and MF Global Securities.

Mr. Amit Nadekar holds an M. Com, CA, and MMS in Finance, and has an impressive background in the financial industry. Prior to joining Canara Robeco Mutual Fund, he worked with LIC Mutual Fund, Alchemy Capital Management Pvt. Ltd., Raymond Limited, Apar Research, and First Global Securities.

Analyzing the risks and returns of fund

Investing in a large and mid-cap fund balances stability and growth by diversifying across established and emerging companies, which helps manage risk and reduce the impact of market fluctuations.

However, it is a high-risk fund as it invests exclusively in equities and equity related instruments.

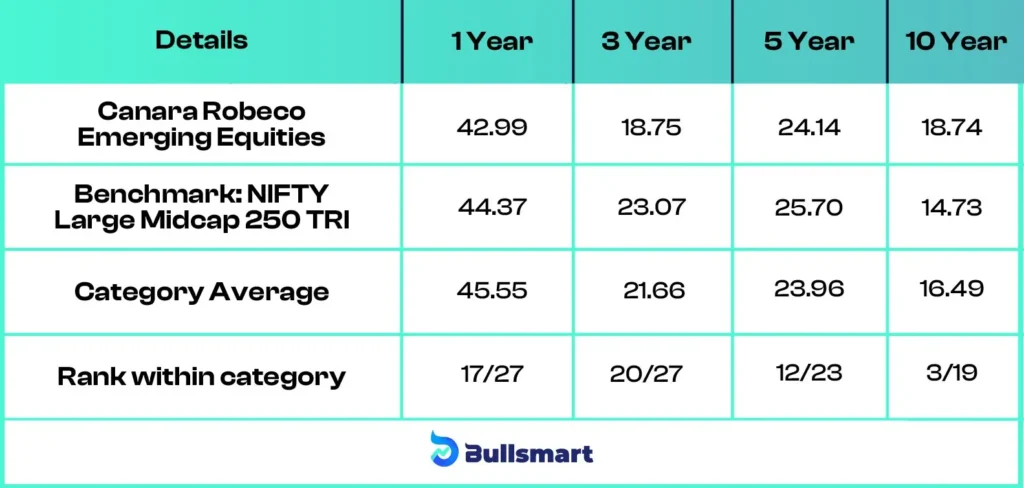

Let’s look at the returns generated by the fund over the years and compare them with its benchmark:

Note: The returns mentioned above are as of 27 August 2024. Past performance is not an indicator of future returns.

Who should Invest in this Fund?

This high-risk fund invests entirely in equities, offering the potential for high returns. It is best suited for investors with a high-risk appetite who are interested in the stability of large caps and the growth potential of mid-caps.

Ideal for those willing to invest for over 5 years, the fund aims to create long-term wealth.

It is always advisable to conduct thorough research on the fund or consult a financial advisor before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.