India’s skies have never been busier. More people are flying, more airlines are expanding, and right in the middle of all this action are two global giants-Boeing and Airbus-quietly battling for dominance behind every takeoff.

With 376 million domestic passengers in 2024, India has now become the third-largest aviation market in the world, behind only the US and China. And this boom isn’t just a random spike, it’s backed by massive structural changes.

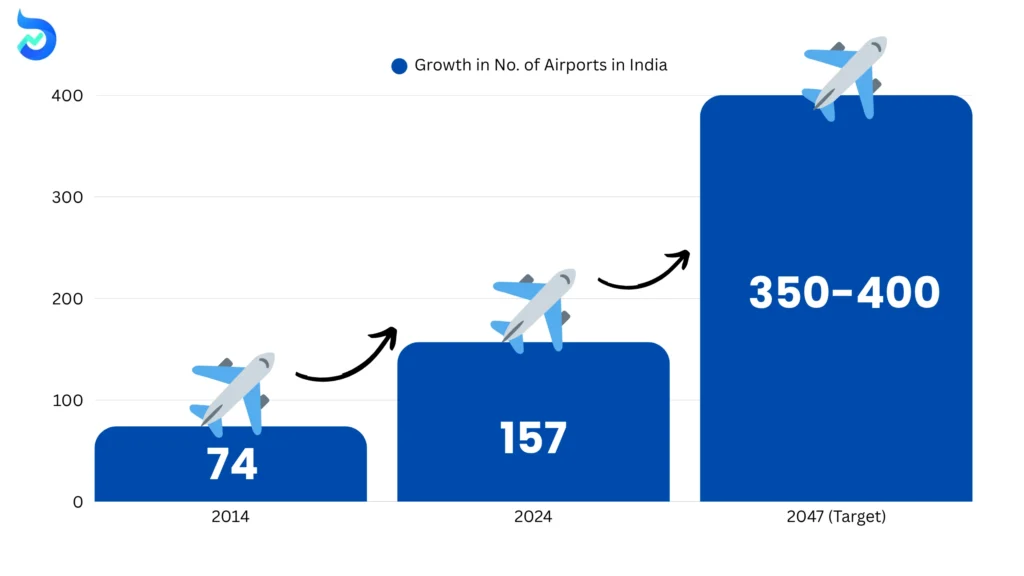

The UDAN scheme has opened up regional routes like never before. The government’s long-term plan to build 350+ airports by 2047 shows just how serious India is about making flying accessible to everyone.

On top of that, there’s a big push toward greener, carbon-neutral aviation, signalling that the country isn’t just trying to fly more-it’s trying to fly smarter.

And with Air India placing a ₹3.84 lakh crore mega-order for 470 aircraft from both Boeing and Airbus, the stakes have never been higher. Choosing between these two manufacturers isn’t just a technical decision-it shapes how India will fly for decades.

So the real question is: between safety, strategy and reliability, who’s shaping India’s aviation future?

Let’s break it down.

India’s Aviation Scene in June 2025: Flying High and Growing Fast

India’s aviation sector is booming right now! As of mid-2025, it’s worth around $16 billion (~₹1.34 lakh crore).

It’s also the third-biggest domestic air travel market in the world, just behind the U.S. and China. That basically means tons of people are flying within India more than ever before.

Quick Highlights

- Passengers: Over 350 million people take flights each year inside the country. That number is going up by 10-12% every year!

- Jobs & Economy: The aviation sector adds $53.6 billion (₹4.47 lakh crore) to India’s GDP and helps support 7.7 million jobs. That includes over 3.7 lakh people directly working in the airline industry.

- Airports: Indian airports made ₹103.7 billion in profit this year. And by 2030, they’re expecting to handle around 600-700 million passengers a year.

- Airplanes: India has 860 planes flying right now and has already ordered 739 more. The planes are also newer than most countries’ fleets!

- Budget Airlines Rule: Airlines like IndiGo are leading the game. Around 69% of all seats are on low-cost flights, which means more people can afford to travel.

What’s Driving All This Growth?

- The government’s UDAN scheme is helping smaller cities get connected by air.

- India is planning to have 350 airports up and running by 2047.

- Cargo flights are booming too; carrying 8 million tonnes last year and growing fast.

- The MRO industry (that’s aircraft repair and maintenance) is worth $4 billion (~₹33,400 crore) and getting major support to become a global player.

What’s Next?

Experts think passenger traffic will keep growing by 7% this year, and there are nearly 1,900 new aircraft still to be delivered.

Some reports even say the aviation market could grow from $14 billion (~₹1.17 lakh crore) in 2024 to $40 billion (~₹3.34 lakh crore) by 2033.

That’s almost 3X growth in less than a decade!

Suggested Read: Adani Airport IPO GMP & Launch: Exciting Buzz for 2027!

Airbus vs Boeing in India: Who’s Dominating the Skies?

India is one of the fastest-growing aviation markets in the world, and both Airbus and Boeing are racing to lock in their share. Let’s look at how each one is doing on the ground, and in the air.

Airbus in India

Airbus has become the backbone of domestic air travel in India, especially through its close relationship with IndiGo.

- 9.4% of all Airbus planes globally are delivered to India.

- 7.6% of those go to IndiGo alone, Airbus’s biggest single customer in the world.

- IndiGo operates 411 Airbus A320neo/A321neo planes, with a massive order of ~946 more.

- Airbus estimates India may need ~50,000 new planes by 2044.

Having a single aircraft type helps airlines with

- Lower maintenance costs

- Easier crew training

- Fewer spare parts

- Better efficiency for frequent domestic flights

Boeing in India

While Airbus leads the domestic game, Boeing is focusing on big-picture growth; especially for long-haul travel and international expansion.

- Boeing expects India + South Asia will need 2,835 new planes over the next 20 years.

- It buys ₹1,250 crore worth of airplane parts from Indian companies every year.

- Has a joint venture (51:49) with Tata to build aircraft components in India.

- Plans to set up a final assembly line, depending on how many orders it gets.

Key Indian airlines flying Boeing jets

- Air India operates Boeing 787 and has ordered Airbus A350s.

- Vistara uses Boeing 787-9 for long-distance international routes.

Quick Comparison: Airbus vs Boeing in India

You can take a glance at the key difference between Boeing and Airbus in india in the table below:

| Feature | Airbus | Boeing |

| Main focus | Domestic (narrow-body) | International (wide-body) |

| Major airline partner | IndiGo | Air India, Vistara |

| Planes currently in operation | 411 A320/A321 with IndiGo | Mostly 787 Dreamliners |

| Orders placed | ~946 aircraft (IndiGo) | Part of 739 overall Indian orders |

| Local production | Not yet | JV with Tata + sourcing parts |

| Market share strength | Dominates short-haul | Strong in long-haul |

So while Airbus is powering India’s short trips, Boeing is quietly preparing to take over the long-haul skies. And with both betting big on India, the next few years could get very interesting.

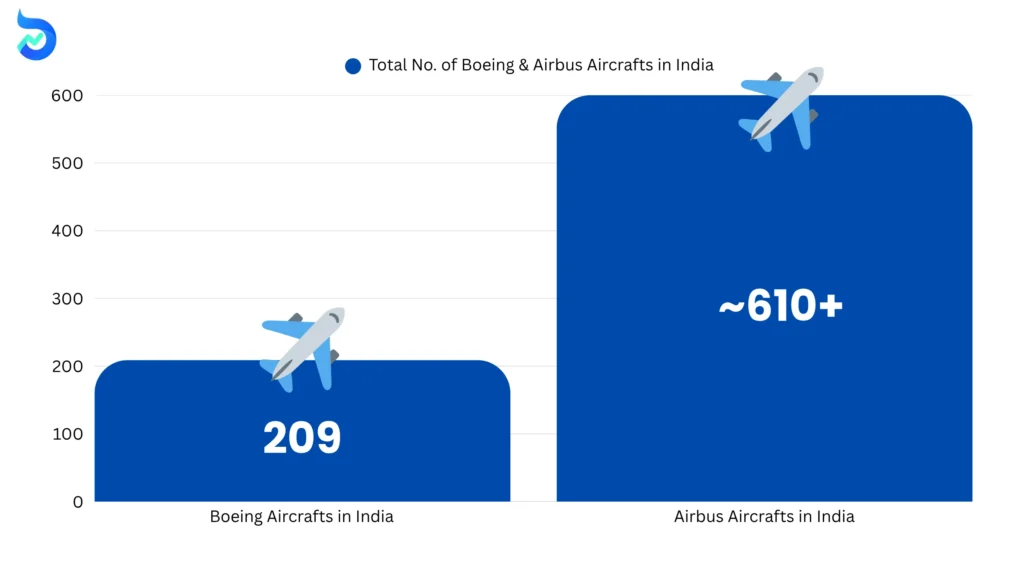

How Many Boeing and Airbus Aircraft in India? (2025)

India’s commercial aviation market is one of the world’s fastest-growing. Airlines here operate a large mixed fleet from Boeing and Airbus.

Total No. Of Boeing Aircraft in Operation in India.

According to data from NDTV Profit and other verified sources, Indian airlines have 209 Boeing aircraft, spread across the 737 MAX, 777, and 787 families:

| Airline | 737 MAX | 777 | 787 | Total Boeing Aircraft |

| Air India | 0 | 27 | 34 | 61 |

| Air India Express | 74 | 0 | 0 | 74 |

| Akasa Air | 29 | 0 | 0 | 29 |

| SpiceJet | 30 | 0 | 0 | 30 |

| IndiGo (leased) | 12 | 2 | 1 | 15 |

| Total | 145 | 29 | 35 | 209 |

Data available is updated as of June 13, 2025.

Notes

- IndiGo’s Boeing aircraft are leased from Qatar Airways and Corendon.

- Some aircraft are currently grounded.

- Damp/wet-leased aircraft are excluded.

Total No. Of Airbus Aircraft in Operation in India

Indian carriers operate a significantly larger Airbus fleet, especially in narrow-body segments:

Key Highlights

- Air India, IndiGo, and Air India Express together operate over 600 Airbus aircraft.

- IndiGo has the largest Airbus fleet, mainly A320neo and A321neo.

- Air India operates A320 family jets and is introducing A350s into service.

Breakdown by Airline (Approximate, as per Moneycontrol & KnowIndia.net):

| Airline | Airbus A320 Family | A350 | Total Airbus Aircraft Delivered |

| IndiGo | 450+ | 0 | ~450+ |

| Air India | ~120 | Few in service, more on order | ~120+ |

| Air India Express | ~40 | 0 | ~40 |

| Combined Total | ~610+ | Ongoing deliveries | ~610+ |

Data available is updated as of June 13, 2025.

Notes

- IndiGo has ordered over 900 Airbus aircraft, including 60 A350 wide-body jets.

- The delivered figure (569) plus operational leased and newly inducted aircraft bring the operational count past 600.

- The A350 fleet is gradually ramping up through 2025.

Summary: Total Fleet Snapshot

| Manufacturer | Approx. Number of Aircraft in Service |

| Boeing | 209 |

| Airbus | 610+ |

Data available is updated as of June 13, 2025.

Key Takeaways

- Airbus dominates narrow-body operations, driven by IndiGo’s scale.

- Boeing retains a strong presence in wide-body fleets, especially with Air India.

- Massive new orders (especially for A350s and 737 MAX) will continue to reshape India’s fleet composition over the next decade.

- Recent incidents (e.g., Ahmedabad Dreamliner crash) have renewed safety scrutiny of Boeing.

Airbus Financial Snapshot (2025)

Airbus entered 2025 on a strong financial footing, signalling higher confidence in both earnings and long-term demand. The company raised its dividend payout ratio to 30-50% of net profit, up from the earlier 30-40% range-an important indicator of profitability and shareholder-friendly policy.

At the 2025 Paris Air Show, Airbus reaffirmed its full-year guidance and highlighted its strong cash conversion (~1 over five years), underscoring that earnings are increasingly translating into real cash.

The company’s Global Market Forecast 2025-2044 paints an ambitious picture:

- 43,420 new aircraft expected globally

- 34,250 single-aisle jets

- 8,200 wide-body and freighter aircraft

Airbus believes the world’s active fleet will nearly double from ~24,730 aircraft in 2024 to ~49,210 by 2044, driven heavily by emerging market growth and replacement cycles in mature markets.

Operationally, Airbus reported 40% fewer component delays compared to early 2025-an encouraging sign that supply-chain pressures are easing and production stability is returning.

Key Takeaway

Airbus is projecting a future of higher dividends, solid profitability, improved production stability, and a massive long-term demand pipeline. Its confidence stems from a strong backlog, resilient market demand, and a clearer path toward consistent aircraft deliveries.

Boeing Financial Snapshot (2024–2025)

- Boeing reported an $11.8 billion net loss for 2024, its largest since 2020.

- Cash flow remains negative in early 2025, with a $4.1 billion cash burn in Q4 2024, though the company expects to turn positive by the second half of 2025.

- For 2025, analysts expect Boeing to achieve positive earnings-per-share (~$1.02) and generate free cash flow.

- Boeing’s Commercial Market Outlook calls for 43,600 new aircraft by 2044, including 33,300 single-aisle planes, 7,800 wide-bodies, 955 freighters, and 1,545 regional jets.

- Around 75% of the demand will come from single-aisle aircraft, mirroring Airbus’s forecast.

- Boeing has secured 303 new orders for 737 MAX aircraft in May 2025, meeting its production targets as deliveries accelerate.

Key takeaway: Boeing is battling through a deep financial deficit, but production improvements—alongside rising deliveries and expected cash flow reversal—are helping stabilize the outlook.

Demand & Fleet Outlook (2025–2044)

- Airbus: 43,420 total units (34,250 single-aisle; 8,200 wide-body/freighter).

- Boeing: 43,600 total units (33,300 narrow-body, 7,800 wide-body, 955 freighter, 1,545 regional).

- Both forecast that 75–80% of demand will come from single-aisle jets, driven by LCCs and short-haul travel in Asia and Latin America.

Comparison Summary

| Metric | Airbus | Boeing |

| 2024 Profit/Loss | Profitable, increasing payout target | $11.8B net loss |

| 2025 Cash Flow Forecast | Positive, steady | Negative early, positive later |

| Dividend Policy | 30–50% of profit | None declared |

| 20-year Demand Forecast | 43,420 units | 43,600 units |

| Single-Aisle Share | ~79% of demand | ~75% of demand |

| Order Backlog & Stability | Strong backlog, fewer delays | High orders for 737 MAX |

Boeing vs Airbus: Real-Life Safety Cases Indian Flyers Should Know (Updated as of June, 2025)

When we talk about flying safely, it is not just about how new the aircraft is. It is also about how it is built, how it is maintained, and whether safety concerns are taken seriously.

In 2025, Indian travelers have more choices than ever. Boeing or Airbus, domestic or international. But what is really the safer option?

Here is a complete breakdown using real events, official investigations, and internal whistleblower accounts, all focused on the Indian context.

Air India Boeing 787 Crash in Ahmedabad, June 12, 2025

- A Boeing 787 Dreamliner, flying as Air India flight AI171, crashed shortly after takeoff from Ahmedabad.

- A total of 241 people on board and several on the ground died. Only one person survived.

- The aircraft was 11 years old. Both engines had been recently serviced.

- Indian authorities ordered emergency inspections of all Boeing 787s operating in India.

- This was the first-ever fatal Boeing 787 crash anywhere in the world since the aircraft began commercial service in 2011.

- Investigators are looking into possible causes including engine failure, flap malfunction, or a fault in the backup power system.

- Further investigation is going on.

Boeing’s History of Safety Warnings

737 MAX Groundings (2018 to 2020)

- Two fatal crashes involving the Boeing 737 MAX model, operated by Lion Air and Ethiopian Airlines, killed 346 people.

- Investigations revealed software issues and internal production pressure.

- The 737 MAX was grounded worldwide for 20 months. It resumed flying in India in 2021.

Boeing Whistleblowers

Sam Salehpour (2024)

- An engineer at Boeing who told the U.S. aviation authority (FAA) that the company was cutting corners on safety checks during the assembly of 787 and 777 aircraft.

- He claimed Boeing skipped critical inspections and that he was removed from the project after raising the issue.

- The FAA launched an official investigation after his complaint.

John Barnett (2017 to 2024)

- A quality manager at Boeing with 32 years of service.

- He raised concerns that some oxygen masks might not work during emergencies, and that metal shavings were left near critical wires.

- He said that Boeing discouraged employees from reporting defects.

- Barnett died by suicide in March 2024 after giving testimony in a whistleblower lawsuit.

Ed Pierson (2019 onward)

- A supervisor at Boeing’s 737 MAX factory.

- He reported problems like incomplete work, missing parts, and pressure to meet deadlines at the cost of safety.

- He testified before the U.S. Congress, but his warnings were initially ignored.

- These are documented cases, not rumors. Each of these whistleblowers was backed by formal investigations.

Airbus: Quietly Reliable in India

Airbus A320 aircraft, widely used by IndiGo, Vistara, and Air India, form the backbone of Indian domestic air travel.

There has been no major Airbus-related crash in India since 1990.

Airbus has not been involved in any whistleblower controversies or major global safety scandals in recent years.

Its aircraft are known for being easy to maintain, fuel-efficient, and highly reliable.

Minor Incident

- In May 2025, Air India operated three Airbus A320 aircraft with delayed safety checks related to emergency slide systems.

- This issue was caused by internal maintenance delays at the airline, not by any design flaw in the Airbus aircraft.

Boeing vs Airbus: Which one’s Safer?

| Feature | Boeing | Airbus |

| Fatal crash in India (2020 to 2025) | Yes, Boeing 787 in 2025 | None |

| Global safety scandals | Yes, including MAX crashes and whistleblowers | None |

| Whistleblower cases | Three major documented cases | None reported |

| Grounded aircraft | 737 MAX grounded globally in 2019 | None |

| Record in India | Mixed, with recent concerns | Consistently strong |

What This Means for Indian Flyers

Boeing makes some of the world’s most advanced aircraft for international travel, like the 787 and 777. But the crash in India and multiple whistleblower complaints have created serious questions about how safety is handled inside the company.

Airbus aircraft, especially the A320 and A321 used in India, have a clean track record and no serious safety concerns in recent years. They are widely considered dependable for short to medium-haul flights.

Stock Market Share of Boeing and Airbus in India

Boeing Stocks in India (Ticker: BA, listed on NYSE)

- Current Price: US $197.68 per share (as of June 20, 2025).

- Market Capitalization: Approximately US $151 billion.

- Geographic Revenue Split: ~18% of sales come from Asia, making India and its neighbors a key market.

Indian Access & Investor Details

- Indian investors can buy Boeing shares via platforms like Groww, Fi Money, Angel One, or INDmoney. They can use fractional shares, allowing investments as small as ₹100.

- According to ownership data, ~76% of Boeing shares are held by institutional investors (pension funds, mutual funds, and global investment firms) . This makes Boeing a blue-chip pick for investors seeking global aerospace exposure.

Airbus (Ticker: AIR, listed on Euronext Paris)

- Current Price: €47.59 (~US $52) per share, yielding approximately 0.87% in annual dividends.

- Market Listing: Airbus is listed on Paris, Frankfurt, and Spanish exchanges. As of May 31, 2025, it had 792.3 million shares issued.

Indian Investor Access

- Airbus shares are accessible through international trading accounts in India via platforms like Groww or INDmoney.

- It features in major global indices such as CAC 40, DAX 40, and MSCI World, making it a stable choice for diversified funds.

How They Compare in the Indian Market

| Feature | Boeing (BA – NYSE) | Airbus (AIR – Euronext) |

| Share Price | US $197.68 | €47.59 (~US $52) |

| Market Cap | US $151 billion | N/A in INR (Euronext listing) |

| Dividend Yield | Variable (US standard) | 0.87% |

| Institutional Ownership | 76% held by global institutions | Listed on indexes; solid institutional backing |

| Indian Access | Yes (via US stock platforms) | Yes (via international trading) |

What This Means for Indian Investors

- Global Exposure: Investing in Boeing or Airbus gives Indian investors access to the global aerospace industry, which isn’t available through NSE or BSE listings.

- Diversified Risk: Institutional ownership provides stability; both are held in major global portfolios, reducing volatility.

- Access Mechanisms: Both are available via internationally listed stock platforms in India, supporting fractional investing.

- Dividend Insights: Airbus offers consistent dividends (~0.87%), while Boeing’s payout depends on future profitability.

- Future Outlook: Airbus is stable and geared for steady growth; Boeing offers higher risk but potential for greater returns if production and profits rebound.

Summary

- Boeing: A well-known blue-chip U.S. stock. Volatile yet accessible to Indian retail investors. It plays a key role in global defense and commercial aviation but must navigate recent safety and financial hurdles.

- Airbus: A major European stock with lower volatility, steady dividends, and strong institutional backing. Viewed as a reliable long-term choice in aviation investing.

Suggested Read: Top Defense Stocks to Invest in 2025 for Explosive Growth

Bottom Line: What’s safe Boeing or Airbus?

After digging through the data, safety records, and real-life incidents, one thing is clear: Airbus currently holds the safer and more stable edge in India.

With no major crashes, zero global safety scandals, and a clean whistleblower record, it’s built a solid reputation, especially with its A320 and A321 aircraft that dominate India’s skies.

Boeing, on the other hand, is unmatched when it comes to long-haul, high-tech jets like the Dreamliner. But the recent 787 crash in Ahmedabad and several serious whistleblower revelations globally have raised some tough questions about internal safety culture and oversight.

If you’re flying domestic or want peace of mind from a safety-first track record, Airbus seems like the smarter bet for now. If you’re going international, Boeing still brings cutting-edge capabilities, but with a side of scrutiny that’s hard to ignore.

So, what matters more to you, tried-and-tested safety or next-gen tech with some turbulence?

The answer might just shape your next flight.

FAQs

Which is safer, Airbus or Boeing?

Both manufacturers maintain excellent safety standards, but data shows Airbus narrow-body jets are involved in slightly fewer serious incidents per million flights than Boeing’s

Still, the margin is minimal and both companies consistently comply with rigorous global safety regulations.

Is Boeing a good company to invest in?

Boeing has faced a recent financial setback, including an $11.8 billion net loss in 2024 and stock volatility after the Air India 787 crash.

With new leadership and improving flight production, analysts now rate Boeing a “buy,” forecasting a rebound to $260/share in 12 months.

Does Boeing crash more than Airbus?

On a per-flight basis, Boeing has had a slightly higher incident rate, which is about 6.5 events per 100,000 departures versus 3.8 for Airbus. However, when adjusted for flight volume, both OEMs exhibit similarly low levels of risk.

Is Airbus good stock to buy?

Airbus trades at around €47.60 and is supported by strong international demand and a projected 43,420-aircraft backlog through 2044. It pays consistent dividends (≈ 0.9%) and is included in major global indices, making it an appealing choice for stable long-term investors.