Small-cap mutual funds have maintained their momentum into 2026, building on the strong base set in previous years. While 2023 saw stellar returns exceeding 40.44%, the segment has matured, with current earnings growth for small-cap companies hitting a robust 22% year-on-year as of the December 2025 quarter. In January 2026 alone, small-cap funds attracted steady inflows of ₹2,942 crore, signaling continued investor confidence despite a broader market shift toward precious metals and hybrid strategies.

Small caps represent companies with smaller market footprints but significant growth runways. Their agility often translates into impressive long-term wealth creation, though they remain sensitive to short-term market shifts. Given the current valuation landscape, many advisors recommend a staggered or SIP-based approach to navigate volatility and avoid the risks of a single lump-sum entry.

Success in this category depends on discipline and a long-term horizon, ideally exceeding 7 years. Small caps are most effective when treated as a strategic wealth-building tool rather than a speculative play. By focusing on quality and patience, investors can benefit from the broadening corporate recovery seen across India’s smaller enterprises.

As we move into March 2026, let’s look at some of the top-performing small-cap mutual funds to consider for your portfolio.

What is a Small Cap Mutual Fund?

Before jumping to the best small cap mutual funds, let’s talk about what small cap mutual funds actually are.

Small-cap mutual funds primarily invest in companies ranked below 250 and have a market capitalisation of less than ₹5,000 crores. These funds focus on small businesses, with only a tiny part of their portfolio invested in larger companies.

Additionally, these schemes must allocate at least 65% of their investments to small cap stocks.

While Small Cap Mutual Funds have the potential to deliver higher returns compared to mid-cap or large-cap funds, they also come with higher risks due to the volatility of smaller companies.

For those looking to explore small cap mutual funds in 2024, it’s a good idea to research the top-performing funds in this category.

Remember, small cap mutual funds can be suitable for long-term investors with a high-risk appetite, as these companies might take time to grow but can offer significant returns if they succeed.

How Small Cap Funds Have Been Performing?

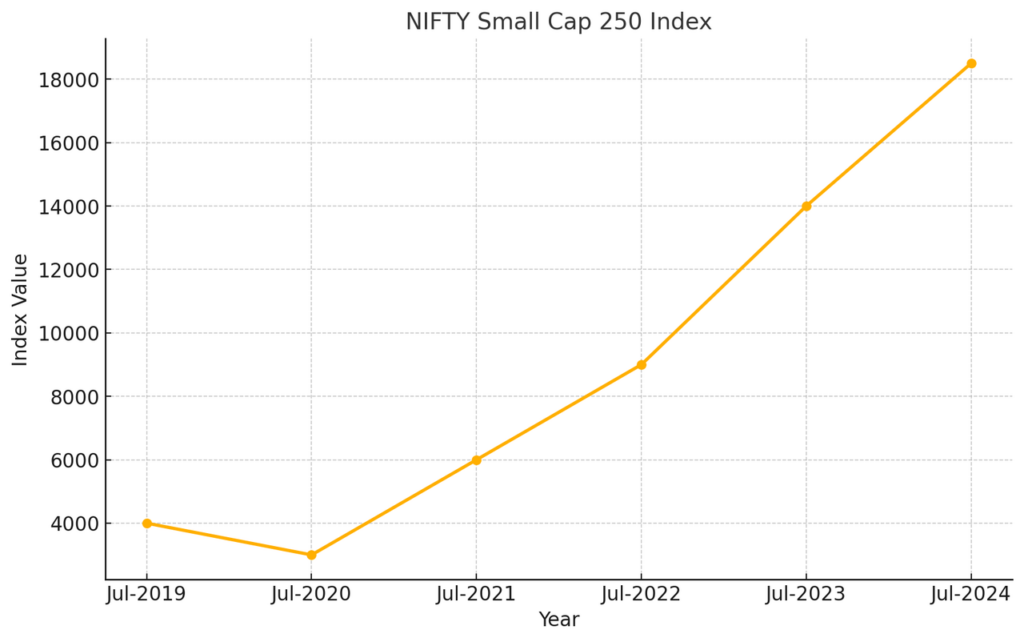

Exceeding all forecasts, the Nifty Small Cap 250 index has increased more than 3.5 times over the past five years and has reached an all-time high, delivering remarkable returns for investors.

In 2024, the Nifty SmallCap 250 index jumped 25%, following a strong performance of 48.1% in the previous year. This growth has notably outperformed the Nifty 50 index, which has risen by 12.8% so far this year.

*Data as of July 2024

List of Best Small Cap Mutual Funds to Invest in 2024

Here are the top performing small-cap mutual funds, ranked by the highest returns achieved in the past month. For a clearer picture of their performance, we’ve also included returns from the last 6 months and 1 year.

However, it is important to keep in mind that past performance does not guarantee future results.

| Fund Name | Category | Risk | 1 Month Return (%) | 6 Month Return (%) | 1 Year Return (%) | AUM(Cr.) |

| Motilal Oswal Small Cap Fund | Equity | Very High | 2.75 | 30.98 | – | 2,579 |

| Tata Small Cap Fund | Equity | Very High | 0.73 | 29.86 | 47.51 | 9,319 |

| Union Small Cap Fund | Equity | Very High | 0.46 | 24.25 | 31.90 | 1,663 |

| HSBC Small Cap Fund | Equity | Very High | 0.44 | 24.67 | 42.22 | 17,306 |

| Baroda BNP Paribas Small Cap Fund | Equity | Very High | 0.20 | 20.18 | – | 1,578 |

About the Funds

Here is an overview of the top performing Small cap mutual funds in October 2024:

Motilal Oswal Small Cap Fund

The Motilal Oswal Small Cap Fund is an open-ended equity scheme focusing on small-cap stocks to generate capital appreciation. Launched on December 26, 2023, it has shown strong performance, aiming to outperform its benchmark, the Nifty Small Cap 250 TRI. The fund requires a minimum investment of ₹500 and has no entry load, with a 1% exit load if redeemed within one year.

Tata Small Cap Fund

The Tata Small Cap Fund, launched on November 12, 2018, targets long-term capital appreciation by investing in small-cap companies with strong growth potential and reasonable valuations. The fund requires a minimum investment of ₹5,000 for lumpsum and ₹100 for SIP

Union Small Cap Fund

The Union Small Cap Fund, aimed at long-term capital appreciation, has a CAGR of 17.22% since inception. If you invested ₹10,000 per month over the past year, it would have grown to approximately ₹140,456. The fund requires at least 65% exposure to small-cap stocks and focuses on a diversified portfolio of growth and bargain stocks.

HSBC Small Cap Fund

The HSBC Small Cap Fund is an open-ended equity scheme focused on long-term capital growth by primarily investing in small-cap stocks. It aims to maintain 65% to 100% of its assets in small-cap equities, with the flexibility to shift up to 35% into fixed-income securities if market conditions are unfavorable. The fund has specific exit load conditions, including no charges for redemptions up to 10% of units within a year and a 1% exit load for amounts exceeding this limit.

Baroda BNP Paribas Small Cap Fund

The Baroda BNP Paribas Small Cap Fund is an open-ended equity scheme launched on October 30, 2023, aimed at long-term capital appreciation. The fund’s benchmark is the Nifty Small Cap 250 TRI, and it carries a very high risk label.

Advantages of Small Cap Mutual Funds

Here are some key benefits of investing in top small-cap mutual funds:

- High Growth Potential: Small-cap companies often have ambitious expansion plans, which can lead to significant growth, especially over the long term. This makes small-cap funds a great option for investors seeking high returns

- Portfolio Balance: When large-cap and mid-cap funds underperform, adding small-cap funds to your portfolio can help boost overall returns. These funds tend to offer higher gains, which can help balance out a portfolio during market downturns.

- Investing in High-Potential Companies: Small-cap funds typically invest in companies with strong growth potential. Fund managers carefully research and select the top-performing stocks, ensuring a diversified portfolio with calculated risks. This diversification can lead to better risk-adjusted returns over time.

- Potential for Higher Returns During Market Recoveries: Small-cap funds often perform well during market recoveries or economic upturns. Since small-cap stocks tend to be more sensitive to market cycles, they can experience sharp gains when the economy rebounds, offering a boost to your portfolio when markets improve.

Understanding Taxation on Small Cap Funds

Taxation of small-cap mutual funds works similarly to other equity funds:

- Short-Term Capital Gains (STCG): If you sell your small-cap mutual fund units within one year of purchase, the gains are classified as short-term capital gains. These are taxed at a flat rate of 20%, regardless of your income tax bracket.

- Long-Term Capital Gains (LTCG): If you hold your small-cap mutual fund units for more than one year before selling, the gains are considered long-term capital gains. Any gains up to ₹1.25 lakh per year are exempt from tax. However, gains exceeding this limit are taxed at 12.5%, and there is no indexation benefit available for Equity Mutual Funds.

Who Should Invest in Small Cap Mutual Funds

- Suitable for investors with existing portfolios looking to diversify further.

- It is best for those with a high-risk tolerance, as small-cap funds can be volatile.

- Ideal for investors who understand the risks of small companies and are prepared for potential losses.

- Fits those who seek higher growth potential but are willing to face short-term fluctuations.

- Not recommended for conservative investors or those looking for stable, low-risk options.

Suggested Read – Nippon India Small Cap Fund vs Quant Small Cap Fund Comparison

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.