The mutual fund industry in India has grown tremendously over the years. In just one year, the assets managed by best mutual funds surged by 40.70%, growing from ₹46.94 lakh crore in August 2023 to ₹66.04 lakh crore in August 2024.

A key factor behind this rapid rise is the strong performance of small and mid-cap companies, which saw a significant jump of 30% to 40% in the past year.

Additionally, the popularity of SIP (Systematic Investment Plans) has grown, with investors contributing around ₹20,000 crore monthly, further boosting mutual fund assets.

In this blog, we will take a closer look at the best mutual funds with the highest returns over the last 10 years across three major categories: equity, debt, and hybrid funds.

If you’re searching for the best mutual funds to invest in for long-term wealth creation, this guide will provide valuable insights into the funds that have consistently delivered strong performance.

Best Mutual Funds for Highest 10-Year Returns

The growth in Mutual Funds has largely been driven by individual investors, especially in equity schemes.

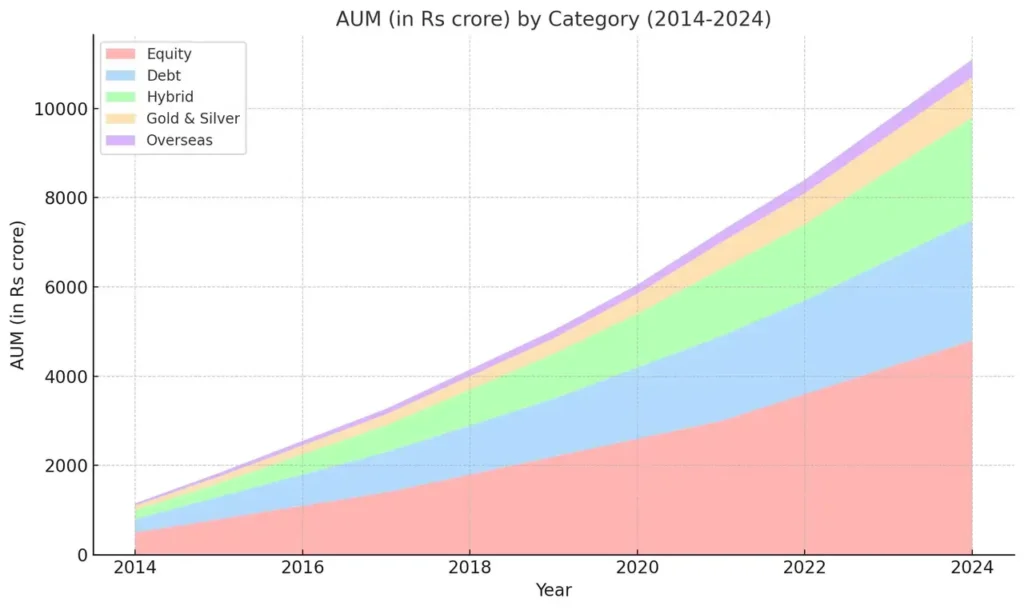

The following graph highlights the distribution of Assets Under Management (AUM) across equity, debt, and hybrid and best mutual funds. It provides a clear picture of how investor preferences have evolved over the years, with varying allocations to each category.

Best Equity Mutual Funds for 10-Year High Returns

Best mutual funds primarily invest in the stocks of companies, aiming for higher returns over the long term by capitalising on the growth of these businesses.

They are considered higher-risk investments compared to debt or hybrid funds, but best mutual funds also offer significant growth potential, making them ideal for investors with a higher risk appetite.

Over the past decade, equity mutual funds have gained significant traction among investors. As of August 2024, equity-oriented schemes accounted for 60.1% of the total industry assets, up from 52.7% in August 2023.

Below are some of the top-performing equity funds that have delivered the highest returns over the last 10 years:

| Fund Name | Risk | 5 Year Return (%) | 10 Year Return (%) | AUM(Cr.) |

| Nippon India Small Cap Fund | Very High | 37.05% | 23.64% | 62,259.55 |

| Quant ELSS Tax Saver Fund | Very High | 33.67% | 23.26% | 11,560.66 |

| Motilal Oswal Midcap Fund | Very High | 33.10% | 21.86% | 18,604.02 |

| Quant Small Cap Fund | Very High | 47.54% | 21.42% | 26,644.74 |

| Edelweiss MidCap Fund | Very High | 31.01% | 21.04% | 7,755.06 |

Best Debt Mutual Funds for 10-Year Returns

Debt mutual funds primarily invest in fixed-income securities such as bonds, treasury bills, and government securities. These funds are considered safer compared to equity funds, as they focus on generating steady returns with lower risk.

They are ideal for investors seeking regular income and capital preservation, making them a preferred choice for conservative investors or those with short- to medium-term investment goals.

Despite their lower risk profile, debt funds have seen fluctuations in their market share over the years. As of August 2024, debt-oriented schemes held 14.5% of the industry assets, down from 19.2% in August 2023. This decline can be attributed to shifting investor preferences toward equity funds and other higher-yield investments.

However, debt mutual funds still remain an important part of a balanced portfolio, offering stability in volatile market conditions.

Here are some of the top-performing debt mutual funds that have delivered solid returns over the last decade:

| Fund Name | Category | Risk | 5 Year Return (%) | 10 Year Return (%) | AUM(Cr.) |

| SBI Magnum Gilt Fund | Debt | Moderate | 7.22% | 8.76% | 10,422.37 |

| ICICI Prudential Constant Maturity Gilt Fund | Debt | Moderate | 6.83% | 8.54% | 2,403.85 |

| Bandhan G sec Fund Constant Maturity | Debt | Moderate | 6.53% | 8.53% | 342.95 |

| ICICI Prudential All Seasons Bond Fund | Debt | Moderate | 7.45% | 8.47% | 12,983.92 |

| Baroda BNP Paribas Small Cap | Debt | Moderate | 7.14% | 8.44% | 171.3 |

Best Hybrid Mutual Funds for 10-Year Returns

Hybrid mutual funds, also known as balanced funds, invest in a mix of equity and debt instruments to provide a balance of growth and income. The equity component in these funds aims for capital appreciation, while the debt portion ensures stability and regular income.

Hybrid funds are designed to offer a moderate risk-reward profile, making them ideal for investors seeking a balance between risk and return.

Over the years, hybrid mutual funds have gained popularity among investors looking for diversified portfolios. As of August 2024, the assets under management (AUM) in hybrid mutual funds have steadily increased as more investors seek a balanced approach to investing.

Below are some of the top-performing hybrid funds in the last decade, delivering strong returns by balancing equity and debt exposure:

| Fund Name | Category | Risk | 5 Year Return (%) | 10 Year Return (%) | AUM(Cr.) |

| Quant Multi Asset Fund | Hybrid | High | 28.30% | 17.39% | 2,983.94 |

| ICICI Prudential Equity and Debt Fund | Hybrid | Very High | 23.29% | 16.49% | 41,395.98 |

| Quant Absolute Fund | Hybrid | Very High | 25.20% | 16.43% | 2,352.27 |

| HDFC Balanced Advantage Fund | Hybrid | High | 21.30% | 15.30% | 96,535.51 |

| ICICI Prudential Multi Asset Fund | Hybrid | Very High | 21.71% | 15.04% | 50,495.58 |

Conclusion

In conclusion, the mutual fund industry in India has seen significant growth, with equity funds leading the way in terms of returns over the past decade. Whether you’re looking at the best mutual funds to invest in 2024 or focusing on best mutual funds with the highest returns, it’s clear that long-term investment is key.

Equity funds offer higher returns, while debt and hybrid funds provide stability and balance.

For those investing regularly, SIPs (Systematic Investment Plans) are a great way to build wealth. Choosing the best SIP platform can help you manage your investments easily and maximize returns based on your financial goals.

Suggested Read – Top performing SWP Mutual Funds in India

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.