Momentum mutual funds aim to take advantage of rising stocks by investing in those that have recently shown strong performance. The idea behind these funds is simple: they buy stocks that are already going up, hoping that the upward trend will continue in the near future.

If you’re looking for mutual funds that can potentially deliver high returns by capturing market momentum, this blog will help you explore some of the best momentum mutual funds to invest in 2024.

What are Momentum Mutual Funds?

Momentum funds are Mutual Funds that invest in stocks or other assets that are already showing strong upward performance. The idea is to ride the wave of an existing trend, where the price of an asset is rising, with the belief that it will continue to rise in the near future. The main strategy of these funds is to pick stocks that have gained momentum and hold onto them as long as they continue to perform well.

How Are Momentum Mutual Funds Performing in India?

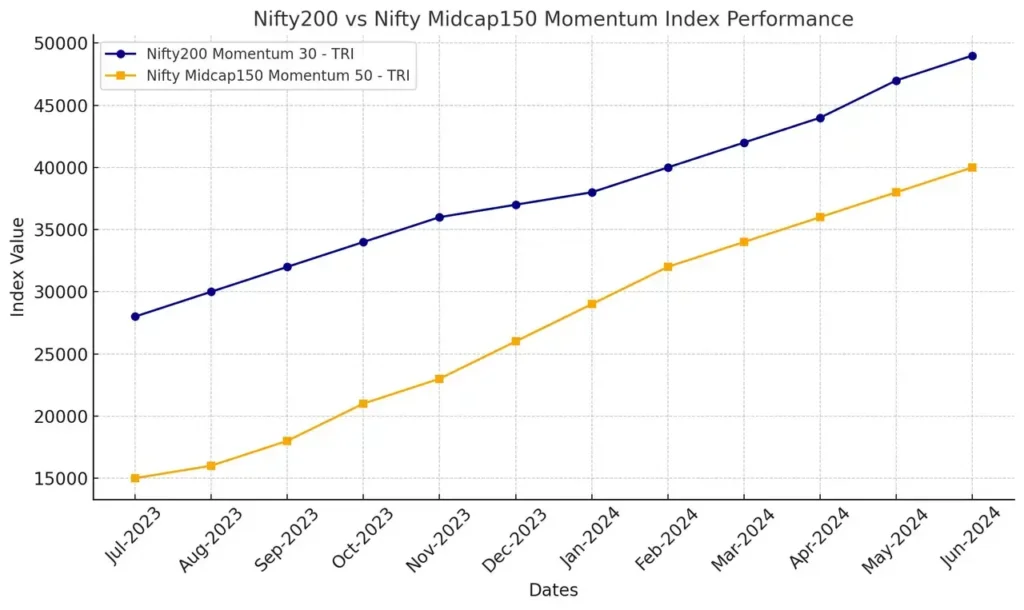

Momentum funds have gained popularity in India, especially with the market doing well recently. For example, top-performing funds like UTI Nifty200 Momentum 30 Index Fund and Motilal Oswal Nifty 200 Momentum 30 Index Fund have delivered impressive returns of around 60% in one year.

As mid-cap and small-cap stocks have been performing particularly well, momentum mutual funds have been quick to tap into this trend by launching specialised funds.

As a result, the assets under management (AUM) for momentum funds in India surged more than fourfold, from ₹3,500 crore in August 2022 to ₹15,100 crore in August 2023.

The Indian mutual fund industry currently has 12 schemes that focus on momentum indices. Index funds tracking the Nifty200 Momentum 30 Index and the Nifty Midcap 150 Momentum 50 Index have emerged as top performers, particularly when considering year-to-date (YTD) performance.

This growth shows that momentum funds are delivering high returns due to the ongoing market rally. However, it’s important to remember that momentum funds can be volatile, especially during market downturns, and work best for investors willing to stay invested for longer periods.

Best Momentum Mutual Funds to Invest in 2025

Here’s a list of the best momentum mutual funds in India, as per the returns delivered in the last 1, 2, and 3 years:

| Fund Name | Risk | 1 Year Return (%) | 2 Year Return (%) | 3 Year Return (%) | AUM(Cr.) |

| Bandhan Nifty200 Momentum 30 Index Fund | Very High | 57.37% | 36.21% | – | ₹ 141.23 Cr |

| Edelweiss Nifty Midcap150 Momentum 50 Index Fund | Very High | 55.81% | – | – | ₹ 681.34 Cr |

| ICICI Prudential Nifty 200 Momentum 30 Index Fund | Very High | 58.90% | 36.47% | – | ₹474.02 Cr |

| Motilal Oswal Nifty 200 Momentum 30 Index Fund | Very High | 59.60% | 37.02% | – | ₹ 871.24 Cr |

| Tata Nifty Midcap 150 Momentum 50 Index Fund | Very High | 54.52% | 38.88% | – | ₹ 618.79 Cr |

| UTI Nifty200 Momentum 30 Index Fund | Very High | 59.80% | 37.35% | 20.45% | ₹ 8449.82 Cr |

How do Momentum Mutual Funds Work?

Here’s how the best momentum funds work:

- Momentum funds invest in stocks that are showing strong upward price movement over a specific period, usually 6 to 12 months.

- Fund managers use a data-driven approach to select stocks, focusing on metrics like price growth, trading volumes, and relative strength indicators.

- The portfolio is built by adding stocks with the highest momentum, ensuring diversification.

- The fund regularly reviews and rebalances the portfolio, replacing stocks that lose momentum with new top-performing ones.

- The strategy assumes that stocks that are trending upward will continue to rise due to market sentiment and investor behaviour.

However, momentum mutual funds may experience higher turnover, leading to increased transaction costs and short-term market volatility.

Why Should You Invest in the Best Momentum Funds in 2025?

- High Returns Potential: Momentum funds aim to invest in stocks that are already rising, allowing investors to benefit from positive price trends. This can lead to strong returns when the market is moving upwards.

- Diversification: Adding momentum funds to your investment portfolio can boost diversification. Since these funds tend to perform differently from traditional assets like bonds, they can help balance your portfolio during market ups and downs.

- Active Management for Better Gains: Fund managers of momentum funds actively track the market to select stocks with high growth potential. This approach can generate better returns compared to passive funds. To plan your investments, use an SIP calculator to make smart decisions.

- Adapts to Market Trends: Momentum funds are flexible, meaning fund managers regularly update the portfolio to align with changing market trends, which can help maximize returns while limiting risks.

- Takes Advantage of Investor Behavior: These funds capitalise on common investor behaviour, where people tend to follow rising stocks. Momentum funds ride this wave, aiming to benefit from continued price increases.

- Professional Expertise: Momentum mutual funds are managed by experts who use advanced analysis to identify high-performing stocks. This gives investors the benefit of professional insight to boost returns.

- Risk Management: Some momentum funds include risk management strategies to minimize losses during market downturns. Techniques like stop-loss orders or rebalancing help protect investors’ capital.

- Consistency in Performance: Studies have shown that momentum strategies often perform well for extended periods. By investing in these funds, you can take advantage of this trend for consistent returns.

Remember to always assess your financial goals and risk tolerance and ensure you’re investing through the best SIP platform for long-term success. Keep in mind that market trends can shift, so it’s important to invest wisely.

Suggested Read – TER in Mutual Funds

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.