Passive investing, also known as index investing, is a long-term investment strategy where investors aim to replicate the performance of a specific market index. These indices range from broad market benchmarks like the Nifty 50 Index to more focused options like the Nifty Bank Index.

Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO aims to replicate the Nifty Midcap 150 Index, providing exposure to midcap stocks that have historically outperformed larger companies and delivered significant growth.

Instead of trying to outperform the market, passive funds aim to track the index as closely as possible, providing investors with market-aligned returns over time.

In India, passive investing has seen a sharp rise, particularly after the pandemic, with a surge in Assets Under Management (AUM) as more investors opt for its simplicity and cost-effectiveness. For example, the Nifty 50 Index has delivered a solid 12.6% CAGR over the last decade, making it an attractive choice for long-term wealth accumulation.

As passive investing gains traction, the introduction of products like the Baroda BNP Paribas Nifty Midcap 150 Index Fund offers an exciting opportunity for investors looking to tap into the potential of mid-sized companies.

Let’s explore if Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO aligns with your financial objective.

What is Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO?

The Baroda BNP Paribas Nifty Midcap 150 Index Fund closely follows the Nifty Midcap 150 Total Returns Index, which represents the top 150 midcap companies in India. The fund will hold the same stocks as the index in the same proportion, with the goal of providing returns that closely track the performance of the index, subject to minor tracking errors.

Investment Objective of the Fund

The primary objective of Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO is to replicate and track the Nifty Midcap 150 Total Returns Index. It seeks to provide investors with the potential to participate in the growth of midcap companies, which often have the ability to deliver higher returns due to their expansion potential. The fund will try to minimize tracking errors, ensuring returns are aligned with the benchmark index.

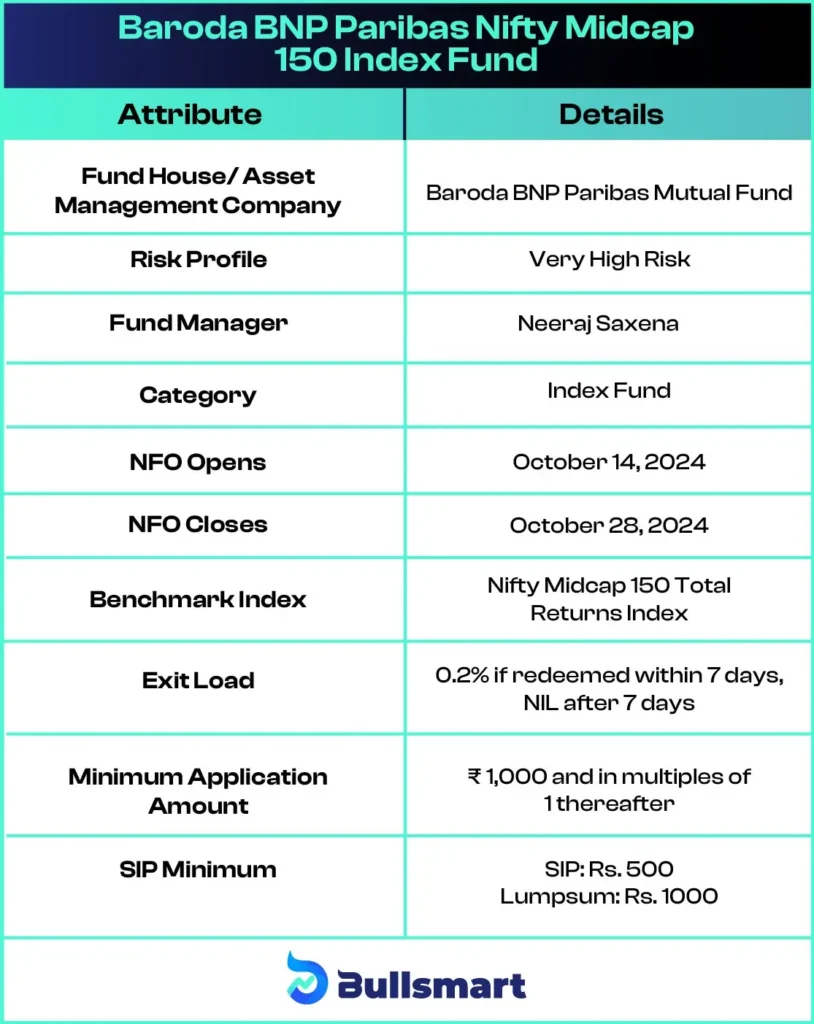

Key Details of Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO:

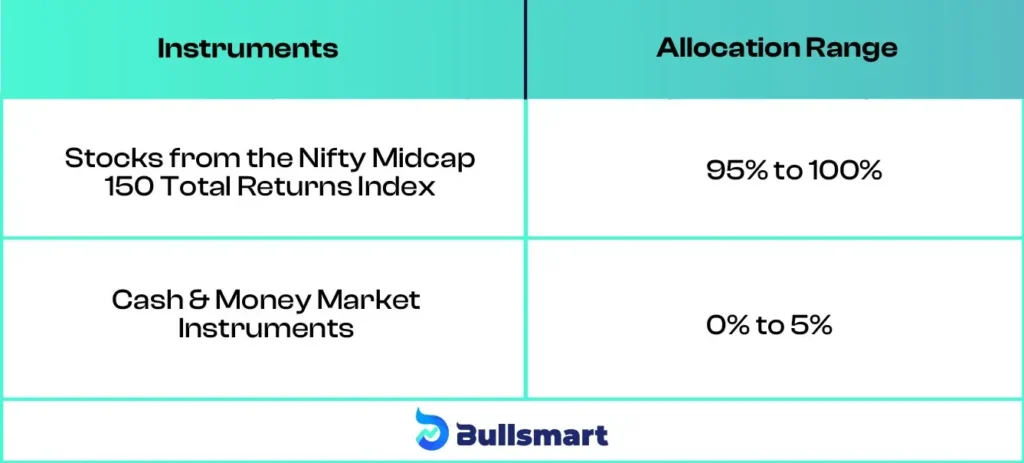

Portfolio Allocation

Baroda BNP Paribas Nifty Midcap 150 Index Fund will invest in equity and equity-related securities that are part of the Nifty Midcap 150 Index, providing exposure to India’s leading midcap companies. The allocation closely follows the composition of the benchmark index, giving investors broad diversification across multiple sectors.

Investment Risks and Return Opportunities

The Baroda BNP Paribas Nifty Midcap 150 Index Fund offers exposure to midcap equities, which come with higher risk but also higher return potential. Midcap stocks tend to outperform large caps in periods of economic growth, but they can also be more volatile during downturns.

This Mutual Fund follows the Nifty Midcap 150 Total Returns Index which has delivered returns of 46.20%, 23.82%, and 31.70% in the past 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

As such, Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO is well-suited for long-term investors who can handle short-term market fluctuations. Investors should be prepared for a very high-risk investment, as indicated by the scheme’s risk-o-meter.

Baroda BNP Paribas Mutual Fund

Baroda BNP Paribas Mutual Fund is a prominent player in India’s mutual fund sector, providing a diverse array of investment options. Renowned for its disciplined investment philosophy and Growth-at-Reasonable Price (GARP) strategy, the company is part of BNP Paribas Asset Management, which manages nearly ₹42 trillion in assets globally.

Having been in India for over 150 years, Baroda BNP Paribas Mutual Fund offers 35 different schemes, including equity, hybrid, and debt funds.

As of June 30, 2024, the firm manages assets totaling ₹39,957.24 crore. Notable funds include the Baroda BNP Paribas Midcap Fund, which has consistently performed well among mid-cap funds over the past five years.

The Baroda BNP Paribas India Consumption Fund is recognized for its strong performance in managing volatility within its category, while the Baroda BNP Paribas ELSS Tax Saver Fund has a solid track record among ELSS funds over the last two years.

Meet the Fund Manager

The scheme is managed by Mr. Neeraj Saxena, who serves as the Fund Manager and Dealer for equity at Baroda BNP Paribas Asset Management. With 20 years of experience in the financial services industry, he also oversees the Baroda BNP Paribas Nifty 50 Index Fund and the Baroda BNP Paribas Arbitrage Fund, collaborating closely with Mr. Vikram Pamnani.

Who Should Invest in this NFO?

Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO is ideal for:

- Long-term investors seeking capital appreciation from midcap companies.

- Investors looking for diversified exposure to midcap equities.

- Individuals who want to align their investments with the Nifty Midcap 150 Index for potentially higher returns.

- Those who are comfortable with high risk and the volatility associated with midcap stocks.

Why Choose Baroda BNP Paribas Nifty Midcap 150 Index Fund NFO?

- Midcap exposure: Midcap stocks often offer higher growth potential compared to large caps.

- Diversification: The fund provides broad exposure to 150 midcap companies across various sectors.

- Index-linked returns: By tracking the Nifty Midcap 150 Total Returns Index, the fund aims to provide cost-effective and transparent returns.

In conclusion, the Baroda BNP Paribas Nifty Midcap 150 Index Fund is an attractive option for investors who believe in the growth story of midcap companies in India.

With a focus on replicating the index and minimising tracking errors, this fund offers a diversified and transparent way to participate in the midcap segment of the market.

However, investors must be prepared for the higher risks associated with midcap stocks and have a long-term investment horizon to capitalize on potential growth.

Suggested Read – Baroda BNP Paribas Nifty200 Momentum 30 Index Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.