India’s equity market continues to attract a wide range of investors, and passive investing is gaining momentum. Momentum investing, in particular, is becoming a popular strategy for long-term investors. To capitalize on this growing trend, Baroda BNP Paribas Mutual Fund has introduced the Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund NFO.

This new fund offer aims to invest in momentum-based stocks selected from the Nifty 200 Index, specifically tracking the Nifty 200 Momentum 30 Total Return Index.

Let’s explore what this fund offers and whether it’s suitable for your portfolio.

Baroda BNP Paribas Nifty 200 Momentum Fund NFO Review

The Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund NFO is an open-ended index fund that replicates the Nifty 200 Momentum 30 Total Return Index (TRI). This fund provides investors with exposure to stocks exhibiting momentum characteristics, meaning stocks with the strongest upward price movements over the past 6 and 12 months, adjusted for volatility.

The fund is benchmarked against the Nifty 200 Momentum 30 Total Return Index.

Understanding the Investment Goals of the Fund

Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund NFO objective is to deliver returns that, before expenses, closely correspond to the total returns of the Nifty 200 Momentum 30 Index, subject to tracking errors.

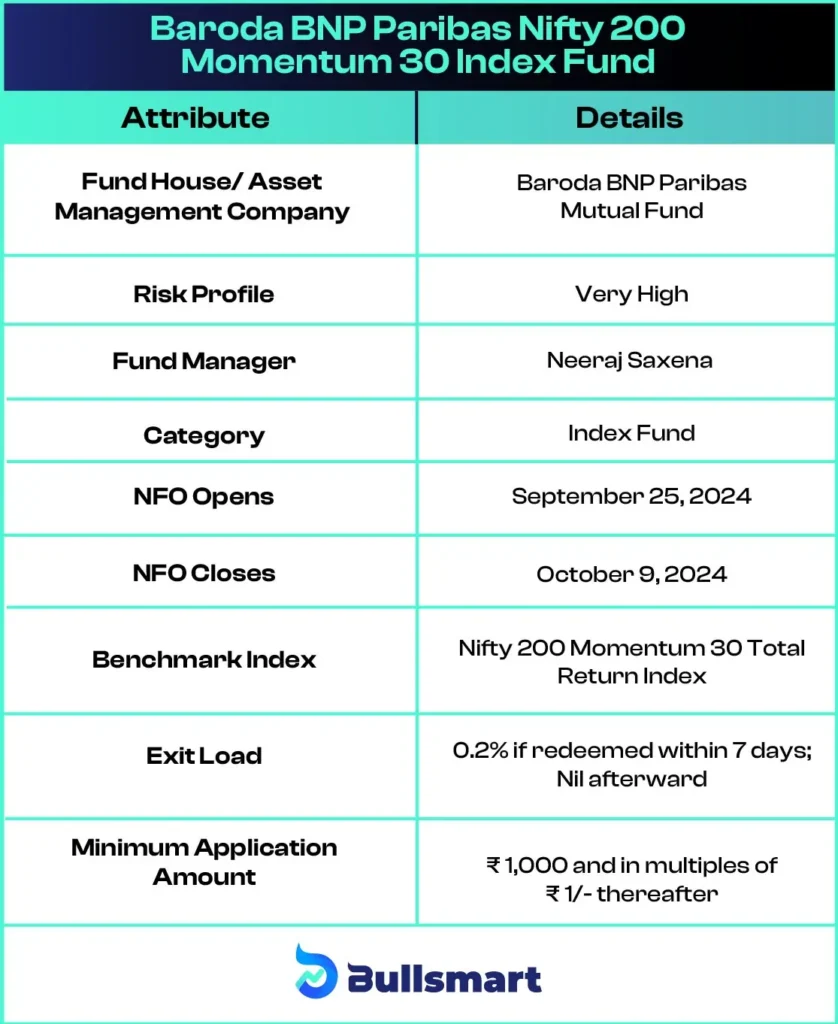

Here are the key details of Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund:

Portfolio Allocation

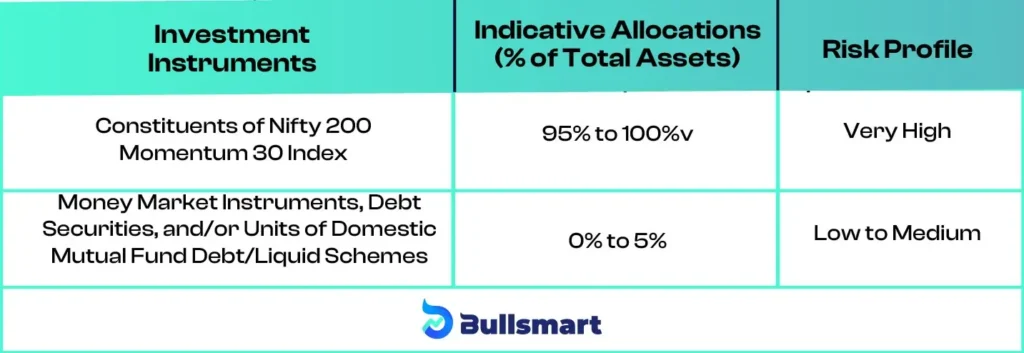

The asset allocation of the Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund is as follows:

Analyzing Investment Risks and Potential Returns

As a momentum-focused index fund, the Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund carries a high-risk profile. Momentum investing relies heavily on price movements, meaning the portfolio could face increased volatility during market downturns.

However, the momentum factor has been known to deliver strong returns during bullish market conditions.

Historically, the Nifty 200 Momentum 30 Index has shown consistent outperformance compared to broader indices like the Nifty 50 Index. The scheme has delivered returns of 65.91, 25.61, and 29.66 in the last 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Baroda BNP Paribas Mutual Fund

Baroda BNP Paribas Mutual Fund is one of the leading mutual fund companies in India, offering a wide range of investment options. The company is known for its disciplined investment approach and its Growth-at-Reasonable Price (GARP) strategy.

Baroda BNP Paribas Mutual Fund is a part of BNP Paribas Asset Management, which oversees nearly ₹42 trillion in assets worldwide.

With a presence in India for over 150 years, the company provides 35 different schemes, including equity, hybrid, and debt funds. As of June 30, 2024, it manages assets worth ₹ 39,957.24 crore.

Get to Know the Fund Managers Behind Your Investment

The scheme is managed by Mr. Neeraj Saxena

He is the Fund Manager and Dealer for equity at Baroda BNP Paribas Asset Management, bringing 20 years of experience in the financial services industry. He also manages the Baroda BNP Paribas Nifty 50 Index Fund and the Baroda BNP Paribas Arbitrage Fund, where he works alongside Mr. Vikram Pamnani.

Who Should Invest in Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund?

The Baroda BNP Paribas Nifty 200 Momentum 30 Index Fund NFO is a good option for:

- Long-term investors looking for capital appreciation through momentum investing.

- Investors who prefer the low-cost and rule-based nature of index funds.

- Those with a high-risk tolerance who want exposure to momentum stocks and can handle the potential volatility associated with this strategy.

This fund is also ideal for investors who believe in the long-term growth potential of momentum investing and want to diversify their portfolio with a passive investment strategy.

Suggested Read – Baroda BNP Paribas Dividend Yield Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.