Bank of India Mutual Funds launched a Business Cycle Fund, “Bank of India Business Cycle Fund” as a New Fund Offer (NFO) on 9th August 2024, which is open for subscription until 23rd August 2024.

Understanding the concept of Business Cycle

Business Cycle Funds are like a roller coaster ride, where each twist and turn represents a different stage of the economy. The economy typically goes through four phases: Expansion, Peak, Contraction, and Trough.

Within any sector, companies can be at different stages of this cycle. During expansions, the economy grows, with more jobs, higher industrial production, and rising incomes. In contrast, during contractions, the economy shrinks, which declines in these same areas.

Macro factors like technological innovations, climate change, demographic shifts, and national initiatives like “Make in India” significantly shape medium to long-term business trends and themes. These macro trends impact business cycles across sectors, influencing how industries evolve and respond to changing economic landscapes.

Business cycle funds, also known as sector rotation funds, are mutual funds designed to take advantage of these economic shifts by strategically investing in sectors or assets that are expected to perform well in each phase.

Details of BOI Business Cycle Fund

Bank of India Business cycle is an open-ended thematic fund which dynamically invest across sectors and companies that are selected based on business cycle theme.

The fund considers “NIFTY 500 TRI” as its benchmark index.

Investment Objective

The scheme seeks to generate long-term capital appreciation by investing predominantly in equity and equity related securities through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy.

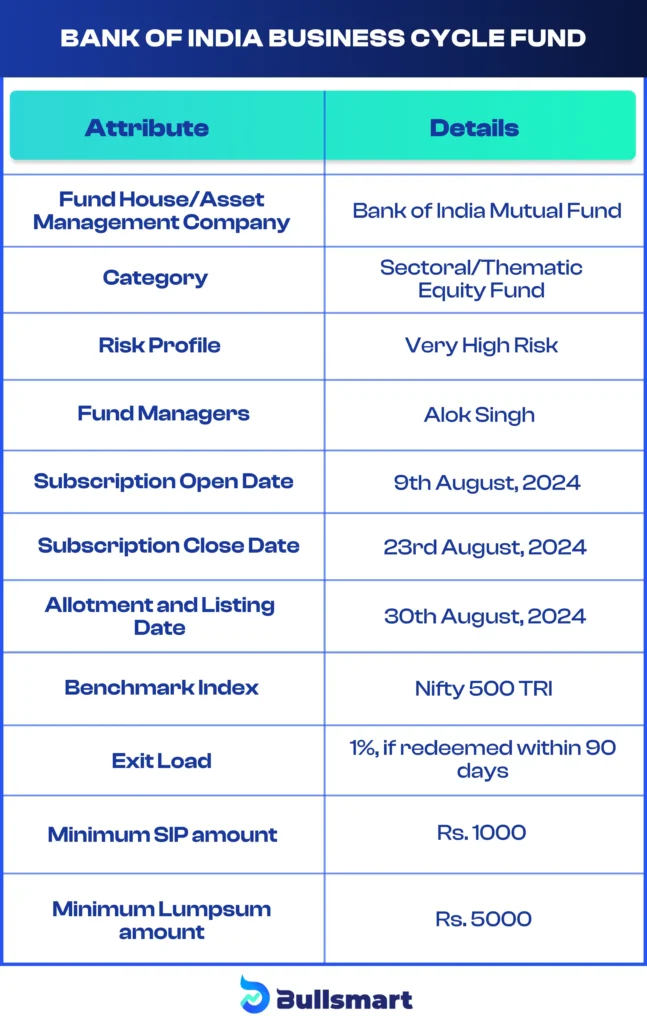

Let’s have a quick look at the key basic details of the fund:

Navigating risks and returns

Bank of India Business Cycle Fund is a sectoral/thematic fund, which means it carries a very high-risk profile but also has the potential to generate higher returns for its investors.

As of 13th August 2024, the NIFTY 500 TRI has delivered returns of 35.61%, 18.52%, and 21.87% over 1-year, 3-year, and 5-year periods, respectively. Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Suggested read: Motilal Oswal Business Cycle Fund

BOI MF Asset Management Company

Bank of India AMC was incorporated on 13-Aug-2007 and is a wholly owned subsidiary of Bank of India. AMC possess a diverse portfolio of 18 mutual fund schemes and is currently serving over 4 lakh investors and managing ₹9,055 crores of AUM as of June 30, 2024.

They have consistently met the diverse financial goals of their clients. From seasoned investors to newcomers, they offer tailored solutions across multiple asset classes and ensure everyone’s investment goals are within reach.

Meet the fund manager – Alok Singh

Alok Singh is a seasoned fund manager who brings a wealth of expertise with his B. Com, PGDBA, and CFA. He has 21 years of experience, including 16 years in the mutual fund industry. Since April 2012, he has been a driving force at Bank of India Investment Managers Private Limited.

Before joining Bank of India, he worked with BNP Paribas Asset Management and Axis Bank.

Who should invest in this NFO?

This thematic fund is ideal for investors seeking long-term capital appreciation by investing in a dynamic equity-oriented portfolio. It focuses on businesses and sectors that could benefit from medium to long-term growth themes. Suitable for those who have knowledge of macro trends and with a minimum investment horizon of 5 years with a very high-risk appetite.

This fund aims to capture opportunities in evolving markets, making it a compelling choice for investors willing to embrace potential volatility for significant returns.

It is always advisable to do thorough research on the fund or consult financial advisor to know whether Bank of India Business cycle fund suits your financial goal and risk profile.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.