Many mutual fund investors are concerned about the high valuations in the mid-cap space. Mid-cap stocks have experienced a strong rally in recent months, allowing investors to earn significant returns. In 2023, mid-cap funds delivered an average return of 32.23%, which has led to some anxiety about future performance.

Before addressing this concern, it’s important to understand the basics. Mid-cap schemes invest in medium-sized companies ranked between 101 and 250 by market capitalisation, as per SEBI guidelines.

These companies hold the potential to become the market leaders of tomorrow, making them attractive investments. If these companies meet their growth potential, investors are likely to see substantial rewards.

One such opportunity is the Bandhan Nifty Midcap 150 Index Fund, which offers a chance to participate in the growth of mid-cap companies and provides diversified exposure to high-growth mid-cap companies, helping investors balance risk with potential rewards.

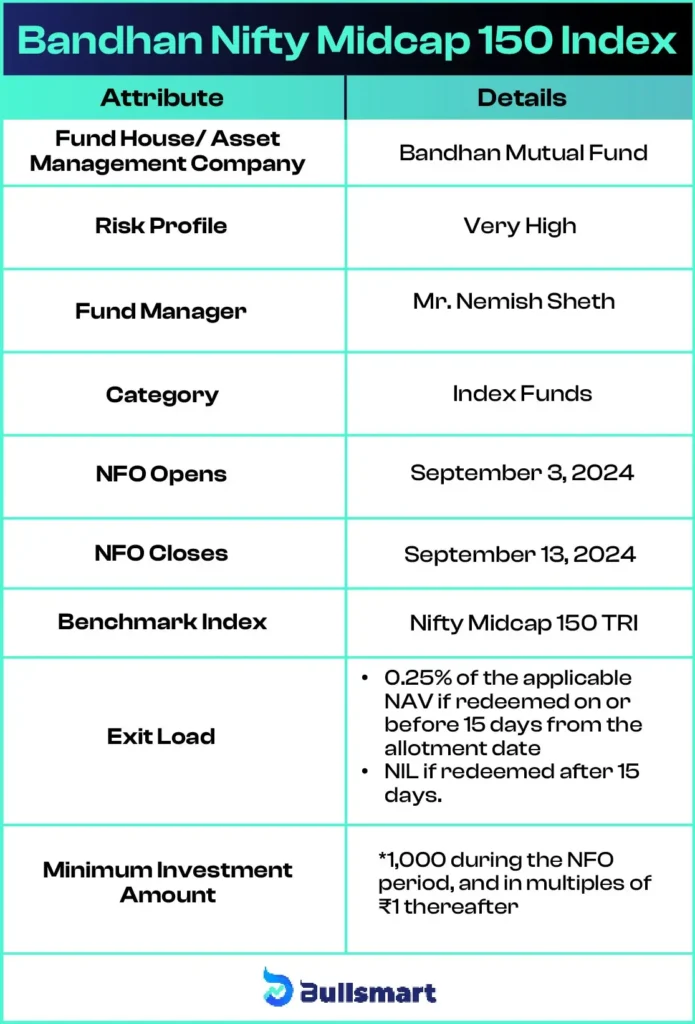

Details of Bandhan Nifty Midcap 150 Index Fund NFO

Bandhan Nifty Midcap 150 Index Fund is an open-ended scheme tracking the Nifty Midcap 150 Index

The scheme invests in the top 150 companies beyond the Nifty 100, providing exposure to mid-sized businesses that are poised for growth. These companies often have more growth potential than large caps but are more stable than small caps, striking a balance for investors looking to capture market opportunities.

Investment Objective of the fund

The investment objective of the scheme is to replicate the performance of the Nifty Midcap 150 Index by investing in its securities in the same proportion and weightage. The aim is to deliver returns, before expenses, that closely track the total return of the Nifty Midcap 150 Index, subject to tracking errors.

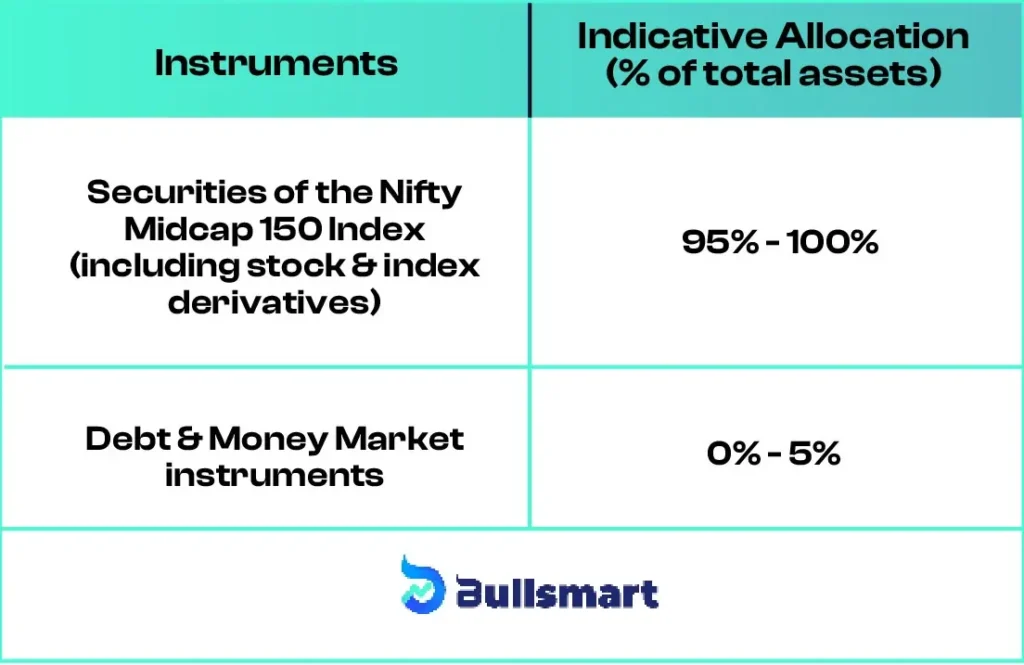

Portfolio Analysis

The asset allocation of the Bandhan Nifty Midcap 150 Index Fund is as follows:

Understanding Risks and Returns

Bandhan Nifty Midcap 150 Index Fund carries a very high-risk profile

While past performance does not guarantee future returns, midcap companies have consistently shown the ability to outperform in growth markets. The Bandhan Nifty Midcap 150 Index Fund aims to replicate the performance of the Nifty Midcap 150 Index, providing investors with a proven avenue for growth.

The Nifty Midcap 150 Index has delivered returns of 46.37%, 27.21%, and 32.22% over the past 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Suggested Read – Bandhan BSE Healthcare Index Fund

Bandhan Asset Management Company

Founded in 2000, Bandhan Mutual Fund is one of India’s top 10 fund houses by Assets Under Management (AUM). With a skilled investment team located in over 60 cities, Bandhan Mutual Fund focuses on helping people grow their savings through smart investing.

Before becoming Bandhan Mutual Fund, the company was known as IDFC Mutual Fund, under its parent company IDFC Ltd. Established in 2000, IDFC Mutual Fund played a key role in the growth of India’s mutual fund industry. As of June 30, 2024, the company’s AUM stood at ₹ 148,741.98 crore

Meet the Fund Managers

Mr. Nemish Sheth, Associate Vice President of Equity at Bandhan AMC, has over 12 years of experience in fund management, specialising in equities, arbitrage, and ETFs. He manages notable funds including the Bandhan Nifty 50 Index Fund, Bandhan Nifty Smallcap 250 Index Fund, and Bandhan BSE Sensex ETF.

Who should invest in the Bandhan Nifty Midcap 150 Index Fund?

This fund is ideal for investors who:

- Aim to build wealth over the long term.

- Are looking to invest in equity and equity-related securities within the Nifty Midcap 150 Index.

If you’re unsure about the suitability of this product for your financial goals, it is recommended to consult with a financial advisor before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.