Over a past decade, the Indian banking industry is riding a wave of transformation, it is fueled by strong economic growth, rising disposable incomes, increasing consumerism, and easier access to credit.

The sharp growth in the number of digital payments over the past few years is proof that the industry has already taken a big step towards modernization. Technological innovations have significantly enhanced efficiency, productivity, quality, inclusion, and competitiveness, particularly in digital lending.

As we look ahead, the sector’s growth is set to be further triggered by liquidity infusion from the RBI, easing deposit rates, and anticipated rate cuts. This dynamic evolution places the Indian banking industry at the forefront of the nation’s economic future, making it a pivotal sector to watch.

To capture this momentum, Bandhan Mutual Fund has released a new fund, the “Bandhan NIFTY Bank Index Fund,” which is designed to leverage the banking sector’s profitability.

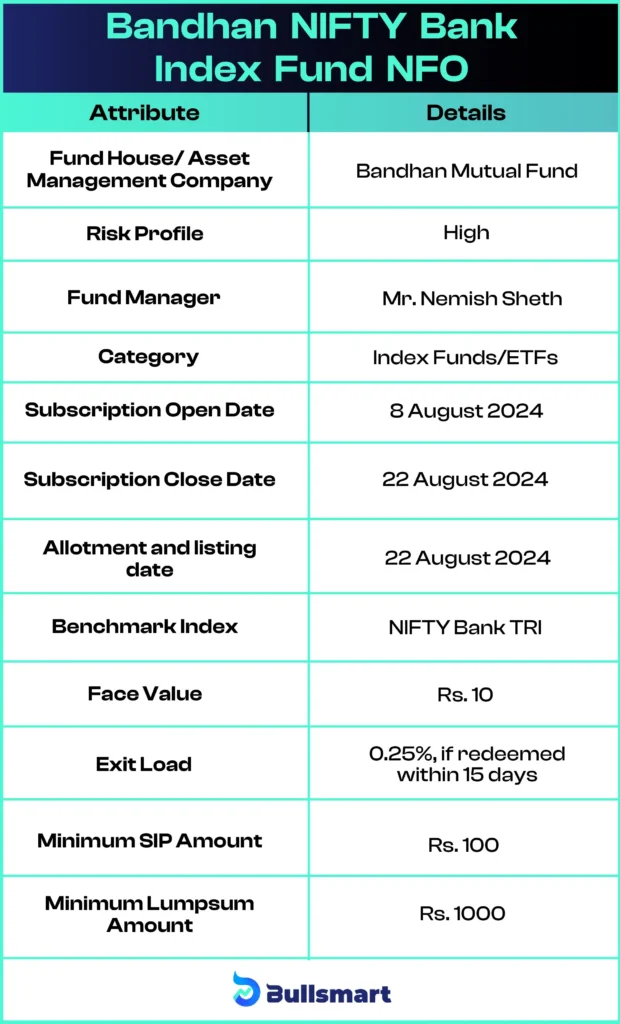

Bandhan NIFTY Bank Index NFO is open for subscription from 8 August 2024 to 22 August 2024, with its allotment date is 22 August 2024.

Details of Bandhan NIFTY Bank Index NFO

The Bandhan NIFTY Bank Index New Fund Offering is a compelling choice for investors with keen interest on the dynamic growth of India’s banking sector.

This is an open-ended fund (investors can enter & exit at any time they want) launched by Bandhan Mutual fund house. This fund mimics or tracks the “Nifty India Bank Total Return Index”, giving the investor direct exposure to banking stocks

What is Bank NIFTY Index?

The Nifty Bank Index includes a few of the largest and most liquid banking stocks listed on the NSE. This index covers key players in the banking industry, across both public and private sector banks and it reflects the banking sector’s health and performance.

Investment Objective of NFO

The investment objective of the Scheme is to replicate the Nifty Bank Index by investing in securities of the Nifty Bank Index in the same proportion or weightage with an aim to provide returns before expenses that track the total return of the Nifty Bank Index, subject to tracking errors.

Let’s have a quick glance at the basic details of the Fund:

Navigating the risks and returns of fund

The Bandhan NIFTY Bank Index Fund aims to invest all its money in equities, which comes with higher risk. However, it also has the potential to generate higher returns.

As of 5th August 2024, the NIFTY Bank Benchmark has generated returns of 15.48% over 1 year and 13.65% over 3 years. While the Bandhan NIFTY Bank Index Fund is expected to generate similar returns, these are not guaranteed and may fluctuate based on market conditions.

Starting with just ₹100, you can tap into the sector’s potential and enjoy low exit costs of 0.25% if you stay invested for less than 15 days. It’s a great way to align your investment with a rapidly evolving sector that is pivotal to India’s future.

Suggested Read: Is the HDFC Nifty500 Multicap 50:25:25 Index Fund Right for You?

Bandhan Asset Management Company

Bandhan Mutual Fund Asset Management Company was established in 2000, and it is one of India’s Top 10 fund houses in terms of Asset Under Management. It is formerly known as IDFC Mutual Fund AMC.

This AMC has an experienced investment team, and it is present in over 60 cities.

Bandhan Mutual Fund’s focus is on helping savers become investors and create wealth. To support this objective, the fund house’s equity and fixed-income offerings aim to deliver performance consistent with their well-defined goals.

Meet the Fund Manager – Mr. Nemish Sheth

The fund will be managed by a seasoned professional, Mr. Nemish Sheth. He completed his post-graduation in management studies with a specialization in finance from IES Management College, Mumbai.

He is currently the Vice President of Equities at Bandhan Asset Management Company Ltd. Mr. Sheth has been associated with Bandhan AMC since November 2021.

Prior to joining Bandhan, he worked with Nippon Life India Asset Management Ltd and ICICI Prudential Asset Management Company Ltd, where he gained experience as a Dealer for Equity, Derivative, and Passive Funds.

Who should invest in Bandhan NIFTY Bank Index Fund NFO?

Investors seeking high returns and willing to take higher risks can consider this fund, especially those interested in the banking sector. It is best suited for those looking to create long-term wealth and who are prepared to stay invested for more than 3 years.

It’s always advisable to consult a financial advisor to get personalized mutual fund recommendations based on your risk appetite.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.