India’s healthcare sector, a dynamic and rapidly expanding powerhouse, is poised to refine the future of medical care and investment. With the Indian hospital market valued at Rs. 8,216.14 crore in 2023 and expected to grow at a robust CAGR of 8% to reach Rs. 16,089.87 crore by 2032, the sector is thriving like never before.

This growth is bolstered by a substantial budget increase in the Interim Union Budget 2024-25, which allocated Rs. 90,659 crore to the Ministry of Health and Family Welfare, up 1.69% from the previous year.

The Bandhan BSE Healthcare Index Fund offers a unique opportunity to invest in this booming sector, tapping into a market that’s not only growing rapidly but is also transforming the landscape of healthcare globally.

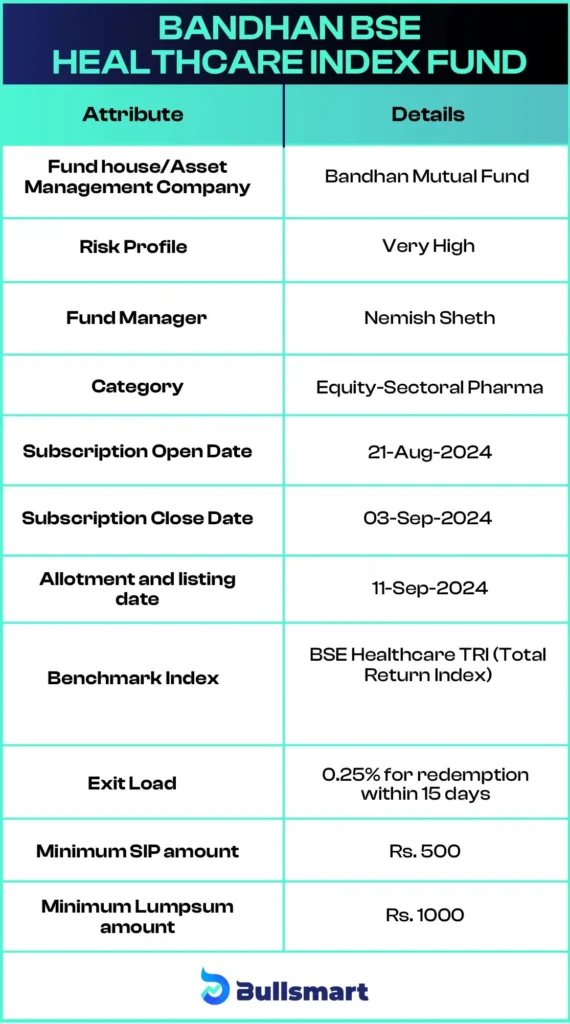

Details of the BSE Healthcare Index Fund

The Bandhan BSE Healthcare Index Fund is an open-ended scheme is designed to let you ride the wave of the industry’s explosive growth. With the New Fund Offer (NFO) open from August 21 to September 3, 2024, the fund tracks the BSE Healthcare Index, giving you access to a diversified portfolio of top healthcare companies–from pharmaceutical giants to cutting-edge biotech firms.

Investment Objective

If you’re looking for your next strategic investment, this could be the opportunity you’ve been waiting for.

The fund aims to achieve returns that closely mirror the performance of the BSE Healthcare Index by investing in equity and equity-related securities of the companies included in this index.

The goal? To match the index’s performance, although some tracking errors may occur.

Let’s glare a bit more at the details:

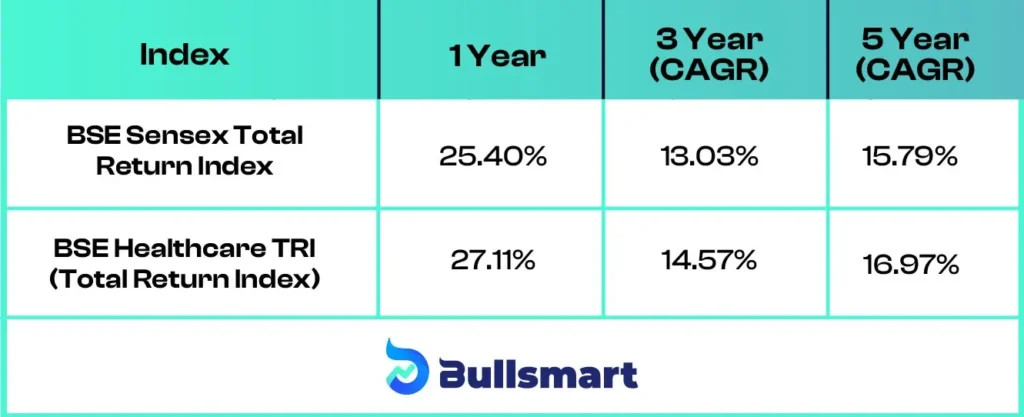

Understanding Risks and Returns

Note: The table above represents the total returns calculated for the BSE Sensex Total Return Index & BSE Healthcare TRI over the course of the last one, three and five year CAGRs.

Also to be noted: The data is updated as of 22.08.24

Top holdings of the Benchmark index

Note: The data as mentioned in the table is updated as of 22.08.24

What is BSE Healthcare TRI?

The BSE Healthcare TRI is like a report card for companies in the healthcare industry listed on the Bombay Stock Exchange (BSE). It tracks how well these companies are doing, including not just the changes in their stock prices but also any dividends they pay out. So, it’s a fuller picture of how much investors are making from both stock price gains and dividends.

Covering a range of businesses, from pharmaceutical firms to hospitals and biotech companies, the BSE Healthcare TRI offers a complete picture of how the healthcare sector is performing. Funds like the Bandhan BSE Healthcare Index Fund use this index to gauge their performance, aiming to replicate its returns.

About Bandhan Mutual Fund AMC

Founded in 2015, Bandhan Mutual Fund AMC quickly established itself in India’s asset management industry, leveraging the strong reputation of its parent company, Bandhan Financial services.

By focusing on financial inclusion, transparency, and investor education, the AMC offered diverse, customer-centric products, making it a trusted name in the market.

Meet the Fund Manager: Nemish Sheth

Nemish Sheth, who joined Bandhan Mutual Fund on August 21, 2024, brings wealth of experience and expertise to his role. With a solid educational foundation, holding a B.Com and a PGDM in Finance, Mr. Sheth is well-equipped to navigate the complexities of asset management.

Before joining Bandhan Mutual Fund (formerlt IDFC Mutual Fund), he honed his skills at Nippon Life India Asset Management Ltd. and ICICI Prudential Asset Management Company Ltd., two of the industry’s leading firms. His extensive background in these esteemed organizations has provided him with a deep understanding of the financial markets and investment strategies. Mr. Sheth’s diverse experience and academic credentials make him a valuable asset to the team, poised to contribute significantly to the fund’s success.

Suggested read: Bandhan Small Cap Fund: 71.33% Returns in 1 Year

Who should Invest in Bandhan BSE Healthcare Index Fund?

The Bandhan BSE Healthcare Index Fund is a great pick for anyone eager to dive into the dynamic world of healthcare investing. If you’re excited about the potential of pharmaceuticals, biotechnology, and medical devices, this fund gives you direct exposure to these high-growth areas.

It’s perfect for those who are ready to invest for the long haul, with the anticipation that the healthcare sector will continue to thrive and innovate over time.

If you’re looking to shake up your portfolio with a sector-specific investment, this fund offers a smart way to do just that. It’s also suited for those who don’t mind a bit of sector specific volatility and are confident in the long-term growth prospects driven by technological advancements and rising healthcare needs.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.