In the vast ocean of investments, the wave that is making a splash recently is small cap mutual funds. On average, these funds have generated over 40.44% returns in 2023 and the momentum did not end there.

In April 2024 small cap funds received an inflow of Rs. 2,208.70 crores. The trend continued in May 2024 with an impressive inflow of Rs. 2,724.67 crores, by capturing investors’ interest and delivering astonishing returns.

In June 2024, the inflow remained strong and received Rs. 2,263.47crores. The constant inflow highlights the steady demand for small cap funds among investors. Despite being highly risky funds, they show no signs of slowing down in future.

One such exceptional fund that we are going to delve into is the Axis Small Cap Fund by Axis Mutual funds.

Understanding Axis Small Cap fund fundamentals

Small cap companies are the future titans of the industry. Axis small cap fund invests in such future titans and grabs the opportunity of higher growth potential.

This fund is an open-ended equity Small Cap Mutual Fund launched on Nov 29, 2013, by Axis Mutual Funds where it holds an AUM of ₹22,262 Cr as on June 30, 2024.

It has an expense ratio of 1.62% which is less than the category average of 1.84% making it more affordable to investors.

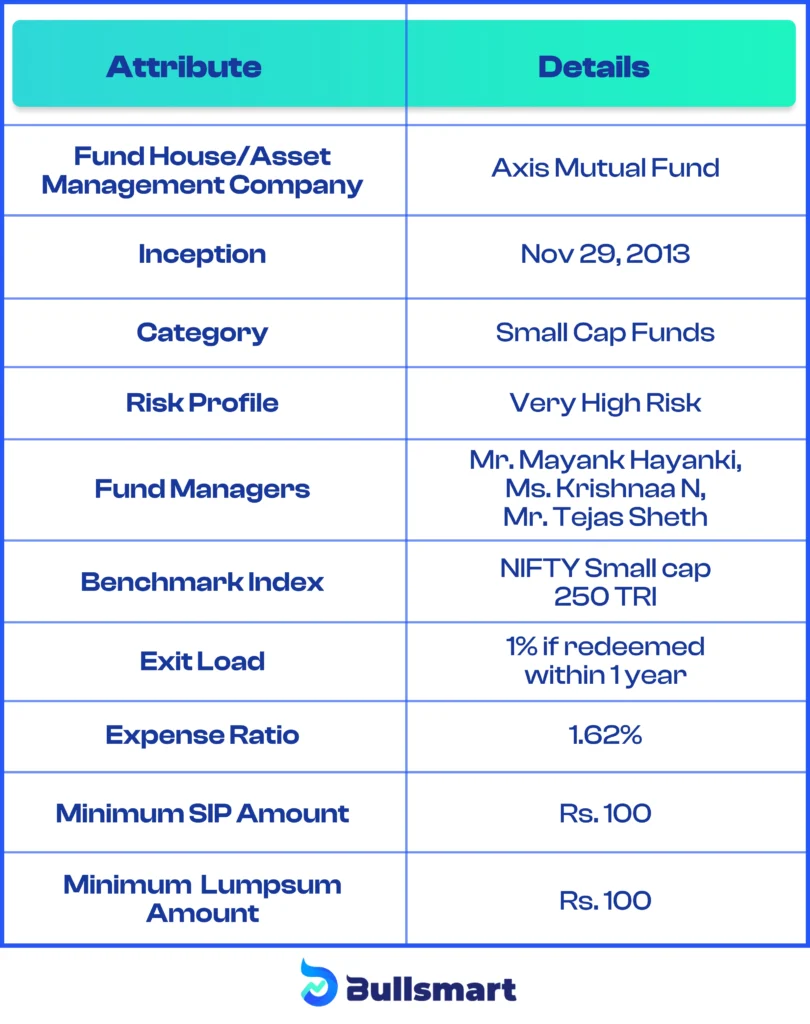

Alright! Let us have a quick glance at the details of the Axis Small Cap Fund:

Why invest in Axis Small Cap fund?

The Axis small cap fund stands out as a top performer and is one of the most preferred funds among Small Cap Mutual Funds in India. Over the past 5 and 10 years, it has generated exceptional returns of 28.83% and 20.89%, respectively.

The factor that is more appealing is its “ALPHA” advantage, which shows that the fund generated higher returns than the risks involved in it.

Portfolio construction

The Axis small cap fund strategically invests in equity & equity related instruments. 94.56% of its corpus is allocated to equities where 73.69% is allocated to small cap companies. The fund holds 120 stocks in its portfolio, higher than the category average of 82.71.

Meet the brains behind the fund

Mr. Mayank Hayanki, Ms. Krishnaa N, and Mr. Tejas Sheth are the experts that are strategically managing the fund.

Mr. Tejas Sheth has over 19 years of experience in equity research and fund management, while Mr. Mayank Hayanki has over 15 years of experience as a research equity analyst. Ms. Krishnaa N is a recent addition to the mutual fund team and has over 3 years of experience.

Risk and returns

It is a high-risk high return fund. Let’s have a look at the returns generated by the Axis Small Cap fund over the years against its benchmark index.

Who can invest in Axis small cap fund?

Investors who seek long term capital appreciation and are willing to take higher risks can choose Axis Small Cap fund. It is suitable for investors looking to invest for at least 3-5 years. Always assess your risk appetite before investing.