Did you know the Nifty500 Value 50 Index has delivered a massive 86.6% CAGR return over the past year? This exceptional performance showcases the potential of value investing, a strategy that focuses on picking stocks that are undervalued compared to their fundamentals.

With the growing interest in index funds and value investing, the Axis Nifty500 Value 50 Index Fund is a great option for investors who want to take advantage of this strategy.

Value investing aims to buy stocks at a lower price and hold them for long-term growth as their value rises over time.

Axis Nifty500 Value 50 Index Fund NFO aims to track the Nifty500 Value 50 TRI, investing in a basket of value stocks from the Nifty 500 Index. It’s designed to help investors capture the returns of undervalued companies, making it a solid choice for long-term wealth creation.

Let’s explore whether this new fund offer (NFO) aligns with your investment goals.

Axis Nifty500 Value 50 Fund NFO Overview

The Axis Nifty500 Value 50 Index Fund NFO is an open-ended index fund that seeks to replicate the performance of the Nifty500 Value 50 TRI (Total Return Index). The fund primarily invests in stocks from the Nifty500 Value 50 index, which includes companies that have strong fundamentals but are available at a lower price relative to their intrinsic value.

Investment Focus of Axis Nifty500 Value 50 Index Fund

The investment objective of the Axis Nifty500 Value 50 Index Fund NFO is to provide returns, before expenses, that correspond to the performance of the Nifty500 Value 50 TRI, subject to tracking errors. While the fund aims to replicate the index, there is no guarantee of achieving the investment objective. The fund offers an opportunity to invest in a basket of value stocks across various sectors of the economy.

Here are the key details of Axis Nifty500 Value 50 Index Fund:

Portfolio Composition of Axis Value Fund

The Axis Nifty500 Value 50 Index Fund NFO invests in equity and equity-related instruments from the Nifty500 Value 50 Index, which includes companies that are considered undervalued compared to their peers.

This value-based approach provides exposure to firms with strong financial performance but lower stock prices relative to their fundamentals, allowing for potential long-term growth.

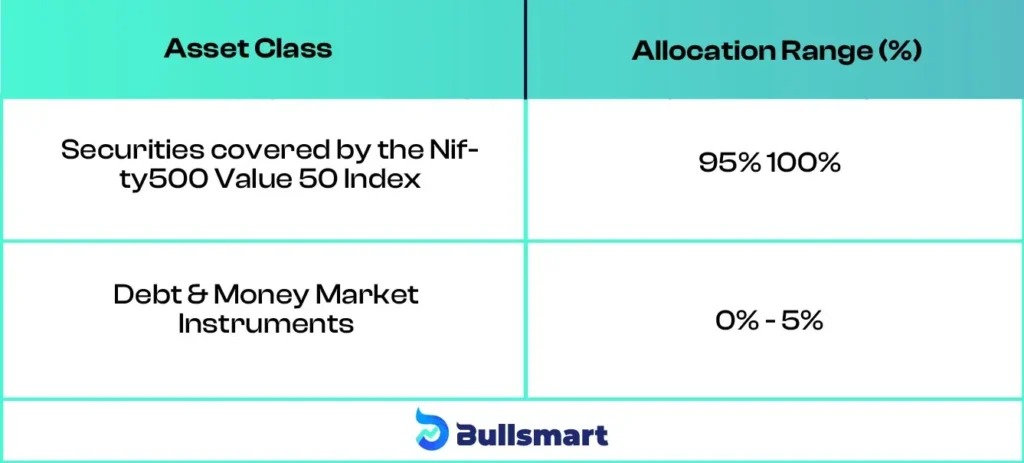

The fund’s asset allocation is as follows:

Risk and Return Analysis

The Axis Nifty500 Value 50 Index Fund carries a very high-risk profile due to its equity exposure and its focus on value stocks. Investors should be aware that this approach may result in market volatility and sector-specific risks. However, value stocks have historically outperformed growth stocks over longer periods, providing potential for capital appreciation.

The benchmark, Nifty500 Value 50 TRI, has delivered returns of 71.00%, 37.35%, and 37.88% in the past 1 year, 3 years, and 5 years respectively.

Since it is the fund’s benchmark, the goal of the fund is to match or exceed the performance of the benchmark, subject to tracking errors.

Axis Asset Management Company Overview

Axis Mutual Fund is the investment branch of Axis Bank, one of India’s largest private banks. Founded in 2009, Axis Asset Management Company Ltd. (Axis AMC) is a partnership between Axis Bank, which holds a 74.99% share, and Schroder Singapore Holdings Private Limited (SSHPL), which owns 24%.

Axis Bank is the third-largest private sector bank in India and caters to various customer segments, including large and mid-sized companies, small and medium enterprises (SMEs), agriculture, and retail.

Schroder Singapore Holdings, established in 1804 and based in London, manages £731.6 billion globally across different investment categories, such as equities, fixed income, multi-asset, and alternatives.

As of June 30, 2024, Axis Mutual Fund manages assets totaling ₹293,150.56 crore, with over 1.26 crore active investor accounts and operations in more than 100 cities.

Profile of Axis Value Fund Managers

The fund is managed by experienced fund managers:

Mr. Karthik Kumar

Mr. Karthik Kumar is 41 years old and holds an M.B.A. from Purdue University, a C.F.A. designation, and a B.E. in Mechanical Engineering. With 14 years of experience, he currently manages several schemes at Axis Mutual Fund, including the Axis Arbitrage Fund and Axis Quant Fund.

Mr. Hitesh Das

Mr. Hitesh Das is 39 years old and has PGDM, M.Tech, and B.Tech. He has 13 years of experience and has worked as a Fund Manager at Axis Mutual Fund since January 2023, overseeing schemes like the Axis Multicap Fund and Axis Focused Fund.

Who Should Invest in this Fund?

The Axis Nifty500 Value 50 Index Fund is suitable for investors who:

- Are looking for long-term capital appreciation.

- Want to gain exposure to value stocks in the Indian market.

- Have a high-risk tolerance and can handle short-term volatility in pursuit of long-term gains.

- Are looking to diversify their portfolio by adding a sector-focused index fund with a value investing approach.

This fund is ideal for investors who believe in the long-term potential of undervalued companies and are comfortable with the associated risks of equity investments.

As always, consulting with a financial advisor is recommended to ensure that this fund aligns with your financial goals and risk appetite.

Suggested Read – Axis Consumption Fund NFO Review

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.