“Foreign investors returning to India”Is this true?

Recent data suggests a strong yes. After months of steady outflows, foreign institutional investors (FIIs) are once again showing renewed confidence in Indian markets. In the week ending March 21, foreign investors bought $515 million worth of Indian stocks—the first weekly equity inflow of 2025.

Even more notably, Indian bonds witnessed an inflow of $3 billion in March, the highest monthly figure since 2017. This sudden reversal is sparking discussions across financial circles: is this the beginning of a sustained comeback?

FIIs have long played a pivotal role in India’s capital markets. Their inflows not only boost market liquidity but also signal international trust in India’s economic growth story. A shift in FII sentiment can cause ripple effects across asset classes, influencing stock indices, currency stability, and even monetary policy expectations.

But this begs the bigger question—are foreign investors truly making a comeback to India, and what does it mean for the future of Indian markets? With improving domestic fundamentals, favorable interest rate expectations, and India emerging as a relatively safer bet amid global uncertainties, it’s worth analyzing what’s driving this inflow and whether it marks a lasting trend.

Recent Trends among Foreign Investors

The tide appears to be turning. In the week ending March 21, foreign institutional investors (FIIs) made a net purchase of $515 million in Indian equities, marking the first positive weekly inflow of 2025.

This signals a possible shift in global investor sentiment, especially after months of relentless selling pressure.

On the debt side, the story is even more remarkable. FIIs pumped $3 billion into Indian rupee bonds in March alone, making it the largest monthly inflow since 2017. These strong inflows have revitalized the broader market, helping the NSE Nifty 50 Index and the Indian rupee recover their year-to-date losses. The bond rally also pushed the 10-year sovereign yield to a three-year low, reinforcing investor optimism.

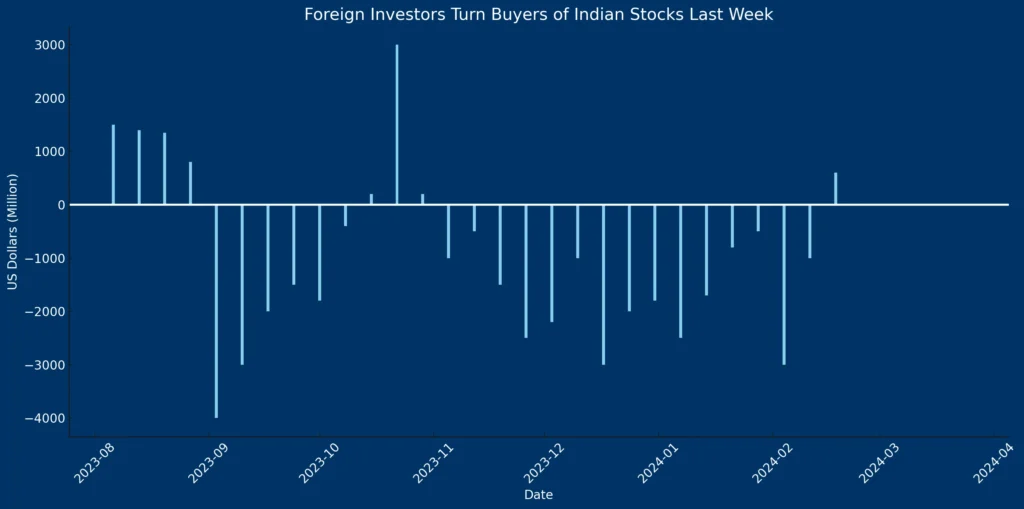

This renewed enthusiasm comes after a difficult stretch for Indian markets. Since January, FIIs had withdrawn over $15 billion from Indian equities, spurred by global uncertainties, high US interest rates, and concerns over trade policies.

The sell-off erased over a trillion dollars in market value and rattled domestic sentiment.

Looking at the bigger picture, foreign investment trends in India have seen cycles of boom and bust over the past decade. Post-2014, India emerged as a favored destination among emerging markets due to strong GDP growth, reforms, and political stability.

However, episodes like the COVID-19 pandemic, global tightening cycles, and geopolitical tensions have triggered periodic outflows.

Yet, India has consistently managed to bounce back—supported by its large domestic consumption base, resilient financial system, and improving macroeconomic fundamentals. The latest FII data suggests we may be entering another phase of positive sentiment, with foreign investors returning to India just as global markets are losing steam.

Factors Driving Foreign Inflows

The recent surge in FII activity isn’t happening in isolation—it’s backed by a mix of strong domestic fundamentals and evolving global dynamics. Several key factors are contributing to foreign investors returning to India with renewed interest.

Improved Economic Indicators

India’s macroeconomic story continues to stand out. The country recently reported robust GDP growth, underpinned by a sharp uptick in manufacturing output, infrastructure spending, and a resilient services sector. Consumer demand remains strong, and inflation has remained largely under control—factors that make India an attractive long-term investment destination.

Central Bank Liquidity Measures

The Reserve Bank of India (RBI) has played a critical role in stabilizing markets. Targeted liquidity infusions, accommodative policy stances, and effective inflation management have boosted investor confidence. Moreover, speculation about a potential interest rate cut next month has further improved market sentiment.

Global Equity Landscape Shifts

As economic headwinds buffet major economies, India is emerging as a stable alternative. China’s ongoing property crisis and regulatory clampdowns have dampened investor appetite there, while the US is grappling with economic stagnation and policy uncertainty. This has made India a relative safe haven in the emerging market basket.

Trade and Policy Tailwinds

US trade policies are pushing global investors to diversify away from American and Chinese assets. In this context, India—armed with favorable bilateral agreements and a balanced trade strategy—has gained importance as a reliable investment hub.

Attractive Valuations

Indian equities are trading at more reasonable valuations compared to global peers. After the recent correction, many sectors—especially banking, manufacturing, and capital goods—offer solid growth potential at attractive entry points.

Pro-Business Government Initiatives

Government reforms around ease of doing business, digital infrastructure, and tax incentives have strengthened India’s investment appeal. Policies like PLI (Production Linked Incentive) schemes and Make in India are signaling long-term structural strength.

Together, these factors are creating a compelling case for foreign investors to return to India, positioning the country as a prime beneficiary of shifting global capital flows.

Sectoral Impact of FII Inflows

The resurgence of foreign investors returning to India is already leaving its mark across key sectors of the economy. As FIIs selectively deploy capital, certain industries are emerging as clear beneficiaries, both in the equity and bond markets.

- Financials & Banking Leading the charge are private sector banks and financial institutions. With balance sheets strengthening, credit growth picking up, and asset quality improving, FIIs are once again showing confidence in India’s banking sector. The renewed foreign interest is driving up valuations in top-tier private banks, NBFCs, and fintech players, many of which were beaten down during the previous selloff.

- Technology & IT Services India’s IT sector continues to be a magnet for global investors. Strong earnings, continued demand for digital transformation services worldwide, and a weakening rupee have made export-driven IT companies even more attractive. FIIs see Indian tech firms as resilient cash generators with global exposure and long-term relevance, making them a key part of their India allocations.

- Infrastructure & Energy The government’s aggressive infrastructure spending—through public capex, roads, railways, and green energy initiatives—is attracting long-term institutional money. Foreign investors are taking note of opportunities in engineering, construction, renewable energy, and power utilities. Companies aligned with the government’s infrastructure goals are witnessing improved investor traction and higher trading volumes.

- Bond Market Influence FIIs have invested over $3 billion into Indian bonds this March alone. This influx is driving down yields, lowering borrowing costs for corporates and infrastructure developers. Sectors like real estate, utilities, and heavy industry—where debt financing is critical—stand to gain from cheaper capital availability. It also strengthens the overall credit ecosystem, improving capital access for mid-sized businesses.

In essence, the sectoral impact of foreign institutional investors returning to India goes beyond just market sentiment—it’s actively reshaping growth trajectories across industries. As global capital flows adjust to new realities, India’s sectoral leaders are positioning themselves to ride the wave of international confidence.

Risks and Challenges

While the recent trend of foreign investors returning to India is encouraging, it’s important to recognize that FII flows are highly sensitive and reactive to global and domestic developments. Several risks loom on the horizon that could temper the optimism.

- Volatility of Foreign Capital FIIs are known for their short-term, tactical approach to emerging markets. Although current inflows are promising, they can be reversed just as swiftly. A sudden shift in global risk appetite, economic shocks, or liquidity concerns can trigger rapid outflows, leading to heightened market volatility.

- US Interest Rate Policies One of the biggest external risks is the stance of the US Federal Reserve. If the Fed resumes rate hikes or delays expected cuts, capital could flow back into US treasuries, making Indian assets less attractive. Historically, FII outflows have been closely linked to tightening monetary policy in developed markets.

- Geopolitical Instability Trade tensions between major economies, rising instability in the Middle East, or unpredictable policy moves by China can all trigger global market turbulence. Such events may drive investors to safer havens, pulling funds out of emerging markets like India.

- Domestic Concerns On the home front, several challenges remain. Slower-than-expected earnings growth, especially in sectors like FMCG and telecom, could dampen sentiment. Additionally, with general elections on the horizon, political uncertainty could lead to cautious behavior among global investors awaiting clarity on policy continuity.

In summary, while the momentum of foreign investors returning to India is clearly building, sustaining this trend will depend on how both global and domestic risks are navigated. Investors and policymakers alike must stay vigilant to ensure that short-term gains translate into long-term confidence.

How Domestic Investors Are Responding

While the spotlight is on foreign investors returning to India, the rise of domestic investors—particularly retail participants and mutual funds—cannot be ignored. Over the past few years, Indian retail investors have evolved into a stabilizing force in the market, often absorbing volatility created by FII movements.

A key trend driving this shift is the surge in SIPs (Systematic Investment Plans). With over ₹18,000 crore flowing into mutual funds monthly via SIPs, retail money is becoming a consistent source of equity inflows. This disciplined, long-term approach is helping cushion the markets during times of foreign capital outflows.

Domestic Institutional Investors (DIIs)—including mutual funds, insurance companies, and pension funds—have stepped up as counterbalances to FII movements. In periods when FIIs were heavy sellers, DIIs played a crucial role in supporting equity prices, displaying increasing maturity and conviction in India’s long-term growth story.

| Month | FII Gross Purchase (₹ Cr) | FII Net Purchase/Sale (₹ Cr) | DII Gross Purchase (₹ Cr) | DII Net Purchase/Sale (₹ Cr) |

| February 2025 | 2,59,256.89 | -58,988.08 | 2,77,187.00 | 64,853.19 |

| January 2025 | 2,42,699.59 | -87,374.66 | 3,39,689.44 | 86,591.80 |

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

FAQs

Will FII return to India?

Yes, foreign institutional investors (FIIs) are already making a comeback to India. After a prolonged phase of outflows, March 2025 saw a net equity inflow of $515 million and a record $3 billion into Indian bonds—the highest monthly debt inflow since 2017. This signals renewed confidence in India’s economic resilience, supported by strong fundamentals, favorable interest rate expectations, and a stable policy environment. While FIIs are known for being sensitive to global trends, current indicators suggest a positive shift in sentiment.

Is the Indian stock market recovering?

Yes, the Indian stock market is clearly on the path to recovery. After facing heavy FII outflows and global uncertainty earlier in the year, recent foreign inflows and sustained domestic participation have helped stabilize and lift major indices. Sectors like banking, IT, and infrastructure are witnessing renewed interest, and improved macroeconomic indicators are reinforcing the recovery narrative.

Why are foreign investors leaving India?

Foreign investors had been exiting India due to a combination of global and domestic challenges. These included high US interest rates, global economic slowdown fears, and geopolitical tensions. On the domestic front, uncertainties around corporate earnings, inflation, and upcoming elections contributed to cautious behavior. However, these concerns are beginning to ease, prompting a shift back toward Indian markets.

Are foreign investments in India slowing down?

No, foreign investments in India are no longer slowing down—in fact, they’re accelerating. March 2025 marked a significant turning point, with the highest bond inflows in nearly a decade and the first weekly equity inflow of the year. This uptick reflects a reversal in sentiment, driven by India’s strong economic performance, attractive valuations, and relative stability compared to other emerging markets.