In 2025, the Indian stock market is no longer just a playground for human intuition–it’s a battlefield of algorithms. From retail investors in Tier 2 cities using robo-advisors to institutions deploying machine learning models at lightning speed, AI trading in India has moved from buzzword to boardroom priority.

But this isn’t just a tech upgrade; it’s a tectonic shift. Powered by AI-based trading platforms in India, algorithms are now making faster, smarter, and emotion-free decisions. And as SEBI opens the doors for retail algorithmic trading, we’re entering an era where even first-time investors have access to strategies once reserved for hedge funds.

Yet with disruption comes a big question: are you adapting, or falling behind?

In this blog, we unpack how AI trading/ algorithmic trading is reshaping the Indian stock market, the platforms leading the charge, and what every investor needs to know to ride this wave, not get wiped out by it.

The Rise of AI in Indian Trading: A 2025 Snapshot

Market Adoption and Growth

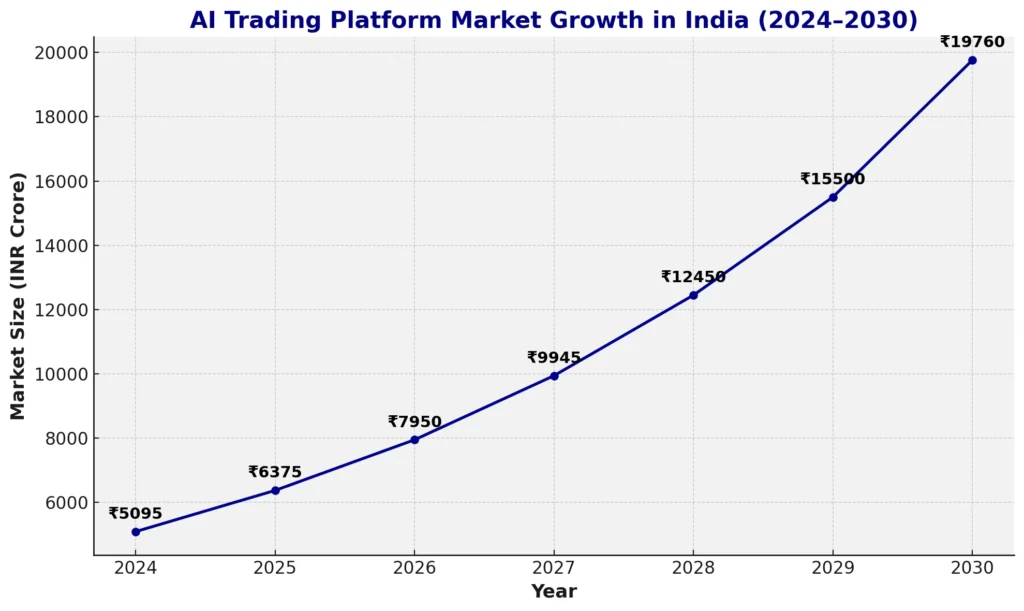

The AI trading platform market in India is projected to grow at a compound annual growth rate (CAGR) of 24.9% from 2025 to 2030, reaching USD 2.3 billion in value. The rapid digitalization of financial services, increasing trading volumes, and the popularity of discount brokers like Zerodha and Upstox are key drivers.

Platforms like “Jarvis Invest,” “Tickeron,” and “Sensibull” are increasingly integrating AI-based features to enhance user experiences, automate strategy recommendations, and support real-time risk analysis.

Regulatory Advancements

SEBI’s December 2024 proposal to allow retail participation in algorithmic trading via stock exchange-vetted APIs is a major shift. This aims to reduce operational risk and ensure transparency.

Such reforms not only foster innovation but also offer protective layers against rogue algo strategies.

Suggested Read: Invest Smarter in 2025: How AI Stocks Will Transform Your Stock Portfolio

Check this graph for a quick sneak-peak into the AI Trading growth in India:

How AI Trading is Reshaping Investment Strategies

Real-Time Data Analysis

AI systems now process millions of data points across price trends, order books, global news, and macroeconomic indicators in real-time.

This enables predictive analytics, helping traders execute more informed and timely decisions.

Sentiment Analysis

Natural Language Processing (NLP) tools like AZFinText are increasingly applied to news headlines, earnings call transcripts, and even social media chatter.

These tools assess sentiment to flag bullish or bearish momentum earlier than traditional indicators.

Risk Management and Strategy Tuning

AI not only helps in building portfolios but also actively monitors and adjusts them. It identifies anomalies (e.g., sudden volatility spikes), offers hedging suggestions, and fine-tunes asset allocation based on evolving risk models.

For instance, Quant-based mutual funds and smallcases are already applying these principles.

Top AI Trading Platforms in India (2025)

1. Jarvis Invest

An AI-driven stock advisory platform, Jarvis personalizes investment strategies based on user risk profiles. It’s popular for its “stress testing” features and has become a go-to tool among retail investors.

2. Tickeron

With an advanced suite of AI trading bots, Tickeron offers options for swing traders, intraday players, and even crypto enthusiasts. It also helps investors test strategies before live deployment.

3. TradeVision

Offering tools like 0DTE options scanners and volatility trackers, TradeVision leverages AI for high-frequency setups. The platform gained traction after outperforming traditional models during 2023-2024’s volatile cycles.

4. InvestingPro AI Bots

InvestingPro’s “Tech Titans” strategy gained popularity after returning 2,086.5% since inception. It combines LLM-based analysis with historical signals to recommend undervalued tech stocks.

5. Sensibull (with AI-enhancements)

While originally an options trading platform, Sensibull now offers AI-generated suggestions for spreads and hedges tailored to market conditions.

Fintech’s Role in India’s AI Trading Revolution

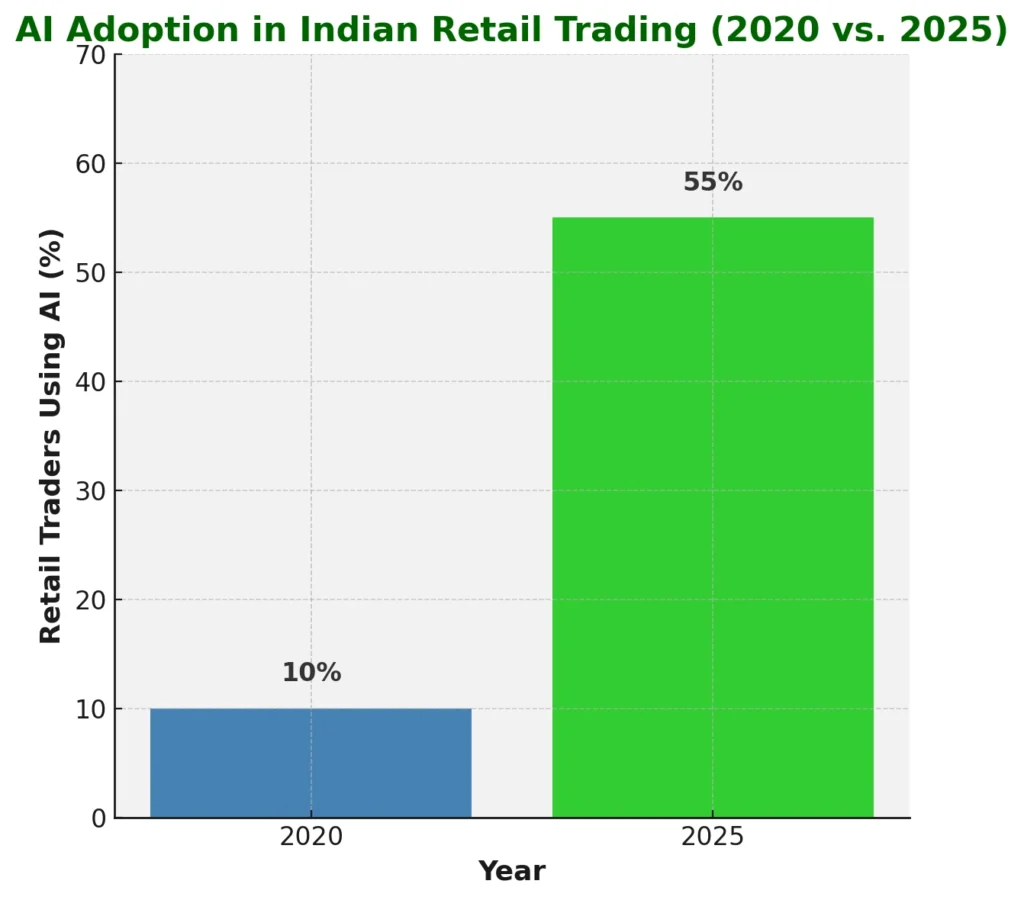

Fintech companies are acting as the bridge between high-tech AI solutions and everyday investors. By embedding AI into mobile trading apps, robo-advisors, and analytics dashboards, fintech platforms are making advanced tools accessible to retail investors.

According to industry reports as of May 6, 2025, over 60% of new retail investors in India rely on fintech apps that use AI for personalized advice and portfolio optimization. These platforms offer features like:

- Strategy backtesting without coding

- Voice-command trading and chatbot support

- Real-time sentiment analysis from news and social media

- Custom risk alerts based on behavioral patterns

Moreover, with India’s UPI ecosystem expanding into stock broking and investment apps, fintech startups are integrating payment, advisory, and trading layers into a seamless AI-powered experience. In short, fintech isn’t just supporting AI trading—it’s accelerating it.

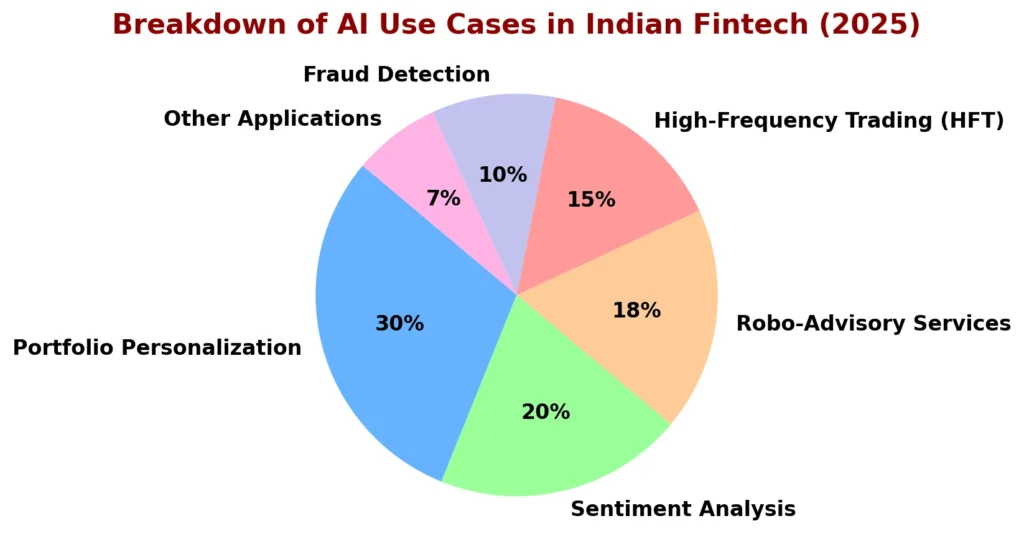

Common AI Use Cases in Indian Markets Explained

- High-Frequency Trading (HFT) Think of this as lightning-fast trading. Big brokerage firms and financial institutions use AI to scan the markets and make trades in microseconds—yes, faster than a blink! It’s all about spotting price differences (called arbitrage) and acting on them instantly before anyone else can.

- Robo-Advisory Ever wondered how apps like Groww, INDmoney, or Paytm Money give you investment suggestions? That’s AI at work. These platforms now offer robo-advisors—automated tools powered by AI that help first-time investors choose funds or stocks based on their goals, risk level, and market trends. It’s like having a smart financial buddy in your pocket!

- AI in Forex Trading AI is also making waves in the foreign exchange (forex) and commodities markets. Many Indian investors—especially NRIs who deal with global currencies—use AI bots to track exchange rates and trading signals round the clock. These bots optimize trading strategies by adjusting to different time zones and market conditions across the world.

- Quantum AI Trading Apps These are the newest kids on the block, especially popular with tech enthusiasts. Apps like these claim to blend quantum computing principles with AI to make trading even more precise and faster. While it’s still an emerging tech, the idea is to reduce delays and increase accuracy—perfect for people who want an edge in the market.

Opportunities for Indian Investors in 2025: What’s New and What to Watch Out For

- Portfolio Personalization Gone are the days of one-size-fits-all portfolios. Thanks to AI, investors can now enjoy hyper-personalized strategies. Whether you’re someone who thrives on high-risk trades or prefers to play it safe, AI-based platforms can build tailored investment baskets that match your goals, risk appetite, and time horizon.

- Democratization of Trading Tools What used to be exclusive to large institutions is now available to everyday investors. Tools like strategy backtesting, real-time market predictions, and decision-making models that stay cool under pressure (unlike human emotions) are now just a few clicks away.

- Cross-Asset Capabilities AI isn’t just limited to stocks anymore. Indian investors can now tap into smart strategies across a wide range of assets—equities, ETFs, commodities, forex, and even global markets. The lines between domestic and international investing are blurring, and AI is making it smoother than ever.

Key Challenges and Considerations to Invest with Algorithmic Trading

- Overreliance on AI AI can be incredibly powerful, but it’s not foolproof. It can sometimes create a false sense of certainty, which may lead to overconfidence or blind trust. If the data behind the model is flawed or a black swan event hits, strategies can unravel fast. Human judgment is still a must-have safety net.

- Data Privacy and Cybersecurity AI thrives on data—and lots of it. But if platforms don’t secure that data properly, it opens the door to leaks, misuse, and serious compliance issues, especially as India sharpens its data protection regulations. Always check how your data is being stored and used.

- Lack of Algorithmic Transparency Many AI platforms operate like black boxes—you don’t always know how they make decisions. That’s why it’s important to ask questions: What kind of data is the AI trained on? Are there safety measures in place? How does it respond when markets go haywire? Transparency matters, especially when your money’s involved.

What’s Next: The Future of AI Trading in India

Integration with Quantum Computing

As quantum AI trading apps emerge, expect models that can simultaneously evaluate thousands of strategies—ideal for options pricing, arbitrage, and hedging.

Blockchain + AI = Smart Contracts

Future AI trading apps may run on decentralized platforms using smart contracts for real-time settlements, automated compliance checks, and transparency.

Increased NRI Participation

With the rise of GIFT City and IFSC exchanges, NRIs are actively exploring AI tools to access Indian markets remotely and efficiently.

Voice-Based & Chatbot Trading

Investors may soon place trades using voice commands or interact with AI chatbots that handle research, alerts, and compliance.

Conclusion: Welcome to the New Era of Smart Investing

AI trading isn’t just transforming the Indian stock market—it’s completely redefining how we think about investing.

We’re no longer living in a world where financial decisions are solely based on gut instinct, news clippings, or advice from a friend. In 2025, investors—whether seasoned pros or absolute beginners—have access to tools that can analyze market sentiment in seconds, decode complex data streams in real time, and build personalized strategies that evolve with every market tick.

But here’s the catch: the same technology that empowers can also mislead. Blindly trusting AI, ignoring transparency, or underestimating cybersecurity threats could cost more than just returns. That’s why, even in an AI-driven world, your best asset remains your own judgment.

This decade is shaping up to be a golden period for Indian investors—democratized access, real-time intelligence, cross-asset opportunities, and global reach. AI isn’t here to replace you; it’s here to upgrade you. But only if you stay informed, ask the right questions, and stay curious.

So, what’s your next move? Will you leverage the rise of AI to take your portfolio to the next level—or sit back and watch others get ahead?

The future of investing in India isn’t just digital. It’s intelligent. And it’s already here.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

What is the future of AI in 2025?

In 2025, Artificial Intelligence (AI) is deeply woven into India’s economic and technological fabric. The Indian AI market is expected to reach approximately ₹1.42 lakh crore by 2027, growing at a compound annual growth rate (CAGR) of 25–35%.

This surge is fueled by rising adoption across sectors like healthcare, finance, agriculture, and manufacturing. Government initiatives such as the ₹10,400 crore IndiaAI Mission are accelerating AI infrastructure and nurturing startups.

Backed by a strong IT ecosystem and a vast talent pool of skilled professionals, India is on track to emerge as a global AI powerhouse.

Which AI stock will boom in 2025?

While it’s not possible to predict a single stock that will “boom,” there are clear signs of momentum in companies that are:\n

- Building AI-based enterprise software or automation platforms

- Powering cloud services with machine learning features

- Offering AI infrastructure support such as chips, APIs, or data analytics tools

- Partnering with global tech players for AI research or product development

Instead of hunting for one “booming” stock, it’s more sustainable to focus on AI-focused sectors or index funds that track innovation-heavy companies. Many top Indian IT and digital transformation firms are investing aggressively in AI and may benefit over the long term.

Is AI trading the future?

Absolutely. AI is reshaping how trades are executed—fast, data-backed, and emotion-free. In India, the rise of retail algorithmic trading is gaining momentum. With SEBI laying down a framework for retail APIs and automated strategy audits, AI trading tools are becoming safer and more accessible.

Whether you’re a full-time trader or a weekend investor, AI platforms now assist in backtesting strategies, spotting trends faster, and even managing risk dynamically. It’s safe to say that in a few years, trading without AI will feel outdated.

How much is the AI market worth in 2025?

India’s AI market is valued at around ₹84,600 crore as of May 2025 and is projected to soar past ₹3.75 lakh crore by 2034. That’s a staggering growth curve, driven by rising automation needs across finance, healthcare, telecom, and governance.

Now add this to the fact that AI has become a core pillar of India’s digital economy vision and it’s easy to see why investors, job seekers, and policymakers are all riding the AI wave with full force.