The Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund NFO is an open-ended Target Maturity Index Fund tracking the CRISIL-IBX AAA NBFC-HFC Index – Sep 2026. It has a low credit risk and a moderate interest rate risk.

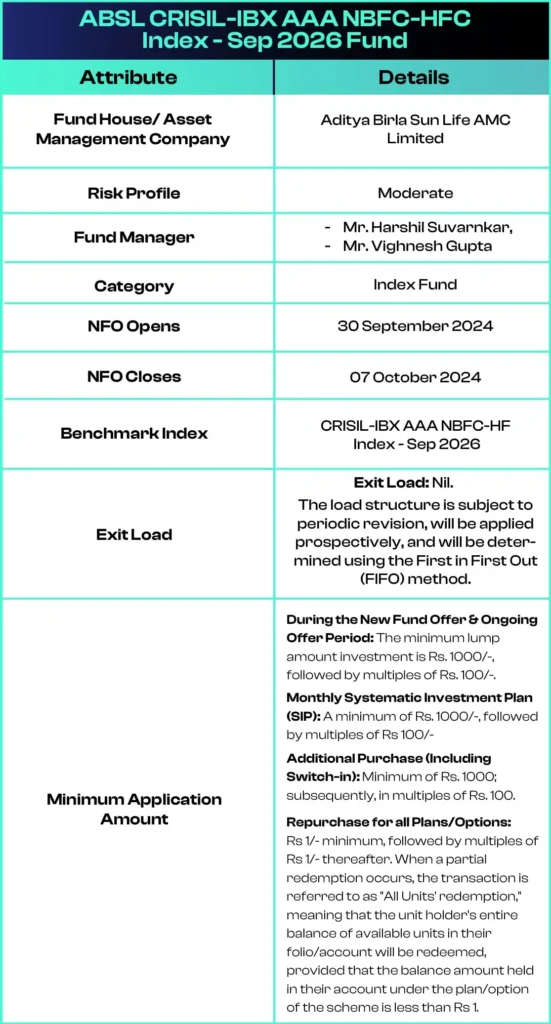

Key Facts about ABSL CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund

Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund NFO’s sectoral target maturity fund, which seizes short-term high-yield opportunities in AAA-rated bonds of NBFCs and HFCs, is one of its notable features.

Investment Objectives of the NFO

Subject to tracking mistakes, the fund’s investment goal is to produce returns that equal the total returns of the securities represented by the CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 before expenses. However, it is crucial for investors to know that the Scheme does not guarantee/indicate any returns. Kindly get guidance from a qualified investment advisor prior to making any decisions.

Here are the details of Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund:

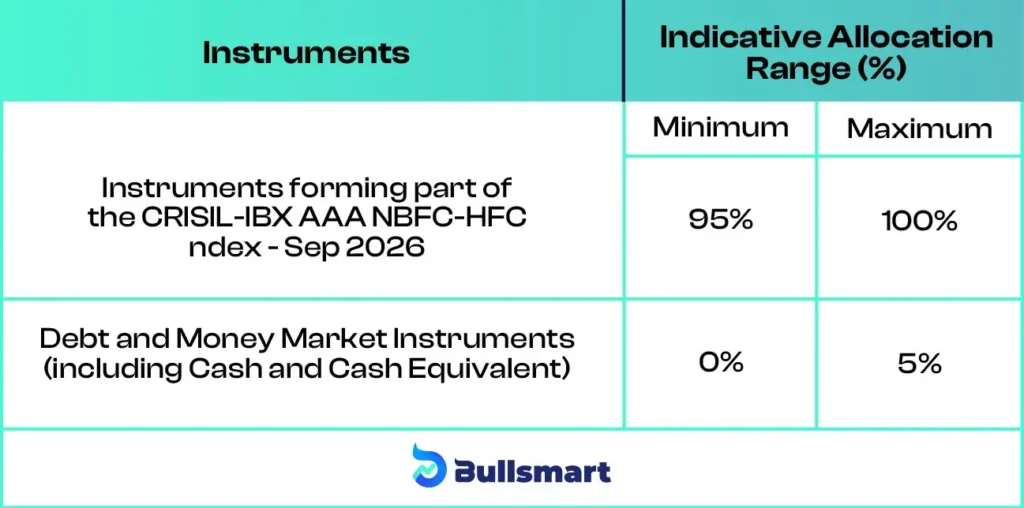

Portfolio Analysis

Under normal circumstances, the anticipated asset allocation of Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund would be:

Risks and Returns Explained

Investors are informed that their capital will be at a moderate risk because both the funds scheme riskometer and the benchmark riskometer are moderate. More information regarding Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund’s advantages and risks is provided below:

Liquidity and Yields on Corporate Bonds Are Balanced

The yields on short-term NBFC-HFC corporate bonds are appropriate in light of the associated risks. These bonds’ robust liquidity makes things favorable for investors with short time horizons.

Potential for Capital Gains

Global rate cuts may lead to possible interest rate reductions in India, resulting in lower debt yields and significant capital gains for investors.

Reduced Credit Risk with AAA Securities

The financial strength of these premium, highly rated debt instruments’ parent companies, NBFCs and HFCs, limits the likelihood of lender defaults and reduces investor credit risk.

Relatively Better Risk Reward Profile with Higher Yields

AAA-rated corporate bonds issued by NBFCs and HFCs have a better risk-reward profile and greater returns than other high-quality asset classes. Their strong financial standing and possibly bright future allow their securities to yield superior risk-adjusted returns.

Roll-Down Strategy

Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund has a buy and hold approach when it comes to securities until they mature. This technique allows assets to receive regular coupons with the possibility for price gains as yields decline, helping to manage interest rate risk in an environment where interest rates are steady or dropping.

Experts behind the Fund

Mr. Harshil Suvarnkar

With 14 years of total experience, Mr. Harshil Suvarnkar is well-versed in the financial services sector. He worked for ten years as Head of Markets, Treasury at Indiabulls Housing Finance Limited, where he oversaw treasury investments, asset liability management (ALM), and capital market borrowing. This was prior to his joining ABSLAMC.

A few other schemes which he handles with other fund managers include, but are not limited to: Aditya Birla Sun Life Bal Bhavishya Yojna, Aditya Birla Sun Life Banking & PSU Debt Fund, Birla Sun Life Equity Hybrid ’95 Fund, Aditya Birla Sun Life Equity Savings Fund, Aditya Birla Sun Life Floating Rate Fund.

Mr. Vighnesh Gupta

Mr. Vignesh Gupta has more than 6 years of expertise in financial markets. Since August 2020, he has worked as a Research Analyst with ABSL AMC. He worked for several Aditya Birla Group companies before joining ABSLAMC. Additionally, he held the position of Executive – Assurance at Ernst & Young.

A few other schemes which he handles with other fund managers include, but are not limited to: Aditya Birla Sun Life US Treasury 3-10 year Bond ETFs Fund of Funds, Aditya Birla Sun Life US Treasury 1–3 year Bond ETFs Fund of Funds, Aditya Birla Sun Life CRISIL Broad Based Gilt ETF.

About the ABSL Asset Management Company

Aditya Birla Sun Life AMC Limited (ABSLAMC) was incorporated in the year 1994. Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc. are the promoters and major shareholders of the Company. ABSL AMC is the primary investment manager for Aditya Birla Sun Life Mutual Fund, a registered trust under the Indian Trusts Act of 1882.

Real estate investments, alternative investment funds, and portfolio management services are just a few of the alternative options that ABSLAMC offers. With approximately 300 locations nationwide and an overall AUM of Rs. 3,676 billion for the quarter ending June 30, 2024, ABSL AMC is one of the top asset managers in India, managing the folios of approximately 9.4 million investors. Its suite of offerings includes Mutual Funds (not including domestic FoFs), offshore and real estate, portfolio management services, and alternative investment funds.

Who should invest in this NFO?

- Investors that prioritize income over the desired maturity period.

- Those looking for an open-ended Target Maturity Index Fund that will allow them to monitor the Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 Fund, but with tracking mistakes

Suggested Read – Aditya Birla Defense Index Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.