The Adani Airport IPO is already making noise, and for good reason. With eight major airports under its wing and the Navi Mumbai International Airport on the way, Adani Airport Holdings Ltd (AAHL) is gearing up for a public debut by March 2027.

In this blog, we unpack everything around this much-anticipated listing, from the expected Grey Market Premium (GMP) and market sentiment to how Adani Group’s massive $100 billion (~₹8.35 lakh crore) capex plan could shape the IPO’s trajectory.

We’ll also break down the timeline, strategic purpose, investor takeaways, and the risks that might come with it.

Whether you’re a retail investor looking for potential long-term value or simply tracking the Adani empire’s next big move, this is your go-to read on what could be one of India’s biggest IPOs of 2027, in the infrastructure space.

Let’s dive right in!

Suggested Read: Starlink India Launch Price, Internet Plans with Exciting Updates & Everything You Need to Know in 2025

Adani Airport IPO Key Details

Though there has not been any major disclosures regarding the Adani Airport IPO by the Adani Group, here’s what we’ve scooped for you:

| Category | Details |

| Proposed IPO Name | Adani Airport Holdings Ltd (AAHL) |

| Adani Airport IPO Timeline | Slated to be spun off and listed by March 2027 |

| Capex Intent | Part of Adani Group’s accelerated $100 billion capex plan over 5-6 years |

| Airports Covered | 8 airports, including Mumbai, Ahmedabad, Lucknow, Guwahati, Nagpur, Jaipur, Mangalore, Thiruvananthapuram + upcoming Navi Mumbai |

| FY25 Passenger Traffic | Approx. 94 million passengers served, with total capacity ~110 million; target to increase to 300 million by 2040 |

| Recent Financing | Secured $750 million from international banks (FAB, Barclays, SCB), with $400 million earmarked for debt refinancing |

| Pre‑IPO Equity Raise | Planning to raise approx. $1 billion from global investors/sovereign funds |

| Strategic Drivers | Infrastructure boom, Navi Mumbai commissioning, and appetite for public-private partnerships in aviation |

| Peer Comparison (Valuation) | GMR Airports valued at ~$10.4 billion; Adani Airports estimated ~$20 billion |

| Major Use of Funds | Debt refinancing, airport capacity expansion, non-aero infrastructure (airside/city‑side developments) |

| Risk Considerations | Timeline slippage (e.g., Navi Mumbai), financial leverage, regulatory/tariff approval, residual governance scrutiny post-Hindenburg |

| Key Milestones Ahead | FY26 – finalize pre-IPO raise; FY27: partial Navi Mumbai commissioning + IPO; FY28 (demerger complete) |

Data available is updated as of 12.06.25.

Why is Adani Launching an IPO for Its Airport Business?

Adani Group is getting ready to take its airport business public, and it could happen as early as March 2027.

According to reports from Financial Express and Reuters, the group plans to list Adani Airport Holdings Ltd (AAHL) on Indian stock exchanges as part of its broader strategy to unlock value by spinning off key business verticals.

So, why now?

There are two big reasons behind this timing:

- Fast-tracked investments: Gautam Adani has compressed his ambitious $100 billion capex plan from a 10-year horizon to just 5-6 years. A big chunk of this is being poured into airport infrastructure, making it the right time to spotlight the airport business.

- Funding the future: With construction in full swing at Navi Mumbai International Airport, the IPO could help raise funds for project execution, repay existing loans, and bring in global partners to fuel future growth.

Capex & Funding Strategy of Adani Group

Big Investment Push

Adani Group is planning to invest around $100 billion (about ₹8.35 lakh crore) across multiple sectors; including energy, ports, data centres, cement, and especially airports.

This fast-tracked plan, reported by Financial Express and Business Standard, is meant to take full advantage of India’s growing infrastructure needs.

Airports are a major focus. The goal is to triple the current passenger capacity, from 100 million in FY25 to 300 million by 2040, and build Adani Airports into a world-class infrastructure brand.

How Are They Funding This?

To make this happen, Adani Group is following a mix of funding routes:

| Funding Source | Amount (INR) | Purpose / Notes |

| Recently Raised Capital | ₹6,262 crore | Includes ₹3,340 crore for debt refinancing |

| Bank-led ECA Financing | Not disclosed | Involves First Abu Dhabi Bank, Barclays, and Standard Chartered |

| Planned Equity Raise (Pre-IPO) | ₹8,350 crore | Expected from sovereign wealth funds and long-term global investors |

Data available is updated as of 12.06.25.

Adani’s Airport Portfolio: Present & Future

Current Network at a Glance

Adani Airport Holdings Ltd (AAHL) currently operates eight key airports across India:

- Passenger Footfall: Over 94 million passengers annually.

- Total Capacity: Currently 110 million; set to cross 200 million post Navi Mumbai expansion.

Looking Ahead: Growth Plans

Navi Mumbai International Airport is under development and will be launched in phases:

Phase 1 Capacity: 20 million passengers/year

Full Capacity (Future): Scalable to 90 million passengers/year

Focus on Non-Aero Revenue Streams

- Retail outlets

- Food courts

- Real estate development

- Duty-free shopping

These segments are set to play a big role in boosting profitability beyond traditional passenger and cargo operations.

Adani Airport IPO GMP and Day Wise Trends

The Grey Market Premium (GMP) gives investors an early glimpse into the demand for IPO shares, even before they hit the stock exchanges.

It shows how much people are willing to pay above the issue price, acting as an unofficial indicator of market sentiment.

While the Adani Airport IPO is still a couple of years away, early buzz in the market suggests that expectations are high. Here’s why:

- Adani Group’s stronghold in infrastructure.

- Renewed investor confidence after bouncing back from the Hindenburg episode.

- Navi Mumbai International Airport nearing completion

Looking at past Adani IPOs from the Adani stable, like Adani Wilmar, Adani Ports, and Adani Green, the trend is clear.

- Adani Wilmar had a GMP of ₹60+ before listing.

- Adani Green was oversubscribed and its stock price doubled post-listing.

These past performances are fueling optimism around the Adani Airport IPO.

Why Make Adani Airports a Separate Company?

Spinning off Adani Airport Holdings Ltd (AAHL) means turning it into its own business, separate from the rest of the Adani Group.

Here’s why that’s a smart move:

- More Focus: It lets the airport business run independently with full attention on growth.

- Less Debt for Parent Company: The money raised can help reduce Adani Group’s overall debt.

- New Investors: It opens the door for investors who are only interested in airport and infrastructure projects.

What’s Happening in the Aviation Space?

India is now the 3rd largest aviation market in the world, and it’s growing fast!

- Passenger traffic is expected to grow 10% every year.

- Government schemes like UDAN are making air travel more accessible in smaller towns.

- New policies are supporting airport expansion and Tier-2 city connections.

How Does Adani Compare to Others?

Let’s look at the competition:

| Company | Airports Operated | Estimated Valuation |

| GMR Airports | Delhi & Hyderabad | ₹86,690 crore |

| Adani Airports | 8 Airports + Navi Mumbai (underway) | ₹1.67 lakh crore (estimated) |

Adani Airports already handles 23% of domestic passengers and 33% of all air cargo in India, which holds a major chunk of the market.

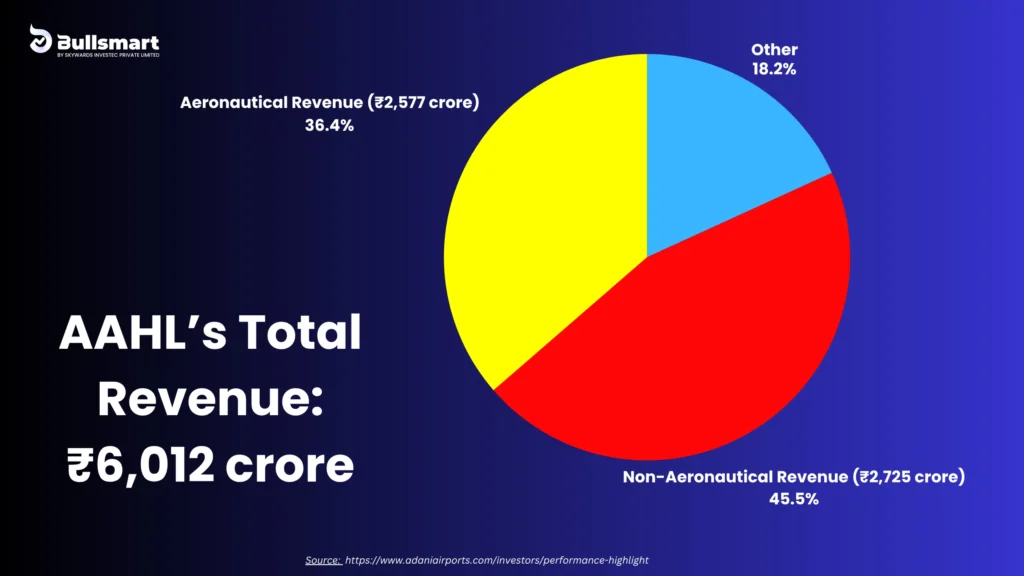

AAHL’s Financial Snapshot: FY 2023–24

Adani Airport Holdings Ltd (AAHL) had a solid year in FY24, reflecting both growth and operational strength across its airport network.

Here’s a simplified breakdown of the financials and key performance metrics:

Source: Adani Airport Holdings Limited

Adani Airport IPO Investor Takeaways

Here’s what the investors can glance over:

| Category | Insights |

| Bullish View | Strong growth potential in Indian aviation sector.Infra seen as undervalued.Interest from global institutional investors |

| Bearish View | Project execution is complex Adani Group carries high debt Reputation recovery still in progress |

| GMP Watch | GMP above ₹100 indicates strong market confidenceWatch out for possible overvaluation |

What can investors expect from the Adani Airports IPO?

The Adani Airports IPO, expected by March 2027, could be one of India’s most-watched infrastructure listings. Backed by a fast-growing airport network, a ₹8.35 lakh crore capex plan, and the soon-to-be operational Navi Mumbai International Airport, the IPO represents more than just another listing—it’s a bet on India’s aviation future.

If You’re a Bullish Investor

- India’s aviation market is expanding rapidly, with 10%+ expected annual passenger growth.

- Adani Airports already handles 24% of India’s passenger traffic and 33% of cargo, indicating clear market dominance.

- Global investors are likely to show strong interest in a “pure-play” infrastructure asset.

- A successful IPO could unlock long-term value like Adani Wilmar or Adani Green did.

If You’re a Cautious Investor

- Project execution is complex, especially with the phased rollout of Navi Mumbai Airport.

- Adani Group’s debt levels are high and under constant market scrutiny.

- Past allegations (like the Hindenburg case) still cast shadows over corporate governance.

Adani Airport IPO GMP Watch

If the Grey Market Premium (GMP) starts climbing well above ₹100 as the IPO nears, that signals high demand; but also calls for careful valuation checks.

Bottom Line

This IPO isn’t just about airports, it’s about India’s sky-high growth plans. Adani Airports is clearly aiming for takeoff with its ₹8.35 lakh crore investment push, eight running airports, and the upcoming Navi Mumbai International Airport.

That’s a pretty solid runway, right? But let’s not ignore the bumps, as there are still concerns about project delays, huge debt, and the group’s past controversies.

That said, the market seems pretty excited. The early GMP signals and investor interest say it all, and people are watching it closely.

If everything goes smoothly, this IPO could be one of the biggest stories of 2027. But if you’re planning to invest, keep your eyes open, do your homework, and don’t just go by the hype.

So whether you’re thinking of jumping in or just curious to see how it plays out, the Adani Airport IPO is definitely one to keep an eye on.

Because this one’s not just about flying people; it’s about watching a giant business try to take off in style.

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

FAQs

What is the price of Adani IPO?

As of now, the official price band for the Adani Airport Holdings Ltd (AAHL) IPO has not been announced.

However, based on past trends and expected valuations (~$20 billion), market experts anticipate a premium pricing structure, especially considering strong passenger traffic and robust non-aeronautical revenue.

How many airports does Adani own?

AAHL currently operates eight functional airports in India: Mumbai, Ahmedabad, Lucknow, Mangalore, Jaipur, Guwahati, Thiruvananthapuram, and Nagpur.

Additionally, the group is developing the Navi Mumbai International Airport, which will significantly boost its passenger capacity over the next few years.

When is the Adani Airport IPO coming?

The IPO is expected to be launched in Q4 of FY2026–27, likely between January to March 2027, as confirmed by Reuters and multiple industry reports.

This timeline aligns with the partial commissioning of Navi Mumbai Airport and AAHL’s strategic demerger from Adani Enterprises.

What is the listing date of IPO?

The exact listing date is yet to be disclosed.

However, if the IPO launches in March 2027, then the shares are likely to be listed on NSE and BSE by April 2027, subject to regulatory clearances and subscription schedules.

What is Adani Airport IPO GMP?

Since the IPO is still under preparation, no official GMP (Grey Market Premium) is available yet.

That said, speculative reports suggest strong expected demand, driven by Adani Group’s infrastructure dominance and past IPO success stories. Investors are closely watching for early GMP signals as we approach FY27.