In today’s uncertain economic environment, investors are constantly searching for smarter ways to protect their wealth and build long-term financial stability. Rising inflation, fluctuating stock markets, global supply disruptions, and the rapid growth of electric vehicles and renewable energy have once again brought metals into the spotlight. This is where commodity investing becomes an important strategy for modern portfolios.

From traditional favourites like gold and silver to high-demand industrial metals such as copper, aluminium, and nickel, metals play a crucial role in both economic growth and investment planning. A well-planned metal investment strategy can help investors reduce portfolio risk, balance market volatility, and benefit from long-term demand trends driven by infrastructure development and technological advancements.

For Indian investors, metals are no longer limited to physical buying or jewellery purchases. Today, multiple investment options such as ETFs, futures and mining stocks make it easier than ever to gain exposure to commodities. However, choosing the right method requires proper knowledge, risk assessment, and clear financial goals.

This guide explains how to invest in gold, silver, copper, aluminium, and nickel in a practical, beginner-friendly manner. Whether you are a conservative saver or an aggressive trader, this article will help you understand the opportunities, risks, and best practices of metal investing.

What Are Commodities and Precious Metals?

Commodities

Commodities are basic raw materials that are widely used in everyday life, manufacturing, and industrial production. These goods are traded in global markets and usually have standard quality and pricing. In simple terms, when you invest in commodities, you invest in resources that power economies and industries.

In the context of commodity investing, metals are broadly divided into two main categories: precious metals and base (industrial) metals.

Precious metals

Precious metals, such as gold and silver, are valued for their rarity, durability, and ability to store wealth over time. They are often used as a hedge against inflation, currency depreciation, and economic uncertainty. During market downturns or financial crises, investors tend to shift towards these metals for safety.

While precious metals focus on stability and wealth preservation, there is another category of metals that has been gaining increasing attention due to rapid industrial growth and global energy transition.

Base metals

Base metals, including copper, aluminium, and nickel, are primarily used in construction, transportation, electronics, and renewable energy sectors. Their prices are closely linked to economic growth, infrastructure spending, and industrial demand. For example, copper is widely used in electric vehicles and power grids, while nickel plays a key role in battery manufacturing.

Understanding this distinction is essential for building a balanced metal investment portfolio. While precious metals focus on stability and wealth preservation, base metals offer growth opportunities linked to industrial expansion and technological progress.

Why Invest in Metals? Key Benefits

Metals offer multiple financial and strategic advantages, which is why they remain an important part of commodity investing. Below are the key reasons why investors include metals in their portfolios.

Portfolio Diversification

- Reduces reliance on pure equity exposure

- May help cushion portfolios during market downturns

- Often behaves differently from equity and debt assets

- Can improve overall portfolio balance over time

Adding metals strengthens long-term metal investment planning by spreading risk across asset classes.

Protection Against Inflation

- Preserves purchasing power during rising prices

- Acts as a hedge against currency depreciation

- Gold and silver perform well in inflationary phases

- Useful for long-term wealth protection

This makes metals suitable for conservative and long-term investors.

Strong Long-Term Demand

- Copper supports EVs, power grids, and electronics

- Aluminium is used in transport and packaging

- Nickel is essential for battery technology

- Infrastructure growth increases metal consumption

Industrial demand creates growth opportunities within commodity markets.

Hedge Against Market Volatility

- Often Performs well during economic uncertainty

- Can provide stability during geopolitical tensions

- Helps reduce emotional investing decisions

- Balances high-risk assets

Metals often act as a safety cushion in unstable markets.

High Liquidity and Transparency

- Traded on regulated exchanges

- Easy buying and selling

- Transparent pricing mechanisms

- Subject to regulatory oversight and disclosure norms

Most modern metal investment products offer strong liquidity.

Multiple Investment Options

- Physical metals

- ETFs and mutual funds

- Futures and options

- Mining and metal stocks

Investors can choose methods based on risk appetite and financial goals.

A well-structured metal investment strategy using these benefits can help investors protect capital, manage risk, and participate in global growth trends.

Different Ways to Invest in Metals

Today, investors have multiple options to participate in commodity investing, depending on their risk appetite, capital availability, and investment goals. Instead of relying only on physical buying, modern metal investment offers flexible and regulated alternatives.

Below is a quick overview of the main ways to invest in metals in India.

Physical Metals

This is the traditional method of investing in metals.

- Includes gold and silver coins, bars, and jewellery

- Easily available through banks and jewellers

- Suitable for long-term wealth preservation

- Requires safe storage and insurance

- Involves making charges and purity verification

Physical metals are more suitable for conservative investors.

Exchange-Traded Funds (ETFs) and Mutual Funds

ETFs allow investors to invest in metals without holding them physically.

- Traded on stock exchanges like shares

- Backed by physical metals or international funds

- Low storage risk

- High liquidity

- Transparent pricing

Popular for gold and silver investments.

Commodity Futures and Options

This method is mainly used by active traders.

- Traded on commodity exchanges (like MCX)

- Allows leveraged trading

- Suitable for short-term strategies

- High risk and volatility

- Requires strong market knowledge

Not recommended for beginners.

Metal and Mining Stocks

Investors can gain indirect exposure through company shares.

- Invest in metal producers and mining companies

- Returns depend on business performance

- Affected by management and operational risks

- Linked to global metal prices

Suitable for equity-oriented investors.

International Funds and Global ETFs

These provide access to global commodity markets.

- Invest in overseas metal ETFs and funds

- Exposure to international demand and pricing

- Currency risk involved

- Requires international investing access

Useful for advanced investors.

Choosing the right method is crucial for successful commodity investing. Each option carries different levels of risk, cost, and return potential, so investors should align their choices with their financial goals.

How to Invest in Gold in India

Gold is the most popular and trusted metal among Indian investors. It plays a key role in commodity investing due to its stability, cultural importance, and ability to preserve wealth over time. Below are the main ways to invest in gold in India.

Suggested Read: Top Gold Stocks in India to Invest for a Golden Portfolio

Physical Gold (Jewellery, Coins, and Bars)

This is the most traditional form of gold investment.

- Includes gold jewellery, coins, and biscuits

- Easily available from jewellers and banks

- Suitable for long-term holding

- Requires secure storage

- Involves making charges and purity checks

While jewellery has emotional value, it is not the most efficient option for pure investment.

Gold Exchange-Traded Funds (Gold ETFs)

Gold ETFs are one of the most popular modern gold investment options.

- Traded on stock exchanges like shares

- Backed by physical gold

- No storage or safety issues

- High liquidity

- Transparent pricing

Gold ETFs are ideal for investors who want hassle-free metal investment without physical handling.

Here are some of the top gold ETFs of 2026:-

| ETF Name | Current Market Price (Rs.) | AUM (₹ Cr) | Expense Ratio (%) | 1Y Return (%) |

| Nippon India Gold BeES | 127.09 | 59,007 | 0.8 | 75.58 |

| SBI Gold ETF | 131.01 | 24,567 | 0.7 | 75.68 |

| ICICI Pru Gold ETF | 131.49 | 25,475 | 0.5 | 76.10 |

| HDFC Gold ETF | 130.99 | 25,140 | 0.59 | 74.94 |

| Kotak Gold ETF | 128.28 | 16,040 | 0.55 | 75.86 |

Data updated is as of 19.02.2026.

Sovereign Gold Bonds (SGBs)

SGBs are government-backed gold investments.

- Issued by the Government of India

- Linked to gold prices

- Offer fixed annual interest

- No capital gains tax on maturity (if held till maturity)

- No storage risk

Best suited for long-term investors looking for safety and tax efficiency.

Gold Mutual Funds

These funds invest in gold ETFs or international gold assets.

- Suitable for SIP-based investing

- Professionally managed

- No need for direct ETF trading

- Slightly higher expense ratios

Useful for investors who prefer mutual fund structures.

Here are some of the top gold Mutual Funds of 2026:-

| Mutual Fund | AUM (Cr.) | Expense Ratio (%) | 1 Year Return (%) | Returns since inception (%) |

| Aditya Birla Sun Life Gold Fund | ₹1,781 | 0.2 | 71.85 | 11.67 |

| SBI Gold Fund | ₹15,024 | 0.42 | 71.35 | 10.78 |

| Nippon India Gold Savings Fund | ₹7,160 | 0.35 | 70.7 | 12.37 |

| Quantum Gold Savings Fund | ₹499 | 0.49 | 71.36 | 18.93 |

| Axis Gold Fund | ₹2,835 | 0.17 | 70.61 | 11.46 |

| Kotak Gold Fund | ₹6,556 | 0.16 | 70.81 | 11.65 |

Data updated is that of 19.02.2026.

Comparison: Best Gold Investment Options

| Method | Risk Level | Liquidity | Suitable For |

| Physical Gold | Low | Medium | Traditional investors |

| Gold ETF | Low | High | Modern investors |

| Gold Fund | Low | High | SIP investors |

| SGB | Very Low | Low | Long-term holders |

Which Gold Option Should You Choose?

- For safety and tax benefits: Sovereign Gold Bonds

- For flexibility and trading: Gold ETFs

- For tradition and gifting: Physical gold

- For small monthly investing: Gold mutual funds or digital gold

Choosing the right gold investment method strengthens your overall metal investment strategy and helps balance portfolio risk.

How to Invest in Silver in India

Silver is gaining popularity among Indian investors due to its dual role as a precious metal and an industrial commodity. In commodity investing, silver is valued not only for wealth preservation but also for its growing use in solar panels, electronics, and electric vehicles. Below are the main ways to invest in silver in India.

Suggested Read: Top Silver ETFs to Invest for a Striking Portfolio

Physical Silver (Coins, Bars, and Utensils)

This is the traditional method of investing in silver.

- Includes silver coins, bars, and articles

- Easily available from jewellers and banks

- Suitable for long-term holding

- Requires safe storage

- Involves purity verification and making charges

Physical silver is suitable for investors who prefer tangible assets.

Silver Exchange-Traded Funds (Silver ETFs)

Silver ETFs offer a modern and convenient way to invest.

- Traded on stock exchanges like shares

- Backed by physical silver

- No storage concerns

- High liquidity

- Transparent pricing

Silver ETFs are ideal for hassle-free metal investment.

Here are some of the top silver ETFs of 2026:

| ETF Name | Current Market Price (Rs.) | AUM (₹ Cr) | Expense Ratio (%) | 1Y Return (%) |

| Nippon India Silver ETF | 233.21 | 44,491 | 0.56 | 139.15 |

| ICICI Prudential Silver ETF | 242.98 | 22,162 | 0.4 | 140.09 |

| HDFC Silver ETF | 233.58 | 10,690 | 0.45 | 137.62 |

| Kotak Silver ETF | 236.50 | 5,193 | 0.45 | 139.52 |

| SBI Silver ETF | 238.68 | 8,495 | 0.4 | 139.23 |

Data updated is that of 19.02.2026.

Silver Futures Trading

This method is mainly for active traders.

- Traded on commodity exchanges such as MCX

- Allows leveraged positions

- Suitable for short-term trading

- Highly volatile

- Requires strong market knowledge

Beginners should avoid silver futures until they gain experience.

Silver Mutual Funds and International Funds

Some mutual funds provide indirect exposure to silver.

- Invest in overseas silver ETFs

- Professionally managed

- Suitable for SIP investors

- Currency risk involved

These are useful for diversification-focused investors.

Comparison: Best Silver Investment Options

| Method | Risk Level | Liquidity | Suitable For |

| Silver Futures | High | Very High | Active traders |

| Physical Silver | Low | Medium | Traditional investors |

| Silver Funds | Medium | Medium | Diversified portfolios |

| Silver ETF | Low | High | Long-term investors |

Which Silver Option Should You Choose?

- For long-term stability: Silver ETFs

- For active trading: Silver futures

- For small investments: Digital silver

- For physical ownership: Coins and bars

Including silver in your metal investment portfolio can improve diversification and provide exposure to both industrial growth and precious metal stability.

How to Invest in Copper in India

Copper is one of the most important industrial metals in the world and plays a crucial role in power generation, electric vehicles, construction, and electronics. In commodity investing, copper is often seen as an indicator of economic growth because its demand rises when industries expand. Below are the main ways to invest in copper in India.

Copper Futures Trading on MCX

The most common way to invest in copper in India is through futures contracts.

- Traded on the Multi Commodity Exchange (MCX)

- Standardised contract sizes

- Allows leveraged trading

- Suitable for short-term strategies

- High risk and volatility

This option is best suited for experienced traders.

International Copper ETFs and Funds

Indian investors can gain exposure through global funds.

- Invest in overseas copper ETFs

- Track international copper prices

- Available through international investment platforms

- Currency risk involved

- Suitable for long-term diversification

Useful for investors seeking global exposure.

Commodity Mutual Funds (Indirect Exposure)

Some mutual funds provide indirect copper exposure.

- Invest in diversified commodity-linked assets

- Managed by professionals

- Lower risk than direct futures trading

- Limited availability in India

Suitable for conservative investors.

Copper Mining and Metal Stocks

Investing in companies related to copper production is another option.

- Includes mining and metal manufacturing companies

- Returns depend on business performance

- Affected by operational and management risks

- Influenced by global copper prices

This method suits equity-oriented investors.

Here are some of the top copper stocks of 2026:-

| Stock Name | Market Cap (Rs. Cr.) | CMP (Rs.) | P/E | ROCE (%) | Dividend Yield (%) |

| Hindustan Copper | 54,521 | 564 | 81.7 | 23.8 | 0.26 |

| Onix Solar | 1,494 | 696 | 98.4 | 32.4 | 0.00 |

| Mardia Samyoung | 582 | 106 | 565 | 22.6 | 0.00 |

| Bhagyanagar Ind | 518 | 162 | 14.3 | 8.28 | 0.00 |

| N D Metal Inds. | 24.7 | 99.6 | 118 | 6.63 | 0.00 |

| Madhav Copper Ltd | 172 | 63.5 | 52.0 | 8.50 | 0.00 |

| Rajputana Industries Ltd | 170 | 76.6 | 16.4 | 18.1 | 0.00 |

| Precision Wires India Ltd | 5,312 | 291 | 40.9 | 26.8 | 0.40 |

Data updated is that of 19.02.2026.

Exchange-Traded Commodity Products (Global)

In some international markets, copper is available through exchange-traded products.

- Traded like ETFs

- High transparency

- Easy entry and exit

- Requires overseas investing access

Best for advanced investors.

Comparison: Best Copper Investment Options

| Method | Risk Level | Liquidity | Suitable For |

| MCX Futures | High | Very High | Active traders |

| Global ETFs | Medium | High | Long-term investors |

| Metal Stocks | Medium | High | Equity investors |

| Global ETPs | Medium | High | Advanced investors |

| Commodity Funds | Low | Medium | Conservative users |

Key Things to Know Before Investing in Copper

- Copper prices are highly sensitive to global economic cycles

- Demand rises with infrastructure and EV growth

- Supply disruptions can cause sharp price movements

- Prices are influenced by China’s industrial activity

- Currency fluctuations affect returns

Including copper in your metal investment strategy can provide growth-oriented exposure, but it requires careful risk management and market awareness.

How to Invest in Aluminium in India

Aluminium is one of the most widely used industrial metals in the world. It is lightweight, durable, and highly recyclable, making it essential for sectors such as transportation, construction, packaging, and renewable energy. In commodity investing, aluminium is valued for its steady demand and close connection to economic growth. Below are the main ways to invest in aluminium in India.

Aluminium Futures Trading on MCX

The primary method of aluminium investment in India is through futures contracts.

- Traded on the Multi Commodity Exchange (MCX)

- Standardised contract sizes

- Allows leveraged positions

- Suitable for short-term trading

- High volatility and risk

This option is best suited for experienced traders.

Aluminium Manufacturing and Metal Stocks

Investors can gain indirect exposure through related companies.

- Includes aluminium producers and manufacturers

- Returns depend on company performance

- Influenced by raw material and energy costs

- Affected by global aluminium prices

Suitable for long-term equity investors.

Here are some of the top aluminium stocks of 2026:-

| Stock Name | Market Cap (Rs. Cr.) | CMP (Rs.) | P/E | ROCE (%) | Dividend Yield (%) |

| Hindalco Industries Ltd | 2,03,577 | 906 | 11.8 | 14.8 | 0.55 |

| National Aluminium Co Ltd (NALCO) | 62,473 | 340 | 10.2 | 44.0 | 3.09 |

| Vedanta Ltd | 2,64,420 | 676 | 24.1 | 25.3 | 6.43 |

| Maan Aluminium Ltd | 875 | 147 | 57.3 | 12.1 | 0.00 |

| Arfin India Ltd | 1,189 | 70.2 | 140 | 14.0 | 0.16 |

Data updated is that of 19.01.2026.

International Aluminium ETFs and Funds

Global funds provide exposure to international aluminium markets.

- Invest in overseas commodity ETFs

- Track global aluminium prices

- Offer geographical diversification

- Involve currency risk

Useful for diversification-focused investors.

Commodity-Based Mutual Funds

Some mutual funds provide indirect aluminium exposure.

- Invest in diversified commodity-linked assets

- Professionally managed

- Lower risk than direct futures trading

- Limited availability

Suitable for conservative investors.

Industrial Demand-Based Investment Approach

Some investors track aluminium demand trends before investing.

- Monitor construction and infrastructure growth

- Follow automobile and aviation sector demand

- Track renewable energy expansion

- Observe packaging industry trends

This approach helps improve timing decisions.

Comparison: Best Aluminium Investment Options

| Method | Risk Level | Liquidity | Suitable For |

| MCX Futures | High | Very High | Active traders |

| Metal Stocks | Medium | High | Equity investors |

| Global ETFs | Medium | High | Long-term investors |

| Commodity Funds | Low | Medium | Conservative users |

| Demand Tracking | Medium | Low | Research-based users |

Key Things to Know Before Investing in Aluminium

- Aluminium prices are influenced by energy costs

- Demand increases with infrastructure development

- Recycling rates affect supply

- Global trade policies impact pricing

- Economic slowdowns can reduce demand

Adding aluminium to your metal investment portfolio provides exposure to steady industrial growth, but requires awareness of global market cycles and cost dynamics.

How to Invest in Nickel in India

Nickel is a critical metal in today’s modern economy, especially due to its growing use in electric vehicle batteries, stainless steel production, and renewable energy storage systems. In commodity investing, nickel is considered a high-growth but high-risk metal because of its sharp price movements and supply constraints. Below are the main ways to invest in nickel in India.

Nickel Futures Trading on MCX

The most direct way to invest in nickel in India is through futures contracts.

- Traded on the Multi Commodity Exchange (MCX)

- Standardised contract specifications

- Allows leveraged trading

- Suitable for short-term strategies

- Highly volatile and risky

Recommended only for experienced traders.

International Nickel ETFs and Funds

Indian investors can access nickel through global funds.

- Invest in overseas nickel-focused ETFs

- Track international nickel prices

- Provide geographical diversification

- Subject to currency fluctuations

Useful for long-term diversification.

Nickel Mining and Metal Stocks

Investing in nickel-related companies is another option.

- Includes mining and stainless steel producers

- Returns depend on operational efficiency

- Affected by regulatory and environmental policies

- Influenced by global nickel demand

Suitable for equity-oriented investors.

Commodity-Based Investment Funds

Some commodity funds provide indirect nickel exposure.

- Invest in diversified commodity portfolios

- Managed by professionals

- Lower risk than direct futures trading

- Limited availability in India

Suitable for conservative investors.

EV and Battery Sector-Based Approach

Some investors invest in nickel based on EV industry growth.

- Track electric vehicle adoption rates

- Follow battery technology developments

- Monitor government EV policies

- Observe global supply chains

This approach helps align investments with future trends.

Comparison: Best Nickel Investment Options

| Method | Risk Level | Liquidity | Suitable For |

| MCX Futures | Very High | Very High | Expert traders |

| Global ETFs | Medium | High | Long-term investors |

| Metal Stocks | Medium | High | Equity investors |

| Commodity Funds | Low | Medium | Conservative users |

| Trend-Based | High | Low | Research investors |

Key Things to Know Before Investing in Nickel

- Nickel prices are highly volatile

- EV demand strongly influences pricing

- Supply is concentrated in a few countries

- Environmental regulations impact mining

- Global trade tensions affect markets

Nickel can significantly boost returns in a metal investment portfolio, but it requires strong risk control and continuous market monitoring.

Below are the leading Metal ETFs in 2026 with Aluminium and Nickel exposure:

| ETF Name | Current Market Price (Rs.) | AUM (₹ Cr) | Expense Ratio (%) | 1Y Return (%) |

| ICICI Prudential Nifty Metal ETF | 11.89 | 1,034 | 0.4 | 43.74 |

| Mirae Asset Nifty Metal ETF | 11.88 | 411 | 0.32 | 43.84 |

Data updated is that of 19.02.2026.

Leading Metal and Natural Resources Funds in 2026

| Fund Name | AUM (Cr.) | Expense Ratio (%) | 1 Year Return (%) | Returns since inception (%) |

| ICICI Pru Commodities Fund | 3,560 | 1.0 | 28.96 | 29.15 |

| SBI Comma Fund | 896 | 1.56 | 28.08 | 14.2 |

| DSP Natural Resources & New Energy Fund | 1,765 | 0.88 | 35.02 | 18.15 |

| Tata Resources & Energy Fund | 1,209 | 0.57 | 23.86 | 18.49 |

Data updated is that of 19.02.2026.

Things to Consider Before Investing in Metals

Before entering commodity investing, it is important to evaluate several key factors that directly affect returns, risks, and long-term success. A well-planned metal investment strategy is built on informed decision-making rather than short-term market emotions.

Below are the most important aspects every investor should consider.

Risk Appetite

- Metals can be volatile, especially industrial metals

- Futures trading carries higher risk than ETFs

- Conservative investors should prefer gold and silver

- Aggressive investors may explore base metals

Always invest according to your comfort with market fluctuations.

Investment Horizon

- Short-term: Suitable for futures trading

- Medium-term: ETFs and metal stocks

- Long-term: SGBs, gold ETFs, and funds

Longer investment horizons help reduce market timing risk.

Market Cycles and Economic Conditions

- Metal prices rise during economic expansion

- Precious metals perform well in uncertainty

- Recessions can reduce industrial metal demand

- Global growth impacts returns

Understanding cycles improves entry and exit timing.

Global Demand and Supply Trends

- EV growth increases copper and nickel demand

- Infrastructure boosts aluminium consumption

- Mining disruptions affect supply

- Geopolitical events influence availability

Global factors play a major role in price movements.

Currency Impact (USD-INR Movement)

- Most metals are priced in US dollars

- Weak rupee increases domestic prices

- Strong rupee can limit returns

- Forex volatility affects investments

Currency trends directly influence Indian investor returns.

Storage, Safety, and Insurance

- Physical metals require secure storage

- Locker and insurance costs reduce returns

- ETFs eliminate storage issues

- Digital platforms reduce handling risk

Hidden costs must be factored into returns.

Taxation and Regulatory Rules

- Different products have different tax treatments

- Futures profits are taxed as business income

- ETF gains attract capital gains tax

- GST applies to physical metals

Understanding tax rules improves net profitability.

Liquidity and Exit Options

- ETFs and futures offer easy exit

- Physical metals may take time to sell

- SGBs have limited liquidity before maturity

- Global funds depend on platform access

High liquidity ensures flexibility.

Platform and Broker Reliability

- Choose SEBI-registered brokers

- Verify trading platforms

- Check customer support quality

- Avoid unregulated apps

Reliable platforms reduce operational risk.

Evaluating these factors carefully helps investors build a disciplined and resilient metal investment portfolio while avoiding common mistakes in commodity investing.

Taxation on Metal Investments in India

Understanding tax rules is essential in commodity investing, as taxes directly impact your final returns. Different metal investment options are taxed differently based on holding period and investment type.

The table below summarises the key tax rules applicable in India.

Tax Treatment of Metal Investments

| Investment Type | Short-Term Tax (STCG) | Long-Term Tax (LTCG) |

| Physical Gold & Silver | As per income tax slab (≤ 24 months) | 12.5% (without indexation) (> 24 months) |

| Gold & Silver Mutual Funds | As per income tax slab (≤ 24 months) | 12.5% (> 24 months) |

| Gold / Silver ETFs | As per income tax slab (≤ 12 months) | 12.5% (without indexation) (> 12 months) |

| Commodity Futures (MCX) | Taxed as business income | |

Source: Cleartax, Jan 27th, 2026

Key Tax Points to Remember

- Physical metals attract GST, which increases purchase cost

- ETFs and funds are more tax-efficient than physical metals

- Futures trading is treated as business income, not capital gains

- SGBs remain the most tax-efficient gold option for long-term investors

- Digital metals follow rules similar to physical metals

Planning taxes in advance helps improve net returns and strengthens your overall metal investment strategy in commodity investing.

Common Mistakes to Avoid

In commodity investing, small mistakes can lead to large losses. Avoid these common errors while building your metal investment strategy:

- Overexposure to one metal instead of diversifying

- Entering futures trading without proper knowledge

- Following tips blindly from social media or unverified sources

- Ignoring global cues like US data, China demand, or geopolitical risks

- Assuming base metals are stable and underestimating volatility

- Using excessive leverage in commodity futures

- Chasing short-term profits instead of maintaining discipline

- Not setting stop-loss levels in trading

- Ignoring currency impact (USD-INR movement)

- Forgetting hidden costs like GST, storage, brokerage, and platform fees

- Using unregulated platforms or brokers

- Investing borrowed money in high-risk trades

Avoiding these pitfalls helps investors build a more disciplined, risk-aware, and sustainable approach to metal investment within the broader framework of commodity investing.

Sample Portfolio Allocation (For Beginners)

For beginners entering commodity investing, the goal should be stability first, growth second. A balanced metal investment allocation reduces risk while allowing exposure to industrial demand trends.

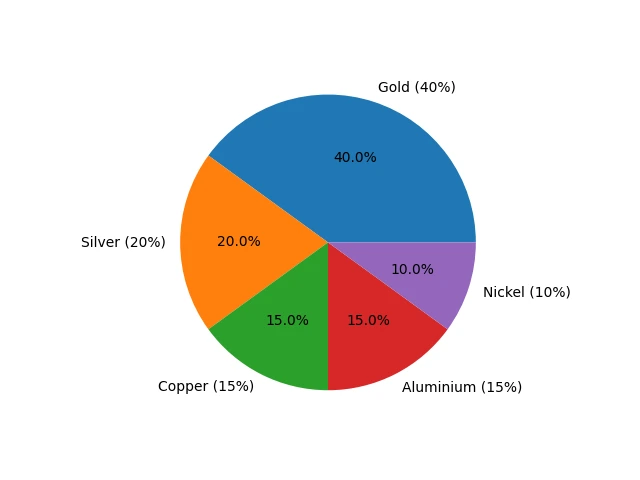

Here’s a simple model allocation for a moderate-risk investor:

Suggested Beginner Allocation

How This Allocation Works

- Gold provides downside protection

- Silver adds moderate growth potential

- Base metals (Copper, Aluminium, Nickel) add growth exposure

- Risk is spread across both defensive and cyclical metals

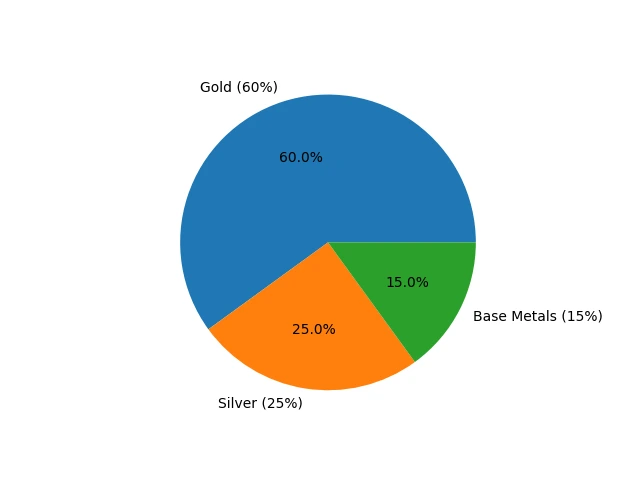

For Conservative Investors

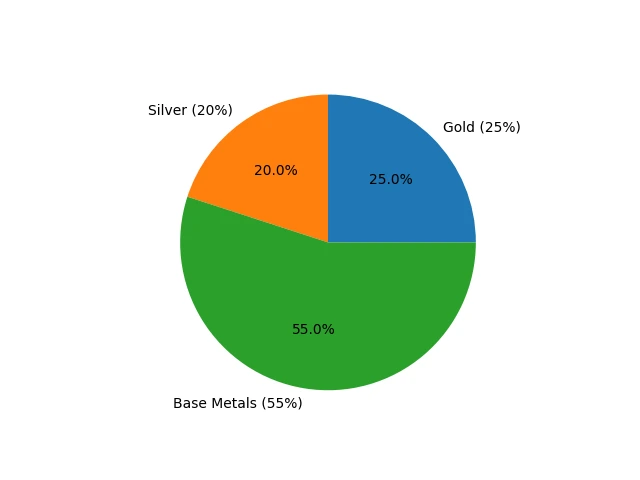

For Aggressive Investors

This is only a reference structure. Investors should adjust allocation based on:

- Risk appetite

- Investment horizon

- Income stability

- Market conditions

A disciplined allocation strategy strengthens long-term results in commodity investing while keeping your metal investment exposure under control.

How to Adjust Metals in Your Overall Portfolio

Metal allocation should not exist in isolation. It should complement your equity, debt, and cash investments. The ideal exposure depends largely on age, income stability, and financial responsibilities.

For Investors Aged 18-30

Focus: Growth with controlled exposure

- Keep metals at 5-15% of the total portfolio

- Prefer silver and limited copper exposure for growth themes

- Maintain gold for stability

- Avoid excessive futures trading

At this stage, equities usually dominate, while metals act as diversification support.

For Investors Aged 31-50

Focus: Balance and wealth protection

- Allocate 10-20% to metals

- Increase gold allocation for stability

- Add selective base metal exposure

- Review allocation annually

This age group benefits from combining growth assets with protective hedges.

For Investors Aged 50+

Focus: Capital preservation

- Allocate 15-25% to metals (primarily gold)

- Limit exposure to high-volatility base metals

- Avoid leveraged commodity trading

- Prefer ETFs or Sovereign Gold Bonds

At this stage, metals primarily serve as risk stabilizers rather than growth drivers.

Metal allocation should evolve with life stages. Adjusting exposure thoughtfully ensures your metal investment strategy supports long-term financial goals within a disciplined commodity investing framework.

Note: The allocations mentioned above are for reference purposes only and do not constitute investment advice or recommendations. Investors should determine appropriate metal exposure based on their individual financial goals, risk profile, and overall portfolio structure, preferably after consulting a qualified financial advisor.

Future Outlook: Metals in the Next 5-10 Years

The future of commodity investing is closely linked to global economic shifts. Over the next decade, metals are expected to remain at the centre of major structural changes such as electric vehicle adoption, renewable energy expansion, and infrastructure development.

Industrial metals like copper, aluminium, and nickel may benefit from rising demand driven by EV batteries, power grids, construction, and clean energy projects. Governments across the world are investing heavily in electrification and urban development, which directly increases consumption of these metals.

At the same time, supply-side challenges such as stricter mining regulations, geopolitical tensions, and environmental restrictions could create volatility. Limited supply combined with rising demand often leads to sharp price movements.

Gold and silver are likely to continue playing their traditional role as inflation hedges and safe-haven assets during economic uncertainty or currency weakness.

For investors, the key takeaway is simple: long-term structural trends matter more than short-term price swings. A balanced metal investment approach that combines stability (precious metals) and growth (industrial metals) can help capture opportunities within evolving global commodity investing trends.

How Metals Affect India’s Economy

- Trade & Imports: India relies heavily on imports for precious and industrial metals. Gold, silver, and copper import volumes remain high, making bullion demand a key factor in the trade deficit and currency stability. Domestic production covers only a small fraction of total demand.

- Industrial Demand: Copper demand in India rose sharply, up 9.3% in FY25 reflecting strong infrastructure and renewable energy projects. Expansion of power grids, solar and wind generation, and construction sectors are driving this trend.

- Non-Ferrous Market Growth: The market for non-ferrous metals like copper and aluminium is expected to grow steadily, supported by expanding manufacturing, urbanisation and transport sectors through 2025-2031.

- EV & Energy Transition Examples: India’s electric vehicle battery production is expected to grow from ~12 GWh in FY24 to ~50 GWh by 2030, boosting demand for copper, nickel and related metals across supply chains.

- Gold Consumption Trends: India’s gold consumption in 2025 was lower than in previous years due to high prices, but investment demand and ETF inflows remain strong, showing how precious metals continue to play a dual role as both cultural assets and investment hedges.

- Global Examples: China is transitioning solar panel manufacturing toward more copper use due to sharply rising silver costs, showing how strategic shifts in global production can impact metal demand patterns.

Conclusion

Metals have moved beyond traditional wealth storage and now play a strategic role in modern portfolios. From gold’s stability to copper and nickel’s industrial growth potential, each metal offers a different opportunity within the broader framework of commodity investing. The key is not choosing the “best” metal, but selecting the right mix based on your risk profile, financial goals, and investment horizon.

A disciplined metal investment strategy combines diversification, risk management, and awareness of global economic trends. Precious metals can provide protection during inflation and uncertainty, while industrial metals offer exposure to long-term themes such as electric vehicles, renewable energy, and infrastructure expansion.

However, like any asset class, metals carry risks. Volatility, global demand shifts, currency fluctuations, and taxation rules must all be considered before investing. Starting small, choosing regulated platforms, and maintaining proper allocation discipline can significantly improve long-term outcomes.

When approached strategically, metals can strengthen portfolio resilience and open new growth avenues. The opportunity lies not in speculation, but in informed and structured participation in commodity markets.

FAQs

Which metal to invest in in 2026?

The choice depends on your objective. Gold is typically linked to stability, silver combines industrial and investment demand, while copper and other base metals are tied to economic growth and infrastructure trends. Allocation usually depends on risk tolerance and time horizon.

Where to invest in 2026: Gold vs Silver vs Copper?

Gold is generally associated with wealth preservation, silver offers mixed exposure to industry and investment demand, and copper reflects global growth and electrification trends. Investors typically choose based on whether they seek stability, balance, or growth-linked exposure.

Is a Silver ETF a good investment in 2026?

A silver ETF provides market-linked exposure without holding physical silver. It offers liquidity and ease of trading, but prices can be volatile due to industrial demand cycles. Suitability depends on portfolio allocation and risk profile.

Is copper a good investment in 2026?

Copper is closely linked to renewable energy, EV growth, and infrastructure spending. It may benefit during economic expansion but can be volatile during slowdowns. Investors usually assess global demand trends and their risk appetite before taking exposure.