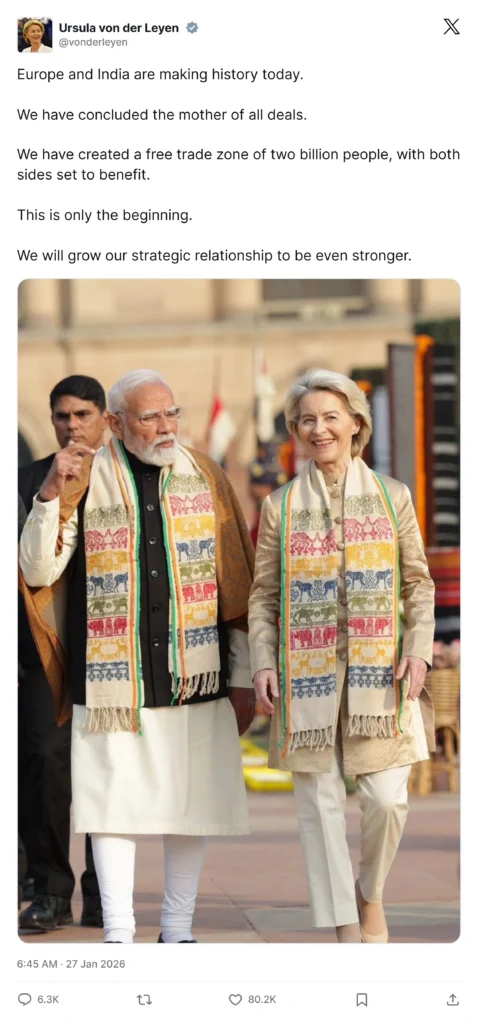

On January 27, 2026, the India EU Free Trade Agreement moved a step closer to reality as India and the European Union concluded negotiations on a long-awaited deal, widely seen as a major reset in trade and strategic ties.

EU Commission President Ursula von der Leyen called it the “mother of all deals”, highlighting the scale of an agreement that connects economies covering nearly 2 billion people and around a quarter of global GDP. The EU has projected that its exports to India could double by 2032.

However, a free trade agreement is not a switch that instantly makes everything cheaper. It is a detailed framework with phased tariff cuts, sector-specific conditions, and clear timelines. Some prices may fall, some benefits are largely business-focused, and sensitive sectors remain protected. The real question is what gets cheaper, when it happens, and who actually benefits.

Negotiations began in 2007, stalled for years, and were revived in 2021, gaining momentum again in 2025 amid global supply chain shifts.

This blog breaks down what’s in the deal, how tariffs change, which sectors gain, where challenges like CBAM arise, and what the realistic timelines look like, using high-credibility sources.

What is India EU Free Trade Agreement?

At its core, the India-EU Free Trade Agreement is a comprehensive trade pact that lowers tariffs, opens services markets, and sets common rules to make cross-border trade more predictable and efficient.

It covers goods, services, investment protection, regulatory standards, and sustainability norms, with trade liberalisation extending to about 96.6% of India’s trade commitments and 99.3% of the EU’s, through a mix of immediate and phased measures.

What is Included in the India EU FTA

Tariff Reductions on Goods

- EU to reduce or eliminate duties on Indian exports such as textiles, leather, footwear, gems, jewellery, and marine products

- India to offer its most ambitious tariff concessions so far on EU exports, including automobiles, machinery, chemicals, and pharmaceuticals

- Some tariff cuts apply immediately, while others are phased over 5, 7, or 10 years, indicating a gradual rollout

Services Liberalisation

- Improved market access for Indian IT and professional services

- Better access to EU financial and consulting services

- Clearer and more enforceable rules compared to the basic WTO framework

- Focus on smoother business operations rather than just cheaper goods

Customs and Regulatory Facilitation

- Measures to reduce red tape and administrative friction

- Faster movement of goods across borders

- Improved regulatory coordination and predictability

- Stronger framework for supply chain security

Broader Regulatory and Strategic Coverage

- Provisions covering intellectual property rights

- Investment protection mechanisms

- Sustainability and compliance standards

- Parallel cooperation on security and defence, making the agreement more strategic than a typical FTA

Pros, Cons and Grey Areas in the Deal

Pros

- Boosts trade from ~₹1,316,400 cr (2024) to double by 2032.

- Saves EU exporters ~₹43,800 cr annually.

- Enhances supply chain resilience.

- For India: Access to 99% exports, jobs in labor sectors.

Cons

- Import surges may pressure Indian autos (e.g., Volkswagen competition).

- Environmental risks if sustainability is not enforced.

- 5-10 year transitions delay benefits.

Areas of Major Changes and Growth

Tariff cuts drive growth in key sectors.

- Textiles: Zero duties open €263 billion EU market, 41-65% trade rise.

- Pharma: 11% duties eliminated for expansion.

- Autos: India cuts from 110% to 10% with quotas.

- Green tech and services: Liberalization spurs innovation.

Grey Areas

Exclusions protect sensitive sectors.

- Agriculture/dairy: Safeguarded for Indian farmers.

- CBAM: Unresolved, may add €1 billion costs to Indian exports.

- Ratification: European Parliament approval may take 1+ year.

What Will be Cheaper after India EU FTA

The FTA lowers tariffs on many EU products, so they’re likely to cost less in India, while sensitive items are kept protected. This includes everything from wines, spirits, beers, olive oil, and chocolates to premium cars, machinery, chemicals, pharmaceuticals, car parts, cosmetics, and processed foods like pasta, as well as sheep meat, fruits, and more.

Here’s a quick summary of the goods that may get affected:

Goods Getting Cheaper in India after India EU FTA

| Product | Current Tariff | Post-FTA Tariff |

| Wines (premium) | 150% | 20% |

| Wines (medium) | 150% | 30% |

| Spirits | 150% | 40% |

| Beers | 110% | 50% |

| Olive Oil | Up to 45% | 0-10% |

| Chocolates | Up to 30% | 0% |

| Premium Cars | 110% | 10% (quota-based) |

| Car Parts | Up to 30% | 0% (after 5-10 years) |

| Machinery | Up to 44% | 0% |

| Chemicals | Up to 22% | 0% |

| Pharmaceuticals | 11% | 0% |

| Cosmetics | Up to 22% | 0% (after 5-7 years) |

| Processed Foods (e.g., pasta) | Up to 50% | 0% |

| Sheep Meat | 33% | 0% (phased) |

| Fruits (e.g., apples) | Up to 50% | Reduced |

Data available is updated as of 29.01.26.

Suggested Read: Top Pharma Stocks in India: 7 Powerful Picks to Watch in 2026

Goods Remaining the Same/Exempt

| Product | Reason for Exemption |

| Dairy | Sensitive for India |

| Cereals | Agricultural protection |

| Beef/Chicken | Cultural/ethical concerns |

| Rice | Food security |

| Sugar | Domestic producer protection |

| Poultry Products (partial) | Sensitive sector |

Data available is updated as of 29.01.26.

Suggested Read: EV Stocks in India Set to Soar in 2026: Top Picks You Can’t Miss

Effects on the Economies of India and the EU

Impact on India: Export Opportunity With Adjustment Pressure

- Stronger export competitiveness: Sectors currently facing 4%-26% EU duties, covering nearly ~₹302,610 cr in exports, are expected to move to zero duty once the FTA comes into force.

- Textiles as a flagship winner: The EU’s textiles and apparel import market is worth ~₹2,415,095 cr (2024). Zero-duty access and tariff cuts of up to 12% create a major growth runway for Indian exporters.

- Boost for MSMEs and jobs: Labour-intensive sectors like textiles, leather, and footwear support around 45 million jobs, with better integration into EU value chains aiding GDP growth.

- Strategic diversification: Helps India reduce reliance on the U.S. and China amid global tariffs and supply chain pressures.

- Domestic competition challenge: Lower tariffs on EU imports mean Indian firms may face sharper competition at home, leading to price pressure, the need for productivity upgrades, or both.

- Compliance and skills gap: Meeting EU standards may require upskilling and investment, and imports could temporarily widen the trade deficit.

Impact on the EU: Access to a High-Growth Market

- Entry into the fastest-growing large economy: The EU frames India as a key long-term growth market with privileged access under the FTA.

- Rising exports: EU goods exports to India are projected to double by 2032, with major gains in autos, machinery, chemicals, pharmaceuticals, and agri-food products.

- Tariff relief: High Indian tariffs, such as spirits duties falling sharply from very high levels, improve EU competitiveness.

- Scale of trade:

- Goods trade stood at ~₹1.32 cr (2024)

- EU imports from India were around ~₹7.8 cr, exports to India about ~₹5.33 cr

- Services trade added ~₹5.33 cr (2024)

- Goods trade stood at ~₹1.32 cr (2024)

- Jobs and diversification: The deal supports job creation and helps the EU diversify supply chains away from over-dependence on China.

- Risks: Benefits are phased rather than immediate, and sensitive sectors like farming may see political pushback.

Overall Economic Effects

- Creation of a massive integrated market: Together, India and the EU represent a combined economy of roughly ~₹2.20 cr.

- Higher trade volumes: Trade flows could rise by 41%-65% over time as tariffs fall and barriers ease.

- Beyond tariffs: The agreement addresses non-tariff barriers such as standards, compliance, and predictability, supporting innovation and longer-term economic integration.

Why This Deal Is a Really Big Deal and Not a Small One

First, let’s understand how big this friendship between India and Europe already is.

Every year, India and the European Union buy and sell things worth more than €180 billion. This includes clothes, machines, medicines, software, banking services, and many other things. Because of this trade, almost 8 lakh people in Europe get jobs.

So this is not a small deal between two countries. It is one of the biggest trading partnerships in the world.

Now let’s talk about one important rule you should know.

From 1 January 2026, Europe started a new system called CBAM. You can think of it like a “pollution check” for products.

If a factory in India sends steel, cement, or other heavy products to Europe, it must now show how much pollution was created while making them. If pollution is too high, extra charges may apply.

So even though this trade deal makes it easier to sell products in Europe, Indian companies also have to become cleaner and greener.

In simple words, this deal brings big opportunities, but it also pushes companies to be more responsible.

Why the EU Pursued This Deal Now

This agreement is about far more than tariffs. It is a strategic move shaped by shifting global trade dynamics.

Trade and Economic Diversification

- The EU has been actively working to reduce over-dependence on a few trading partners and lower concentrated risk in an increasingly fragmented global economy.

- With a large trade deficit with China and rising geopolitical uncertainty, India offers a fast-growing alternative market with 6-8% growth potential.

A Hedge Against Global Protectionism

- The deal is widely seen as a response to rising protectionism and tariff-driven trade tensions globally.

- It gives EU firms early access and a “first-mover” advantage in India at a time when trade barriers are hardening elsewhere.

India as a Long-Term Demand Engine

- EU policy and press framing consistently highlight India’s scale, demographics, and long-term demand potential.

- The agreement opens access to one of the world’s largest consumer bases, especially for EU industrial, agri-food, technology, and services exporters.

Strategic and Sustainability Alignment

- The partnership aligns with India’s long-term development vision, including initiatives such as Viksit Bharat 2047.

- It also advances EU priorities on sustainability, labour standards, human rights, and access to critical minerals needed for green and digital transitions.

The Geopolitical Side of the Deal

This deal is not just about trade. It is also about how India and the EU position themselves in a changing global order.

First, it’s a signal of “rules-based” cooperation.

In plain terms, India and the EU are saying they want predictable, rule-following trade instead of sudden tariffs or trade shocks. Working together reduces the risk of depending too much on any one country and helps both sides stay steady in a world where supply chains are constantly shifting.

Second, it helps balance big power pressures.

By strengthening ties with each other, both India and the EU reduce their dependence on China and protect themselves from unpredictable trade moves elsewhere. It also gives them a safety net against sudden tariff hikes that can disrupt businesses overnight.

Third, it fits into a bigger strategic picture.

The agreement supports closer cooperation in the Indo-Pacific region and goes beyond trade into areas like defence and long-term strategic coordination. The idea is to build stronger, more reliable partnerships instead of fragmented ones.

But there are risks too.

Closer alignment can invite pushback from other major powers. On top of that, EU rules around sustainability, labour, and compliance are strict, which can increase costs for businesses trying to meet those standards.

In short, the deal is about stability and influence, not just imports and exports, and it comes with both advantages and trade-offs.

Impact on the Indian Stock Market

The announcement of the India-EU FTA on 27 January 2026 triggered clear sector-wise movements in the Indian equity market.

1. Strong Positive Reaction: Major Gainers

These sectors and stocks showed strong upward movement immediately after the announcement.

| Sector / Theme | Impact Driver / Reason | Company / Segment | Stock Movement / Reaction |

| Textiles & Apparel | Zero / sharp reduction in duties | KPR Mill | Up 6.5% to 8% |

| Arvind Ltd | Up 5% to 7% | ||

| Welspun India | Up 5.5% to 7.5% | ||

| Trident | Up 4% to 6% | ||

| Page Industries | Moderate gains | ||

| Pharma & Specialty Chemicals | Improved export access / trade benefits | PI Industries | Up 5% to 8% |

| UPL | Up 4% to 7% | ||

| Aarti Industries | Noticeable gains | ||

| Atul Ltd | Good upward move | ||

| Deepak Nitrite | Decent gains | ||

| Marine Products Export | Better access to EU markets | Avanti Feeds | Up 4% to 7% |

| Apex Frozen Foods | Up 4% to 7% | ||

| IT & IT Services | Cross-border business opportunities | KPIT Tech | Mild to moderate gains |

| Persistent Systems | Mild to moderate gains | ||

| LTIMindtree | Mild to moderate gains | ||

| Defence & Engineering | Security cooperation / defence partnerships | L&T Technology Services | Moved higher |

| Select Defence Companies | Positive momentum |

Data available is updated as of 29.01.26.

2. Clear Negative Reaction: Stocks That Fell

| Sector / Theme | Impact Driver / Reason | Company / Segment | Stock Movement / Reaction |

| Automobile & Auto Ancillaries | Higher competition from European imports | Mahindra & Mahindra | Down 3.5% to 5% |

| Maruti Suzuki | Down 3% to 4.5% | ||

| Ashok Leyland | Noticeable decline | ||

| Auto Component Companies | Down 2% to 5% | ||

| Alcoholic Beverages | Lower import duties on wine, spirits, and beer | Sula Vineyards | Down 2.5% to 4% |

| United Spirits | Mild decline | ||

| Radico Khaitan | Mild decline |

Data available is updated as of 29.01.26.

Stock Market Reaction After India EU FTA

| Segment / Sector | Immediate Reaction | Main Reason |

| Nifty 50 | Up 0.8% to 1.6% | Overall positive market sentiment |

| Nifty Midcap 100 | Up 1.2% to 2.1% | Higher exposure to textile & chemical stocks |

| Textiles & Apparel | Very strong positive | Zero / near-zero duty advantage |

| Pharmaceuticals | Strong positive | Duty elimination and better market access |

| Specialty Chemicals | Strong positive | Major duty reduction |

| Automobiles | Clearly negative | Fear of increased European competition |

| Alcoholic Beverages | Negative | Sharp duty cut on imported liquor |

| Marine Foods | Strong positive | Zero duty in major EU markets |

| IT & IT Services | Mildly positive | Services liberalisation |

Data available is updated as of 29.01.26.

Quick Summary

- Very strong winners: Textiles, apparel, home textiles, marine products, select pharma and specialty chemicals

- Clear losers (at least in the short term): Passenger vehicle segment (especially premium and mid-segment cars), domestic liquor companies (especially wine and premium spirits)

- Neutral to mildly positive: IT services, engineering, defence, other services

- Most important big-picture view right now: The market considers this a very strong long-term positive development for India. Short-term sectoral rotation is visible. Medium to long term, export-oriented sectors are expected to see re-rating and higher valuations.

Why Tariffs Matter So Much in the India-EU Deal

First, think of tariffs like a “tax” you pay when something is imported from another country.

The higher the tax, the more expensive that product becomes in local shops.

For many years, India kept these import taxes quite high. In 2024, India’s average import tariff was about 16 percent. This helped protect Indian companies, but it also made many foreign products costly.

Countries like the US, China, and the EU kept much lower tariffs. The EU, in particular, charged very little on most imports. That is why European products often entered other countries at lower prices.

Now this is where the India-EU trade deal becomes important.

Under this agreement, India has agreed to reduce or remove import taxes on most European goods over time. This includes machines, chemicals, medicines, food products, and even some cars. Many of these cuts will happen slowly over 5 to 10 years, not overnight.

Because India’s tariffs were already high, these cuts can have a big impact. When the tax goes down, the cost of importing also goes down. Businesses save money. And when businesses save money, part of that benefit can reach customers through better prices.

At the same time, Indian companies now face stronger competition. They will need to improve quality, reduce waste, and use better technology to stay competitive.

So in simple words, this deal is not just about “free trade”.

It is about India slowly opening its doors, step by step, to European products, while preparing its own companies to compete globally.

Bottom Line

It is not about overnight discounts or instant price drops. It is about slow, steady change. Over the next few years, many products may become more affordable, businesses may become more competitive, and financial services may become smoother and smarter.

For India, this deal opens the door to one of the world’s biggest markets. For Europe, it creates strong access to one of the fastest-growing economies. And for everyday people like you and me, it means more choices, better quality, and hopefully better value for money.

At the same time, this agreement also brings challenges. Indian companies will need to upgrade, follow strict environmental rules, and learn to compete globally. Some sectors will gain faster than others. Some will need time to adjust.

That is why the India EU FTA should be seen as a long-term journey, not a quick win.

If you follow how it unfolds, it can help you make smarter decisions, whether you are a consumer, a business owner, or an investor.

In the coming years, this deal may quietly reshape how India trades with the world.

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

What EU imports from India?

The EU mainly imports machinery and transport equipment, chemicals, manufactured goods (like metals and materials), textiles, and some mineral products/fuels from India. In 2024, these categories made up the bulk of EU imports from India, with machinery and transport equipment and chemicals among the biggest chunks.

What is the FTA between EU and India?

The India EU Free Trade Agreement (India EU FTA) is a trade pact that reduces import duties, opens selected services, and sets common rules so India and the EU can trade more smoothly. It covers goods, services, and trade procedures, with very high coverage of tariff liberalisation through immediate and phased cuts over multiple years.

Which cars will be cheaper due to India EU FTA?

Under the India EU Free Trade Agreement, import duties on fully built European cars in India will be cut sharply from very high levels (around 110 %) to much lower rates over time, first to about 40 % and eventually down to around 10 % within quota limits. This mainly makes premium European brands like BMW, Mercedes-Benz, Audi, Porsche, Lamborghini, and Rolls-Royce more affordable in India once the phased tariff reductions take effect.

What will India gain from EU FTA?

India gains easier access to the EU market for key exports like textiles, leather, footwear, gems and jewellery, and marine products, with many lines moving toward zero duty once the deal enters into force. It can support jobs in labour-intensive sectors, help MSMEs export more, and reduce dependence on a few major markets, although benefits arrive in phases.