GST 2.0 has just reshaped India’s tax system in one of the biggest overhauls since GST was first introduced back in 2017. Approved at the 56th GST Council meeting in September 2025, this reform package is being hailed as a turning point for both everyday citizens and businesses.

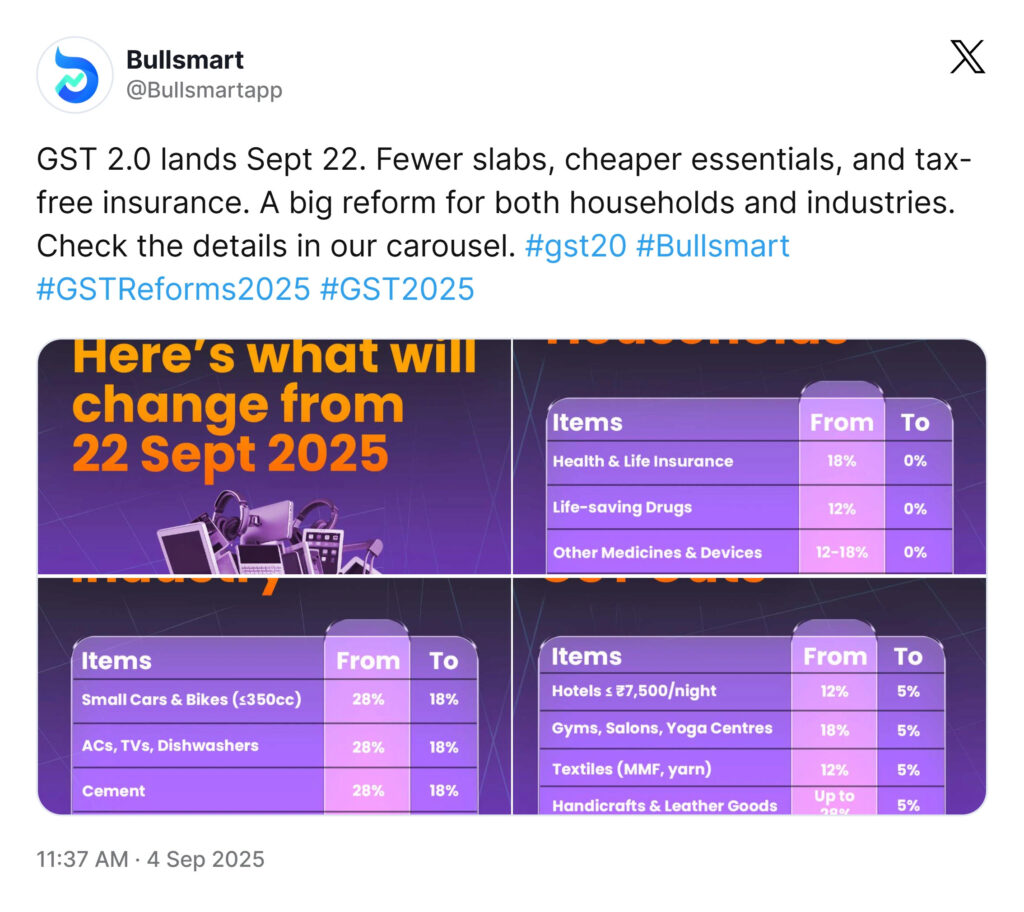

So, what exactly is different? To begin with, there are big rate cuts on essentials that impact your daily spending. Health and life insurance premiums, which earlier carried the Goods and Services Tax, are now completely exempt-a direct relief for families. The overall structure has also been simplified, which means small traders and entrepreneurs will find compliance less burdensome.

Why does it matter? Because these changes aren’t just about lower taxes. They directly affect your household budget, making groceries, medicines, and services more affordable. Insurance becomes easier to access, helping families secure their future. For businesses, lower costs and simpler rules can free up resources for growth, job creation, and investment.

In short, GST 2.0 promises to leave you with more savings while giving India’s economy a fresh push toward expansion.

What is GST 2.0?

GST 2.0 is India’s new, simplified GST regime approved at the 56th GST Council meeting in September 2025.

It rationalises the previous four-tier system into two main slabs: 5% (merit) and 18% (standard), with a special 40% de-merit rate for select luxury and sin goods.

The package cuts rates on hundreds of everyday items, from hair oil and soaps to bicycles and kitchenware; reduces 28% to 18% on ACs, TVs (≤32″), small cars and motorcycles; and lowers many agri, renewable-energy and healthcare inputs to 5% or nil.

Crucially, all individual life and health insurance policies (and related reinsurance) are now exempt from GST.

The Council also moved to fix inverted duty structures (textiles, fertiliser) and to operationalise the GST Appellate Tribunal.

Most changes take effect September 22, 2025, with tobacco-related items deferred.

Overall, GST 2.0 aims to lower consumer prices, ease compliance and stimulate demand-led growth for households and small businesses alike.

Why GST 2.0 Was Needed in 2025

Problems in the Old GST Framework

While the Goods & Services Tax unified India’s tax system in 2017, it had multiple challenges:

- Too many slabs (0%, 5%, 12%, 18%, 28%) made compliance confusing.

- High rates on essentials like soaps, toothpaste, and medicines burdened families.

- Inverted duty structures (inputs taxed higher than finished goods) caused losses for industries like textiles and fertilizers.

- Lack of easy dispute resolution created a backlog of cases.

The Push for Simplification

By 2025, businesses and taxpayers demanded:

- A simpler, citizen-friendly system.

- Relief for middle-class and rural households.

- Boost for manufacturing & exports.

This gave birth to GST 2.0, which is a Simplified, Growth-Oriented Tax System.

Major GST Rate Changes in Goods

GST 2.0 is not just about structure; it’s about immediate, visible relief on items that touch daily life and major sectors of the economy.

Relief for Households & Everyday Essentials

The Council has slashed rates on several items that find a place in every household:

- Hair oil, soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware, and other household articles: down from 12%/18% to 5%.

- UHT milk, paneer, and all Indian breads (roti, paratha, parotta, etc.): Goods and Services Tax reduced from 5% to NIL.

- Packaged namkeens, snacks, sauces, noodles, chocolates, coffee, butter, ghee, cornflakes: cut from 12%/18% to 5%.

For the common family, this directly reduces monthly spending. For FMCG and retail investors, it promises higher demand volumes, especially in smaller towns.

Suggested Read: Top FMCG Stocks to Invest in 2025 for Explosive Returns

Automobiles & Transport

The auto sector saw wide-ranging changes:

- Small cars and motorcycles ≤ 350cc: 28% → 18%.

- Buses, trucks, ambulances: 28% → 18%.

- Three-wheelers: 28% → 18%.

- Auto parts: uniform 18%, replacing the old 28% bracket.

This means affordable mobility for families, lower capital costs for transporters, and simplified taxation for manufacturers.

The table below showcases the updated details of the Goods and Services Tax changes in Automobiles & Transport:

| Vehicle Category | Old Rate | New Rate | Why It Matters |

| Cars ≤ 350 cc, motorcycles | 28% | 18% | Boosts small vehicle affordability |

| Buses, trucks, ambulances | 28% | 18% | Cuts logistics & healthcare costs |

| Three-wheelers | 28% | 18% | Helps small transport operators |

| Auto parts | 28% | 18% | Simplifies structure, lowers costs |

Data available is updated as of 03.09.25.

Suggested Read: EV Stocks in India Set to Soar in 2025: Top Picks You Can’t Miss

Fixing Inverted Duty Structures

- Textiles: manmade fibre reduced from 18 percent to 5 percent; manmade yarn reduced from 12 percent to 5 percent.

- Fertilizers: sulphuric acid, nitric acid, and ammonia reduced from 18 percent to 5 percent.

This correction ensures liquidity for manufacturers and strengthens export competitiveness.

Agriculture, Renewables, and Infrastructure

- Agricultural machinery such as tractors, threshers, and compost machines: reduced from 12 percent to 5 percent.

- Renewable energy devices and parts: reduced from 12 percent to 5 percent.

- Cement: reduced from 28 percent to 18 percent.

These cuts support farmers, renewable adoption, and lower housing and infrastructure costs.

Suggested Read: Top Monsoon Stocks to Watch in 2025: Sectors That Profit with the Rains

Hospitality and Wellness

- Hotel rooms priced up to Rs. 7,500 per night: reduced from 12 percent to 5 percent.

- Beauty and well-being services such as gyms, salons, barbers, and yoga centres: reduced from 18 percent to 5 percent.

Suggested Read: Top Pharma Stocks in India: 7 Powerful Picks to Watch in 2025

Special Provisions

- Tobacco products including pan masala, gutkha, cigarettes, bidi, zarda, and unmanufactured tobacco: GST to be levied on retail sale price instead of transaction value.

- A one-off exemption from IGST and cess for the import of an armoured sedan for the President of India.

GST Rate Changes in Services

Services Getting Cheaper

- Hotel accommodation priced at Rs. 7,500 or below per night: reduced from 12 percent to 5 percent.

- Gyms, salons, yoga, and wellness services: reduced from 18 percent to 5 percent.

Clarifications

Standalone restaurants cannot self-declare as “specified premises” to claim 18 percent with input tax credit.

Valuation Rules Updated

Lottery tickets and certain services: valuation rules aligned with new tax rates to ensure consistency.

Table: Goods and Services Tax Relief on Services

| Service Category | Old Rate | New Rate | Note |

| Hotels up to Rs. 7,500/day | 12% | 5% | Boosts tourism |

| Gyms, salons, yoga | 18% | 5% | Improves affordability |

| Stand-alone restaurants | – | – | Clarification issued |

Implementation Timeline

Most GST 2.0 changes take effect from September 22, 2025.

| Category | New Rates Apply From |

| All goods and services (general) | 22 Sep 2025 |

| Provisional refunds (IDS cases) | 1 Nov 2025 |

| GSTAT appeals start | End of Sep 2025 |

| GSTAT hearings | End of Dec 2025 |

| Backlog appeal deadline | 30 Jun 2026 |

| Tobacco and pan masala products | After cess repayment |

Institutional and Procedural Reforms

GST Appellate Tribunal (GSTAT)

- Appeals to be accepted by end of September 2025.

- Hearings to commence by end of December 2025.

- Backlog appeals allowed until June 30, 2026.

- Principal Bench to serve as the National Appellate Authority for Advance Ruling.

Refund Reforms

- 90 percent provisional refunds for inverted duty structure cases.

- Based on risk evaluation, similar to zero-rated supplies.

- Effective from November 1, 2025.

Process Reform

- FAQs and circulars will be issued to provide clarity.

- Additional facilitation measures to be notified later.

Why These Reforms Matter

For Citizens

- Lower costs for groceries, medicines, personal care, and wellness services.

- More affordable insurance coverage.

- Reduced expenses on travel and hospitality.

For Businesses and Investors

- Sectors such as auto, cement, textiles, fertilizers, FMCG, and pharma will benefit.

- Simplified structure reduces compliance burden.

- Faster refunds improve liquidity for exporters and manufacturers.

For Governance

- GSTAT provides a robust dispute resolution mechanism.

- RSP-based taxation on tobacco strengthens revenue collection.

- Balanced implementation protects fiscal stability.

Annexure Highlights

The PIB release included annexures with detailed item lists. Key takeaways include:

- Food: milk, paneer, breads at nil rate; packaged snacks at 5 percent.

- FMCG: soaps, toothpaste, hair oil at 5 percent.

- Pharma: lifesaving drugs at nil, others at 5 percent.

- Infrastructure: cement at 18 percent.

- Renewables: solar and wind devices at 5 percent.

- Services: hotels and wellness at 5 percent.

- Law and procedure: clarifications on post-sale discounts and valuation rules.

What Does the GST Council Meeting Outcome Mean for the Indian Stock Market?

The reforms announced in the 56th GST Council meeting are not just about cheaper goods and services, they also matter for investors. Here is how different sectors could be impacted:

- Autos and Infrastructure: Lower GST on small cars, two-wheelers, and cement can drive demand in auto, housing, and construction. Listed auto and cement stocks could benefit.

- FMCG: Everyday essentials like soaps, toothpaste, and food products now attract lower GST. This can boost consumption volumes, helping FMCG majors.

- Healthcare and Insurance: Cheaper medicines and GST-free life and health insurance may increase coverage and demand. Pharma companies, hospitals, and insurers could see tailwinds.

- Textiles and Fertilizers: Fixing inverted duty structures improves working capital flows and export competitiveness. This is positive for textile and agri-input firms.

- Renewables: Tax cuts on renewable energy devices align with India’s green targets and support renewable energy companies.

Overall, GST 2.0 signals a pro-growth policy stance. It encourages consumption, eases pressure on industries, and strengthens investor confidence in India’s medium-term equity outlook.

Bottom Line

GST 2.0 is more than just another tax tweak. It marks a real shift in how India’s indirect tax system works and feels for both citizens and businesses. For families, the changes are immediate and visible: lower grocery bills, cheaper medicines, and zero GST on health and life insurance premiums. These are the kinds of changes that make everyday living costs lighter.

For small businesses, the move to a simpler two-rate structure takes away much of the confusion that existed in the earlier multi-slab system. Compliance becomes easier, margins improve thanks to reduced input costs, and faster refunds mean cash flow problems ease up. The operationalisation of the GST Appellate Tribunal also signals that disputes will finally have a quicker, more reliable resolution channel.

From an economy-wide perspective, reform is growth-oriented. Sectors like autos, cement, textiles, renewables, and FMCG get a fresh demand boost, while investors see clear reasons to stay positive on India’s consumption story.

In short, GST 2.0 delivers on two fronts: direct relief for households and stronger competitiveness for industries. The real question now is, how quickly will these reforms translate into tangible growth on the ground?

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing.

FAQs

What is the difference between GST 1 and GST 2?

GST 1, introduced in 2017, had five slabs (0, 5, 12, 18, 28 percent) and left inverted duty issues unresolved. GST 2, rolled out in 2025, simplifies the system into two main rates (5 and 18 percent, plus a 40 percent demerit rate), exempts insurance, lowers rates on essentials, and fixes structural distortions.

What will come under 40% GST?

GST 1, introduced in 2017, had five slabs (0, 5, 12, 18, 28 percent) and left inverted duty issues unresolved. GST 2, rolled out in 2025, simplifies the system into two main rates (5 and 18 percent, plus a 40 percent demerit rate), exempts insurance, lowers rates on essentials, and fixes structural distortions.

Why is there 18% GST on health insurance?

The 40 percent GST slab applies to select demerit goods considered luxury or harmful, often referred to as “sin goods.” These typically include items such as pan masala, gutkha, cigarettes, and similar tobacco products. This higher rate is meant to discourage consumption while also generating revenue for government obligations under compensation cess.

What is the new GST rate?

GST 2.0 introduces a simplified structure with two primary slabs: 5 percent for merit goods and services, and 18 percent as the standard rate. A special 40 percent demerit rate continues for sin goods like tobacco. Alongside, many essentials such as food items, insurance, and lifesaving drugs are now either taxed at 5 percent or fully exempt.

Which stocks will benefit from GST cut?

The GST 2.0 rate cuts are expected to benefit sectors closely tied to consumption and infrastructure. Consumer goods companies may see stronger demand as essentials like soaps, toothpaste, and packaged food become cheaper. Automobiles and auto components could gain from lower taxes on small vehicles and parts, while cement and housing may see a boost from reduced construction costs. Healthcare and insurance stand to benefit through exemptions on policies and lower costs of medicines and medical devices, encouraging wider adoption. Textiles, fertilizers, and renewable energy also gain from duty corrections and tax reliefs that improve competitiveness. Overall, GST 2.0 supports demand recovery and reduces industry costs, creating a more favorable environment for economic growth and capital markets.