It happened again. In June 2025, oil price volatility struck again. This time, because of fresh tensions between Iran and Israel. Brent crude shot up past $81 a barrel, triggering volatility in global stock markets. In India, the Sensex slipped, and the rupee took a hit, falling to ₹86.75 against the dollar.

You might be thinking, what does oil have to do with the stock market? Well, quite a lot.

Oil is used in transport, factories, packaging, and more. So, when oil becomes expensive, many things around us also become costly. This hurts businesses, lowers their profits, and can pull down stock prices

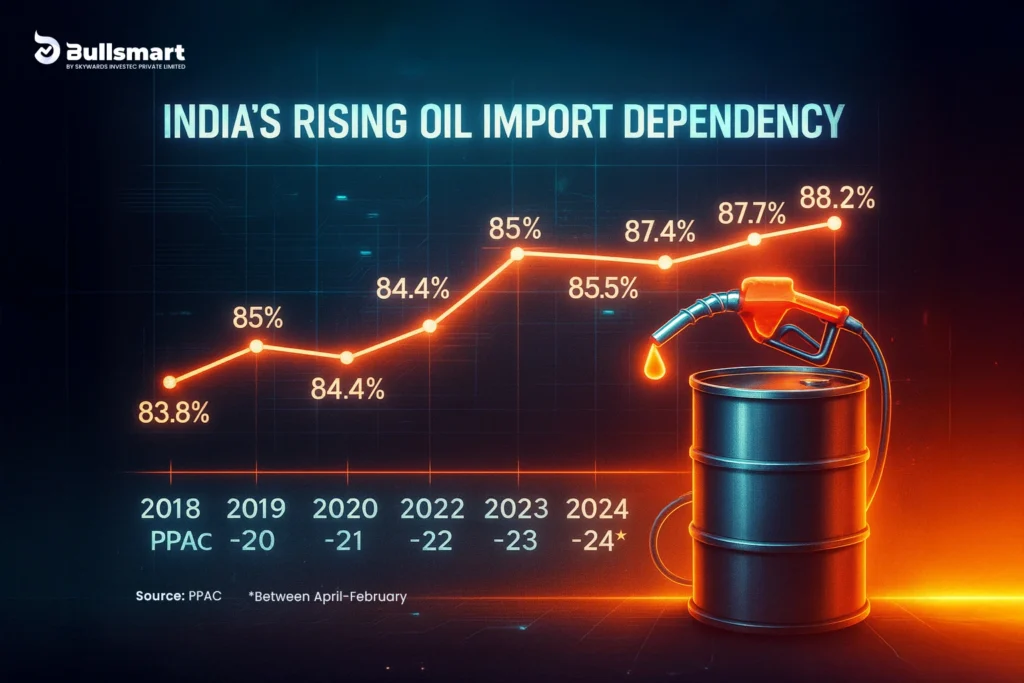

India depends on imports for nearly 88% of its crude oil. So, when global oil prices rise, it’s like our economy catches a cold. This clearly denotes that the oil price today affects the country’s overall pace of progress by a significant rate.

In this blog, we’ll walk you through how oil prices affect the Indian stock market in 2025 and what smart investors are doing to stay calm and stay ahead.

Let’s get started!

Understanding the Link Between Oil Prices and Stock Markets

Let’s break it down in simple terms, oil isn’t just fuel for your car or that flight you booked. It’s used in moving goods, powering machines, running factories, and even in making plastic. When crude oil price volatility hits, it doesn’t just affect fuel bills, it ripples across the entire economy. Higher oil volatility means higher costs for companies, tighter margins, and nervous investors.

Think about it: if a company has to spend more on transport and energy, their profits will naturally take a hit. And when profits drop, the stock prices usually don’t stay quiet for long, they start slipping.

But it doesn’t end there.

Rising oil prices also lead to higher inflation. That’s when everyday things,from food to fuel start costing more. To manage that, central banks may raise interest rates, which can slow down business growth even further.

Now imagine investors watching all this unfold. Many of them start to panic, sell off their stocks, or move money elsewhere. And just like that, markets turn choppy.

That’s how oil quietly pulls the strings behind stock market ups and downs.

India’s Oil Dependency in 2025: Why It Matters to Every Investor

When it comes to crude oil, India’s story is simple: we consume a lot, but produce very little. And in 2025, this imbalance has only grown. Whether it’s the global oil price shock, the rupee dipping, or the stock market reacting nervously, there’s one root trigger: our growing dependency on imported oil.

Let’s break this down using real numbers, recent events, and what they mean for everyday investors.

Record-Breaking Imports: We’re Buying More Oil Than Ever

In the financial year 2024–25, India imported 242.4 million tonnes (MT) of crude oil. That’s 4.2% more than the previous year despite global price drops, highlighting how exposed we are to crude volatility.

At the same time, our oil import dependency hit an all-time high of 89.1% in May 2025, up from 88.6% in March 2024.With 89.1% of our oil being imported, even slight volatility of crude oil prices puts us at serious risk.

Even though oil prices dropped a bit globally, our oil bill still went up to $161 billion from $156 billion last year. Why? Because we stocked up. With global tensions rising, our refiners didn’t want to take chances.

We’re Using More Oil, But Producing Less

While our imports are increasing, domestic oil production is falling. India produced just 28.7 MT of oil in FY25, down from 29.4 MT in FY24. In fact, our oil output has been dropping by around 3% every year since 2017.

Why is this happening? Older oil fields are drying up, and new oil discoveries have been slow. There are also technical and geographical challenges in extracting more oil.

Rising Demand: India’s Growing Fuel Appetite

At the same time, our energy needs keep rising. In 2025, total fuel consumption in India went up by 2.1% to touch 239.2 million tonnes. Here’s how that breaks down:

- Petrol demand jumped by 7.5%

- Diesel use rose by 2%

- LPG usage went up 5.6%

Why the spike? More travel, busy factories, early monsoons, a strong wedding season, and farmers getting back to work. All this activity means more energy is needed across the board.

Oil Politics: How the Israel-Iran Conflict Changed Our Buying Strategy

What’s Happening?

- Tensions between Israel and Iran have escalated.

- There are fears Iran may block the Strait of Hormuz, a crucial route through which about 25% of the world’s oil passes.

- If this happens, it could disrupt global oil trade and push prices up sharply; some say even to $400 per barrel.

How Is India Responding?

India isn’t waiting for a disruption to happen. It has quickly shifted gears, increasing oil imports from Russia and the United States to ensure supply remains stable and to avoid a major crisis in oil market volatility.

- From Russia: 2 to 2.2 million barrels/day

- From the U.S.: 439,000 barrels/day

Less Reliance on Middle East Route

- India’s Oil Minister Hardeep Singh Puri said that India has diversified its oil supply.

- That means less oil now comes through the Strait of Hormuz,making India less vulnerable to any blockage.

Reserves Are Strong, Routes Are Ready

Thankfully, India’s Oil Marketing Companies (OMCs) already have enough oil in storage to last several weeks.

Meanwhile, shipments continue through safer alternatives like the Suez Canal, Cape of Good Hope, and across the Pacific Ocean.

Russia Becomes a Safer Bet

Here’s why Russia has become a go-to supplier:

- It doesn’t rely on the Strait of Hormuz.

- It offers discounted rates post-Ukraine war sanctions.

- As of mid-June 2025, Russia now supplies 35% of India’s oil.

If the conflict gets worse, India is also likely to tap into sources like Nigeria, Angola, Brazil, and the U.S., though costs may be higher due to longer shipping distances.

Why It All Matters

Even though there hasn’t been any actual disruption yet, India is not taking any chances.

By diversifying suppliers, building reserves, and choosing safer shipping routes, the country is actively working to protect its energy security and prevent price shocks; not just for industries, but for everyday citizens at the petrol pump.

What Does All This Mean for the Rupee, Inflation, and Stocks?

This isn’t just oil talk, it hits where it hurts.

- The rupee weakens: Buying more oil = spending more dollars = rupee loses strength. It recently dropped to around ₹86.75 per USD.

- Prices go up: More expensive oil means higher costs for transport, food, and everyday goods. Inflation creeps in, and people start feeling the pinch.

- Markets get nervous: When oil prices surge, investors panic. In June 2025, the Sensex slipped about 1%, and volatility spiked to a six-month high.

Table: Comparison of Petrol, Diesel, and Crude Oil Prices in India (2004–2024), along with Total Taxes and Observed Price Responses

Global crude prices have seen huge ups and downs, but India’s petrol and diesel prices haven’t always followed the same path.

This table shows how fuel prices, taxes, and global oil trends moved over the last 20 years—and how retail prices often stayed high even when crude fell.

| Year | Avg Petrol Price (₹/Litre) | Avg Diesel Price (₹/Litre) | Avg Crude Oil Price ($/Barrel) | Total Taxes (₹/Litre) | Petrol Down When Crude Down | Diesel Down When Crude Down |

| 2004 | 33.71 | 22.74 | 37.66 | 14 | – | – |

| 2005 | 37.84 | 28.46 | 50.04 | 15 | – | – |

| 2006 | 40.62 | 30.48 | 58.3 | 16 | – | – |

| 2007 | 43.52 | 31.76 | 64.2 | 17 | – | – |

| 2008 | 50.62 | 37.94 | 99.67 | 18 | – | – |

| 2009 | 47.93 | 36.31 | 61.74 | 17 | Yes | Yes |

| 2010 | 51.83 | 40.02 | 79.61 | 18 | – | – |

| 2011 | 63.77 | 48.67 | 111.26 | 22 | – | – |

| 2012 | 68.57 | 53.13 | 111.63 | 23 | – | – |

| 2013 | 72.26 | 53.75 | 108.56 | 24 | No | No |

| 2014 | 72.43 | 54.91 | 96.29 | 25 | No | No |

| 2015 | 60.5 | 46.09 | 49.49 | 22 | Yes | Yes |

| 2016 | 64.38 | 50.57 | 40.76 | 23 | No | No |

| 2017 | 69.99 | 58.03 | 54.25 | 24 | – | – |

| 2018 | 78.52 | 67.11 | 71.34 | 26 | – | – |

| 2019 | 73.83 | 64.32 | 64.33 | 25 | Yes | Yes |

| 2020 | 80.43 | 70.17 | 39.68 | 27 | No | No |

| 2021 | 95.41 | 85.38 | 70.68 | 30 | – | – |

| 2022 | 95 | 86.38 | 100 | 30 | – | – |

| 2023 | 98 | 89.54 | 85 | 31 | No | No |

| 2024 | 100 | 90 | 90 | 32 | – | – |

Note: Crude oil in USD/barrel; fuel prices in ₹/litre. ‘Yes/No’ shows if Indian fuel prices dropped when crude did. It highlights how taxes and policy often keep pump prices elevated.

This long-term trend helps explain why rising crude prices often hit Indian consumers and industries harder and why sectors linked to fuel costs react so quickly in the stock market.

Top Oil Stocks in India (2025)

Displayed in the table below are some of the top oil stocks in India that you can check out, given your investment plans:

| Name of the Stock | Market Cap (in Cr.) | CMP | P/E Ratio | Div. Yield |

| O N G C | 305700.74 | 243 | 8.45 | 5.07 |

| Oil India | 71700.89 | 440.8 | 10.93 | 2.38 |

| Aegis Vopak Term | 27838.29 | 251.25 | 218.81 | 0 |

| Prabha Energy | 4066.09 | 297 | – | 0 |

| Deep Industries | 2867.52 | 448.05 | 21.43 | 0.55 |

| Hind.Oil Explor. | 2272.6 | 171.85 | 15.45 | 0 |

| Jindal Drilling | 1877.73 | 647.95 | 8.68 | 0.08 |

| Dolphin Offshore | 1636.79 | 409.15 | 35.22 | 0 |

| Asian Energy | 1364.73 | 304.8 | 32.4 | 0 |

| Selan Expl. Tech | 1051.85 | 692 | 14.21 | 0 |

Data available is updated as of 26.06.25.

Which Sectors Get Hit the Hardest When Oil Prices Rise?

When oil prices surge, they don’t just pinch consumers at the petrol pump, they squeeze entire industries. And in India, where we import over 89% of our crude oil needs, the impact is felt even more sharply across multiple sectors.

Let’s break down the key industries most vulnerable to rising crude prices, and why they tend to suffer the most.

Oil Marketing Companies (OMCs)

Companies impacted: HPCL, BPCL, IOC

These companies buy crude oil, refine it, and sell products like petrol and diesel. But when oil prices shoot up, their costs rise too. The tricky part? They can’t always pass those higher costs on to customers because of government regulations on fuel prices. This eats into their profits.

Real impact: In June 2025, when tensions between Iran and Israel pushed crude prices above $80/barrel, stocks of these companies fell. Investors were worried their profit margins would shrink.

Aviation

Companies impacted: IndiGo (InterGlobe Aviation), SpiceJet, Jet Airways, Global Vectra

Fuel is a huge expense for airlines, around 25–30% of their total costs. So, when oil gets expensive, flying becomes costlier. Airlines may try to hike ticket prices, but that doesn’t always work, and profits take a hit.

Plus, when conflicts close key air routes (like over Iran or Pakistan in 2025), flights get longer and burn more fuel. Plus, aviation stocks were already under pressure due to recent safety concerns (e.g., Air India’s Boeing 787 incident). A crude price surge only adds to their woes.

Suggested Read: Top Defense Stocks to Invest in 2025 for Explosive Growth

Paints

Companies impacted: Asian Paints, Berger Paints, Kansai Nerolac

Making paints involves crude oil-based ingredients like solvents and resins. These can make up over 50% of the manufacturing cost. So, when oil prices climb, input costs surge.

Paint companies either absorb the hit or try to raise prices but in a competitive market, that’s not always easy. Many firms saw their profit margins drop in early 2025 because of rising raw material costs.

Automobiles

Companies impacted: Maruti Suzuki, Tata Motors, Mahindra & Mahindra, Bajaj Auto, Eicher Motors

This industry feels pain in two ways:

- Production costs go up because they use oil-based materials like plastics, tyres, and paints.

- Customer demand may go down because rising fuel prices make car and bike usage more expensive.

In a price-sensitive market like India, passing extra costs to buyers can backfire. As a result, auto companies often see slower sales and tighter margins during oil price spikes.

Chemicals, Petrochemicals & Fertilizers

Companies impacted: Deepak Nitrite, Tata Chemicals, Supreme Petrochem, Chambal Fertilisers, SRF

These sectors use crude oil and natural gas as raw materials. For instance, oil gets processed into key ingredients like ethylene and benzene, which are used to make plastics and rubbers. Fertilizer makers depend on gas-based chemicals too.

When oil becomes expensive, the cost of making these products also rises. Companies either see profits shrink or have to raise prices, which might reduce demand.

Tyres & Auto Parts

Companies impacted: MRF, Apollo Tyres, CEAT, Balkrishna Industries

Tyres are mostly made using synthetic rubber, a crude oil product. So, rising oil prices directly raise manufacturing costs. At the same time, if the auto industry slows down (due to fuel cost hikes), demand for new tyres also dips.

It’s a double whammy, higher costs and lower demand can drag these stocks down.

These industries are among the most sensitive to crude oil price volatility, and even a $5 per barrel jump can significantly alter their quarterly profits.

How Oil Price Volatility Impacts the Rupee, Inflation, and Market Mood

When oil prices go up suddenly, it’s not just your fuel bill that takes a hit. It can shake up the entire economy from the strength of the rupee to stock market sentiment. Let’s break down what’s been happening in 2025 and what it means for investors like you.

The Rupee Feels the Heat

India pays for its oil in US dollars. So, when oil becomes more expensive, the country has to spend more dollars to import the same amount of crude. This puts pressure on the rupee, which tends to weaken against the dollar.

That’s exactly what happened in June 2025. As crude oil prices spiked due to tensions in the Middle East, the rupee dropped to ₹86.86 per dollar before stabilizing at ₹86.75 due to a spike in crude oil daily volatility.

According to traders, the RBI even stepped in, likely selling dollars to prevent the rupee from slipping further.

Key Stats

- The rupee traded between ₹86.66 and ₹86.86 in a single day (June 24, 2025).

- Brent Crude hit a 5-month high of $81.40, before cooling to $77.40.

- Rising crude = higher dollar demand from Indian oil companies = weaker rupee.

Higher Oil = Higher Inflation

Crude oil plays a big role in everyday costs; be it transportation, manufacturing, food delivery, or packaging. So when oil prices jump, these costs also go up.

That’s called imported inflation, and India, being a major oil importer, is very sensitive to it.

What experts are saying?

“With every $10 rise in oil prices, India’s current account deficit could widen by 0.4% of GDP.”

–MUFG Bank, June 2025

India’s CAD (Current Account Deficit) was just 1.1% of GDP in Q3 FY24. But if crude prices stay high, it could exceed 2%, putting pressure on public finances and forcing policy action.

Market Mood Turns Cautious

It’s not just the rupee. Stock markets also took a hit in mid-June 2025. Rising crude prices, along with global jitters, spooked investors.

June 12, 2025

- Sensex dropped 823 points (–1%) to close at 81,691.98

- Nifty 50 fell 253 points to settle at 24,888.20

Investors pulled back from risky assets. Analysts said this was a “risk-off” reaction to fears of inflation, global conflict, and weakening currencies in emerging markets like India.

RBI May Step In

If inflation rises and the rupee continues to weaken, the RBI may raise interest rates to manage price stability.

While this helps control inflation, it also makes loans costlier and can slow down economic growth, which again affects investor confidence.

Smart Investment Strategies During Oil Price Volatility

Oil prices are unpredictable. They can surge overnight due to a geopolitical conflict or crash suddenly after an OPEC announcement. For Indian investors; this volatility doesn’t just affect fuel prices, it shakes up the stock market, the rupee, and inflation.

So how do you protect your portfolio or even grow it when oil prices are all over the place? Let’s look at a few practical strategies.

Suggested Read: Geopolitical Events: The Profound Shockwaves Shaping Financial Markets in 2025

Diversify Across Sectors

Don’t put all your money into sectors that are sensitive to oil; like airlines, autos, paints, or chemicals. Instead, spread your investments into sectors less tied to crude oil volatility

Balance high-risk sectors with more stable ones like:

- IT and Pharma: Less dependent on oil, often benefit from a weaker rupee.

Suggested Read: Top Pharma Stocks in India: 7 Powerful Picks to Watch in 2025 - Banking: Can gain during stable rate cycles.

- Upstream Oil Stocks: ONGC, Oil India often gain when crude rises.

Look for Margin Gainers During Crude Falls

When oil prices fall, some businesses benefit as their raw materials or transport costs go down. These margin gains can lead to stock price upticks.

Watch out for:

- FMCG players (e.g., HUL, Dabur)

- Paint stocks (e.g., Asian Paints, Berger)

- Tyre companies (e.g., Apollo Tyres, CEAT)

- Aviation stocks (e.g., IndiGo) during short-term crude corrections

Use Defensive Assets as a Cushion

When markets are nervous due to oil price shocks, investors often turn to “safe havens”:

- Gold: Tends to perform well when inflation is rising or the rupee is weakening.

- Short-term debt funds or liquid funds: Help park cash during uncertainty.

- Multi-asset mutual funds: Give automatic diversification across equities, debt, and commodities.

Keep an Eye on Currency-Exposed Opportunities

A weakening rupee isn’t always bad news.

- Exporters (like IT companies or specialty chemical firms) often benefit from a weaker rupee as they earn in dollars.

- Global ETFs or US-focused mutual funds may gain in INR terms when the rupee falls.

Add global exposure through mutual funds or ETFs (like Nasdaq 100 or S&P 500-based funds) as a currency hedge.

Explore Alternative Investments (Low Drama, Decent Returns)

When traditional investments falter, alternative investments can offer peace of mind.

Here are a few that stand out:

Corporate Bonds

Companies borrow money through bonds and pay you fixed interest. It’s like giving a loan to a business and earning interest. Some corporate bonds offer returns as high as 9–14% annually.

SDIs and Baskets

Think of Securitised Debt Instruments (SDIs) as a basket of loans; you get exposure to multiple loans, reducing your risk. Baskets, on the other hand, allow you to invest across different assets like bonds and SDIs together. It’s like a buffet of stable returns.

Money Market Instruments

These are short-term, low-risk instruments often used by the government or large institutions. You can access them through money market mutual funds, which offered an average return of around 7.4% over one year in 2025.

Avoid Emotional Trading

It’s tempting to react quickly when crude spikes or the Sensex drops. But most of the time, sudden panic-selling or buying doesn’t work out well.

Stick to your long-term asset allocation and make gradual portfolio adjustments based on market signals, not emotions.

Suggested Read: Best Ways to Make Money with AI: Step-by-Step Guide (2025)

Final Thoughts

Crude oil prices are more than just numbers flashing on a business channel. They ripple through everything from our grocery bills to our investments. In 2025, with geopolitical tensions running high and oil markets on edge, it’s clear that what happens halfway across the world can shake up portfolios back home in India.

But here’s the good news: understanding what’s happening is already half the battle.

By understanding how oil price swings affect the stock market, the rupee, inflation, and various sectors, you’re already a step ahead of most investors. And by diversifying your portfolio, across traditional and alternative investments, you can cushion yourself against the worst shocks.

Oil prices will always go up and down. That’s out of our control. But how do we respond? That’s completely in our hands.

So breathe easy, stay informed, and invest wisely. Because in a world full of noise, clarity is your biggest asset.

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

What happens to the stock market if oil prices go up?

When oil prices rise, stock markets often respond negatively. This is because higher oil prices increase inflation expectations and production costs for companies, which reduce profit margins and lower future earnings projections. Investors become more uncertain, demanding higher risk premiums, which further pushes stock prices down. Sectors like energy may benefit, but most others, especially cyclical ones, tend to suffer.

What happens if crude oil prices go up in India?

When crude oil prices rise in India, it negatively impacts Oil Marketing Companies (OMCs) like HPCL, BPCL, and IOC by increasing their input costs and shrinking profit margins. Sectors such as aviation, paints, and tyres also suffer due to higher expenses. However, upstream oil companies like ONGC and Oil India benefit, as their revenues rise with each dollar increase in oil prices.

Is India to lead global oil demand growth in 2025 surpassing China?

Yes, India is poised to become the world’s leading driver of oil demand growth in 2025 and beyond, according to Moody’s Ratings. As China’s oil consumption approaches its peak, India’s expanding economy, rapid industrialisation, and infrastructure boom are expected to fuel a 3-5% annual rise in demand, firmly placing India at the center of global oil market growth.

Which stocks benefit from higher oil prices?

Upstream oil companies like ONGC and Oil India benefit from higher crude oil prices. According to JM Financial, every $1 per barrel increase in crude boosts their earnings per share (EPS) by 1.5–2%. With no current cap on their crude realisation and supportive policy reforms, rising oil prices directly enhance their profitability and growth prospects.