The Bharat Coking Coal IPO’s gearing up to make headlines in 2025, and it’s more than just another public issue; it’s a big step in India’s energy and economic game plan.

As a major arm of Coal India Limited, Bharat Coking Coal Limited (BCCL) plays a key role in supplying coking coal, the stuff that keeps steel plants running.

The Bharat Coking Coal IPO comes at a time when the government is focused on privatization, unlocking value from PSUs, and boosting capital market participation. With BCCL (along with its Bharat Coking Coal IPO) stepping into the stock market, it’s clear the Centre is serious about turning strategic assets into public investment opportunities.

Why does this matter?

Because coking coal isn’t your average coal; it’s essential for steel production, and steel demand in India is expected to grow by 7.5% annually. Backed by huge reserves and a prime location, BCCL is perfectly positioned to ride that wave.

Let’s dive into the nitty-gritty of it!

Bharat Coking Coal IPO Key Details

With Bharat Coking IPO lurking around the entry gates of the IPO world, here are the details available at present:

| Particulars | Details |

| Bharat Coking Coal IPO Type | 100% Offer for Sale (OFS) by Coal India Limited |

| Bharat Coking Coal IPO Total Shares Offered | Up to 46.57 crore equity shares |

| Bharat Coking Coal IPO Face Value | ₹10 per share |

| Bharat Coking Coal IPO Price Band | To be announced |

| Bharat Coking Coal IPO Lot Size | To be announced |

| Bharat Coking Coal IPO Issue Size | Based on the final price band |

| Bharat Coking Coal IPO Opening Date | To be announced |

| Bharat Coking Coal Closing Date | To be announced |

| Bharat Coking Coal IPO Listing Exchange | BSE and NSE |

| Bharat Coking Coal IPO Book Running Lead Managers | IDBI Capital and ICICI Securities |

| Bharat Coking Coal IPO Registrar | KFin Technologies Ltd. |

Data available is as of 05.06.25.

Being a 100% OFS, all proceeds from BCCL IPO will go to Coal India, not BCCL. There is no fresh issue component, meaning no new shares are being created.

Bharat Coking Coal IPO Objectives and Utilization of Funds

As a 100% Offer for Sale (OFS):

- No capital will be raised for the company.

- The entire proceeds will be credited to the parent, Coal India Limited.

- The objective is to:

- Enhance transparency and governance.

- Enable market-based valuation discovery.

- Provide retail and institutional investors access to India’s strategic coal assets.

- Enhance transparency and governance.

This also supports the government’s broader disinvestment target of ₹1 lakh crore for FY 2025.

Bharat Coking Coal IPO GMP Day Wise Trend Analysis

As of now, GMP for the Bharat Coking Coal IPO has not surfaced in the grey market.

However, based on recent PSU IPO trends such as Indian Renewable Energy Development Agency (IREDA), Coal India’s own IPO legacy, and IRCTC, investors are likely to show keen interest.

Historically, PSU IPOs backed by strong fundamentals and profitability have seen positive GMP activity closer to listing. For instance:

- IREDA’s IPO listed at 56% premium.

- Coal India’s IPO in 2010 was oversubscribed 15 times.

A rising GMP closer to the Bharat Coking Coal IPO date would indicate strong market confidence, especially considering BCCL’s strategic reserves and profitability.

About Bharat Coking Coal Limited (BCCL)

History & Ownership

Incorporated in 1972, Bharat Coking Coal Limited (BCCL) is a wholly-owned subsidiary of Coal India Limited.

The company is primarily engaged in the production of coking coal, along with non-coking and washed coal, catering mainly to the steel and power sectors.

Operational Footprint

As of March 31, 2025, BCCL operates 32 mines, including 25 opencast, 3 underground, and 4 mixed mines, spread across Jharia in Jharkhand and Raniganj in West Bengal. Its leasehold area spans 288.31 sq. km.

The company also manages coal washeries and is advancing projects through models like WDO (Washery Developer & Operator), MDO (Mine Developer & Operator), and solar monetisation.

Production & Market Share

In FY2025, BCCL produced 40.50 million tonnes of coal, including 39.11 million tonnes of coking coal and 1.99 million tonnes of non-coking coal.

It accounted for 58.5% of India’s total coking coal production, reinforcing its leadership in the sector.

Reserves

As of April 1, 2024, Bharat Coking Coal Limited holds approximately 7,910 million tonnes of geological coking coal reserves.

Strategic Importance of BCCL

Bharat Coking Coal Limited’s strong positioning is backed by:

- Being India’s largest coking coal producer

- Strategically located mines and large washeries

- Robust demand from steel production

- Consistent performance and strong backing from Coal India Limited

Bharat Coking Coal Limited’s Financial Performance

A glance at a company’s financials, that is planning to launch an IPO can give you an idea about how the IPO and its potential performance in the stock market post IPO can look like.

Between FY2024 and FY2025, Bharat Coking Coal Limited (BCCL) saw a modest 1% rise in revenue but a 21% dip in profit after tax (PAT), reflecting cost pressures or operational challenges despite stable topline performance.

Here’s a snapshot of BCCL’s key financial metrics over the last three fiscal years (amounts in ₹ crore):

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 17,283.48 | 14,727.73 | 13,312.86 |

| Revenue | 14,597.53 | 14,452.01 | 13,691.24 |

| Profit After Tax | 1,240.19 | 1,564.46 | 664.78 |

| Net Worth | 6,551.23 | 5,355.47 | 3,791.01 |

| Reserves and Surplus | 1,805.73 | 664.72 | -853.1 |

| Total Borrowing | 0 | 0 | 0 |

| Amount in ₹ Crore | |||

Data available is as of 05.06.25.

Return Ratios

- ROCE: Improved from 16.56% (FY23) to 30.13% (FY25)

- RONW: Ranged between 19–34%, indicating efficient capital use

BCCL’s margin expansion and net profitability in FY2024 were attributed to operational improvements and higher coal realization prices.

Financial Observations

- BCCL’s income grew just a little in FY2025, but its profits dropped by 21%, likely because its costs went up or earnings didn’t improve as much.

- The company’s overall financial strength improved; its savings (reserves) more than doubled, and its total value (net worth) went up by over ₹1,000 crore in a year.

- Even without taking any loans, BCCL gave strong returns, meaning it used its money wisely and stayed profitable.

Strengths and Risks of BCCL

Key Strengths

- Dominant Market Player: Largest producer of coking coal in India.

- Strategic Reserves: Over 7.91 billion tonnes of high-quality reserves.

- Coal India Backing: Institutional credibility and scale benefits.

- Washeries and Logistics: Integrated supply chain from mining to delivery.

- Strong Financial Track Record: Growing profitability and improving margins.

Potential Risks

- Regional Dependency: Over-dependence on mines in Jharia and Raniganj.

- Contractor Reliance: Outsourcing of key operations can lead to cost fluctuations.

- Energy Costs: High power and diesel dependency could affect margins.

- Legal Liabilities: Pending litigation risks worth ₹192.23 crore could impact valuation.

- Environmental Policy Exposure: Stricter climate controls may impact mining licenses and production.

Peer Comparison

Here’s how BCCL stacks up against other coal-sector players:

| Company | FY25 Revenue (₹ Cr) | Net Profit (₹ Cr) | ROCE (%) | RONW (%) |

| BCCL | 13,998.45 | 1,240.19 | 30.13 | 20.83 |

| Coal India | 1,33,000+ | 28,125 | 45.5 | 36.7 |

| NLC India | 14,000 | 1,315 | 19.4 | 16.5 |

| Singareni | 26,000 | 2,005 | 24.1 | 22.3 |

Data available is as of 05.06.25.

While Coal India remains the largest, BCCL’s niche in metallurgical coal and healthy margins give it a competitive edge.

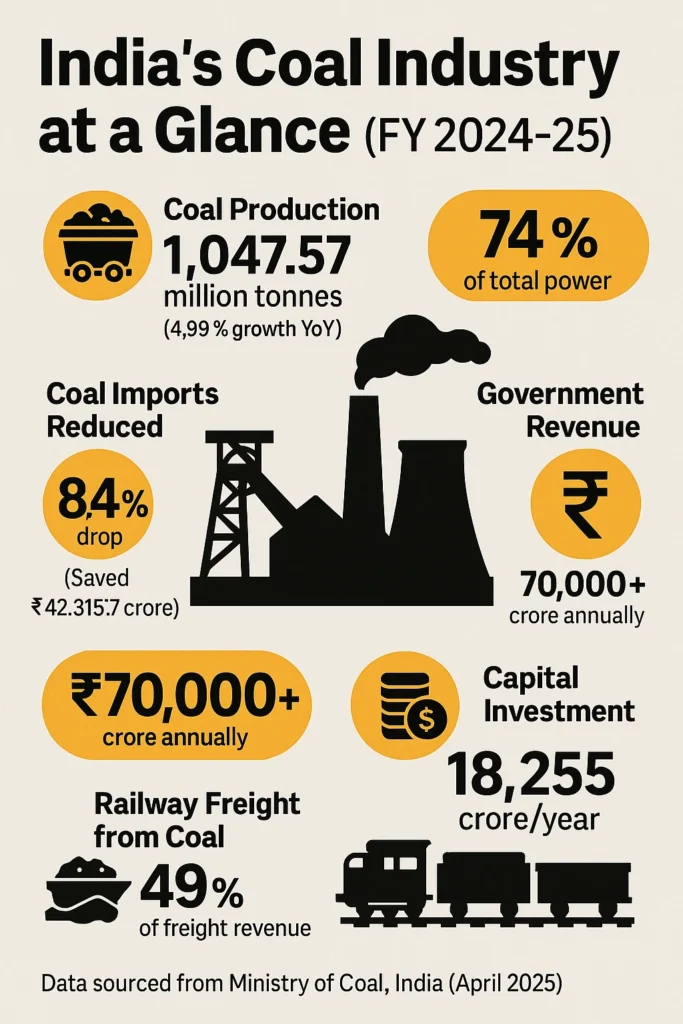

India’s Coal Industry Worth

As of April 2025, India’s coal industry hit a huge milestone by producing over 1 billion tonnes of coal in a year, which is a big jump from last year and shows how important coal still is for the country.

This boost in production means India is relying less on coal imports, saving a lot of money and becoming more energy independent.

Coal powers around 74% of India’s electricity, so it keeps the lights on for millions of homes and businesses. It’s also a major part of industries like steel and cement.

Plus, coal plays a huge role in India’s railways, making up almost half of all freight income, which helps keep trains running and goods moving across the country.

The coal sector brings in over ₹70,000 crore every year through taxes and royalties, helping fund roads, schools, and other important projects.

The government is also investing big in new tech like coal gasification to make coal cleaner and more useful for things like fertilizers and fuel.

How to Apply for the BCCL IPO

Here’s how you can apply for the Bharat Coking Coal Limited IPO easily:

Option 1: Apply via ASBA (Net Banking)

Option 2: Apply via UPI

Important Points to Keep in Mind

- You must have a valid PAN card to apply.

- Make sure you have enough funds in your linked bank account until the IPO allotment is complete.

- You can check your allotment status on KFintech or the NSE/BSE websites

We’ll update you with key dates like IPO opening and listing as soon as they’re announced, so stay tuned!

Bharat Coking Coal IPO: Invest or Skip?

Who Should Consider Investing in the Bharat Coking Coal IPO?

- If you’re planning to invest for the long term and believe India’s steel industry will keep growing, this could be a good pick.

- If you want to own a part of a big government company with a strong position in the coal business, this IPO gives you that chance.

- If you like safer, steady businesses that are important for India’s infrastructure, BCCL fits the bill.

- If you’re a value investor who wants to invest in a company with huge coal reserves and solid backing, this might interest you.

Who Should Be Careful or Skip Bharat Coking Coal IPO?

- If you’re looking for quick profits or short-term gains, this might not be the best choice because it’s a 100% offer for sale, meaning no fresh money is coming into the company.

- If you don’t like risks, keep in mind BCCL depends on coal mines in specific regions, faces rising costs, and must deal with environmental rules and legal issues.

- If you’re worried about the future of coal with more focus on clean energy, you might want to stay away for now.

- If you want high-growth or flashy tech stocks, coal is more of a steady, slow-grower, so this won’t be very exciting.

- And if you’re not sure how PSUs or the coal industry work, it’s better to learn more before investing.

Bottom Line

So, what’s the takeaway on Bharat Coking Coal IPO? It’s a solid opportunity if you’re thinking long-term and want to tap into India’s steel and energy backbone.

With its huge coal reserves, strategic location, and strong government backing, BCCL is a heavyweight in the coking coal game, a key ingredient for steel production that India desperately needs as the country grows.

But remember, this isn’t a quick-win kind of IPO. Since it’s a 100% offer for sale with no fresh money coming into the company, short-term traders might want to sit this one out.

Plus, the coal sector faces challenges like rising costs, environmental rules, and a push towards cleaner energy, so it’s definitely not risk-free.

If you’re cool with all that and believe in the steady growth story of coal powering India’s industries, then keep an eye on this IPO. It could be a smart way to add a strategic, stable stock to your portfolio.

Stay tuned for the official dates and price band! This one’s worth watching 😉

Suggested Read: Groww IPO GMP, DRHP Filing, Date, Price, 7 Billion Dollar (~₹58,100 crore) Valuation and Important Details

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

FAQs

What was coal india IPO listing price?

Coal India’s Initial Public Offering (IPO) was priced at ₹245 per share, which was the upper limit of its price band. The IPO opened on October 18, 2010, and closed on October 21, 2010.

On its listing day, November 4, 2010, the shares debuted at ₹287.75 on the Bombay Stock Exchange (BSE), marking a 17.5% premium over the issue price. The stock closed at ₹342.60, delivering a 40% gain on the first day of trading.

Who is the owner of Bharat Coking Coal Limited?

Bharat Coking Coal Limited (BCCL) is a wholly-owned subsidiary of Coal India Limited (CIL), which is a public sector undertaking under the Ministry of Coal, Government of India.

CIL is the world’s largest coal-producing company, and BCCL operates under its administrative control.

Is Bccl a public or private company?

BCCL is a public sector undertaking (PSU). It was incorporated in January 1972 to operate coking coal mines in the Jharia and Raniganj coalfields, which were nationalized by the Government of India.

As a PSU, BCCL is owned and managed by the government through its parent company, Coal India Limited.

What is the revenue of Bharat Coking Coal Limited?

For the fiscal year 2024 – 25, BCCL reported a revenue from operations of ₹13,998.45 crore.

The company also achieved a net profit of ₹1,240.19 crore during the same period.