The Aegis Vopak Terminals Limited IPO is making its way to the markets on May 29, 2025, and it’s one you might want to keep on your radar.

With a stronghold in India’s liquid and gas storage infrastructure, Aegis Vopak plays a behind-the-scenes yet critical role in the supply chains of petroleum, chemicals, and LPG.

Curious if this IPO is worth your attention or your money? That’s exactly what we’re diving into.

In this piece, you’ll find everything stripped down to the essentials. No overcomplicated financial jargon, just clean, clear insights.

We’ll walk you through the latest GMP buzz, key dates for subscription, how the company plans to use the funds it raises, and what makes its business model tick.

Plus, we’re not skipping the fine print, as risk factors are part of the conversation too.

Whether you’re a cautious beginner or someone who scans IPOs for their next big opportunity, this breakdown is designed to help you make sense of the Aegis Vopak Terminals Limited IPO review with clarity, confidence, and a little less confusion.

Aegis Vopak Terminals Limited IPO Key Details

Here’s a snapshot of everything you need to know about Aegis Vopak Terminals Limited IPO price:

| Details | Information |

| Aegis Vopak Terminals Limited IPO Opening Date | May 29, 2025 |

| Aegis Vopak Terminals Limited IPO Closing Date | May 31, 2025 |

| Aegis Vopak Terminals Limited IPO Allotment Finalization | June 3, 2025 |

| Aegis Vopak Terminals Limited IPO Tentative Listing Date | June 6, 2025 |

| Aegis Vopak Terminals Limited IPO Face Value | ₹2 per share |

| Aegis Vopak Terminals Limited IPO Price Band | ₹93 to ₹98 per share |

| Aegis Vopak Terminals Limited IPO Lot Size | 150 shares |

| Aegis Vopak Terminals Limited IPO Minimum Retail Investment | ₹14,700 |

| Total Issue Size | ₹600 crore (Offer for Sale) |

| Issue Type | Book Building (OFS) |

| Listing Platforms | NSE, BSE |

| Registrar | Link Intime India Pvt Ltd |

| Book-running Lead Managers | Axis Capital, DAM Capital, ICICI Securities |

| Market Capitalization (Est.) | ₹4,868 crore |

Data available is as of 23.05.25.

Aegis Vopak Terminals IPO GMP Day-wise Trend Table

Here’s what the grey market buzz looks like so far:

| Date | IPO GMP (₹) | GMP Trend |

| 23 May 2025 | – | – |

| 22 May 2025 | – | – |

| 21 May 2025 | – | – |

Data available is as of 23.05.25.

Note: GMP (Grey Market Premium) hasn’t shown movement yet. Stay tuned for updates as the IPO date approaches; GMP can often hint at listing-day sentiment.

Why Aegis Vopak Terminals Limited is Raising Money Through the IPO?

- The IPO is a pure Offer-for-Sale (OFS), which means no new money is being raised by the company.

- Instead of the company receiving funds, existing shareholders are selling some of their stake to the public.

- The proceeds from the IPO will go directly to these selling shareholders, not into the company’s bank account.

- This usually happens when the company is already doing well and doesn’t need extra capital right now.

- For investors, this setup can still be appealing; especially if they believe in the company’s long-term potential, even without immediate business expansion plans.

Company Overview: Aegis Vopak Terminals Limited

Launched in 2023 as a powerhouse joint venture between India’s Aegis Logistics Ltd and global giant Royal Vopak (Netherlands), Aegis Vopak Terminals Limited has quickly become India’s largest independent platform for liquid and gas storage and logistics.

Here’s what sets them apart:

- A robust network of 15 terminals spread across 5 strategic ports.

- A massive combined storage capacity of 1.24 million kiloliters.

- Prime operational footprint in crucial hubs like Mumbai, Haldia, Kandla, Mangalore, and Kochi.

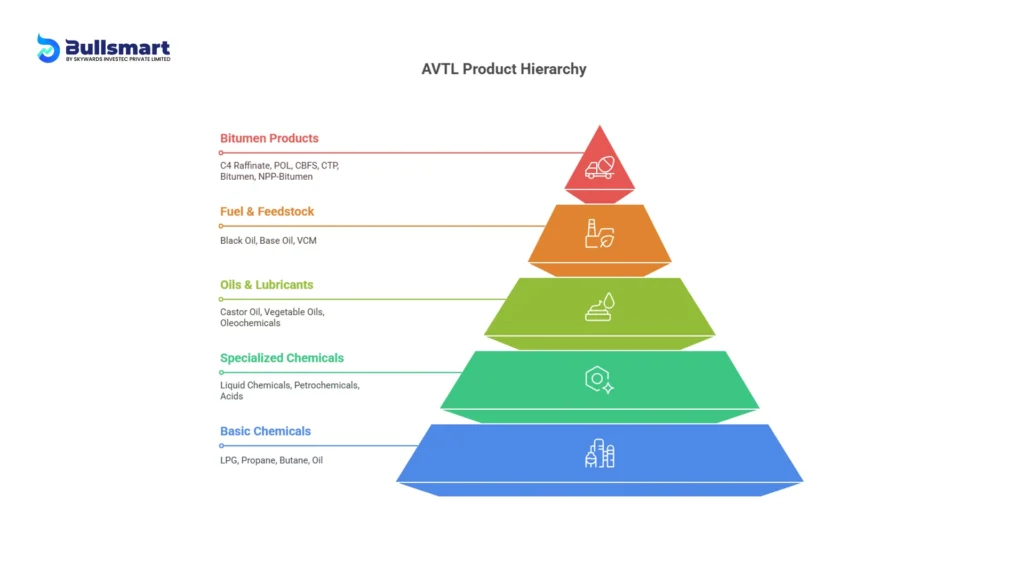

Industries Served by Aegis Vopak Terminals Limited: Oil & gas, chemicals, LPG, petrochemicals, and specialty chemicals.

Why does Aegis Vopak Terminals Limited stand out?

- Leverages cutting-edge global technology from Vopak paired with deep local expertise from Aegis.

- Operates on an asset-light, long-term contract model that’s both efficient and scalable.

- Plays a vital role in powering India’s energy supply chain and trade ecosystem.

In short, Aegis Vopak isn’t just a logistics company; they’re the silent force fueling India’s energy and industrial growth.

Financial Performance Snapshot

Here’s how Aegis Vopak Terminals Limited has performed financially in recent years:

| Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 5,855.60 | 4,523.40 | 3,481.48 | 102.56 |

| Revenue | 476.15 | 570.12 | 355.99 | 0 |

| Profit After Tax | 85.89 | 86.54 | -0.08 | -1.09 |

| Net Worth | 2,037.61 | 1,151.94 | 1,098.20 | -0.53 |

| Reserves and Surplus | 0 | 0 | 0 | 0 |

| Total Borrowing | 2,485.75 | 2,586.42 | 1,745.17 | 98.1 |

| Amount in ₹ Crore | ||||

Data available is as of 23.05.25.

Financial Insights

- Very strong profit margins and consistent revenue.

- Impressive return metrics for a capital-intensive industry.

- Low financial leverage, strong balance sheet, and efficient operations.

Pros & Cons of Applying for Aegis Vopak Terminals Limited IPO

No IPO can be labeled as good or bad; however, based on applicant’s desires and requirements, certain parameters can suit or baffle them.

Check out this interesting table of comparison between benefits and constraints of investing in Aegis Vopak Terminals Limited IPO:

| Benefits | Constraints |

| Largest independent terminal network in India | Pure OFS – no fresh capital into business |

| High margins and healthy return ratios | Business tied to energy and commodity cycles |

| Strategic JV: Global (Vopak) + Local (Aegis) | Limited brand recall among retail investors |

| Strong presence at key ports | Grey market activity not yet active (low GMP) |

Who Should and Shouldn’t Apply for Aegis Vopak Terminals Limited IPO

Who can apply for Aegis Vopak Terminals Limited IPO

- A long-term investor betting on India’s energy infrastructure.

- A believer in stable, cash-rich businesses with high entry barriers.

- Looking for defensive play in a volatile market.

Who should not apply for Aegis Vopak Terminals Limited IPO

- A trader hoping for massive listing-day pop (no GMP yet).

- Uncomfortable with OFS issues where the company doesn’t raise new capital.

- New to infrastructure or logistics sectors and unsure of long-term trends.

Bottom Line

To sum it up, the Aegis Vopak Terminals Limited IPO is something to keep on your radar if you’re interested in India’s energy and logistics space. This company, backed by a solid partnership between Aegis Logistics and the global player Royal Vopak, runs a huge network of terminals that handle important fuels and chemicals all over the country.

Since the Aegis Vopak Terminals Limited IPO is a pure Offer-for-Sale, the money raised goes straight to existing shareholders, not the company, which usually means the business is already doing well and doesn’t need extra cash right now.

Their financials of Aegis Vopak Terminals Limited look strong, with steady profits and an efficient, asset-light model that combines international know-how with local expertise.

Now, if you’re looking for a quick pop on listing day or just starting out with infrastructure stocks, this might not be your best bet.

But if you’re thinking long-term and want to back a company that plays a key role in India’s energy supply chain, it could be worth considering.

So, keep an eye on the subscription dates, weigh the risks and rewards, and see if it fits your investment style.

Either way, Aegis Vopak Terminals Limited is quietly powering India’s growth, and this IPO gives you a chance to be part of that story.

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

FAQs

What is the size of the Aegis Vopak IPO?

The issue size of Aegis Vopak Terminals Limited IPO is ₹600 crore, entirely an offer-for-sale.

Who is the owner of Aegis Vopak?

Aegis Vopak Terminals Ltd. (AVTL) is a joint venture between Aegis Logistics Limited (India) and Royal Vopak (Netherlands).

As of May 2025, Aegis holds a 50.1% stake, while Vopak owns 47.4%. The remaining 2.5% is held by other investors.

What is the turnover of Aegis Vopak?

In the fiscal year 2023–24 (FY24), AVTL reported revenue of ₹570.12 crore. For the nine months ending December 31, 2024, the company achieved revenue of ₹464.18 crore.

When does the Aegis Vopak IPO open?

The Aegis Vopal Terminals Limited IPO opens on May 29, 2025 and closes on May 31, 2025.

What is the IPO price band?

The Aegis Vopak Terminals Limited IPO is priced in the range of ₹93 to ₹98 per share.

Who is the CEO of Aegis Capital?

Robert J. Eide serves as the Chief Executive Officer and Chairman of the Board at Aegis Capital Corp.

What does the Vopak do?

Royal Vopak is a Dutch multinational specializing in the storage and handling of liquid bulk products, including oil, chemicals, gases, and biofuels.

With a history spanning over 400 years, Vopak operates a global network of terminals, providing infrastructure solutions that support the safe and efficient movement of vital products worldwide.

Who are the competitors of Vopak?

Vopak’s primary competitors in the global tank storage industry include:

- Oiltanking: A company specializing in tank storage logistics.

- Rotterdam World Gateway: A container terminal operator in the Port of Rotterdam.

- BCTN: A network of inland terminals in the Netherlands and Belgium.

- Odfjell: A Norwegian company engaged in the transportation and storage of chemicals and other specialty bulk liquids.

Suggested Reads: Prostarm Info Systems Limited IPO 2025: GMP, Price Band, Key Dates & Other Important Details