With the Indian Rupee falling, it has now crossed the 87 mark against the U.S. Dollar (USD) for the first time in history. This sharp drop has raised concerns across the board—investors, businesses, and policymakers are all watching closely as currency fluctuations directly impact economic stability.

So, what’s driving this decline?

A mix of global economic shifts, domestic fiscal challenges, and deeper structural issues within India’s economy. And it’s not just about exchange rates—this depreciation affects everything from inflation and trade balances to stock market sentiment and overall growth.

In this article, we’ll break down the key reasons behind the rupee’s depreciation, explore its impact on the economy and markets, and examine how the INR & USD exchange rate has evolved over the past two decades.

Let’s dive right in!

Understanding Why the Indian Rupee Is Falling

What Is Rupee Depreciation?

Rupee depreciation simply means that the Indian Rupee is losing value compared to another currency, like the U.S. Dollar (USD).

If the INR depreciates, it takes more rupees to buy one dollar.

For example, if ₹80 could get you $1 before, but now you need ₹87, that means the rupee has weakened.

Suggested Read: Will mutual fund crash in 2025?

Current Value of Indian Rupee in Comparison to Major Currencies in the World

As of February 27, 2025, the Indian Rupee (INR) has experienced notable depreciation against major global currencies.

Below is a summary of the INR’s exchange rates compared to select major currencies:

| Currency | ISO Code | Exchange Rate (1 INR = ) | Inverse Rate (1 Unit = INR) |

| British Pound (Pound Sterling) | GBP | 0.009047 | 116.54 |

| Swiss Franc | CHF | 0.010284 | 107.75 |

| Euro | EUR | 0.010944 | 100.46 |

| US Dollar | USD | 0.011465 | 85.62 |

| Singapore Dollar | SGD | 0.015374 | 66.94 |

| Canadian Dollar | CAD | 0.016433 | 62.67 |

| Australian Dollar | AUD | 0.018195 | 56.17 |

| Chinese Yuan Renminbi | CNY | 0.083328 | 11.93 |

| Japanese Yen | JPY | 1.71105 | 0.59 |

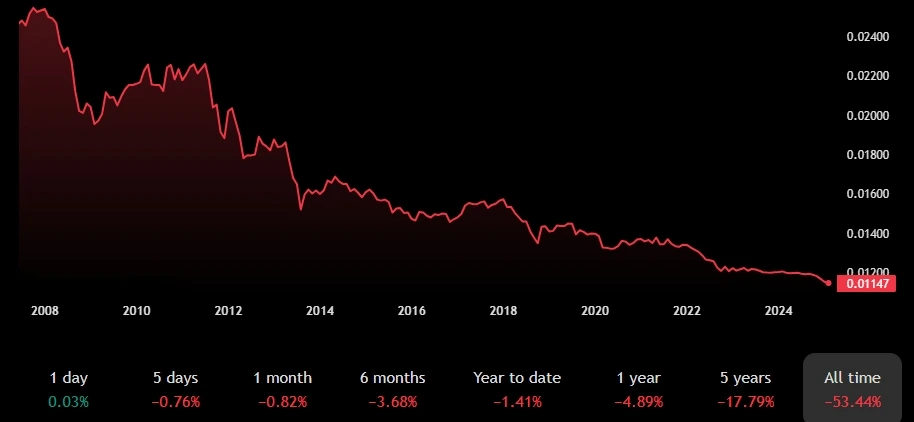

This chart shows how the value of Indian rupee has fell in the given periods of time:

Note: Exchange rates are based on data from February 27, 2025, at 08:18 UTC (13:48 IST (1:48 PM IST)).

What Decides Exchange Rates?

Several factors influence how much a currency is worth:

- Supply and Demand: If more people want Indian Rupees, its value goes up. If fewer people want it, the value drops.

- Interest Rates: Higher interest rates attract foreign investors, which can strengthen the rupee. Lower rates, on the other hand, can weaken it.

- Inflation: If India has high inflation, the rupee loses value because goods and services become more expensive compared to other countries.

- Trade Balance: If India imports more than it exports, more foreign currency is needed to pay for imports, which can weaken the rupee.

How Do Foreign Reserves and Investments Help?

India’s foreign exchange reserves (money kept in USD and other foreign currencies) act as a safety net. If reserves are high, they can be used to support the rupee when it weakens.

Similarly, foreign investments (money coming from global businesses and investors) help strengthen the rupee. If investors pull out their money, the rupee can lose value.

Is This Only Happening to the Rupee?

No, many currencies in emerging markets are facing similar issues in 2025 due to global economic conditions and a strong U.S. Dollar.

However, the rupee has fallen more than others, which suggests India is facing additional domestic economic challenges.

Historic Trends: Rupee vs. US Dollar (2005-2025)

Over the last 20 years, the INR-USD exchange rate has seen many ups and downs.

Here’s a look at how the rupee has performed against the dollar over time:

| Year | INR per USD |

| 2005 | 44.1 |

| 2006 | 45.31 |

| 2007 | 41.35 |

| 2008 | 43.51 |

| 2009 | 48.41 |

| 2010 | 45.73 |

| 2011 | 46.67 |

| 2012 | 53.44 |

| 2013 | 56.57 |

| 2014 | 62.33 |

| 2015 | 62.97 |

| 2016 | 66.46 |

| 2017 | 67.79 |

| 2018 | 70.09 |

| 2019 | 70.39 |

| 2020 | 76.38 |

| 2021 | 74.57 |

| 2022 | 81.35 |

| 2023 | 81.94 |

| 2024 | 85.56 |

| 2025 | 87.29 |

Data Source: Exchange Rate History of the Indian Rupee

Key Periods of Depreciation of the Indian Rupee

Over the past two decades, the Indian Rupee (INR) has experienced several significant periods of depreciation against the U.S. Dollar (USD).

Here’s a breakdown of these key phases and the factors that influenced them:

- 2008: Global Financial Crisis: The 2008 financial meltdown led to widespread economic instability. Investors, seeking safer assets, withdrew capital from emerging markets like India.

This capital flight increased the demand for the USD, causing the INR to weaken from around ₹40 to ₹50 per USD. - 2013: Taper Tantrum: In May 2013, the U.S. Federal Reserve hinted at reducing its bond-buying program, a move known as “tapering.” This announcement spooked investors, leading to significant outflows of Foreign Institutional Investments (FII) from India.

The sudden demand for dollars to repatriate funds caused the rupee to depreciate from approximately ₹55 to ₹68 per USD. - 2018: Rising Oil Prices and Fed Rate Hikes: In 2018, a combination of rising crude oil prices and aggressive interest rate hikes by the U.S. Federal Reserve put pressure on the rupee.

As India imports a significant portion of its oil, higher prices widened the trade deficit, increasing demand for dollars. Consequently, the INR depreciated to around ₹74 per USD. - 2020: COVID-19 Pandemic: The onset of the COVID-19 pandemic brought unprecedented economic disruptions globally. In India, lockdowns and reduced economic activity led to uncertainty, prompting investors to move their capital to perceived safer currencies like the USD.

This shift resulted in the rupee initially depreciating to ₹76 per USD. However, subsequent government stimulus measures and renewed FII inflows facilitated a partial recovery. - 2022: Fed Rate Hikes and Geopolitical Tensions: In 2022, the U.S. Federal Reserve implemented aggressive interest rate hikes to combat rising inflation. Higher interest rates in the U.S. attracted investors seeking better returns, leading to capital outflows from India.

Additionally, geopolitical tensions, such as the Russia-Ukraine conflict, increased global risk aversion. These factors combined to weaken the rupee, which hit ₹83 per USD. - 2025: Current Depreciation: As of February 2025, the rupee has breached the ₹87 per USD mark, marking its most significant fall in history. This recent depreciation can be attributed to a combination of factors, including ongoing global economic uncertainties, persistent trade deficits, and domestic fiscal challenges.

The Reserve Bank of India’s interventions and policy measures continue to play a crucial role in managing the currency’s stability.

These events highlight the rupee’s vulnerability to global economic shifts and investor sentiment. Understanding these periods of depreciation provides insight into the complex interplay between domestic factors and international developments affecting India’s currency stability.

Suggested Read: Market Crashes: A Devastating Truth You Can’t Ignore

Indian Rupee’s Performance in a Global Context

Whenever there’s a global economic crisis, the Indian Rupee tends to move in sync with other emerging market currencies—it’s not alone in the struggle.

But here’s the catch: domestic issues like inflation, government spending, and policy decisions also play a big role in how much the rupee gains or loses over time.

While external shocks can trigger volatility, what happens within India often determines how deep the impact really is.

Key Reasons Behind the Rupee’s Fall in 2025

Several global and domestic factors have come together to contribute to the Indian Rupee’s significant depreciation in 2025. Let’s take a look at the main drivers:

A. Global Factors

- U.S. Federal Reserve’s Tightening Monetary Policy The U.S. Federal Reserve has been raising interest rates aggressively to tackle inflation, making the U.S. Dollar more attractive to global investors.

This has led to capital flowing out of emerging markets like India, weakening the rupee as demand for dollars increases. - Rising Crude Oil Prices India is heavily dependent on imported crude oil, and the recent surge in global oil prices has significantly increased India’s import bill.

This has put added pressure on the rupee, as the rising costs of oil worsen India’s current account deficit, further driving down the currency. - Geopolitical Tensions Ongoing geopolitical risks, such as the Russia-Ukraine conflict, have added layers of uncertainty to the global economy.

During times of instability, investors typically flock to safer assets like the U.S. Dollar, which puts more downward pressure on emerging market currencies, including the rupee. - Strength of the U.S. Dollar (DXY): The U.S. Dollar has been exceptionally strong recently, with the U.S. Dollar Index (DXY) hitting multi-decade highs.

This strength has contributed to the depreciation of several emerging market currencies, including the Indian Rupee.

All these factors combined have made 2025 a challenging year for the rupee. The interplay of these global events continues to affect its value, making it crucial to keep an eye on these developments.

B. Domestic Factors Contributing to the Rupee’s Decline

Several domestic challenges are also playing a key role in the rupee’s struggle in 2025. Here’s a breakdown of the main contributors:

- Widening Trade Deficit India’s trade deficit has grown significantly, mainly due to higher imports of crude oil and other essential goods. Unfortunately, exports haven’t been able to keep up, which means India needs more foreign currencies to pay for these imports. This increased demand for foreign currencies puts downward pressure on the rupee.

- Slower GDP Growth in 2025 India’s GDP growth projections for 2025 have been downgraded, driven by a slowdown in key sectors like manufacturing and agriculture. When economic growth slows down, investor confidence typically drops, which weakens the currency.

- Increased Fiscal Deficit The government has been borrowing more to meet its fiscal needs, raising concerns about the sustainability of India’s public debt. This not only increases inflationary pressures but also contributes to the rupee’s depreciation as investors worry about long-term fiscal stability.

- Declining Foreign Investments India has been seeing a decline in both Foreign Direct Investment (FDI) and Foreign Institutional Investor (FII) inflows. With concerns over India’s fiscal and trade deficits, combined with the ongoing global risks, investors are becoming more cautious, which is adding to the rupee’s troubles.

These domestic factors, when combined with global economic challenges, are making it difficult for the rupee to hold its ground in 2025.

Structural Challenges Impacting the Rupee

India’s structural challenges are also adding pressure on the rupee in 2025. Let’s break down some of the key issues:

- Dependence on Energy Imports India’s heavy reliance on energy imports, especially oil and natural gas, makes the rupee highly susceptible to global price changes. When energy prices rise, as they often do, it puts extra strain on the currency, causing it to weaken.

- Weak Export Growth Although there have been efforts to boost exports, India continues to struggle with low export growth. This limits the inflow of foreign currency, which worsens the trade deficit and further weakens the rupee.

- Challenges in Attracting Long-Term Capital India faces challenges in attracting long-term foreign investment. Concerns about infrastructure, regulatory issues, and fiscal stability make investors hesitant to commit to long-term projects in the country, which in turn affects the strength of the rupee.

These structural challenges, compounded by both global and domestic factors, are making it harder for the rupee to stabilize in 2025.

How a Falling Rupee Affects the Indian Economy: The Good and the Bad

When the Indian Rupee falls in value, it has both positive and negative impacts on the economy. Let’s break it down in simple terms with examples:

Positive Effects of Indian Rupee Falling

- Boosts Export Competitiveness: A weaker rupee makes Indian goods and services cheaper for foreign buyers. For example, if a U.S. company buys IT services from India, the cost in dollars becomes lower when the rupee is weaker.

This makes Indian exports, like textiles or pharmaceuticals, more attractive to global markets, potentially increasing sales. - Increased Remittances: If you know someone living abroad, you’ve probably heard how they benefit when the rupee falls. When the rupee weakens, Non-Resident Indians (NRIs) sending money back home get more value for their dollars.

For instance, if an NRI sends 1,000 dollars, it converts to more rupees than it would have before the fall, which helps families in India afford more. - Benefits for Tourism: A weaker rupee can actually make India an appealing travel destination for foreign tourists. When their currency, like the U.S. Dollar or Euro, is stronger against the rupee, they get more for their money.

It’s like a traveler from the U.S. suddenly getting a better deal on food, shopping, and hotels when they visit India.

Two Tourism Funds to check out:

1. Tata Nifty India Tourism Index Fund

2. Kotak Nifty India Tourism Index Fund

Negative Effects of Indian Rupee Falling

1. Higher Import Costs: The downside is that imports become more expensive when the rupee falls. For example, India imports a lot of crude oil and electronics.

When the rupee weakens, the cost of these items rises. That means the price of petrol, electronics like smartphones, or machinery used by businesses can go up, making life more expensive for everyone.

2. Inflationary Pressures Because imported goods get pricier, the overall cost of living increases.

So, things like imported food items or products that rely on foreign components—like your laptop or car—could become more expensive. This eats into people’s savings and makes it harder for them to buy everyday essentials.

3. Rising Debt Burden Many Indian businesses have loans in U.S. dollars. When the rupee falls, they have to pay more rupees to cover their dollar-denominated debt.

So, companies might face financial difficulties as they struggle to repay these loans, which could eventually affect jobs and business operations.

4. Impact on Education and Travel If you’re planning to study abroad or go on a trip, a weaker rupee makes it more expensive.

For example, if you’re paying tuition fees in dollars for a university in the U.S., the falling rupee means you’ll need more rupees to cover the same cost. The same applies if you want to travel abroad—flights, accommodation, and shopping become costlier.

In short, a falling rupee can be a double-edged sword for India. While it makes exports cheaper and remittances more valuable, it also raises costs for imports, puts pressure on inflation, and increases financial strain on both businesses and consumers.

How a Weak Rupee Impacts the Stock Market: Who Wins and Who Loses

A falling rupee doesn’t just affect what we pay for goods—it also shakes up the stock market. Some sectors gain from the rupee’s decline, while others struggle.

Here’s a simple breakdown of how it plays out in India:

Sectors That Benefit

- IT and Software Services When the rupee falls, companies that earn money in U.S. dollars or other foreign currencies get a boost. Their earnings, when converted to rupees, increase, making them more profitable. This is good news for Indian tech companies providing IT and software services to global clients.

- Pharmaceuticals Pharmaceutical companies that export medicines abroad also benefit when the rupee weakens. Their products become cheaper for foreign buyers, helping them sell more and improve their revenue from international markets.

Some pharma mutual funds to check out:

1. Aditya Birla Sun Life Pharma & Healthcare Fund

2. HDFC Pharma and Healthcare Fund

3. ICICI Prudential Nifty Pharma Index Fund

4. ICICI Prudential Pharma Healthcare and Diagnostics (P.H.D) Fund

5. ITI Pharma & Healthcare Fund

6. Nippon India Pharma Fund

7. Tata India Pharma & Healthcare Fund

8. WhiteOak Capital Pharma and Healthcare Fund - Export-Driven Manufacturing Manufacturers in India that export products to other countries see an increase in profits when the rupee falls. Since their products become more affordable for international buyers, they can sell more, leading to higher profits. For instance: FMCG mutual funds and stocks.

Check out this FMCG fund: ICICI Prudential FMCG Fund

Sectors That Face Challenges

- Oil & Gas India imports a significant amount of its oil. When the rupee weakens, the cost of crude oil goes up, and companies that rely on importing oil see their costs rise. This puts pressure on their profit margins, as they have to spend more for the same amount of oil.

- Aviation For airlines in India, a falling rupee means higher fuel costs. This increases the cost of flying, which may lead to higher ticket prices and reduced profitability for airlines, as it becomes harder to keep fares affordable.

- FMCG (Fast-Moving Consumer Goods) Companies that produce everyday products like food, toiletries, and cleaning items face higher costs when the rupee weakens. Imported raw materials become more expensive, making it tougher for these companies to keep product prices low without hurting their profits.

In short, when the rupee falls, some sectors—like IT, pharmaceuticals, and manufacturing—benefit, while others—like oil, airlines, and FMCG companies—struggle. This shift plays a big role in how stock prices move in India.

Policy Measures & Possible Future Outlook

RBI and Government Measures

- Foreign Exchange Swaps: RBI conducted $10 billion swap auctions, adding ₹870 billion to the banking system to stabilize the rupee.

- Market Intervention: RBI sold dollars to support the rupee when it neared 88 per dollar, spending $2.5 to $3 billion.

- Monetary Policy Adjustments: Potential 50 basis point interest rate cut to stimulate growth despite the rupee’s depreciation.

- Flexible Exchange Rate: RBI may allow more rupee fluctuation to enhance export competitiveness.

Corporate Strategies

- Hedging Currency Risks: Companies are using hedging strategies to protect against currency fluctuations, especially in a volatile market.

- Diversifying Funding Sources: Firms are reducing reliance on foreign currency debt by seeking domestic borrowing and equity financing.

- Attracting NRI Investments: Companies are targeting NRIs for investment, offering better returns due to the depreciated rupee.

RBI and businesses are combining liquidity support, market intervention, interest rate adjustments, and strategic financial planning to mitigate the rupee’s fall and maintain economic stability.

What to Expect in the Coming Months?

- Short-Term Outlook: The rupee may continue to weaken in the near future due to global and domestic challenges.

- Government Efforts: Measures like boosting exports and attracting investments could help stabilize the currency over time.

- Long-Term Recovery: While the short term looks uncertain, these policy actions may support the rupee’s recovery in the long run.

How to Manage Investments During a Rupee Fall?

If you’re an investor during this time of the rupee’s decline, here’s what you can do:

- Diversify Your Portfolio: With the rupee weakening, it’s smart to consider investing in international assets or funds that are more insulated from the rupee’s fluctuations.

This can protect your investments from the volatility. - Focus on Export-Oriented Stocks: Companies that benefit from a weaker rupee—like those involved in exports—could see a boost in their earnings as their products become cheaper for foreign buyers.

Look for sectors like IT, pharmaceuticals, and textiles. - Hedge Your Risk: If you’re heavily invested in the Indian market, consider hedging your currency risk. Instruments like currency futures or options can help you manage losses from a weakening rupee.

- Watch Inflation and Interest Rates: A falling rupee can drive inflation, so keep an eye on how the Reserve Bank of India is reacting with interest rates.

Higher rates can help stabilize the rupee, but they might also affect borrowing costs for businesses.

You can use an inflation calculator to get an estimate for how your funds are going to perform with inflation on the rise. - Be Cautious with Imports: The rising cost of imports due to the rupee’s fall can hurt companies that rely on foreign goods or services.

Avoid stocks or sectors that may be directly impacted by these higher costs. - Consider Safe-Haven Assets: In times of economic uncertainty, investing in assets like gold or government bonds can provide more stability; so that you can double your money safely.

Bottom Line

The fall of the Indian Rupee in 2025 is caused by a mix of global and local factors. The U.S. Federal Reserve’s interest rate hikes, global political tensions, and rising oil prices have made the dollar stronger, putting pressure on the rupee.

On top of that, India’s trade deficits, slowing economy, and reduced foreign investments are making things harder for the currency.

While a weaker rupee can help boost exports and bring in more remittances, the downsides are tough to ignore—import costs go up, inflation rises, and everyday expenses for people become more expensive. Companies with foreign debt also feel the heat.

It’s a tricky situation, and there’s no easy solution. But by understanding these factors, investors, businesses, and policymakers can better navigate the challenges.

The path ahead may not be smooth, but staying informed and flexible will help as the rupee’s journey continues.

FAQs

Why is India’s currency falling?

Several factors contribute to the depreciation of the INR:

Global Economic Conditions: The U.S. Federal Reserve’s monetary policy tightening has strengthened the USD, leading to capital outflows from emerging markets like India.

Trade Deficit: India’s import expenses, especially for crude oil, have risen, widening the trade deficit and increasing demand for foreign currency.

Geopolitical Tensions: Global uncertainties, including tariff threats and geopolitical conflicts, have heightened risk aversion among investors, impacting the INR negatively.

Will Indian currency get stronger?

The future strength of the INR depends on various factors:

Economic Reforms: Implementing policies that boost economic growth and reduce the trade deficit could support the rupee.

Global Market Dynamics: Stabilization of global markets and favorable geopolitical developments may enhance investor confidence, potentially strengthening the INR.

However, some analysts predict that the rupee may continue to face challenges, with forecasts suggesting it could reach 88.50 per USD by the end of 2025.

How much will 1 dollar be in Indian rupees in 2025?

As of February 27, 2025, 1 USD equals approximately 87.41 INR

Projections indicate that the USD/INR exchange rate may rise to around 88.50 by the end of 2025.

What happens if the rupee value decreases?

A depreciating rupee has several implications:

Imports Become Costlier: Essential goods like oil and electronics become more expensive, leading to higher consumer prices.

Inflation Rises: Increased import costs can contribute to overall inflation, reducing purchasing power.

Export Competitiveness Improves: Indian goods become cheaper for foreign buyers, potentially boosting exports.

Foreign Debt Servicing Costs Increase: Repaying foreign-denominated debt becomes more expensive for Indian businesses.

Understanding these dynamics is crucial for making informed financial and business decisions in the current economic climate.