Small-cap mutual funds have significantly increased their exposure to micro cap stocks, with allocations reaching up to 60% of total holdings.

The total number of micro-cap stocks in these portfolios has surged from 292 to 387 in the past year.

Fund managers have gone deeper into the market capitalization spectrum, leveraging growth opportunities despite the high volatility and liquidity risks associated with micro-caps.

Let’s learn what happened!

What Are Micro-Cap Stocks?

As per the Securities and Exchange Board of India (SEBI), micro cap stocks are not explicitly defined as a separate category. However, they fall beyond the classification of small cap stocks, making them companies ranked beyond 500th in terms of market capitalization.

SEBI classifies stocks into three categories based on market capitalization:

Large-cap stocks: Top 100 companies by market cap.

Mid-Cap Stocks: Ranked 101-250 by market cap.

Small Cap Stocks: Ranked 251 and beyond by market cap.

Understanding Micro Cap Stocks

Since small cap stocks are defined as those ranked 251st and beyond, micro cap stocks are generally considered to be companies ranked beyond 500th position, having the smallest market capitalisations in the listed universe.

Characteristics of Micro Cap Stocks

- Lower Market Capitalisation: These companies have the smallest valuations among listed stocks.

- High Volatility: Micro-cap stocks can have sharp price movements, making them highly risky.

- Lower Liquidity: Fewer buyers and sellers lead to higher bid-ask spreads and difficulty in exiting positions.

- Growth Potential: They may offer higher returns in the long run if they grow into small or mid-sized companies.

- Limited Research & Coverage: Since they are small, there is often less analyst coverage, making it harder to assess their financials.

Rising Micro-Cap Allocation in Small Cap Funds

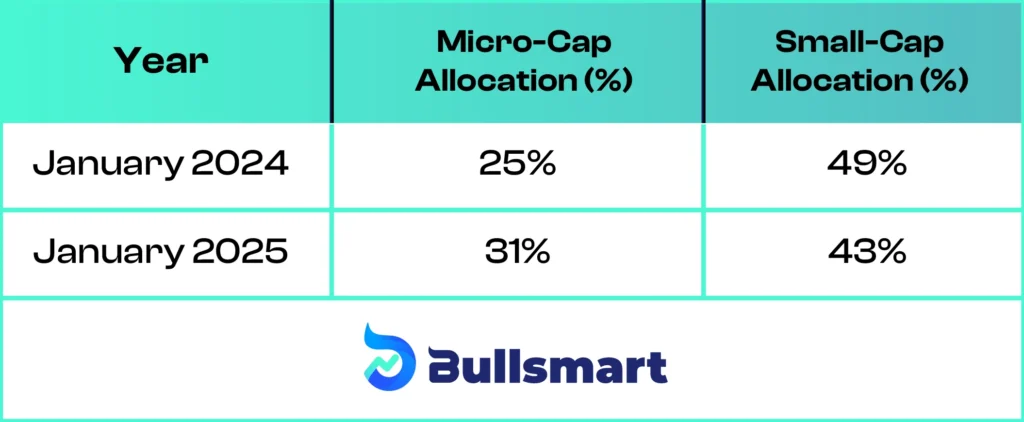

According to ACEMF data, small cap mutual funds have increased their allocation to micro cap stocks from 25% in January 2024 to 31% in January 2025.

Meanwhile, their share of small-cap stocks has fallen from 49% to 43%. This shift reflects a growing confidence in the micro cap segment, driven by improved market infrastructure and sustained investor inflows.

Why Are Small Cap Mutual Funds Increasing Micro-Cap Exposure?

Despite the risks, fund managers are actively increasing their exposure to micro-cap stocks due to:

- Higher Growth Potential: Micro-cap stocks often experience exponential growth in favorable market conditions.

- Under-Researched Opportunities: Many micro-cap stocks remain undiscovered by institutional investors, presenting unique opportunities.

- Portfolio Diversification: Expanding into micro-caps helps small cap funds diversify their holdings and improve potential alpha generation.

- Steady Inflows: Consistent retail and institutional investments allow fund managers to explore smaller companies with growth potential.

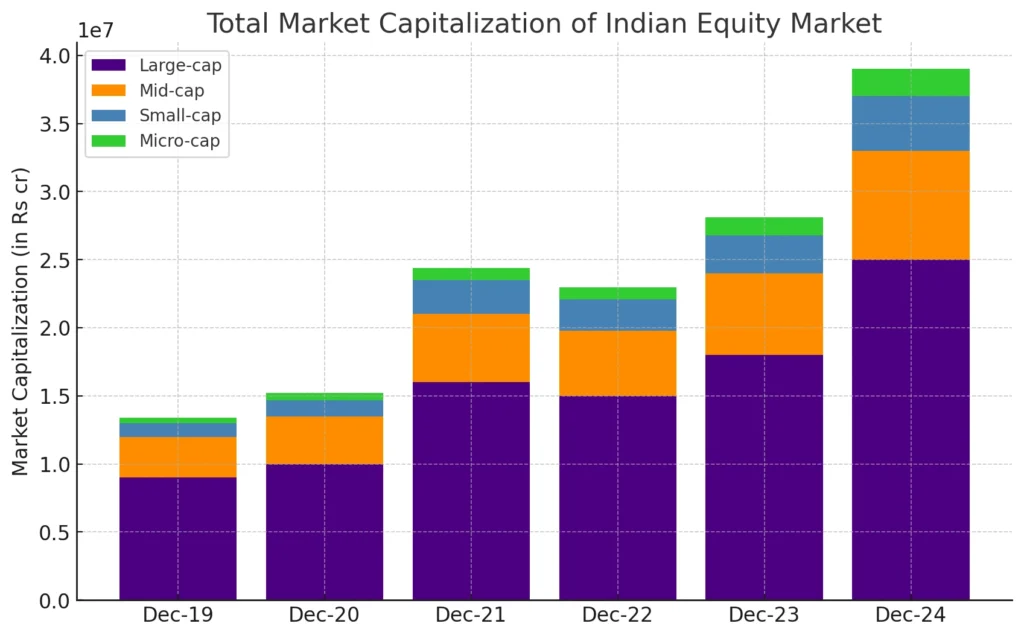

Expanding Micro-Cap Universe in India

The number of investable micro-cap stocks has grown substantially in recent years due to better market liquidity, improved transparency, and increasing investor participation.

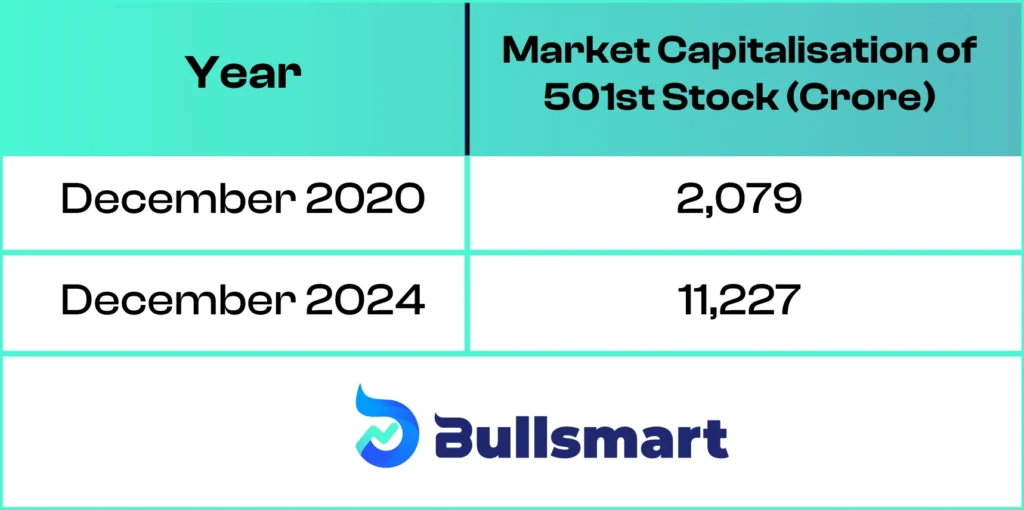

As per AMFI classification, stocks ranked below 500 are considered micro-caps.

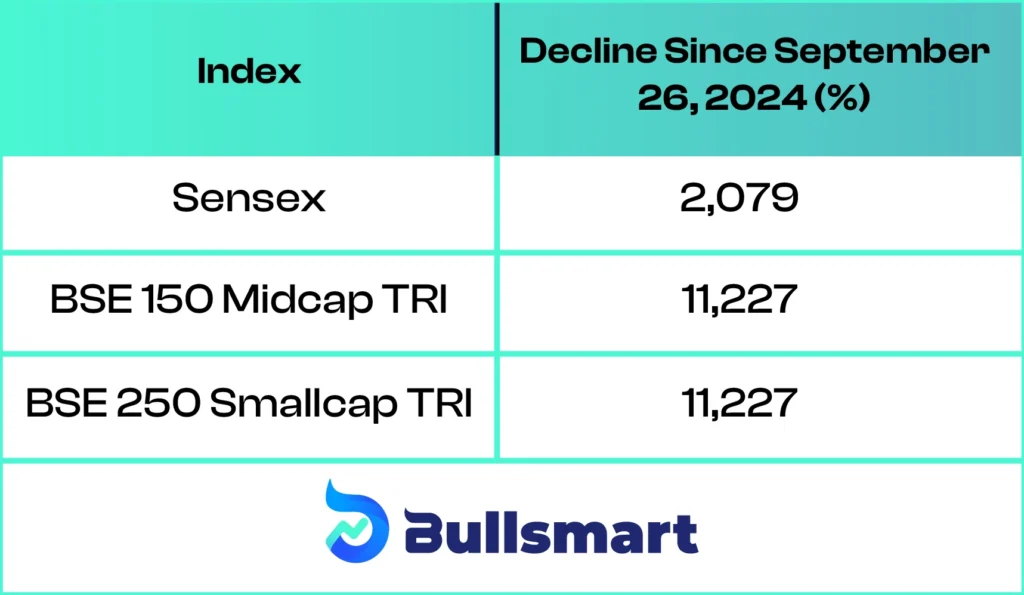

The market capitalisation threshold for the 501st stock has increased from ₹2,079 crore in December 2020 to ₹11,227 crore in December 2024, showcasing rapid growth in the segment.

Recent Market Correction and Its Impact on Small Cap Funds

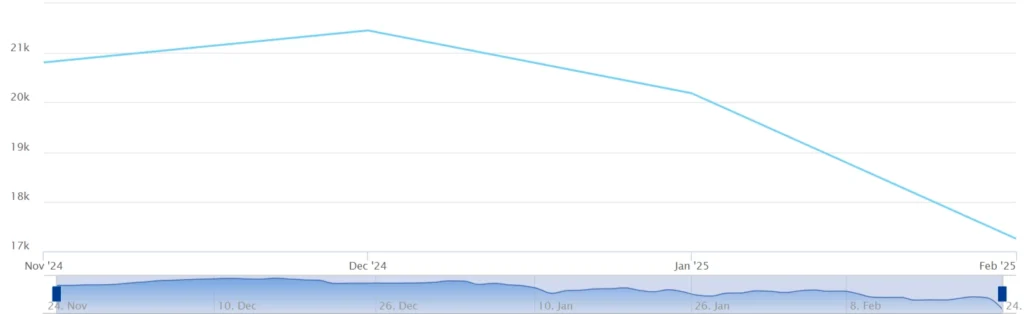

The Indian stock market has faced significant corrections in recent months, affecting small cap funds heavily. Since September 26, 2024, the Sensex has fallen by 11.3%, while the BSE 250 Smallcap TRI index has plummeted by 21.3%. The sharp decline has exposed vulnerabilities in some small cap funds.

The Hardest-Hit Small Cap Funds

The correction has impacted several small cap mutual funds, with some suffering significant losses. The five hardest-hit funds based on returns since September 26, 2024, are:

| Fund Name | Return (%) | AUM (₹ Crore) |

| Bank of India Small Cap Fund | -19.08% | 1,556 |

| Kotak Small Cap Fund | -19.68% | 16,450 |

| Quant Small Cap Fund | -19.91% | 25,183 |

| Aditya Birla Sun Life Small Cap Fund | -20.35% | 4,585 |

| Mahindra Manulife Small Cap Fund | -21.65% | 3,541 |

Most Resilient Small Cap Funds

Despite the downturn, some small cap mutual funds have demonstrated resilience, offering better protection against volatility. The top-performing small cap funds in this period include:

| Fund Name | Return (%) | AUM (₹ Crore) |

| HDFC Small Cap Fund | -10.25% | 22,340 |

| Nippon India Small Cap Fund | -11.85% | 35,412 |

| SBI Small Cap Fund | -12.47% | 19,874 |

| ICICI Prudential Small Cap Fund | -13.32% | 8,730 |

| Tata Small Cap Fund | -14.05% | 6,281 |

Key Factors Contributing to Their Resilience

The resilience of small cap mutual funds like Nippon India Small Cap Fund and HDFC Small Cap Fund comes down to three main factors: diversification, risk management, and sector selection.

Diversified Portfolio

These funds spread their investments across a large number of stocks, reducing risk from any single company’s poor performance. For example, Nippon India Small Cap Fund holds over 150 stocks, with its top 10 holdings making up only 17% of its portfolio. This broad exposure helps in balancing potential losses.

Strong Risk Management

Both funds follow a disciplined investment strategy, focusing on long-term holdings rather than frequent trading.

Smart Sector Allocation

Sector selection plays a crucial role in reducing volatility. Nippon India Small Cap Fund has nearly 39% exposure to the engineering and financial sectors, which tend to perform well during economic recovery. It also invests 55.5% in IT, consumer durables, and chemicals, which have strong growth potential.

Similarly, the HDFC Small Cap Fund focuses on stable sectors like healthcare, automobiles, banking, and IT, covering about 50% of its portfolio. These industries typically provide long-term stability, even during uncertain market conditions.

Should You Invest in Small Cap Mutual Funds Now?

Small cap mutual funds offer significant growth potential but also come with inherent risks. Here’s what you need to consider before investing:

Pros

- High Long-Term Returns: Small cap stocks have the potential to deliver substantial gains over time, as these companies are in their early growth phases and can expand rapidly.

- Opportunity to Invest in Under-Researched Companies: Since small cap stocks often receive less attention from institutional investors and analysts, there may be opportunities to discover undervalued companies before they gain widespread recognition.

- Portfolio Diversification: Adding small cap funds to your investment mix can help diversify your portfolio, as these stocks tend to have different growth patterns compared to large-cap stocks.

Cons

- High Volatility: Small cap stocks are more susceptible to market fluctuations, making them highly volatile, especially during economic downturns or bear markets.

- Liquidity Risk: In case of large investor redemptions, small cap funds may face liquidity challenges, as these stocks are less frequently traded than large-cap stocks. This could impact the fund’s ability to buy or sell shares at favorable prices.

- Governance and Transparency Issues: Many small and micro-cap companies may have weaker corporate governance standards or lack transparency, increasing the risk of fraud or mismanagement.

Investment Strategies

Investment experts suggest the following investment strategies for small cap fund investors:

- Limit Small Cap Exposure: Restrict small cap allocation to 20-25% of the portfolio.

- Long-Term Investment Horizon: Invest with a 7-10-year perspective to withstand volatility.

- Diversify Across Fund Houses: Avoid concentrating on investments in a single fund.

- Monitor Market Trends: Stay updated on broader market movements and fund performance.

Final Thoughts

Small cap mutual funds have significantly increased their allocation to micro-cap stocks, reflecting fund managers’ confidence in the segment’s growth potential. However, the recent market correction highlights the volatility and risks associated with these investments.

For retail investors, due diligence and a long-term approach are essential. Using an SIP calculator can help plan investments strategically while choosing the best investment platform ensures seamless execution.

Investing in well-managed small cap funds with a proven track record of resilience can help balance risk and reward effectively in this dynamic segment.

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

Can a small-cap fund invest in microcap?

Yes, a small-cap mutual fund can invest in micro-cap stocks, but its primary focus remains on small-cap companies (ranked 251st onward by market capitalisation). Some funds allocate a portion of their portfolio to micro-cap stocks to enhance returns, but this also increases volatility and risk.

What is the optimal small-cap allocation?

The optimal allocation to small-cap funds depends on an investor’s risk tolerance and financial goals. Typically:

Conservative investors: 0-10%

Moderate investors: 10-20%

Aggressive investors: 20-30%

A higher allocation can offer growth potential but also increases volatility.

What is the asset allocation of a small-cap fund?

Small-cap funds primarily invest at least 65% of their assets in small-cap stocks. The remaining allocation may include:

Micro-cap stocks (for growth opportunities)

Mid and large-cap stocks (for stability)

Cash & debt instruments (for liquidity and risk management)

Which small-cap mutual fund gives the highest return?

Most resilient small-cap funds have managed to navigate market volatility while delivering strong returns. Despite recent corrections, some funds have demonstrated better stability and long-term growth potential.

Currently, the top-performing small-cap funds include the Nippon India Small Cap Fund with a -11.85% return and HDFC Small Cap Fund with a -10.25% return

These funds have shown resilience even in downturns, making them strong contenders for investors looking for high-growth potential with relative stability. However, past performance doesn’t guarantee future results, so it’s essential to evaluate risk tolerance and investment horizon before investing.