Investing doesn’t have to be expensive! With Systematic Investment Plans (SIPs), you can start building wealth with just ₹100 per month—less than your daily coffee! This blog is for those who are curious to learn how they can start an SIP under ₹100 with the best mutual funds in India.

This super affordable approach makes wealth-building easy, especially for beginners or anyone on a budget.

SIPs let you invest small amounts regularly, tapping into the power of compounding to grow your money over time. No need to worry about market timing; just set it and forget it. Whether you’re a beginner or on a tight budget, SIPs are the perfect way to get started on your financial journey!

Ready to take the first step? Let’s get into it!

What are SIPs?

SIP (Systematic Investment Plan) is a method of investing a fixed amount regularly in mutual funds, typically on a monthly or quarterly basis. Instead of making a lump-sum investment, you contribute a small, consistent amount over time.

Over time, your investments grow through the power of compounding, making it a smart and accessible way to build wealth for the future.

Suggested Read: Top 5 Mutual Fund SIPs To Invest In January 2025 – Expert’s Ultimate Choice

?Did You Know?

SIPs are sometimes called “Rupee Cost Averaging Plans”.

It’s because they help you smooth out the ups and downs of the market by investing a fixed amount regularly, no matter how the prices fluctuate.

So, whether the market is on a rollercoaster ride or cruising smoothly, your SIP keeps it steady–and your money keeps growing.

Top SIP Under ₹100 to Start Investing in 2025 with the Best Mutual Funds in India

Here are the top-performing funds in which you can start SIP Under ₹100:

| Fund Name | Category | Expense Ratio (%) | 1 Year Returns (%) | AUM (INR) |

| Mirae Asset Hang Seng TECH ETF Fund of Fund | FoFs (Overseas) | 0.62% | 83.47% | 318 Cr |

| Mirae Asset NYSE FANG+ETF Fund of Fund | FoFs (Overseas) | 0.07% | 80.56% | 2,061 Cr |

| Mirae Asset S&P 500 Top 50 ETF Fund of Fund | FoFs (Overseas) | 0.09% | 65.55% | 701 Cr |

| DSP World Gold Fund of Fund | FoFs (Domestic / Overseas ) – Gold | 1.69% | 64.57% | 947 Cr |

| Motilal Oswal Nasdaq 100 Fund of Fund | FoFs (Overseas) | 0.24% | 42.10% | 6,587 Cr |

| Category Average | 1.05% | |||

These funds provide you with options for Best SIP investments under ₹500

Data available is as of 21.02.25.

Comparison of Fund’s Returns with Category Average: These funds greatly surpass the category average of 1.05%, driven by strong performance in tech-heavy overseas sectors.

While one fund focuses on gold, it still outperforms the average but with more modest returns. Overall, high-growth sectors have been the key contributors to these funds’ success.

Suggested Read: Best Time To Start SIP Investments: Investor’s Guide – Blogs

Terms Related to SIPs You Should Know About

Understanding these terms will help you make smarter investment decisions and feel more confident about your SIP journey.

- Rupee Cost Averaging (RCA): This strategy helps you deal with market ups and downs. Since you invest a fixed amount regularly, you automatically buy more units when prices are low and fewer when prices are high. Over time, this reduces the average cost of your investment, making it less risky.

- Compounding: Think of compounding as your money working for you. When you earn returns on your investment, those returns are reinvested to generate even more returns. The longer you stay invested, the more your wealth grows.

- Net Asset Value (NAV): NAV is the price per unit of a mutual fund. Every time you invest through SIP, the number of units you receive depends on the NAV that day. A lower NAV means you get more units, and a higher NAV means you get fewer units.

- Systematic Withdrawal Plan (SWP): If you ever need a steady income from your investment, an SWP allows you to withdraw a fixed amount periodically. This is useful when you need regular cash flow, like during retirement.

- Lock-in Period: Some mutual funds, especially tax-saving ones like ELSS, have a lock-in period (e.g., 3 years). This means you can’t withdraw your money before this time is up. If you’re planning long-term investments, knowing this helps you make better decisions. The tax season is coming up. Check out these top ELSS funds to stay ahead of the league:

| Fund Name | Expense Ratio (%) | 1 Year Returns (%) | AUM (INR) |

| WhiteOak Capital ELSS Tax Saver Fund | 0.70% | 0.70% | 312 Cr |

| LIC MF ELSS Tax Saver Fund | 0.97% | 12.78% | 1,093 Cr |

| HSBC ELSS Tax Saver Fund | 1.12% | 12.55% | 3,977 Cr |

| HSBC Tax Saver Equity Fund | 1.59% | 11.48% | 236 Cr |

| DSP ELSS Tax Saver Fund | 0.72% | 11.33% | 15,985 Cr |

Data available is as of 21.02.25

- SIP Top-Up: As your income grows, you may want to increase your SIP contributions. A top-up SIP allows you to automatically raise your investment at fixed intervals, helping you keep up with inflation and financial goals.

- SIP Date: This is the date your investment gets deducted from your bank account each month. Choosing the right SIP date (e.g., right after salary credit) ensures you never miss an investment.

- Asset Allocation: Your SIP money doesn’t just go into one place. It can be divided into equity (stocks), debt (bonds), or hybrid funds. The right mix helps you balance risk and returns based on your financial goals.

Fun fact: Most of the best mutual funds in India offer a knack for your portfolio to be equally weighted in all parameters indicating potential for growth. - Diversification: Instead of putting all your money into one type of asset, SIPs allow you to invest in different sectors and funds. This lowers the risk—if one investment performs poorly, others can still do well.

- SIP Return: The return on your SIP investment depends on how the mutual fund performs over time. Staying invested for longer periods increases the chances of higher returns through market growth and compounding.

All these terms will help you better understand how to choose the right mutual fund SIP.

5 Benefits of SIP Investing for Beginners in 2025

Investing can feel overwhelming, but SIPs simplify the process and offer multiple benefits that make wealth creation easier.

- Protects You from Market Volatility: By investing a fixed amount regularly, Rupee Cost Averaging helps you avoid the stress of trying to time the market. It ensures you buy more when prices are low and less when they are high.

- Grows Your Wealth Over Time: With compounding, your investment grows exponentially as returns are reinvested. The earlier you start, the greater the potential wealth you can build.

- Makes Investing Affordable: You don’t need a large sum to start investing. With SIPs, you can begin with as little as ₹100 per month, making it accessible to everyone.

- Builds Financial Discipline: Since SIPs work on automation, they help you develop a habit of regular investing. This ensures that you stay committed to your financial goals without worrying about market fluctuations.

By understanding these terms and benefits, you can make informed decisions and stay confident in your SIP investments.

Returns in SIP

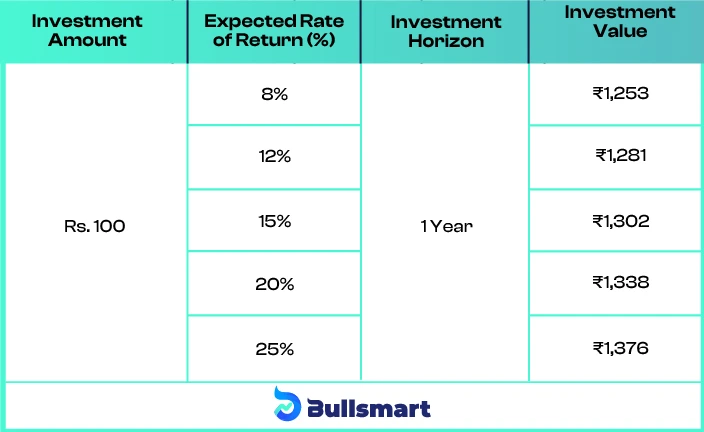

Here’s a table showcasing the type of returns you can receive if you invest in the best mutual funds in India via SIPs:

Note: This calculation was performed using an SIP calculator. However, factors like inflation, price change and market conditions may affect your overall returns. Please analyze the risks before you invest.

Pro Tip: Use tools like a SIP Calculator, CAGR Calculator or Lumpsum Calculator to evaluate your returns and optimize your investment strategy.

How to Maximize Returns in SIP?

As you may have noticed, returns on investments with just ₹100 can often be quite low. So, how do you make the most of your SIP (Systematic Investment Plan) and achieve better financial growth?

The answer lies in adding some magic to your investments by hopping onto a Step-Up SIP.

What is Step-Up SIP?

A Step-Up SIP is an advanced strategy that allows you to gradually increase your SIP contributions at regular intervals in some of the best mutual funds in India. This can be based on your preference, income growth, or inflation rate.

The beauty of a Step-Up SIP lies in its ability to compound your returns over time. As your investments grow, so does your SIP contribution—allowing you to invest more, earn more, and ultimately build a larger corpus over time.

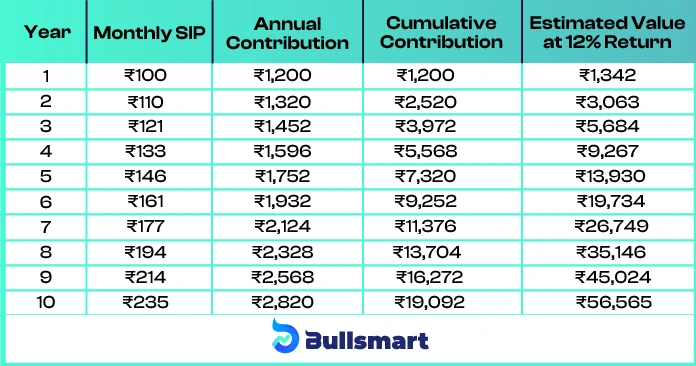

Step-Up SIP Returns Table: ₹100 Starting SIP with 10% Annual Increase

How this works?

- Monthly SIP: Starts with an SIP under ₹100 in the first year, and increases by 10% every year.

- Annual Contribution: This is the monthly SIP amount multiplied by 12.

- Cumulative Contribution: This is the total amount you’ve invested by the end of each year.

- Estimated Value at 12% Return: The future value of the SIP at an assumed return rate of 12% per annum, compounded monthly.

This table shows how the combination of regular contributions and a step-up in SIP amounts every year, along with the power of compounding, can grow your investments substantially over time. Even with starting small, the gradual increase makes a big difference!

Why Choose Step-Up SIP to Maximize Returns?

- Automatic Growth: Step-Up SIP helps you increase your investment systematically, which means you don’t have to worry about doing it manually every time. It’s a hassle-free way to grow your wealth.

- Beat Inflation: As inflation rises, your purchasing power decreases. A Step-Up SIP ensures your investments keep pace with inflation, protecting your future financial goals, empowered by the benefits offered by some of the best mutual funds in India with SIP under ₹100.

- Harness the Power of Compounding: By increasing your SIP amount, you’re giving yourself more exposure to the power of compounding. The more you invest, the more you stand to earn in the long run.

- Customizable to Your Goals: Whether you want to increase your SIP by 5%, 10%, or more each year, the choice is yours. Step-Up SIPs can be tailored to your financial objectives.

- Better Returns: By increasing your investment consistently, you are allowing your money to grow faster and potentially provide higher returns compared to a fixed SIP.

A Step-Up SIP is one of the most effective ways to maximize your returns while keeping your investments in check. It’s a smart strategy for long-term wealth creation that adapts to your growing financial capacity.

So, if you’re looking to level up your SIP game and achieve better returns, consider making the switch to a Step-Up SIP today!

Why does kick-starting with a SIP Under ₹100 make sense for beginners and low-risk investors?

Starting with a SIP Under ₹100 is a smart choice for beginners and low-risk investors for several reasons:

- Affordability: A SIP under ₹100 doesn’t require a large upfront investment, making it accessible for people just starting their investment journey or those with limited funds. It’s a manageable amount that doesn’t strain finances.

- Low-Risk, High Rewards: If you’re a newbie or prefer to play it safe, SIPs let you invest a fixed amount over time, reducing the stress of trying to time the market. With just ₹100, you’re not risking much but still setting yourself up for growth in the long run along with the best mutual funds in India.

- Habit Formation: Investing regularly, even in small amounts, helps develop a disciplined investment habit. This can lead to long-term wealth creation without feeling overwhelmed or pressured to invest large sums initially.

- Rupee Cost Averaging: With a fixed ₹100 monthly investment, you’ll buy more units when prices are low and fewer when prices are high. This strategy lowers the average cost per unit over time, helping to reduce the impact of market fluctuations.

- Compound It Up: Even small amounts, like ₹100, can turn into a lot when compounded over time. The earlier you start, the more your money can grow. Starting with ₹100 could lead to some seriously sweet returns down the road!

- Flexibility: Starting small doesn’t mean staying small forever. You can increase your SIP amount as your financial situation grows, making it super easy to scale your investments when you’re ready.

So, why not start SIP with ₹100? It’s a low-risk, easy way to begin building wealth while getting comfortable with investing. Plus, the longer you stick with it, the more you’ll see your money working for you. Ready to start your SIP journey? Let’s go!

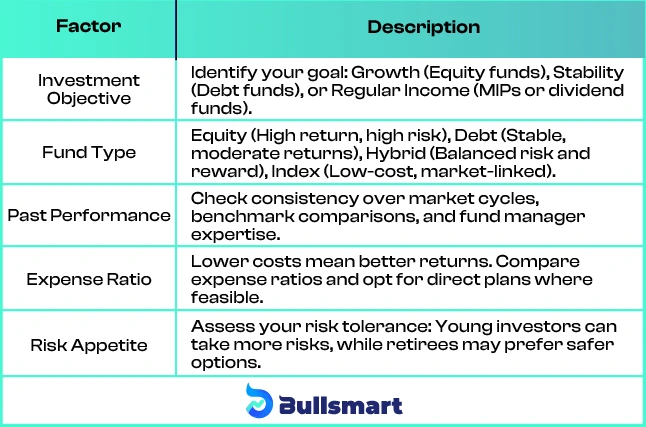

Key Factors to Consider Before Choosing the Right SIP with Best Mutual Funds in India in 2025

Choosing the right mutual fund is crucial for achieving your financial goals. Here’s what to consider:

Final Thoughts

Pick a fund that aligns with your goals, risk tolerance, and budget. A diversified, well-planned approach leads to smart investing!

How to Start a SIP Under ₹100?

Step 1: Pick a reliable platform.

For instance: Choose the Bullsmart app to invest through.

Step 2: Complete KYC.

Upload your documents (Aadhaar, PAN) for verification. Quick and easy!

Step 3: Choose your fund.

Decide based on your goals—growth or stability—and pick a fund that suits you.

Step 4: Set up auto-debit.

Enable automatic deductions for ₹100 every month, so you never miss an investment!

And you’re good to go!

Bottom Line

Starting with SIP under ₹100 might seem like a small step, but trust me, it’s a game-changer when it comes to building long-term wealth. Investing doesn’t have to be complicated or require huge amounts of money.

With SIPs, you can take the plunge and let the magic of compounding do its thing, even with the tiniest amounts. Whether you’re just starting out, working with a limited budget, or simply testing the waters, SIPs make it easy to dive in without the stress of trying to time the market or worrying about volatility.

The best part? You can always level up your investment game as your financial situation grows, with options like Step-Up SIPs to keep you on track.

So why wait? Let your money start working for you now, no matter how small the initial investment is.

The future will thank you for it. Let’s get that SIP journey going!

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

Which mutual fund is best for 100 SIP?

The best mutual fund for a ₹100 SIP depends on your investment goals and risk appetite. If you are looking for high returns, equity funds could be a good choice, while debt funds offer more stability with lower risk. Consider factors like historical performance, expense ratio, and fund category before selecting the right SIP plan for you.

Can I start SIP with 100 rs?

Yes, you can start a SIP with just ₹100 per month! Many mutual funds offer this low minimum investment, making it a great option for beginners and those on a tight budget. This allows you to build financial discipline and benefit from compounding without needing a large sum upfront.

Can I invest with only 100 rupees?

Absolutely! With just ₹100, you can start your investment journey through a Systematic Investment Plan (SIP). While ₹100 may seem like a small amount, regular investments over time can grow significantly due to the power of compounding. Plus, you can increase your SIP amount as your financial situation improves.

Is SIP is 100 safe?

SIP investments are not entirely risk-free, as mutual fund returns depend on market movements. However, SIPs help reduce risk through rupee cost averaging, meaning you buy more units when prices are low and fewer when they are high. If you prefer low-risk investments, consider funds with a stable return history. Always align your SIP with your financial goals and risk tolerance for a balanced investment approach.