In recent years, Artificial Intelligence (AI) has garnered significant attention for its potential to revolutionize industries and create new opportunities in finance. As 2025 progresses, the Indian government has emphasized AI in its budget, signaling its importance in driving the country’s digital economy.

Consequently, investors are increasingly looking for ways to capitalize on AI’s potential, either through direct investment in stocks or via mutual funds.

This blog explores the AI mutual funds that Indian investors are considering, and the role AI plays in their investment strategies.

AI in India’s Union Budget 2025

In the Union Budget 2025-26, the Indian government underscored its commitment to advancing AI through initiatives such as:

- Centre of Excellence in AI for Education: An allocation of ₹500 crore aims to enhance AI’s role in education, skill development, and job readiness.

- Promotion of Global Capability Centres (GCCs): The government seeks to position India as a global AI hub by fostering the development of GCCs in tier-two cities, which will create skilled jobs and bridge the regional divide in the tech sector.

- Deep Tech Fund of Funds: The ₹20,000 crore fund is aimed at boosting research, development, and innovation in AI and other emerging technologies, driving growth in AI-driven startups.

These budgetary highlights suggest that AI will continue to play a crucial role in India’s economic development, making AI-centric investments increasingly attractive to investors.

Curious on how AI impacts the investments? Check out this video to learn more:

India’s AI Strategy in 2025: From Catch-Up to Leadership

India’s AI game in 2025 is no longer about catching up; it’s about leading smartly and inclusively. With the launch of the National AI Mission (NAIM) in 2024, India has taken a structured approach: build talent, unlock data, boost R&D, and make AI work for sectors like healthcare, agriculture, and education.

What’s impressive is the momentum. India now ranks 10th globally in private AI investment, raising $1.4 billion (₹11,943 crore) in 2023. Pharma companies are using AI for drug discovery, and platforms like e-Sanjeevani are making healthcare accessible in remote areas. In fact, by 2025, AI is expected to drive 30% of global new drug discoveries, India’s firmly in that race.

The Ayushman Bharat Digital Mission is turning paper records digital, using federated learning to maintain privacy while boosting diagnostic accuracy. Meanwhile, India’s AI chip market, valued at $21.7 billion, is forecasted to grow 37.5% annually, hitting nearly $202 billion by 2030.

India now ranks 36th in tech readiness, up from 48th in 2022, and has 13 million developers, second only to the U.S. Startups like SigTuple, Yellow.ai, and Fractal Analytics are redefining AI at the ground level. The message is clear: India’s AI journey is only getting started.

Passive vs. Active Mutual Funds in AI Mutual Funds

When it comes to mutual funds focused on AI, Indian investors typically have two choices:

- Passive Funds: These funds track an index and are generally cost-effective. They passively invest in companies, many of which are at the forefront of AI technology.

- Active Funds: These funds are actively managed, with fund managers selecting specific stocks, including high-growth AI companies, to potentially generate higher returns.

Both options offer unique advantages, but the key is understanding how AI exposure is leveraged in each fund.

Top 10 Mutual Funds Leveraging AI for Enhanced Returns

Let’s look at some of the top mutual funds that are strategically investing in AI stocks:

| Mutual Fund | Category | Total Investment (₹ in crores) | Allocation to AI Stocks |

| Motilal Oswal Nasdaq 100 ETF | Passive | 2000 | 33% |

| Mirae NYSE FANG+ | Passive | 760 | >50% |

| Motilal Oswal S&P 500 Index | Passive | 530 | 20% |

| ICICI Pru Nasdaq 100 | Passive | 285 | 33% |

| Mirae S&P 500 Top 50 ETF | Passive | 200 | 35% |

| Parag Parikh Flexi Cap Fund | Active | 7000 | 16% |

| SBI Focused Equity Fund | Active | 2000 | 7% |

| SBI Flexicap Fund | Active | 730 | 4% |

| SBI Magnum | Active | 133 | 11% |

| ICICI Pru Blue Chip | Active | 133 | 5% |

Top 5 Equity Funds with High AI Exposure

Let’s take a deeper dive into the top 5 equity funds that are AI- based and focus on investing in AI stocks.

1. Parag Parikh Flexi Cap Fund

This fund has emerged as a significant player in AI stock investments, with an allocation of around 16% to AI stocks. It holds shares of Microsoft, Alphabet, Amazon, and Meta, all of which are at the forefront of AI innovation.

With a diversified portfolio across large-cap, mid-cap, and small-cap stocks, it provides a balanced approach to investing in high-growth AI stocks.

2. SBI Focused Equity Fund

Focused on a compact portfolio of 30 stocks, this fund holds 7.1% of its investments in AI stocks like Alphabet Inc.

This focused approach helps the fund achieve a strong performance, especially in the fast-evolving AI sector.

3. SBI Flexicap Fund

This fund allocates 4% to AI stocks, including large-cap stocks such as Microsoft.

Although its AI exposure is relatively lower, it still provides a solid entry point for investors looking for a diversified portfolio with exposure to AI.

4. SBI Magnum Fund

Investing 11% in AI stocks, SBI Magnum Fund has a clear interest in AI-driven companies.

It targets AI leaders, offering investors access to some of the most influential players in the tech space.

5. ICICI Pru Blue Chip Fund

Although ICICI Pru Blue Chip Fund has only 5% exposure to AI, it is still a good option for investors seeking low-cost, high-quality large-cap investments with moderate AI exposure.

Best Artificial Intelligence Stocks in India for 2025

AI is not just revolutionizing industries; it’s also creating promising investment opportunities. Below are the best AI stocks in India, based on analyst ratings and market capitalization, both of which serve as strong indicators of a company’s potential for growth in the AI sector.

While selecting AI mutual funds, it’s better to see the underlying stock in which the fund is investing.

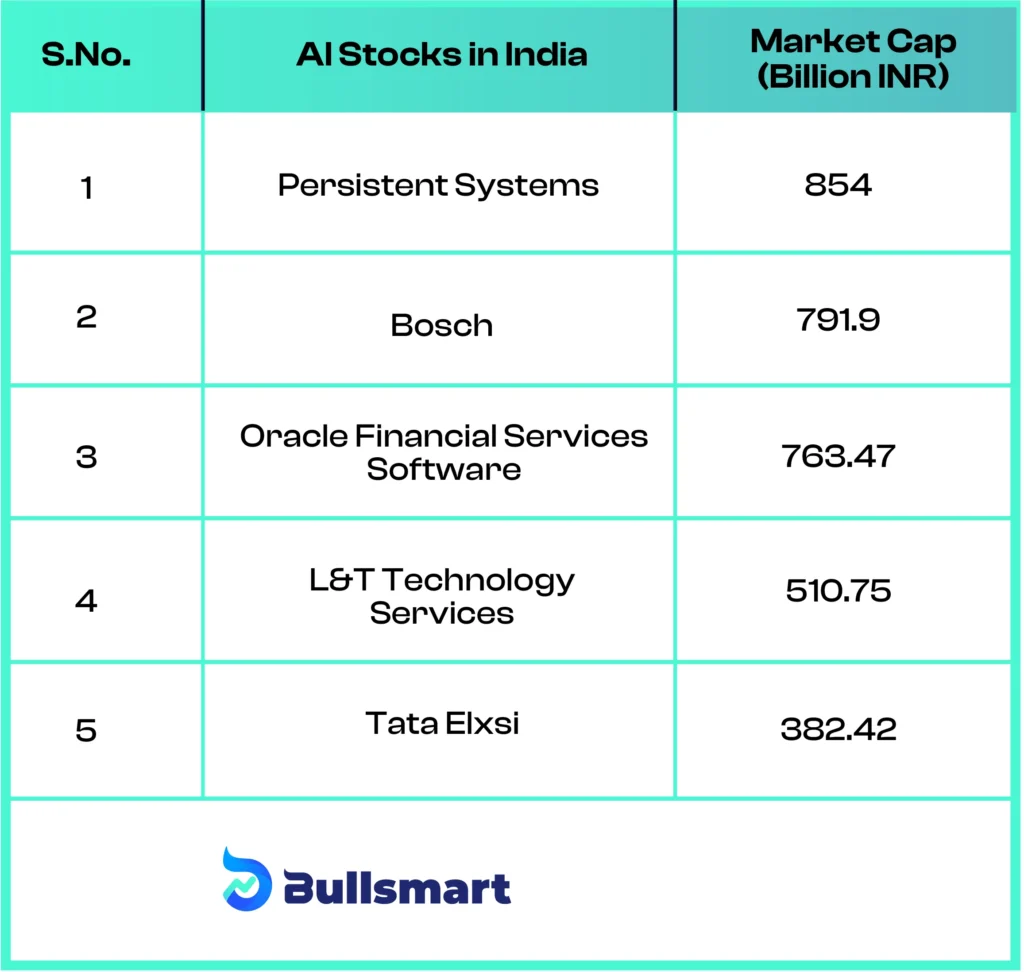

AI Stocks in India – Based on Market Capitalisation

Market capitalization helps investors gauge the size and stability of a company. The following are top AI stocks in India based on market capitalization:

Overview of Best Artificial Intelligence Stocks in India

Here’s an in-depth overview of some of the leading AI stocks in India that you should consider when looking for AI exposure through mutual funds:

Affle India

- Founded: 1994

- Headquarters: Mumbai, India

- Sector: Mobile technology, advertising

- Growth Potential: Affle India is expected to continue growing as mobile advertising and user engagement technologies become more important.

Overview: Affle India is a leading AI-driven company specializing in mobile advertising and user engagement. Its enterprise platform offers digital transformation services, while its consumer platform uses AI to drive mobile advertising and recommendations.

Affle India helps businesses with app development and digital solutions to connect with mobile users and engage with potential customers across the globe. Affle India leverages AI to deliver targeted digital ads, enabling companies to drive more relevant and effective marketing strategies.

Zensar Technologies

- Founded: 1991

- Headquarters: Pune, India

- Sector: IT services, digital transformation

- Growth Potential: Zensar’s broad portfolio of digital services, including AI, positions it well for growth in the rapidly evolving AI space.

Overview: Zensar Technologies is a leading provider of digital solutions and technology services, offering expertise in areas like cloud transformation, data engineering, AI, and machine learning. The company integrates AI into a range of its services, from automating data analytics to offering generative AI services.

Zensar’s AI and ML capabilities help businesses automate workflows, enhance decision-making, and unlock value from large datasets. It also uses AI to improve customer experiences.

Persistent Systems

- Founded: 1990

- Headquarters: Pune, India

- Sector: IT services, cloud computing, software engineering

- Growth Potential: Persistent’s AI expertise, particularly in intelligent automation and cloud-based solutions, will likely continue to drive growth.

Overview: Persistent Systems is a global technology services company offering software development and IT services. The company provides AI-driven solutions in cloud computing, data analytics, and enterprise automation. Its Persistent.

AI suite is designed to enhance software development and automate complex processes. Persistent Systems leverages AI to optimize business processes, reduce operational costs, and enhance customer engagement across a variety of industries.

Bosch

- Founded: 1951

- Headquarters: Bengaluru, India

- Sector: Automotive, industrial technology

- Growth Potential: Bosch’s strong AI capabilities in autonomous vehicles and industrial automation will drive future growth, making it a top choice for long-term investors.

Overview: Bosch is a global leader in engineering and technology, offering products and services across sectors like mobility, industrial technology, and consumer goods. Bosch integrates AI into its products, especially in the automotive and industrial automation sectors.

Bosch applies AI in autonomous driving technologies, predictive maintenance, and factory automation, making it a leader in AI adoption in the manufacturing and automotive sectors.

Oracle Financial Services Software

- Founded: 1990

- Headquarters: Mumbai, India

- Sector: Financial technology, software

- Growth Potential: With increasing demand for AI in finance, Oracle’s position as a leader in financial services software is poised for continued growth.

Overview: Oracle Financial Services Software (OFSS) provides AI-driven solutions for the financial services industry, offering tools for fraud detection, financial crime compliance, and data analytics.

Oracle’s AI capabilities are particularly effective in automating regulatory compliance and enhancing decision-making in financial transactions.

AI Stocks to Look for in Mutual Funds

If you’re considering mutual funds with significant exposure to AI stocks, some of the top companies to watch include Affle India, Zensar Technologies, and Persistent Systems for their innovative applications of AI. Additionally, Bosch, Oracle Financial Services, and L&T Technology Services are likely to feature in many AI-focused mutual funds due to their large market capitalizations and AI-driven business models.

AI stocks in mutual funds offer investors a way to tap into the future potential of AI while benefiting from the expertise of professional fund managers who actively select the top-performing AI companies. As India’s AI industry grows, these stocks are well-positioned to benefit from both domestic and international demand for AI-powered solutions.

The Future of AI in Indian Mutual Funds

With the growing role of AI mutual funds in the Indian economy, mutual funds are increasingly incorporating AI stocks into their portfolios. As AI technology continues to mature, these mutual funds are likely to see enhanced returns, offering investors exposure to one of the most promising sectors in the global economy.

- Regulatory Landscape: As the government continues to support AI through initiatives like the Centre of Excellence, we can expect more companies to emerge, providing new opportunities for AI-focused mutual funds.

- AI in Business: AI is transforming industries like healthcare, agriculture, and finance, presenting both challenges and opportunities. Mutual funds that track AI stocks are well-positioned to benefit from these advancements.

Risks and Considerations for AI-Focused Mutual Funds

While AI offers great promise, investing in AI-based mutual funds comes with certain risks:

- Technological Uncertainty: AI is still evolving, and investments in early-stage AI companies or disruptive technologies may be volatile.

- Concentration Risk: Funds that focus heavily on AI companies may be more sensitive to the performance of those companies, leading to higher risk.

- Regulatory and Ethical Risks: Governments are increasing their scrutiny of AI technologies, especially in areas like privacy and security, which could affect stock prices and fund performance.

Understanding these risks is crucial for any investor considering AI mutual funds.

Conclusion

In conclusion, AI is rapidly becoming a pivotal force in the world of investing, and Indian mutual funds are keen to tap into this potential. From passive funds that track AI-heavy indices to active funds that carefully select AI mutual funds and AI-centric stocks, there are ample opportunities for investors to gain exposure to AI.

With the Indian government’s focus on AI Mutual Funds in its 2025 budget and its ongoing support for the tech ecosystem, the future for AI mutual funds looks promising.

Investors need to weigh the benefits of AI exposure with the risks involved, keeping in mind that, while AI has the potential to drive significant returns, it is not without its challenges. As the sector matures, AI mutual funds may become an integral part of diversified portfolios aiming for long-term growth.

It is very important to invest in keeping in mind your risk appetite and financial objectives.

Tip: You can use our SIP calculator to plan your investments in a better and more diversified manner.

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

Which mutual fund is best for artificial intelligence?

Look for global tech or thematic funds that invest in AI-driven companies like cloud providers, chipmakers, and enterprise software firms. Choose funds with strong global exposure and consistent performance.

What is the most powerful AI right now?

Currently, the most advanced AI models are from top global tech firms, offering human-like reasoning, real-time responses, and powerful coding abilities across industries.

How to invest in AI mutual funds in India?

Use platforms like mutual fund apps or Demat accounts. Select global tech or innovation-focused funds, start with SIPs, and review fund holdings to ensure AI exposure.

Who is the leading AI company in India?

India’s top IT firms lead in AI adoption across sectors. Some startups are innovating in healthcare and analytics, but large enterprises dominate real-world implementation.