India is witnessing a transformation in its consumption landscape, driven by rising incomes, urbanization, and evolving consumer preferences. As the economy expands and purchasing power increases, sectors like FMCG, retail, automobiles, e-commerce, and discretionary spending are experiencing significant growth. This trend presents an opportunity for investors to tap into India’s long-term consumption potential through thematic investments.

This blog will explore the details of the NFO: Edelweiss Consumption Fund and how the fund allocates its assets, taking advantage of India’s consumption boom.

India’s consumption boom

India is rapidly emerging as one of the fastest-growing consumer markets in the world. With a population of over 1.4 billion and a growing middle class, the country’s consumption landscape is evolving at an unprecedented pace.

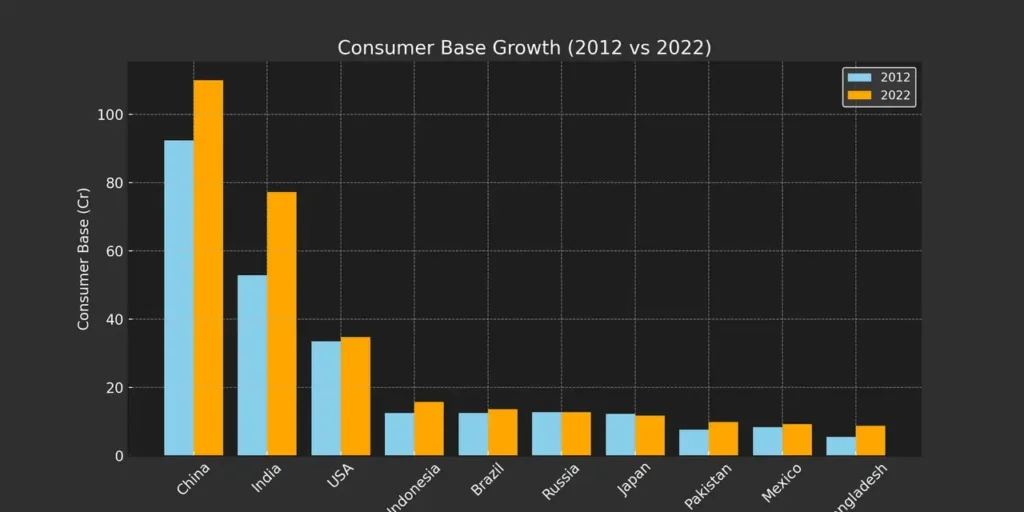

According to global data, India ranks second in terms of growth in the consumer market, surpassing major economies like the U.S., Indonesia, and Brazil. Between 2012 and 2022, India’s consumer base surged by 46%, reaching 77.3 crore consumers. This growth outpaced even China’s 15% increase during the same period.

This strong growth is fueled by rising disposable incomes. India’s per capita income is projected to grow from $2,540 in 2023 to $5,000 by 2030 and further to $17,500 by 2047. Additionally, private consumption expenditure contributes around 61% of India’s GDP, indicating the critical role of domestic consumption in economic expansion.

| Year | Per Capita Income (USD) | Growth in Per Capita Income | Consumption Spend (USD bn) | Growth in Consumption Spend |

| 2023 | 2,540 | – | 2,176 | – |

| 2030E | 5,000 | 2.23x | 4,270 | 1.96x |

| 2047E | 17,500 | 3.50x | 18,300 | 4.29x |

What is a Consumption Fund?

A consumption-focused fund is a thematic equity mutual fund that invests in companies primarily engaged in sectors benefiting from increasing consumer spending. These funds aim to capitalize on India’s growing domestic demand by investing in businesses that cater to essential and discretionary consumption, including FMCG, retail, automobiles, e-commerce, and other allied sectors.

Edelweiss Consumption Fund NFO : Investment Objective and Key Details

The Edelweiss Consumption Fund is an open-ended equity scheme that follows the consumption theme. The fund aims to provide long-term capital appreciation by investing in equity and equity-related instruments of companies operating in consumption and related sectors.

Key Scheme Details

| Feature | Details |

| Fund Name | Edelweiss Consumption Fund |

| Fund Category | Thematic Fund |

| Type | Open-ended equity scheme following the consumption theme |

| Benchmark | NIFTY India Consumption TRI |

| NFO Open Date | January 31, 2025 |

| NFO Close Date | February 14, 2025 |

| Scheme Reopen Date | On or before March 03, 2025 |

| Minimum Investment | Rs. 100 and in multiples of Re. 1 thereafter |

| Exit Load | 1% if redeemed within 90 days; NIL after 90 days |

| Risk Level | Very High |

Understanding the Portfolio Strategy

The fund is designed to tap into India’s expansive consumption landscape by strategically investing across three key categories: Core Consumption, Cyclical Consumption, and Emerging Consumption.

Each of these segments presents unique opportunities for long-term growth, allowing the fund to balance stability with high-growth potential.

Core Consumption

Core consumption includes businesses that cater to essential and everyday needs, ensuring steady demand regardless of economic fluctuations. Companies in FMCG, retail, pharmaceuticals, and consumer durables fall into this category.

An example is Britannia Industries Ltd., which dominates the Indian biscuit market with a 34% share and has an extensive distribution network reaching 45,000 villages. The FMCG sector has seen continuous growth, with the market value increasing from 18 billion to 28 billion in 2024.

Cyclical Consumption

Cyclical consumption companies experience fluctuations based on economic conditions. These businesses thrive during economic booms and slow down during downturns. Sectors such as real estate, auto, and hotels fall under this category.

For instance, The Indian Hotels Company Ltd. has significantly expanded its portfolio, with 232 operational hotels and 118 in the pipeline, benefiting from India’s growing hospitality sector. Hotel revenues have surged, with IHCL’s average room revenue (ARR) growing 61% compared to industry growth of 39%. Similarly, TVS Motor Company, India’s fourth-largest two-wheeler manufacturer, benefits from the rising demand for premium motorcycles, holding a 12.5% market share in the electric scooter category and exporting to over 80+ countries.

Emerging Consumption

This segment includes businesses that are benefiting from evolving consumer preferences and technological advancements. Digital consumption, e-commerce, health & wellness, and premiumization are key growth drivers.

Trent Ltd., for example, has rapidly expanded its retail presence, catering to budget-conscious shoppers through Zudio and offering high-end fashion via Zara and Massimo Dutti. The company’s revenue has grown at a CAGR of 39%, highlighting the booming retail sector. Another example is Bharti Airtel, which is positioned to benefit from India’s low Average Revenue Per User (ARPU) compared to global peers. Tariff hikes and increased digital penetration provide significant growth potential.

Performance of Key Consumption Sectors

| Sector | Stock Example | YTD Return (%) |

| FMCG | Britannia Industries | -21.22% |

| Auto | Bajaj Auto | -31.89% |

| Consumer Durables | Kajaria Ceramics | -31.79% |

| Emerging Retail | Trent Ltd. | 0.39 |

| Telecom | Bharti Airtel | 0.7 |

| Hospitality | Indian Hotels (IHCL) | 0.66 |

The data above reflects the varied nature of consumption stocks, with sectors like telecom and retail showing strong growth, while traditional FMCG and auto stocks have faced some challenges. The fund’s strategy ensures diversification across all three consumption categories, balancing stability with high-growth opportunities.

By carefully selecting companies across these themes, the fund aims to generate long-term wealth for investors while benefiting from India’s evolving consumption patterns.

Portfolio Allocation of Edelweiss Consumption Fund

The fund primarily invests in companies related to the consumption sector, ensuring exposure to businesses that are expected to benefit from India’s rising consumer demand.

| Asset Class | Minimum Allocation | Maximum Allocation |

| Equity & equity-related instruments (Consumption sectors) | 80% | 100% |

| Other equity & equity-related instruments | 0% | 20% |

| Debt & money market instruments | 0% | 20% |

| REITs & InvITs | 0% | 10% |

Meet the Fund Managers

The fund is managed by experienced professionals with strong expertise in equity markets:

Mr. Dhruv Bhatia

Mr. Dhruv Bhatia, the Fund Manager managing the scheme since October 14, 2024, is 36 years old and holds a PGDM in Finance. With over 12 years of experience in equity markets, he joined Edelweiss Asset Management Limited in October 2024. Before that, he was associated with Bank of India Investment Managers Pvt. Ltd and AUM Fund Advisors LLP. He has managed several schemes, including the Edelweiss Mid Cap Fund and Edelweiss Small Cap Fund.

Mr. Trideep Bhattacharya

Mr. Trideep Bhattacharya, a Fund Manager with over 15 years of experience, has been managing schemes at Edelweiss since its inception. At 48 years old, he holds a B. Tech from IIT, an MBA in Finance, and is a CFA. His previous roles include Senior Portfolio Manager at Axis Asset Management, Head of Research at Motilal Oswal Securities, and Portfolio Manager at State Street Global Advisors and UBS Global Asset Management. He has managed multiple funds, including the Edelweiss Flexi-Cap Fund, Edelweiss Focused Fund, and Edelweiss Large & Mid Cap Fund.

Mr. Amit Vora

Mr. Amit Vora, aged 46, holds a Bachelor’s degree in Commerce from Mumbai University and has over 16 years of experience in the financial services sector. Prior to joining Edelweiss, he worked at Antique Stock Broking Ltd., D.E. Shaw India Securities Pvt. Ltd., Derivium Tradition Securities India Pvt. Ltd., and Tower Capital and Securities Pvt. Ltd. He manages schemes like Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund, Edelweiss Multi Asset Allocation Fund, and Edelweiss Multi Cap Fund.

Who Should Invest in Edelweiss Consumption Fund NFO?

Edelweiss Consumption fund NFO is suitable for investors who:

- Have a long-term investment horizon (at least 5 years).

- Want exposure to India’s growing consumption sector.

- Can tolerate high risk for potential high returns.

- Are looking for thematic equity investments aligned with India’s economic growth.

Conclusion

India’s consumption-driven economy is poised for sustained growth, making the Edelweiss Consumption Fund NFO an attractive option for investors seeking exposure to this theme. For those looking to invest in mutual funds, choosing the best SIP platform or using an SIP return calculator can help in making informed investment decisions. With a structured investment strategy, experienced fund managers, and a growing consumer market, this fund could be a valuable addition to a diversified portfolio.

Suggested Read – Baroda BNP Paribas Energy Opportunities Fund NFO

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.