Fixed Income Mutual Funds, also known as Debt or Bond Funds, are investment vehicles that allocate money into assets like corporate bonds, government bonds, and money market instruments.

These funds aim to provide steady returns through interest payments while minimizing risk, making them a popular choice for conservative investors. They offer a stable alternative to equity investments and are ideal for those seeking consistent income with lower volatility.

The best fixed income mutual funds are designed to balance safety and returns, catering to different risk tolerances and investment goals.

In recent years, top-performing fixed-income mutual funds in India have delivered returns ranging from 6% to 14%, depending on the duration and the type of debt instruments they hold.

What are Fixed Income Mutual Funds?

Fixed income mutual funds invest in financial products that offer regular returns, like government bonds, corporate bonds, and other debt instruments. These funds, often called debt funds, aim to provide steady income with lower risk compared to equity funds.

Some common types of fixed income funds include Corporate Bond Funds, Dynamic Bond Funds, Banking & PSU Debt Funds, Gilt Funds, and Liquid Funds. They are a good option for investors looking for more stable returns over time.

How have Fixed Income Mutual Funds performed in India?

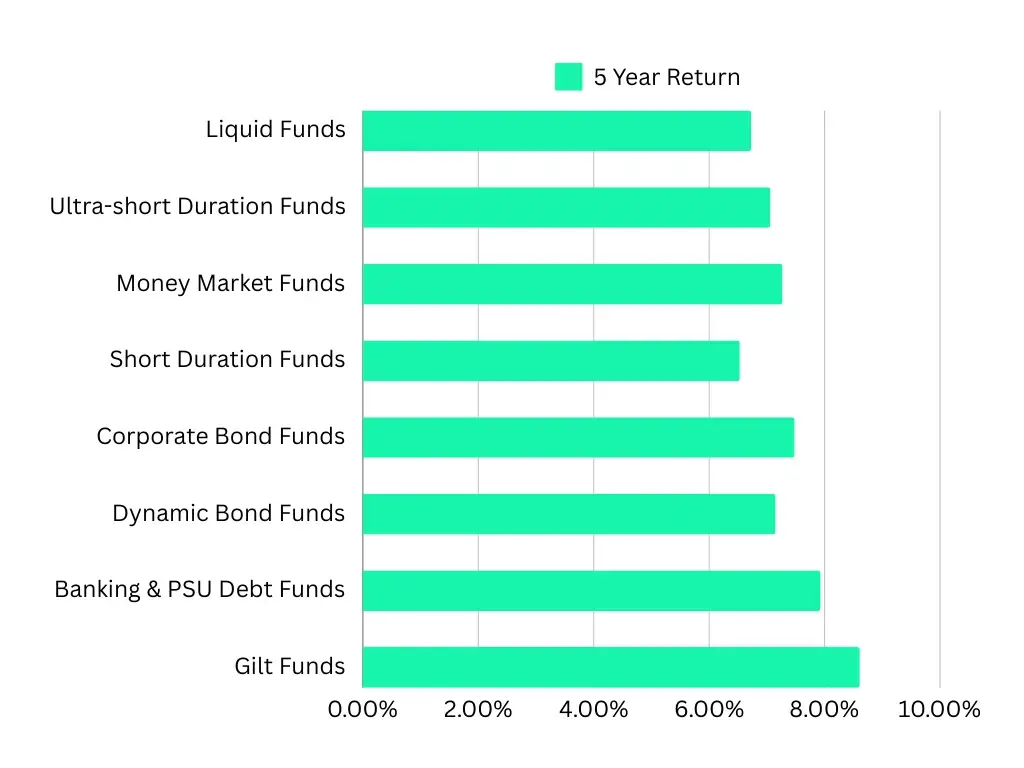

Here’s how these funds have been performing over the last 5 years:

**Past performance does not guarantee future results and should not be relied upon as a predictor of future investment outcomes.

List of Best Fixed Income Mutual Funds in India 2024

Here’s a list of the top fixed income mutual funds in India for 2024, based on their performance over the past 1 year, 3 years, and 5 years:

| Fund Name | 1 Year Return (%) | 3 Year Return (%) | 5 Year Return (%) | AUM(Cr.) |

| Aditya Birla Sun Life Medium Term Fund | 10.97% | 8.91% | 13.63% | 1,920.74 |

| UTI Dynamic Bond Fund | 9.62% | 7.96% | 8.29% | 424.18 |

| Baroda BNP Paribas Credit Risk Fund | 8.41% | 6.48% | 8.04% | 167.40 |

| UTI Short Duration Fund | 8.35% | 5.93% | 7.50% | 2,567.03 |

| ICICI Prudential Gilt Fund | 8.62% | 6.39% | 7.37% | 6,633.27 |

| SBI Magnum Gilt Fund | 10.40% | 6.90% | 7.23% | 10,422.37 |

Types of Fixed Income Funds

Here’s are the different types of fixed income mutual funds or debt mutual funds:

| Type of Fund | Description |

| Long-Term Debt Funds | Invest in government and corporate debt with maturities of 5 to 10 years. Sensitive to interest rate changes, with capital appreciation during rate cuts and depreciation during rate hikes. |

| Short-Term Debt Funds | Focus on short-term investments like G-Secs and money market instruments. Less impacted by interest rate shifts, providing more stability. |

| Credit Opportunities Fund | Invests in slightly riskier bonds, including AA-rated bonds, to achieve higher yields. Requires careful selection to reduce default risks. |

| Floating Rate Debt Funds | Invest in floating-rate instruments, where interest rates adjust based on benchmarks like MCLR or the Bank rate. Suitable for both short and long-term, and often perform better in a rising rate environment. |

| Ultra-Short Term Funds | Also known as Liquid-Plus Funds, these funds invest in short-term papers with less than one-year maturity. A portion of long-term paper may be included to boost yields |

Components of Fixed Income Funds

Fixed income funds are shaped by their investment approach and the expected returns. Let’s break down the key components of top fixed income mutual funds:

- Debt Funds: These funds focus on relatively safer investments like government bonds, corporate bonds, debentures, and other debt instruments. The main goal is to provide steady returns through interest while taking on less risk compared to equity investments.

- Money Market Funds: These funds invest in short-term, highly liquid instruments such as treasury bills, commercial paper, and short-term bank certificates of deposit (CDs). They are ideal for short-term investments, usually up to 90 days, and their performance is influenced by interest rate changes.

- Exchange-Traded Funds (ETFs): Fixed income ETFs are index funds that trade on stock exchanges. They track the performance of a specific index, like Nifty or BSE Sensex. ETFs allow investors to buy and sell shares daily, just like regular stocks. Gold ETFs, for example, give exposure to gold’s market performance.

Taxation on Fixed Income Mutual Funds

Many investors often mix up the tax rules for fixed income mutual funds and fixed deposits (FDs) in banks, but they are taxed differently.

For bank fixed deposits, the interest earned (whether received or not) is added to your taxable income and taxed according to your income tax slab. The bank also deducts 10% as TDS (Tax Deducted at Source) on interest unless you submit Form 15G to declare that your income is below the taxable limit.

On the other hand, mutual debt funds are taxed only when you redeem your units. If you sell your units within 24 months, you incur Short-Term Capital Gains (STCG), which is taxed according to your income slab rate.

If you hold your investment for more than 24 months, the Long-Term Capital Gains (LTCG) tax applies. Gains up to ₹1,25,000 are exempt from tax, but anything beyond that is taxed at 12.5%.

It’s important to note that after recent changes, the indexation benefit has been discontinued, which could slightly increase your tax liability.

Who Should Invest in Fixed Income Bond Funds?

- Fixed monthly income plans are ideal for investors seeking a steady stream of income rather than focusing on growing their investment value, such as retirees.

- The allocation to fixed-income funds in a portfolio depends on individual risk tolerance and financial goals, which can vary from person to person.

- A balanced approach can involve combining fixed-income products and equities, allowing for both stability and growth potential.

- For example, investors may choose to allocate 50% of their portfolio to fixed-income products for stability and the remaining 50% to stocks for potential growth.

Conclusion

In conclusion, Fixed Income Mutual Funds offer a stable and reliable option for investors seeking consistent returns with lower risk, making them a popular choice, especially for conservative investors and retirees. With various options like corporate bond funds, dynamic bond funds, and gilt funds, these mutual funds provide flexibility to meet different financial goals and risk preferences.

For those looking to automate their investments, using the best SIP platforms can make the process seamless. SIPs allow you to invest regularly in these funds, helping you build wealth steadily over time. You can also use a SIP calculator to estimate your future returns based on your investment amount and tenure, giving you better clarity on your financial journey.

By integrating fixed income funds into your portfolio, you can strike a balance between stability and growth, ensuring your investments work toward meeting your long-term goals.

Suggested Read – Best Momentum Mutual Funds to invest in 2024

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.