When it comes to building wealth, one of the most reliable methods is investing in Systematic Investment Plans (SIPs) with 7-5-3-1 Rule in Mutual Funds.

By following the 7-5-3-1 SIP Rule, investors can minimise risk and maximise returns over the long term.

This approach has been validated by historical data and offers a simple yet effective strategy for those looking to invest in the equity market.

Let’s break down the 7-5-3-1 Rule in Mutual Funds step by step:

7+: Patience for Long-Term Gains

The foundation of the 7-5-3-1 Rule in Mutual Funds has a minimum 7-year investment horizon.

Why 7 years? Data shows that equity markets tend to smooth out volatility and downturns over a longer period, leading to higher returns.

For instance:

- In the past 20 years, Nifty 50 TRI has delivered positive returns 80% of the time when investors stayed invested for 7+ years, compared to just 58% for shorter periods like one year.

- The power of compounding starts to show its full effect when you remain invested for at least 7 years, allowing your earnings to grow on top of the initial principal.

5: Diversification Across Key Assets

The second rule in 7-5-3-1 Rule in Mutual Funds focuses on diversifying your investments into five key categories, ensuring that risk is spread across different assets while maintaining growth potential. This “5-Finger Strategy” includes:

- Quality Stocks: Blue-chip, large-cap stocks that offer stability during market downturns.

- Value Stocks: Stocks trading below their intrinsic value, offering the potential for future appreciation.

- Growth Stocks (GARP): Stocks with high growth potential at reasonable prices, like those in emerging sectors such as technology or telecommunications.

- Midcap/Small-Cap Stocks: High-growth companies with the potential to deliver exponential returns, though they carry higher risk.

- Global Stocks: Investing in international markets to diversify geographically and hedge against local market risks.

This strategy has historically outperformed benchmarks like Nifty 50 TRI, providing higher returns and lowering downside risk during market crashes like COVID-19.

3: Mental Phases of Investment

3rd rule in 7-5-3-1 Rule in Mutual Funds is Investing in equity SIPs isn’t always smooth sailing. The third part of the rule involves recognising the three mental phases that most investors go through:

- Disappointment Phase (7-10% Returns): In this stage, returns may feel modest compared to expectations. It’s important to stay focused and not be swayed by short-term performance.

- Irritation Phase (0-7% Returns): Investors may feel frustrated, thinking that fixed deposits or other safer investments could have yielded better results. Remember, SIPs are meant for long-term growth.

- Panic Phase (Negative Returns): The hardest phase where the market dips below your initial investment. However, market history shows that patience pays off, and staying invested leads to recovery and eventual gains.

1: Step Up Your SIP Annually

To further accelerate your wealth creation, consider increasing your SIP Investment amount by 10% every year according to 7-5-3-1 Rule in Mutual Funds. This approach allows you to gradually invest more as your income grows, thereby increasing your returns.

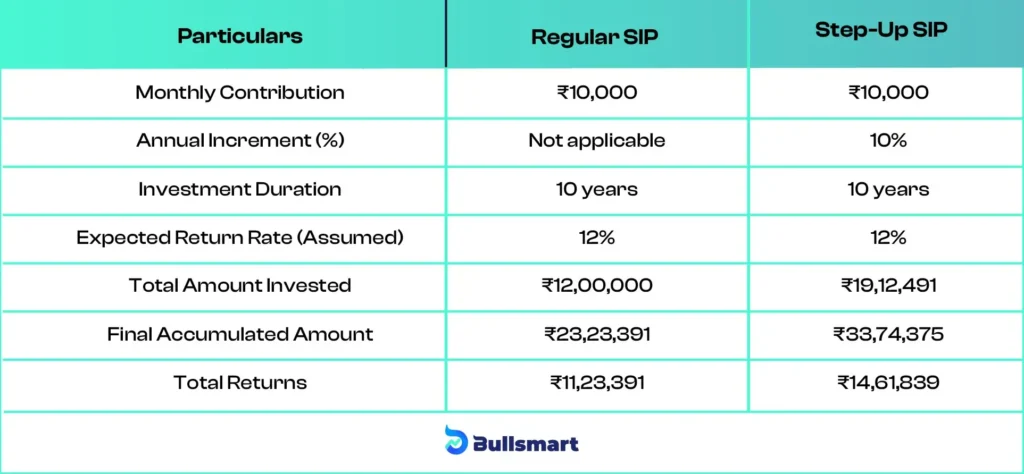

Here’s a comparison of normal SIP vs step-up SIP:

Disclaimer: The above calculations are based on assumed rates of return and incremental SIP contributions. Actual returns and investment outcomes may vary depending on market conditions and individual fund performance. It is recommended to consult with a financial advisor before making any investment decisions.

A Step-Up SIP builds a 45% larger corpus compared to a Regular SIP. It generates 30%more returns, though the total investment amount in a Step-Up SIP is 59.30% higher than the regular one.

Conclusion

The 7-5-3-1 Rule in Mutual Funds offers a structured and comprehensive approach to maximize returns from Equity Mutual Fund SIPs. By focusing on long-term investment, diversification, mental resilience, and incremental growth, this strategy is ideal for those looking to achieve stable and higher returns over time.

Suggested Read – 15 15 15 rule mutual fund

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.